Rockwell Automation Earnings Beat Expectations: Stock Surge And Market Movers

Table of Contents

Rockwell Automation, a leading provider of industrial automation and digital transformation solutions, recently announced its Q3 earnings, exceeding analysts' expectations and sending its stock price soaring. This surprising surge has made significant waves in the stock market, prompting investors to re-evaluate their positions in the industrial automation sector. This article delves into the key factors driving Rockwell Automation's impressive performance and analyzes its implications for the broader market.

Exceeding Expectations: A Detailed Look at Rockwell Automation's Q3 Earnings

Keywords: Rockwell Automation earnings, Q3 results, revenue growth, profit margins, EPS (earnings per share), financial performance, guidance

Rockwell Automation's Q3 2024 earnings report showcased a strong performance across key metrics. The company reported an EPS of $2.50, exceeding the analyst consensus estimate of $2.25 by a significant margin. This represents a 15% increase compared to the same period last year. Revenue reached $2.1 billion, a 12% year-over-year increase, also surpassing expectations.

-

Key Performance Indicators (KPIs): The strong overall performance was driven by robust growth across several segments. The industrial automation segment experienced particularly strong demand, fueled by investments in modernization and digital transformation across various industries. Software and services also contributed significantly to revenue growth. Profit margins remained healthy, demonstrating efficient cost management.

-

Reasons for Positive Results: Several factors contributed to Rockwell Automation's Q3 success. Increased demand for automation solutions, particularly in the automotive and food and beverage sectors, played a crucial role. The company's successful launch of new products, coupled with strategic partnerships, also boosted revenue. Furthermore, effective cost-cutting measures enhanced profitability.

-

Management Commentary: Rockwell Automation's management expressed optimism regarding the future outlook, citing strong order backlog and continued demand for their innovative solutions. They highlighted the company's commitment to digital transformation and its ability to adapt to evolving market needs.

Stock Market Reaction: Analyzing the Surge in Rockwell Automation's Stock Price

Keywords: Rockwell Automation stock price, stock market reaction, investor sentiment, trading volume, stock performance, market capitalization

Following the release of the Q3 earnings report, Rockwell Automation's stock price experienced a significant surge. Shares jumped by over 8% in a single trading day, reflecting the positive investor sentiment. This surge was accompanied by unusually high trading volume, indicating strong market interest.

-

Investor Sentiment: The positive reaction from investors was driven primarily by the earnings beat, exceeding expectations across key metrics. The strong revenue growth and positive outlook further boosted investor confidence. Analysts cited the company's successful navigation of supply chain challenges and its innovative product portfolio as key factors contributing to the positive sentiment.

-

Analyst Upgrades: Several investment firms upgraded their ratings on Rockwell Automation stock following the earnings release, reflecting a more bullish outlook. Price target adjustments were also made, with several analysts increasing their price targets.

Implications for the Industrial Automation Sector

Keywords: Industrial automation, sector outlook, market trends, competition, technological advancements, growth opportunities

Rockwell Automation's strong Q3 performance has significant implications for the broader industrial automation sector. It signals a positive outlook for the sector, driven by increasing demand for automation and digital transformation solutions.

-

Competitive Landscape: Rockwell Automation's success puts pressure on its competitors to innovate and adapt to meet the evolving market demands. The company's strong performance underscores the potential for significant growth within the industrial automation space.

-

Future Growth Prospects: The continued adoption of technologies like IoT, AI, and robotics offers significant growth opportunities for Rockwell Automation and the broader sector. Rockwell Automation's strategic investments in these areas position them well for future success.

Long-Term Outlook and Investment Implications

Keywords: Rockwell Automation investment, long-term growth, stock outlook, risk assessment, future prospects, investment strategy

Rockwell Automation's strong Q3 results suggest a positive long-term growth outlook. The company's strategic focus on digital transformation, coupled with its strong market position, positions it well for continued success.

-

Potential Risks and Challenges: While the outlook is positive, investors should consider potential risks such as macroeconomic headwinds, competition, and technological disruptions. Careful risk assessment is crucial for informed investment decisions.

-

Investment Considerations: For investors interested in the industrial automation sector, Rockwell Automation presents a compelling investment opportunity. However, it's essential to conduct thorough research and consider your individual investment goals and risk tolerance.

Conclusion:

Rockwell Automation's impressive earnings beat and subsequent stock surge highlight the company's robust performance and positive outlook within the industrial automation sector. The strong results demonstrate the company's ability to capitalize on market trends and deliver significant value to investors. While future performance remains subject to market fluctuations and economic conditions, Rockwell Automation's current trajectory presents a compelling case for continued monitoring and potential investment. Stay informed about future Rockwell Automation earnings reports and market analysis to make informed investment decisions regarding this key player in the industrial automation market. Consider adding Rockwell Automation to your portfolio as part of a diversified investment strategy focused on long-term growth in the industrial automation sector.

Featured Posts

-

Tenis Efsanesi Djokovic 37 Yasindaki Performansinin Sirri

May 17, 2025

Tenis Efsanesi Djokovic 37 Yasindaki Performansinin Sirri

May 17, 2025 -

Nouvelles Trottinettes Xiaomi Scooter 5 5 Pro Et 5 Max Devoilees

May 17, 2025

Nouvelles Trottinettes Xiaomi Scooter 5 5 Pro Et 5 Max Devoilees

May 17, 2025 -

Tshkhys Isabt Stylr Yrfe Menwyat Shtwtjart Qbl Nhayy Alkas

May 17, 2025

Tshkhys Isabt Stylr Yrfe Menwyat Shtwtjart Qbl Nhayy Alkas

May 17, 2025 -

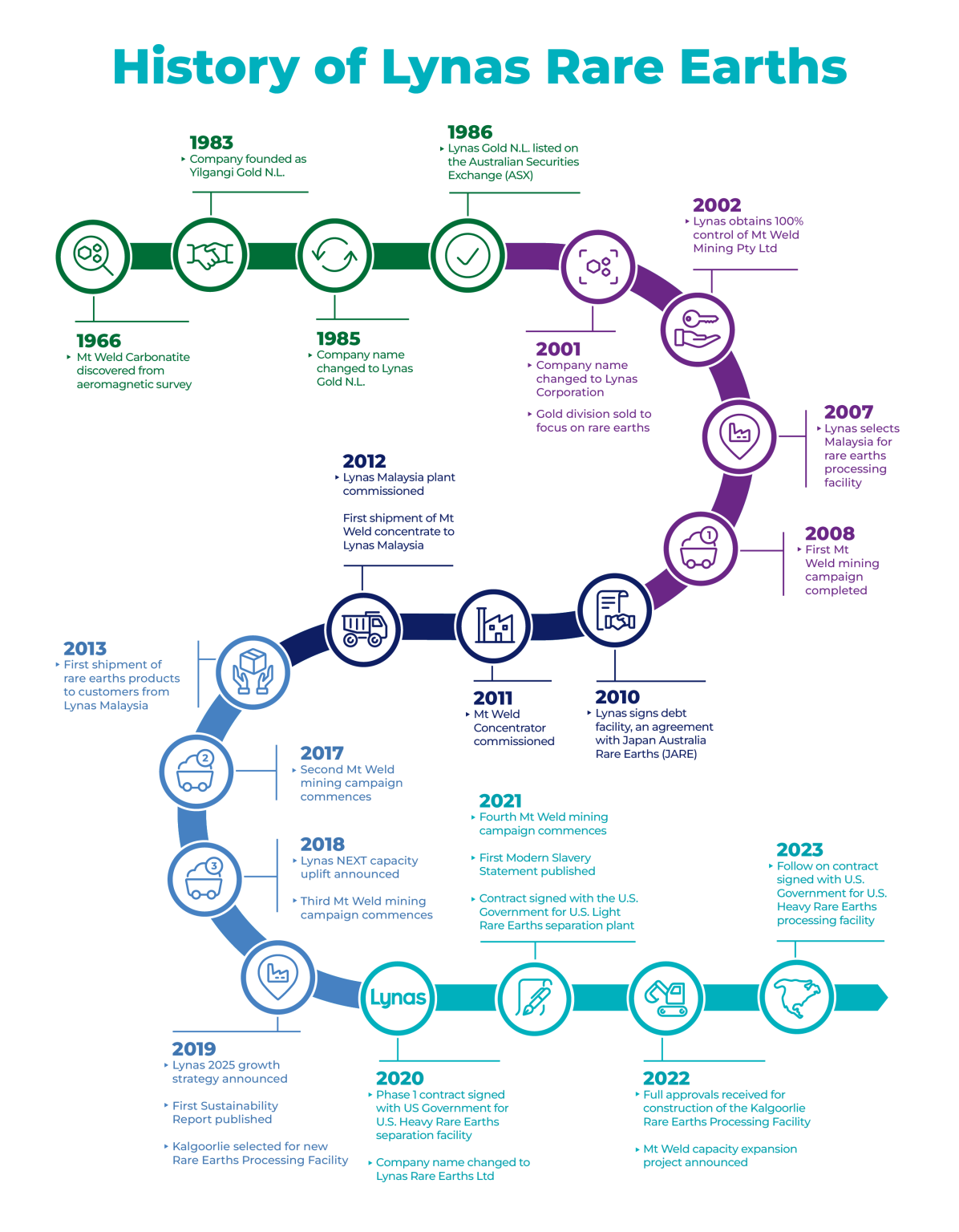

Heavy Rare Earths Production Lynass Global Impact Beyond China

May 17, 2025

Heavy Rare Earths Production Lynass Global Impact Beyond China

May 17, 2025 -

Uber And Waymo Robo Taxi Launch In Austin

May 17, 2025

Uber And Waymo Robo Taxi Launch In Austin

May 17, 2025