Rockwell Automation Earnings Beat Expectations: Stock Surge Explained

Table of Contents

Rockwell Automation's Q[Quarter] Earnings Report: Key Highlights

Rockwell Automation's Q[Quarter] earnings report showcased robust financial health, exceeding analyst predictions across multiple key performance indicators (KPIs). This outstanding performance fueled the significant stock market rally.

Revenue Growth and Key Performance Indicators (KPIs)

The company reported a [Insert Specific Revenue Figure]% increase in revenue, reaching [Insert Specific Revenue Figure] compared to the same quarter last year. This impressive revenue growth was driven by several factors, including a strong increase in orders. Key performance indicators significantly surpassed expectations:

- Order Backlog: Experienced a [Insert Percentage]% increase, indicating strong future demand and sustained revenue growth potential.

- Profit Margins: Reached [Insert Specific Percentage]%, exceeding analyst forecasts and demonstrating efficient operations.

- Earnings Per Share (EPS): Surpassed expectations, reaching [Insert Specific EPS Figure], a [Insert Percentage]% increase year-over-year.

- Operating Income: Showed a substantial increase, reflecting strong operational efficiency and cost management.

Strong Performance Across Business Segments

Rockwell Automation's success wasn't limited to a single segment; it demonstrated broad-based strength across its operations:

- Industrial Automation: This segment benefited from increased demand in key sectors like automotive and food and beverage, driven by automation trends and modernization initiatives. New product launches and strategic partnerships played a crucial role.

- Process Automation: This area saw strong growth driven by increased investment in digital transformation across various industries, including oil and gas, chemicals, and pharmaceuticals.

- Discrete Automation: This segment also exceeded expectations, reflecting continued investment in factory automation and the broader trend toward smart manufacturing solutions.

These strong performances across all segments highlight the resilience and adaptability of Rockwell Automation's business model.

Factors Contributing to Exceeding Expectations

Several factors contributed to Rockwell Automation's surpassing of analyst predictions:

- Strong Demand Growth: Increased demand across various industrial sectors fueled robust revenue growth.

- Effective Cost Reduction Measures: The company implemented successful cost-cutting strategies that improved profit margins.

- Successful Strategic Initiatives: Strategic acquisitions and partnerships enhanced the company's market position and product offerings.

- Innovation and Product Development: Continuous innovation and the launch of new, cutting-edge products kept Rockwell Automation ahead of the competition.

- Improved Supply Chain Management: Efficient supply chain management mitigated potential disruptions and ensured timely delivery of products to customers.

Analysis of the Rockwell Automation Stock Surge

The positive earnings report triggered an immediate and significant market reaction, reflecting investor confidence in Rockwell Automation's future prospects.

Market Reaction and Investor Sentiment

The announcement of the earnings beat led to:

- Stock Price Increase: A substantial increase in Rockwell Automation's stock price, reflecting investor enthusiasm.

- Increased Trading Volume: A surge in trading volume indicated heightened investor interest and activity.

- Positive Analyst Upgrades: Several analysts upgraded their ratings and price targets for Rockwell Automation stock, further boosting investor sentiment.

- Strong Buy Recommendations: Many investment firms issued strong buy recommendations, reflecting their bullish outlook on the company's future performance.

Long-Term Implications for Rockwell Automation

The strong Q[Quarter] earnings report suggests a positive long-term outlook for Rockwell Automation. Several factors point towards continued growth:

- Continued Growth in Industrial Automation: The ongoing trend toward automation across various industries is expected to drive further demand for Rockwell Automation's products and services.

- Technological Advancements: Rockwell Automation's continued investments in research and development will ensure it remains at the forefront of technological advancements in industrial automation.

- Strategic Acquisitions and Partnerships: Further strategic acquisitions and partnerships will solidify Rockwell Automation's market position and enhance its product portfolio.

Comparison to Industry Peers and Market Trends

Rockwell Automation's performance stands out compared to some of its main competitors in the industrial automation sector. [Insert comparison data and analysis here, mentioning specific competitors and relevant metrics]. This superior performance highlights Rockwell Automation's strong competitive advantage and strategic positioning within the market. The overall industrial automation market is experiencing [Insert overall market trend analysis here, discussing growth, challenges, and opportunities]. Rockwell Automation’s strong performance suggests it is well-positioned to benefit from these trends.

Conclusion: Rockwell Automation's Positive Outlook and Investment Implications

Rockwell Automation's Q[Quarter] earnings report delivered a resounding success, significantly exceeding expectations and driving a substantial stock surge. The company’s strong performance across all business segments, fueled by robust demand, effective cost management, and strategic initiatives, points towards a bright future. The positive market reaction underscores investor confidence in Rockwell Automation's long-term growth prospects. While we cannot provide financial advice, the company’s results present a compelling narrative for investors interested in the industrial automation sector. Consider learning more about Rockwell Automation's strategies and performance to assess its potential as a worthwhile investment. Keep an eye on Rockwell Automation stock and its future developments within the dynamic industrial automation market.

Featured Posts

-

Nba Crew Chief Acknowledges Missed Call Cost Pistons Game Against Knicks

May 17, 2025

Nba Crew Chief Acknowledges Missed Call Cost Pistons Game Against Knicks

May 17, 2025 -

Save With Uber One Free Deliveries And Discounts Now Live In Kenya

May 17, 2025

Save With Uber One Free Deliveries And Discounts Now Live In Kenya

May 17, 2025 -

Analyzing Cassie Venturas Testimony Key Takeaways From Diddys Trial

May 17, 2025

Analyzing Cassie Venturas Testimony Key Takeaways From Diddys Trial

May 17, 2025 -

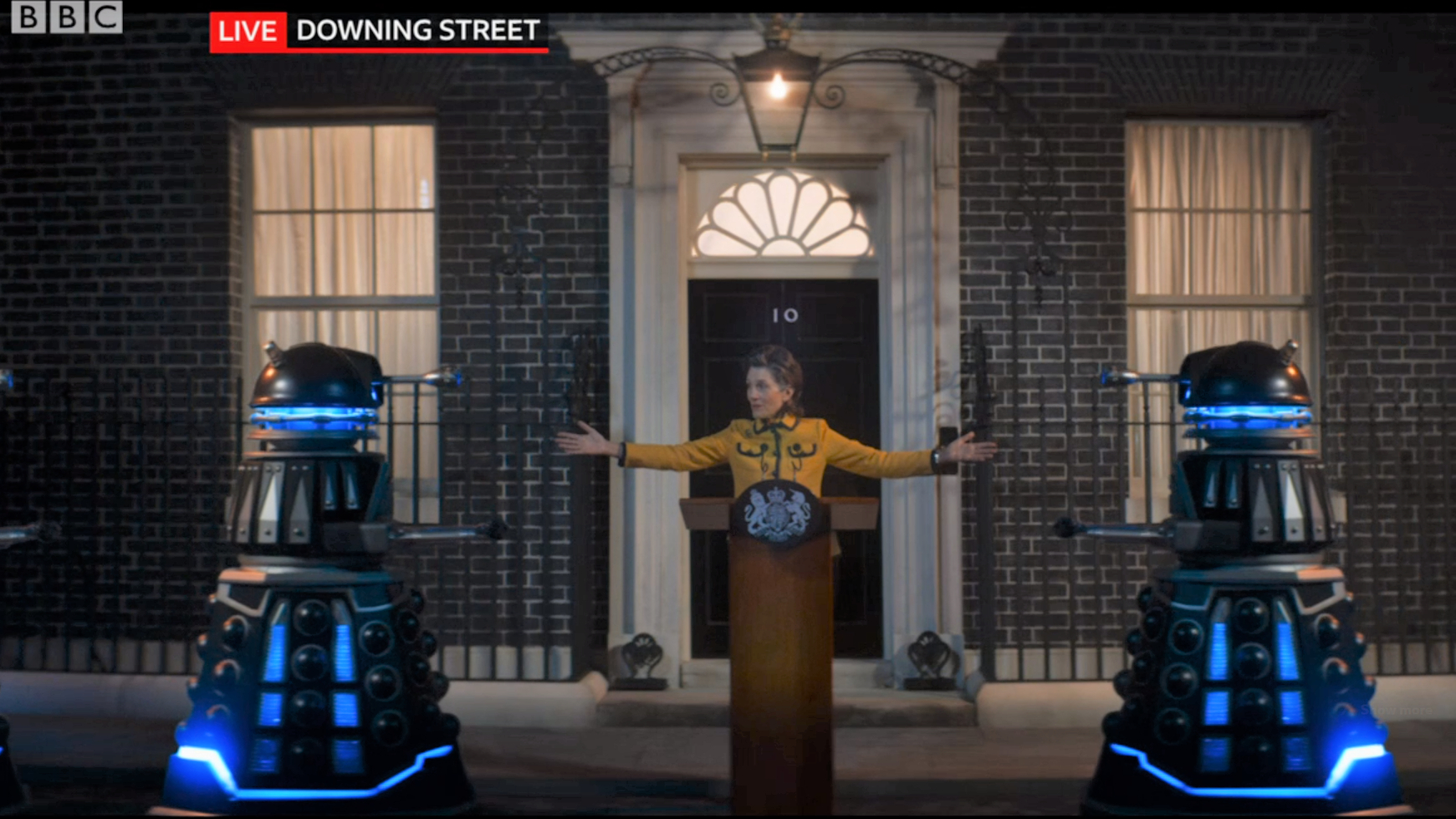

Is The Doctor Who Christmas Special Cancelled

May 17, 2025

Is The Doctor Who Christmas Special Cancelled

May 17, 2025 -

Anunoby Lidera A Knicks Con 27 Puntos Victoria 105 91 Sobre Sixers Que Encadenan Novena Derrota

May 17, 2025

Anunoby Lidera A Knicks Con 27 Puntos Victoria 105 91 Sobre Sixers Que Encadenan Novena Derrota

May 17, 2025