Risk Mitigation In BESS Financing: A Belgian Case Study (270MWh)

Table of Contents

Assessing and Quantifying Project Risks in Belgian BESS Projects

Before securing financing, a comprehensive risk assessment is paramount. For a 270MWh BESS project in Belgium, several key risk categories must be carefully analyzed and quantified:

Regulatory and Policy Risks

The Belgian regulatory landscape for BESS is constantly evolving. Challenges include:

- Belgian energy policy: Changes in government incentives or regulations can significantly impact project profitability.

- BESS regulations: Navigating the complexities of interconnection approvals and permitting processes can lead to delays.

- Grid integration: Ensuring seamless integration with the existing Belgian grid infrastructure is essential and can present technical and regulatory hurdles.

- Permitting delays: Unforeseen delays in obtaining necessary permits can significantly impact project timelines and budgets.

- Renewable energy incentives: The availability and stability of government incentives for renewable energy projects, including BESS, are crucial factors.

Technological Risks

Technological risks associated with BESS include:

- Battery technology: The choice of battery chemistry impacts performance, lifespan, and overall cost-effectiveness.

- Degradation rates: Accurately predicting battery degradation over time is critical for long-term financial projections.

- Lifecycle analysis: A thorough lifecycle analysis, considering factors like replacement costs and end-of-life management, is crucial.

- Performance warranties: Robust performance warranties from technology providers are essential to mitigate performance-related risks.

- Maintenance contracts: Comprehensive maintenance contracts can help minimize unexpected maintenance costs and downtime.

Market Risks

Market risks are inherent in the energy sector and heavily influence BESS project viability:

- Electricity price forecasting: Accurate forecasting of electricity prices is vital for determining the profitability of arbitrage opportunities.

- Energy market analysis: A thorough understanding of the Belgian energy market, including competition and demand dynamics, is essential.

- Arbitrage opportunities: Identifying and capitalizing on arbitrage opportunities (buying low and selling high) is key to maximizing revenue streams.

- Ancillary services: Participation in ancillary services markets can provide additional revenue streams, diversifying income sources.

- Revenue streams: Diversifying revenue streams beyond simple arbitrage is crucial to mitigate risks associated with electricity price volatility.

Financial Risks

Financial risks are a significant concern for large-scale BESS projects:

- Project finance: Securing appropriate project financing is often complex, involving a mix of debt and equity financing.

- Debt financing: Negotiating favorable terms with lenders, considering interest rate fluctuations, is crucial.

- Equity financing: Attracting equity investors requires a compelling investment thesis and a detailed risk assessment.

- Risk-adjusted discount rate: Applying a realistic discount rate reflecting the project's inherent risks is crucial for accurate financial modeling.

- Financial modeling: Sophisticated financial modeling is essential to assess the project's financial viability under various scenarios.

Risk Mitigation Strategies Employed in the 270MWh Belgian BESS Case Study

The successful 270MWh BESS project in Belgium implemented several key risk mitigation strategies:

Insurance and Guarantees

The project utilized a comprehensive insurance and guarantee strategy:

- Insurance coverage: Multiple insurance policies covered construction risks, operational risks, and potential equipment failures.

- Performance guarantees: The technology provider offered robust performance guarantees, assuring consistent performance throughout the project's lifespan.

- Risk transfer mechanisms: Insurance and guarantees effectively transferred some risks to third parties, reducing the financial burden on the project developers.

- Off-take agreements: Long-term power purchase agreements (PPAs) provided a stable revenue stream, mitigating market price volatility.

Due Diligence and Risk Assessment

An extensive due diligence process was conducted before financing commenced:

- Due diligence: Thorough due diligence covered all aspects of the project, from regulatory compliance to technological feasibility.

- Risk assessment: A detailed risk assessment identified potential challenges and outlined mitigation strategies.

- Feasibility study: An independent feasibility study validated the project's technical and financial viability.

- Financial modeling: Sophisticated financial models were used to assess project sensitivity to various risk factors.

- Independent verification: Independent engineering reports and financial audits provided external validation of the project's soundness.

Structured Financing and Capital Stack

The project employed a well-structured financing approach:

- Project financing: A combination of debt and equity financing optimized the project's capital structure.

- Debt financing: Debt was secured from multiple lenders to diversify funding sources and mitigate lender-specific risks.

- Equity financing: Equity investment provided additional capital and reduced reliance on debt financing.

- Blended finance: The use of blended finance may have involved concessional loans or grants to reduce overall financing costs.

- Capital structure optimization: The optimal capital structure balanced the cost of capital with the project's risk profile.

Lessons Learned and Best Practices for Future BESS Projects in Belgium

The 270MWh case study highlights several best practices:

Importance of Early-Stage Planning

Proactive risk identification and mitigation are crucial from the project's inception:

- Project planning: A well-defined project plan, including detailed risk assessments, is essential for effective risk management.

- Risk management: Establishing a robust risk management framework should be a top priority.

- Stakeholder engagement: Early and ongoing engagement with all stakeholders (regulators, financiers, technology providers) facilitates collaboration and shared understanding.

- Early-stage risk assessment: Addressing potential risks early in the development phase minimizes the likelihood of costly delays and setbacks.

Transparency and Clear Communication

Open communication throughout the project lifecycle builds trust and confidence:

- Communication strategy: A clear and effective communication strategy should be implemented to keep all stakeholders informed.

- Transparency: Maintaining transparency in all aspects of the project, from regulatory compliance to financial performance, is critical.

- Investor relations: Effective investor relations are key to attracting and retaining investment.

- Stakeholder management: Managing stakeholder expectations and addressing concerns proactively is essential for success.

Adaptability and Flexibility

The ability to adapt to changing market conditions and regulatory frameworks is essential:

- Market volatility: BESS projects must be designed to withstand market volatility in electricity prices and regulatory changes.

- Regulatory changes: The project design should incorporate flexibility to accommodate potential changes in regulations.

- Project adaptability: Incorporating flexibility into the project design allows for adjustments in response to unforeseen circumstances.

- Flexible design: Modular design allows for scalability and adaptation to future market needs.

Conclusion: Mitigating Risks for Successful BESS Financing in Belgium

This article has highlighted the critical importance of risk mitigation in BESS financing, using the successful 270MWh Belgian BESS project as a case study. Successfully navigating the regulatory, technological, market, and financial risks requires comprehensive risk assessment, proactive mitigation planning, and a well-structured financing approach. By implementing the strategies discussed here – including robust insurance, thorough due diligence, and a well-defined capital structure – developers can significantly improve their chances of securing financing for their BESS projects in Belgium. We encourage you to adopt these best practices to ensure the success of your own BESS ventures. For further insights into specific aspects of securing BESS finance and other challenges in the Belgian energy market, stay tuned for future articles exploring related topics in depth.

Featured Posts

-

Justice Departments Decision To End School Desegregation A Turning Point

May 03, 2025

Justice Departments Decision To End School Desegregation A Turning Point

May 03, 2025 -

Renovacion De Flota Sistema Penitenciario Incorpora Siete Vehiculos

May 03, 2025

Renovacion De Flota Sistema Penitenciario Incorpora Siete Vehiculos

May 03, 2025 -

Souness On Rice Arsenal Star Needs To Sharpen Final Third Play

May 03, 2025

Souness On Rice Arsenal Star Needs To Sharpen Final Third Play

May 03, 2025 -

The Growing Trend Of Betting On The Los Angeles Wildfires

May 03, 2025

The Growing Trend Of Betting On The Los Angeles Wildfires

May 03, 2025 -

Exclusive Report The Hunt For Teslas Next Ceo After Elon Musk

May 03, 2025

Exclusive Report The Hunt For Teslas Next Ceo After Elon Musk

May 03, 2025

Latest Posts

-

From Celeb Traitors To Bbc Daisy May And Charlie Coopers Next Venture

May 03, 2025

From Celeb Traitors To Bbc Daisy May And Charlie Coopers Next Venture

May 03, 2025 -

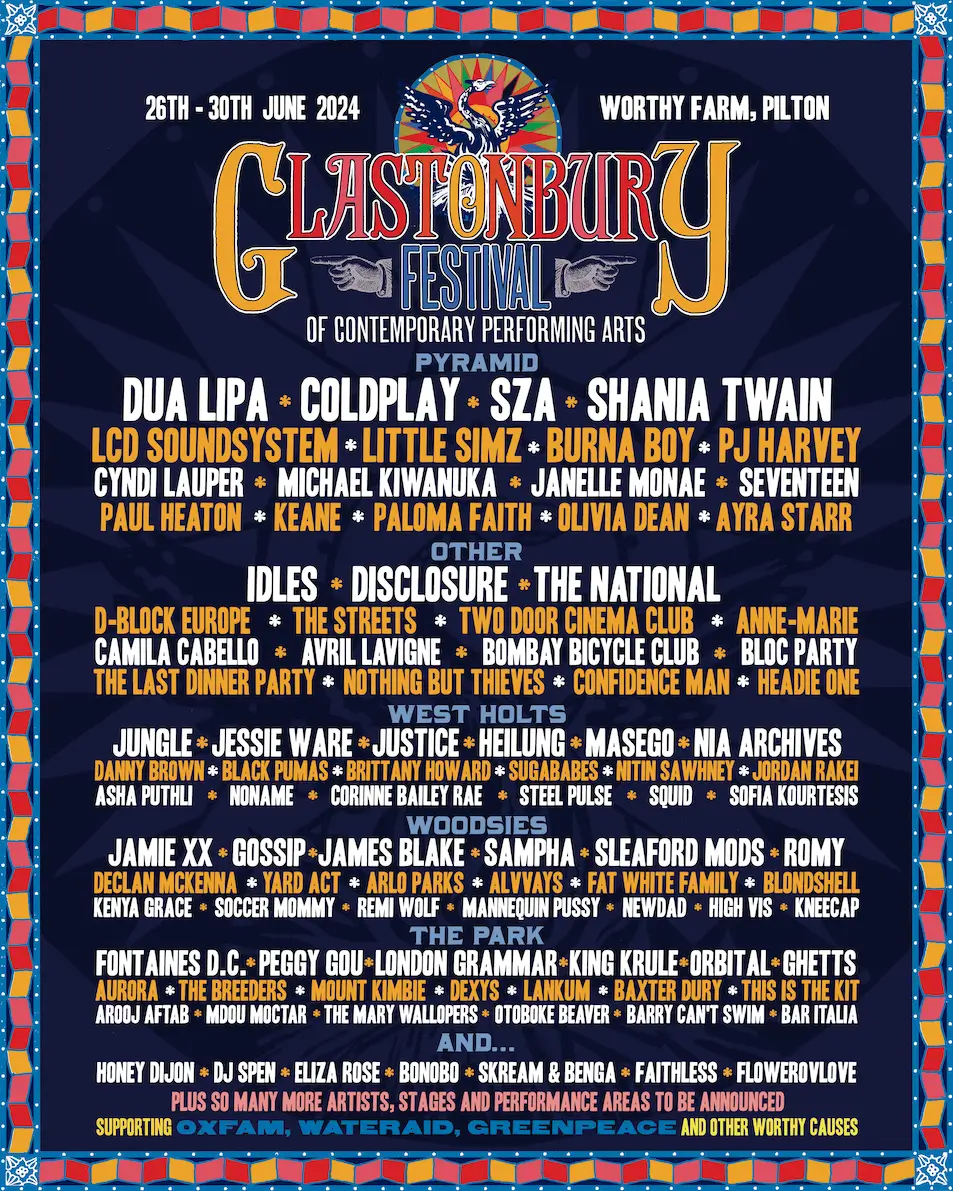

The 1975 And Olivia Rodrigo Glastonbury 2024 Headliner Predictions

May 03, 2025

The 1975 And Olivia Rodrigo Glastonbury 2024 Headliner Predictions

May 03, 2025 -

Two Celebrity Traitors Uk Contestants Have Left The Show

May 03, 2025

Two Celebrity Traitors Uk Contestants Have Left The Show

May 03, 2025 -

Daisy May Coopers Engagement To Anthony Huggins Official Confirmation

May 03, 2025

Daisy May Coopers Engagement To Anthony Huggins Official Confirmation

May 03, 2025 -

Daisy May Cooper And Charlie Coopers New Bbc Show After Celeb Traitors

May 03, 2025

Daisy May Cooper And Charlie Coopers New Bbc Show After Celeb Traitors

May 03, 2025