Ripple's XRP Gains Traction: SBI Holdings' Shareholder Reward Program Details

Table of Contents

SBI Holdings' XRP Shareholder Reward Program: A Deep Dive

Program Overview

SBI Holdings, a major Japanese financial services company and a significant investor in Ripple, launched a shareholder reward program distributing XRP to its shareholders. This initiative demonstrates a strong belief in XRP's potential and has generated considerable interest within the crypto community.

- Eligibility criteria: Shareholders holding a certain number of SBI Holdings shares for a specified period qualify for the XRP distribution. Exact figures regarding share ownership thresholds and holding periods are typically detailed in official SBI Holdings announcements.

- XRP distribution schedule: The program usually involves periodic distributions of XRP to eligible shareholders. The frequency (e.g., annually, semi-annually) and the amount of XRP distributed per share are determined by SBI Holdings and communicated to its shareholders.

- Taxes and fees: Recipients should be aware of any applicable taxes or fees associated with receiving the XRP distribution. Tax liabilities vary depending on individual circumstances and local regulations.

The program mechanics usually involve a direct deposit of XRP into the digital wallets of eligible shareholders. SBI Holdings provides clear instructions on how to register for the program and securely receive the distributed XRP tokens. Specific dates for registration and distribution are usually announced well in advance.

Impact on XRP Price and Volume

SBI Holdings' XRP shareholder reward program has had a noticeable impact on XRP's price and trading volume.

- Price changes: While market factors influence XRP's price, the announcement and implementation of the program have been associated with periods of increased price activity. Analyzing price charts before, during, and after the program launch can reveal potential correlations.

- Increased trading volume: The distribution of XRP to a large number of shareholders has led to increased trading activity, as some recipients choose to sell their newly acquired XRP, creating greater liquidity in the market. Data on trading volume can be found on various cryptocurrency exchanges.

- Market sentiment: The program has generally been met with positive market sentiment, reflecting increased investor confidence in both SBI Holdings and XRP. This positive sentiment often translates to greater price stability and demand.

It's crucial to note that other market forces (regulatory changes, overall market trends, etc.) also impact XRP's price and volume. The SBI Holdings program is one factor among many influencing XRP's market performance.

SBI Holdings' Strategic Rationale

SBI Holdings' decision to implement this XRP reward program is driven by several strategic objectives:

- Increased brand visibility and positive PR: The program generates significant media attention, enhancing SBI Holdings' brand image as an innovator in the fintech space and a supporter of digital assets.

- Strengthened shareholder relationships: Rewarding shareholders with XRP fosters stronger relationships and boosts loyalty, increasing investor confidence and potentially reducing shareholder turnover.

- Attracting new investors: The program can serve as an attractive incentive for potential investors, showcasing SBI Holdings' commitment to innovation and growth within the cryptocurrency market.

By aligning its interests with its shareholders through this initiative, SBI Holdings is likely aiming to build a strong long-term investment strategy based on the growth and adoption of XRP. The company's strategic vision clearly includes integrating blockchain technology and digital assets into its core business model.

XRP's Growing Adoption and Use Cases

Increased Institutional Interest

XRP is seeing increased adoption among financial institutions due to its potential in facilitating cross-border payments.

- Institutions using XRP: While specific institutional adoption details are sometimes confidential, numerous reports suggest several banks and payment processors exploring or utilizing XRP for faster and cheaper international transactions.

- Advantages of XRP: XRP’s speed and relatively low transaction costs compared to traditional banking systems are key advantages. It also offers 24/7 availability, further boosting efficiency.

This institutional interest stems from the potential for XRP to significantly reduce the time and cost associated with international money transfers, streamlining financial processes and potentially disrupting the traditional banking landscape.

Technological Advancements and RippleNet

RippleNet, Ripple's payment network, is continuously being developed and improved.

- RippleNet Updates: Ripple regularly releases updates enhancing RippleNet's functionality, improving transaction speeds, security, and scalability.

- New Partnerships: Ripple actively seeks partnerships with financial institutions worldwide, expanding its network and increasing the use cases for XRP.

These technological advancements strengthen XRP's position in the market, making it a more robust and attractive solution for financial institutions looking to leverage blockchain technology for international payments.

Conclusion

SBI Holdings' shareholder reward program, distributing XRP, is a significant development contributing to the growing traction of Ripple's cryptocurrency. The program's impact on XRP price and volume, along with increased institutional interest and technological advancements within RippleNet, paints a positive picture for the future of XRP. By rewarding shareholders with XRP, SBI Holdings demonstrates its confidence in the long-term potential of this digital asset. To stay updated on the latest developments in the XRP ecosystem and learn more about SBI Holdings’ program, continue following industry news and official announcements regarding XRP, Ripple, and SBI Holdings.

Featured Posts

-

Louisiana School Desegregation Justice Departments Final Order

May 02, 2025

Louisiana School Desegregation Justice Departments Final Order

May 02, 2025 -

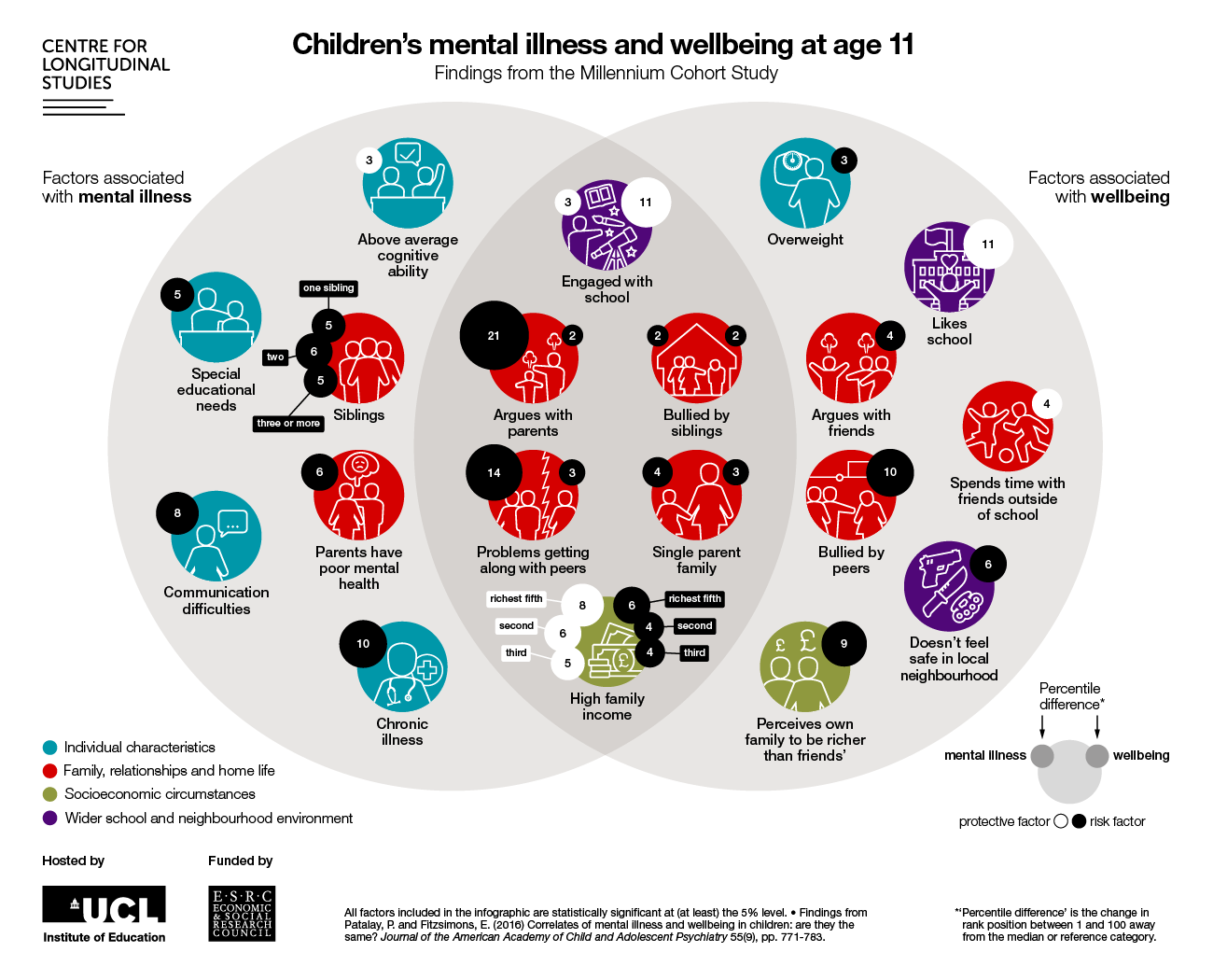

Protecting Our Future The Urgent Need To Invest In Childrens Mental Wellbeing

May 02, 2025

Protecting Our Future The Urgent Need To Invest In Childrens Mental Wellbeing

May 02, 2025 -

Scotland In The Six Nations 2025 A Realistic Assessment Of Their Capabilities

May 02, 2025

Scotland In The Six Nations 2025 A Realistic Assessment Of Their Capabilities

May 02, 2025 -

Hidden Ps Plus Gem A 2024 Underrated Game Arrives

May 02, 2025

Hidden Ps Plus Gem A 2024 Underrated Game Arrives

May 02, 2025 -

Court Case Challenges Trumps Tariff Authority

May 02, 2025

Court Case Challenges Trumps Tariff Authority

May 02, 2025

Latest Posts

-

Utahs Clayton Keller 500 Nhl Points Missouris Second

May 02, 2025

Utahs Clayton Keller 500 Nhl Points Missouris Second

May 02, 2025 -

Zhizn Za Shirmoy Realnost Raboty Eskortnits V Moskve

May 02, 2025

Zhizn Za Shirmoy Realnost Raboty Eskortnits V Moskve

May 02, 2025 -

East Idaho Resident Lisa Ann Keller Obituary And Life Celebration Details

May 02, 2025

East Idaho Resident Lisa Ann Keller Obituary And Life Celebration Details

May 02, 2025 -

Remembering Lisa Ann Keller Obituary And Service Information East Idaho

May 02, 2025

Remembering Lisa Ann Keller Obituary And Service Information East Idaho

May 02, 2025 -

Eskortnitsy Moskvy Pochemu Oni Vybirayut Kladovki

May 02, 2025

Eskortnitsy Moskvy Pochemu Oni Vybirayut Kladovki

May 02, 2025