Russia's Gas Pipeline: An Exclusive Elliott Investment

Table of Contents

Understanding Elliott Investment's Approach to Russian Energy

Elliott Investment Management is renowned for its activist investing style, often targeting distressed assets and emerging markets. Their approach in the Russian energy market likely centers on identifying undervalued or financially stressed assets within the country's extensive gas pipeline network. This strategy could involve several key elements:

- Focus on distressed debt opportunities: Elliott might seek to acquire debt of struggling pipeline companies at a discount, potentially gaining control through debt restructuring.

- Asset stripping or restructuring: Once involved, Elliott may focus on streamlining operations, divesting non-core assets, or renegotiating contracts to boost profitability and maximize returns from their pipeline investment.

- Leveraging global expertise: Elliott boasts extensive experience in navigating complex legal and regulatory environments globally, giving them a potential edge in dealing with the intricacies of the Russian energy sector.

- High risk tolerance: Elliott's history suggests a considerable risk appetite. This could mean pursuing higher-risk, higher-reward investments in the Russian gas pipeline infrastructure that might deter other investors.

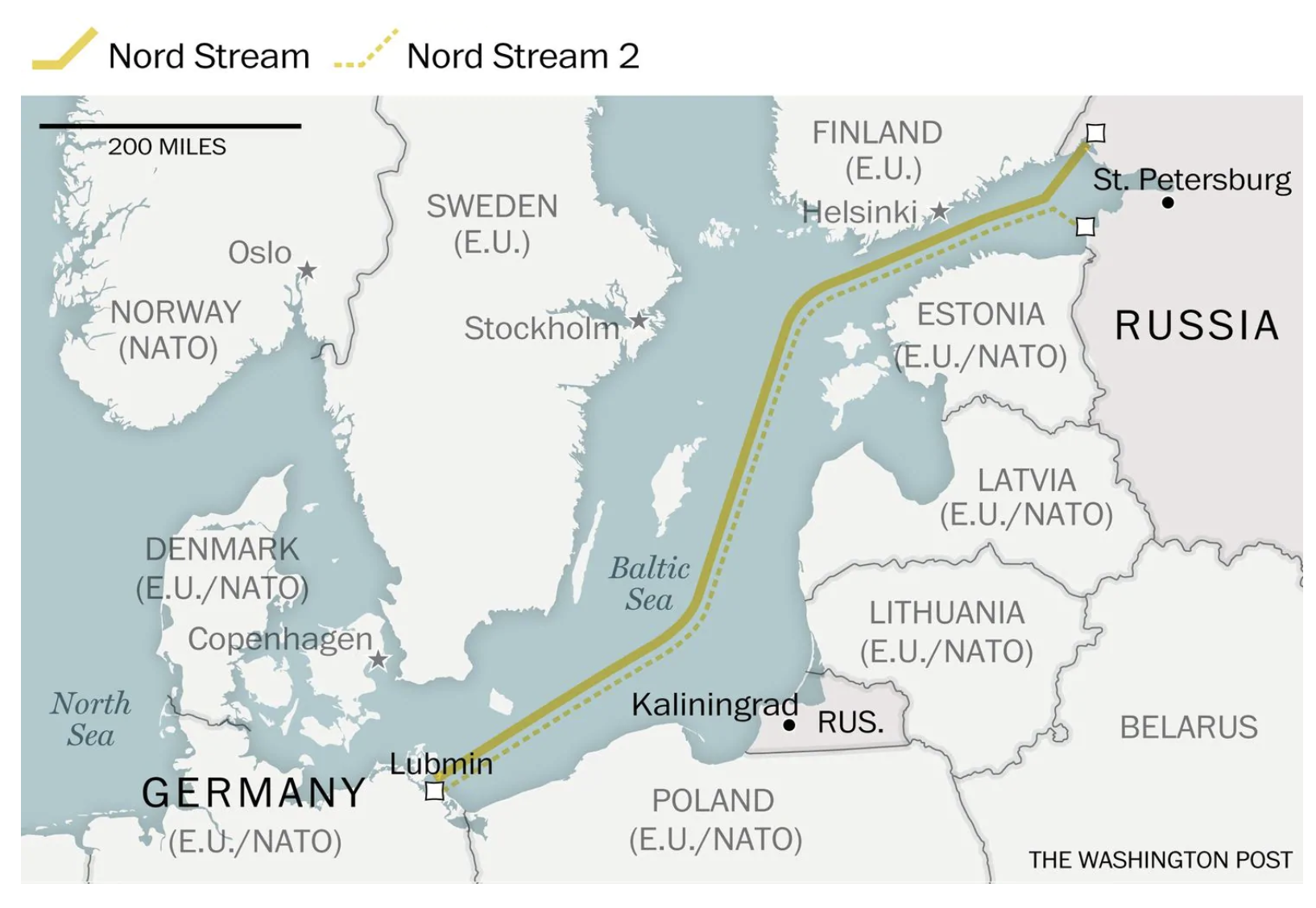

Geopolitical Risks and Rewards of Investing in Russia's Gas Pipelines

Investing in Russia's gas pipelines carries significant geopolitical risks. The ongoing conflict in Ukraine, Western sanctions, and the inherent political instability of the region all pose substantial challenges:

- Sanctions risk: New sanctions or the tightening of existing ones could significantly impact pipeline operations and investment value. Mitigation strategies might include diversification across multiple pipelines or focusing on assets less directly impacted by sanctions.

- Ukraine conflict impact: The conflict's effects on gas transit routes and energy security in Europe significantly influence the valuation of Russian gas pipelines, creating both uncertainty and potential opportunities.

- Strategic importance of Russian gas: Despite the risks, Russian gas remains a crucial energy source for Europe and parts of Asia. This underlying demand provides a counterbalance to the geopolitical instability, offering the potential for significant long-term returns.

- Diversification strategy: Reducing risk involves diversifying investments across different pipelines, regions, and even energy sectors to avoid overexposure to any single geopolitical event.

Financial Analysis of Russian Gas Pipeline Investments

Analyzing the financial viability of Russian gas pipeline investments requires careful consideration of various factors. A hypothetical analysis might include:

- Return on investment (ROI): Projected ROI would depend on gas prices, transportation fees, operational costs, and the initial investment cost. Different scenarios (e.g., high gas prices, low gas prices, sanctions impact) need to be modeled.

- Pipeline valuation: Discounted cash flow (DCF) analysis and comparable company analysis are common valuation methods for gas pipelines. However, accurately estimating future cash flows in such a volatile geopolitical environment is challenging.

- Cash flow projections: These projections need to consider fluctuating gas prices, operational expenses (maintenance, repairs), and potential disruptions caused by geopolitical events or sanctions.

- Sensitivity analysis: Examining how changes in key variables (gas prices, operational costs, sanctions risk) impact profitability is crucial for assessing the investment's overall risk profile.

Due Diligence and Risk Mitigation Strategies

Thorough due diligence is paramount for navigating the complex regulatory and geopolitical landscape. Key aspects include:

- Legal compliance: Ensuring full compliance with all relevant Russian and international laws is essential. This includes understanding and adhering to sanctions regulations.

- Sanctions compliance: A detailed assessment of sanctions risks and the development of robust compliance programs are critical for mitigating potential penalties and operational disruptions.

- ESG factors: Increasingly, investors are considering Environmental, Social, and Governance (ESG) factors. Due diligence should encompass environmental impact assessments, social responsibility considerations, and good governance practices of the targeted pipeline assets.

Conclusion

Investing in Russia's gas pipeline infrastructure, as pursued by entities like Elliott Investment, presents a high-risk, high-reward proposition. The geopolitical risks are substantial, but the potential for significant returns, given the strategic importance of Russian gas, remains attractive. Thorough due diligence, a deep understanding of the geopolitical landscape, and a sophisticated risk mitigation strategy are paramount for success. Investing in Russia's gas pipeline infrastructure requires careful consideration and expertise. Learn more about navigating the complexities of Russia's energy sector and discover potential investment opportunities in Russia's gas pipeline infrastructure.

Featured Posts

-

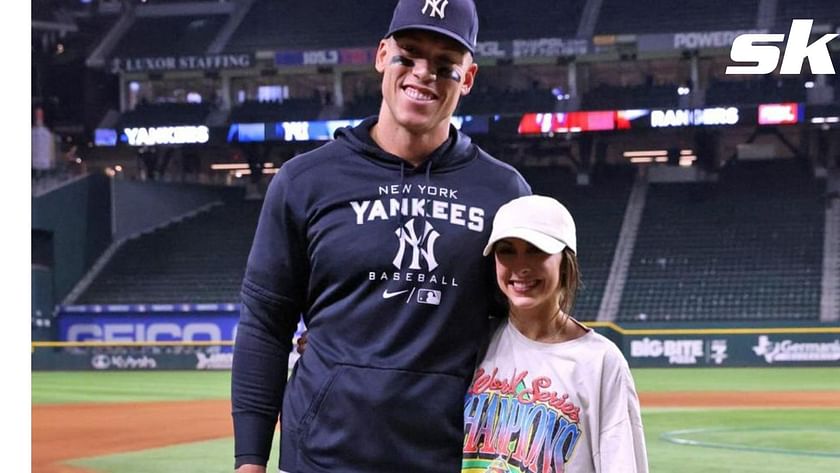

Predicting Aaron Judges 2024 Performance Yankees Magazine Analysis

May 11, 2025

Predicting Aaron Judges 2024 Performance Yankees Magazine Analysis

May 11, 2025 -

First Gen Ford Gt Restoration Lynxs Expertise On Display

May 11, 2025

First Gen Ford Gt Restoration Lynxs Expertise On Display

May 11, 2025 -

Champ Ready Stadium Track Gets A New Surface

May 11, 2025

Champ Ready Stadium Track Gets A New Surface

May 11, 2025 -

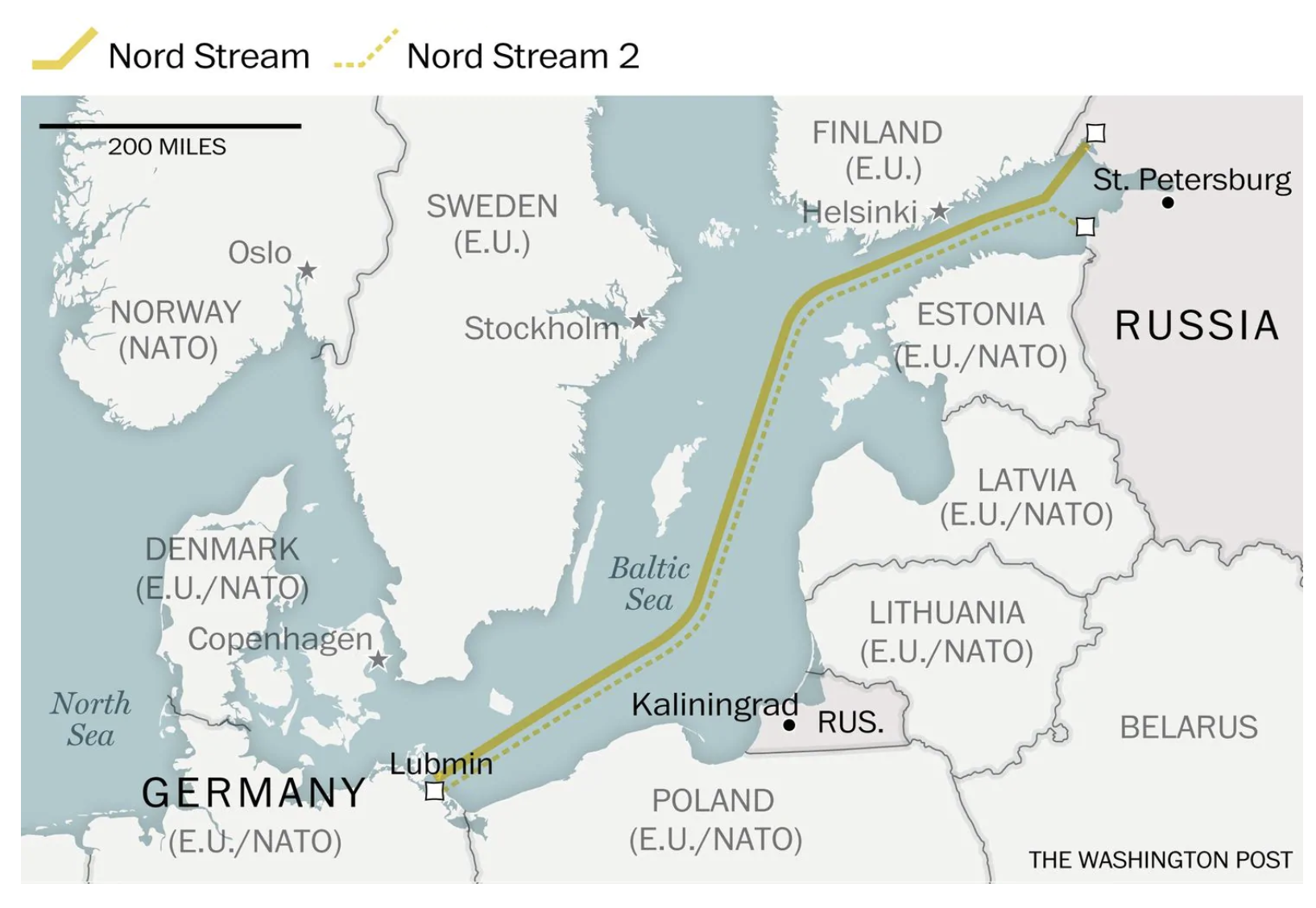

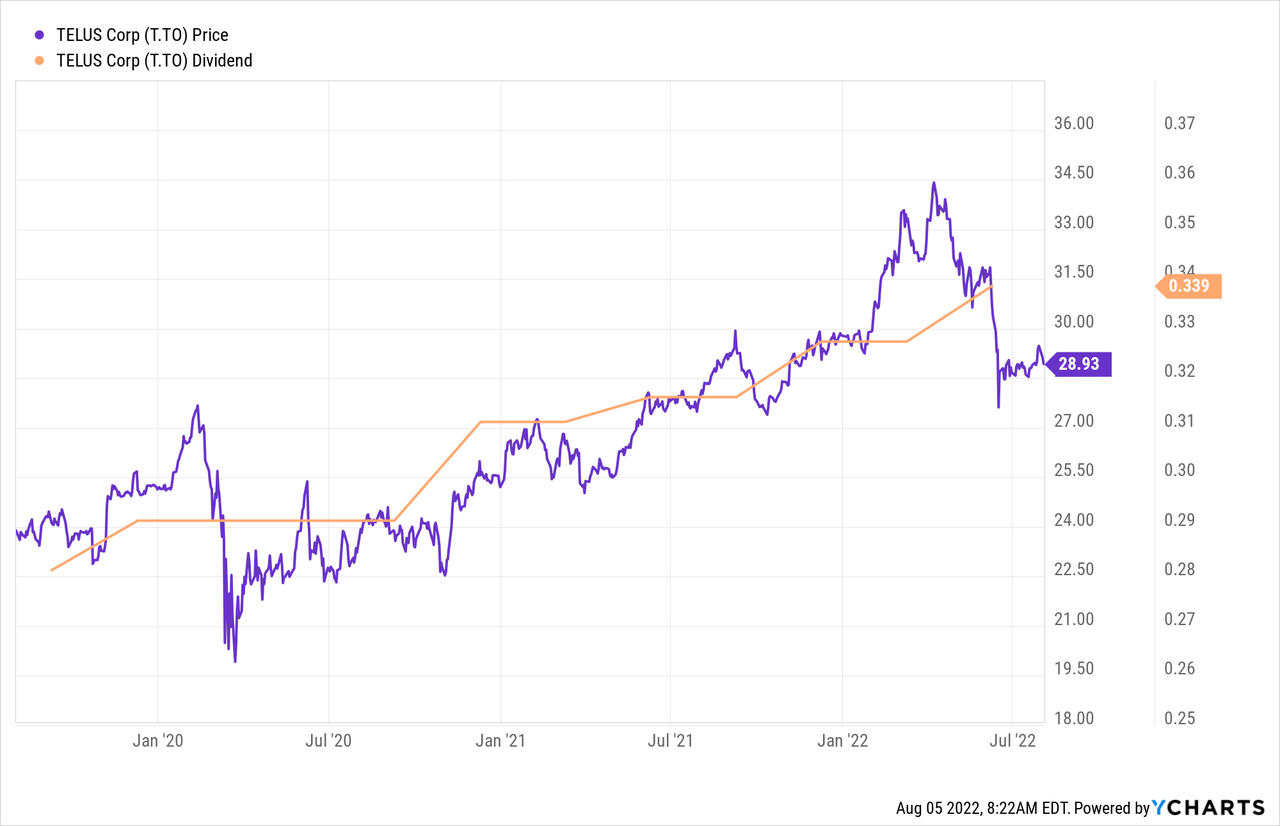

Telus Announces Q1 Earnings Growth And Dividend Boost

May 11, 2025

Telus Announces Q1 Earnings Growth And Dividend Boost

May 11, 2025 -

Yankees Magazine Aaron Judges Road To A Historic 2024

May 11, 2025

Yankees Magazine Aaron Judges Road To A Historic 2024

May 11, 2025

Latest Posts

-

Ford Gt Restoration The Lynx Approach To Automotive Excellence

May 11, 2025

Ford Gt Restoration The Lynx Approach To Automotive Excellence

May 11, 2025 -

Indy 500 Palous Pole Position Highlights Andrettis Difficulties

May 11, 2025

Indy 500 Palous Pole Position Highlights Andrettis Difficulties

May 11, 2025 -

First Gen Ford Gt Restoration Lynxs Expertise On Display

May 11, 2025

First Gen Ford Gt Restoration Lynxs Expertise On Display

May 11, 2025 -

Lynx Brings First Gen Ford Gt Back To Life A Complete Restoration

May 11, 2025

Lynx Brings First Gen Ford Gt Back To Life A Complete Restoration

May 11, 2025 -

Indy 500 Qualifying Palou On Pole Andretti Drivers Struggle

May 11, 2025

Indy 500 Qualifying Palou On Pole Andretti Drivers Struggle

May 11, 2025