Romanian Shipyard Mangalia: Turkish Company Desan Explores Takeover

Table of Contents

Desan Shipyard's Interest in Mangalia

Desan Shipyard, a prominent player in the Turkish shipbuilding sector, boasts a strong track record in constructing various vessels, including naval ships and commercial tankers. Their interest in the Romanian Shipyard Mangalia stems from several strategic factors:

-

Expansion into the EU Market: Acquiring Mangalia provides Desan with direct access to the European Union market, significantly broadening their customer base and market share. This strategic move allows them to bypass potential trade barriers and access lucrative EU contracts.

-

Access to Skilled Romanian Workforce: Romania possesses a skilled workforce with experience in shipbuilding, offering Desan a ready pool of talent to support their expansion. This reduces the need for extensive training and recruitment costs.

-

Strategic Location of Mangalia Shipyard: Mangalia's location on the Black Sea offers significant logistical advantages, providing easy access to major shipping routes and facilitating efficient transportation of materials and finished products.

-

Potential Synergies between the Two Companies: Merging Desan's expertise and resources with Mangalia's existing infrastructure and workforce could create considerable synergies, leading to enhanced efficiency and innovation.

-

Acquisition Cost and Potential Return on Investment: While the exact acquisition cost remains undisclosed, the potential return on investment for Desan is likely substantial, considering Mangalia's strategic location and access to EU markets.

Impact on Romanian Economy and Employment

The potential takeover of the Romanian Shipyard Mangalia by Desan presents a mixed bag for the Romanian economy and employment.

-

Job Creation and Retention in the Mangalia Region: While some restructuring is inevitable, Desan's investment could potentially lead to job creation and the retention of existing positions in the Mangalia region, bolstering the local economy.

-

Potential for Technology Transfer and Upskilling of Romanian Workers: The acquisition could bring advanced shipbuilding technologies and expertise to Romania, offering opportunities for upskilling and professional development for Romanian workers. This could enhance their competitiveness in the global shipbuilding market.

-

Impact on Local Suppliers and Related Industries: Increased activity at the Mangalia shipyard could positively impact local suppliers and related industries, creating a ripple effect of economic growth within the region.

-

Government's Role in Supporting the Transition: The Romanian government will play a crucial role in ensuring a smooth transition, mitigating potential job losses, and maximizing the economic benefits of the takeover. Government incentives and support for retraining programs will be vital.

-

Economic Benefits from Increased Shipbuilding Activity: A revitalized Mangalia shipyard, under Desan's management, could boost Romania's shipbuilding capacity and contribute significantly to the country's GDP.

Geopolitical Implications of the Takeover

The Mangalia shipyard holds significant geopolitical importance due to its strategic location on the Black Sea. Desan's acquisition introduces several geopolitical considerations:

-

Mangalia's Strategic Location and its Role in Regional Security: Mangalia’s position on the Black Sea makes it strategically important for regional security and trade. The change in ownership could impact the regional balance of power.

-

Implications for Romania's Defense Industry: The takeover may influence Romania's defense industry capabilities, particularly if Desan secures contracts for naval vessel construction.

-

Potential Impact on Black Sea Trade and Maritime Cooperation: The acquisition could influence trade routes and maritime cooperation within the Black Sea region.

-

EU and NATO Perspectives on the Takeover: The EU and NATO will likely scrutinize the takeover to assess its potential impact on regional security and stability. Transparency and adherence to regulations will be crucial.

-

Strengthening of Turkey's Presence in the Black Sea Region: Desan's acquisition enhances Turkey's presence in the Black Sea, impacting the regional power dynamics.

The Future of the Romanian Shipyard Mangalia Under Desan

The future of the Romanian Shipyard Mangalia under Desan's ownership hinges on several factors:

-

Projected Investment Plans by Desan: Desan's investment strategy will determine the extent of modernization, expansion, and technological upgrades at the shipyard.

-

Potential New Shipbuilding Contracts and Projects: Securing new contracts will be essential to ensure the shipyard's long-term viability and profitability.

-

Expected Changes in Workforce and Management Structure: Restructuring and changes in management are likely, requiring careful handling to minimize disruption and maintain employee morale.

-

Modernization of Facilities and Technology Upgrades: Investments in modern facilities and technology will be crucial to enhancing the shipyard's competitiveness.

-

Long-Term Vision for the Mangalia Shipyard: Desan's long-term vision for the shipyard will shape its future role in the Romanian and international shipbuilding industries.

Conclusion

The potential takeover of the Romanian Shipyard Mangalia by Desan Shipyard presents both opportunities and challenges for Romania. While it could boost the economy, create jobs, and introduce advanced technologies, it also raises concerns about potential job losses, economic dependence, and geopolitical implications. The success of this acquisition hinges on transparent management, strategic planning, and cooperation between Desan, the Romanian government, and other stakeholders. Stay informed about the developments surrounding the Romanian Shipyard Mangalia and the Desan takeover for further insights into the future of Romanian shipbuilding. Follow our updates for the latest news on the Romanian Shipyard Mangalia.

Featured Posts

-

Fusion Portfolio Welcomes Dong Duong Hotel In Hue

Apr 26, 2025

Fusion Portfolio Welcomes Dong Duong Hotel In Hue

Apr 26, 2025 -

Investigation Federal Agencys Inquiry Into Jewish Employees At Columbia And Barnard

Apr 26, 2025

Investigation Federal Agencys Inquiry Into Jewish Employees At Columbia And Barnard

Apr 26, 2025 -

Santierul Naval Mangalia Interventie Solicitata De Sindicat Catre Ambasada Olandei

Apr 26, 2025

Santierul Naval Mangalia Interventie Solicitata De Sindicat Catre Ambasada Olandei

Apr 26, 2025 -

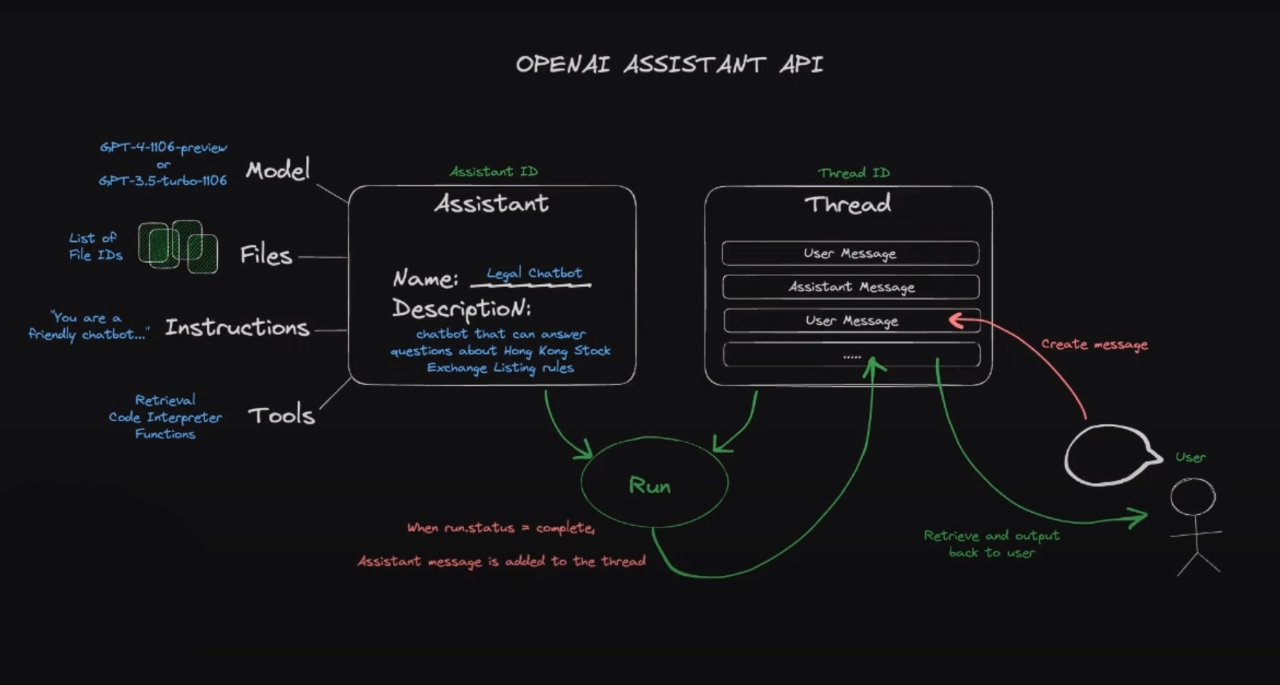

Building Voice Assistants Just Got Easier Open Ais 2024 Announcement

Apr 26, 2025

Building Voice Assistants Just Got Easier Open Ais 2024 Announcement

Apr 26, 2025 -

Exclusive Report Polygraph Tests Leaks And Infighting Target Pete Hegseth

Apr 26, 2025

Exclusive Report Polygraph Tests Leaks And Infighting Target Pete Hegseth

Apr 26, 2025

Latest Posts

-

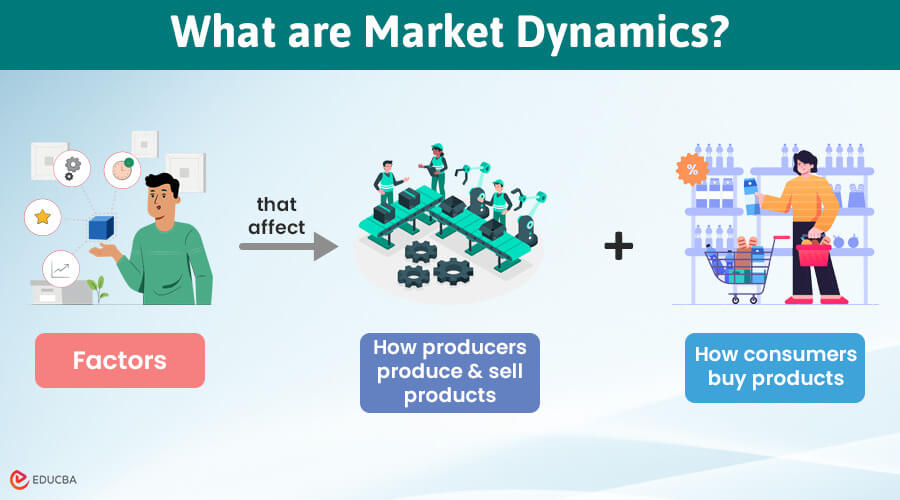

Bmw And Porsche In China Understanding Market Dynamics And Future Strategies

Apr 26, 2025

Bmw And Porsche In China Understanding Market Dynamics And Future Strategies

Apr 26, 2025 -

Premium Car Sales In China Bmw And Porsches Strategies And Results

Apr 26, 2025

Premium Car Sales In China Bmw And Porsches Strategies And Results

Apr 26, 2025 -

Gambling On Calamity The Case Of The Los Angeles Wildfires

Apr 26, 2025

Gambling On Calamity The Case Of The Los Angeles Wildfires

Apr 26, 2025 -

Los Angeles Wildfires The Growing Market For Disaster Betting

Apr 26, 2025

Los Angeles Wildfires The Growing Market For Disaster Betting

Apr 26, 2025 -

The Complexities Of The Chinese Auto Market Case Studies Of Bmw And Porsche

Apr 26, 2025

The Complexities Of The Chinese Auto Market Case Studies Of Bmw And Porsche

Apr 26, 2025