Ryan Reynolds' MNTN: Next Week's Potential IPO Launch

Table of Contents

MNTN's Unique Brand and Marketing Strategy

MNTN's success hinges on a carefully crafted brand identity and a savvy marketing approach. The company isn't just selling fitness equipment; it's selling a lifestyle. This section examines the key components of their strategy.

Leveraging Celebrity Endorsement and Influencer Marketing

Ryan Reynolds' involvement is arguably MNTN's most significant asset. His personal brand, built on humor, self-deprecation, and savvy marketing, perfectly aligns with the company's image.

- The Power of Ryan Reynolds: Reynolds' massive social media following and established reputation for successful brand building (Aviation Gin being a prime example) directly translate into significant brand awareness and trust for MNTN. His involvement transcends simple celebrity endorsement; it's an integral part of the brand DNA.

- Social Media Savvy: MNTN's social media presence isn't just about posting product photos; it's about creating engaging content that resonates with its target audience. The use of humor, relatable content, and strategic partnerships with fitness influencers amplifies their reach and message.

- Humorous and Engaging Campaigns: MNTN’s marketing campaigns avoid the typical overly serious tone often associated with fitness brands. Their playful and often irreverent approach stands out in a crowded market, fostering a strong connection with consumers.

- Competitive Comparison: Unlike competitors who rely heavily on traditional advertising, MNTN prioritizes digital marketing and influencer collaborations, allowing for more targeted reach and better ROI. This nimble approach gives them an edge in the competitive fitness equipment market.

The Direct-to-Consumer (DTC) Business Model

MNTN operates on a direct-to-consumer (DTC) model, selling its products directly to consumers online, bypassing traditional retail channels.

- Advantages of DTC: A DTC model allows for greater control over pricing, branding, and customer experience. It also enables the collection of valuable customer data, which is crucial for targeted marketing and product development.

- Scalability and Growth: The DTC model allows for rapid scaling and expansion into new markets, without the limitations and costs associated with traditional retail partnerships.

- E-commerce and CRM: MNTN's success hinges on a robust e-commerce platform and effective Customer Relationship Management (CRM) system. This ensures seamless customer experiences, facilitates personalized marketing, and builds brand loyalty.

- CAC and LTV: Analyzing MNTN's Customer Acquisition Cost (CAC) and Customer Lifetime Value (LTV) is crucial for assessing the long-term financial health of the company. A healthy LTV:CAC ratio indicates a sustainable business model.

Financial Projections and Investment Potential

Assessing MNTN's investment potential requires a thorough examination of its financial performance and an understanding of the inherent risks.

Analyzing MNTN's Financial Performance and Growth Trajectory

While specific financial details may be limited before the IPO, publicly available information and market analysis can offer insights into MNTN's potential.

- Key Financial Metrics: Analyzing revenue growth, profitability margins, and market share projections will help determine the company's financial health and growth potential. (Note: If projections are publicly available, include them here.)

- Competitive Advantage: MNTN’s premium positioning, unique brand identity, and DTC strategy give it a potential competitive advantage in the fitness equipment sector.

- Macroeconomic Factors: External factors like inflation, economic downturns, and changes in consumer spending habits could impact MNTN's performance. A thorough risk assessment is needed to understand these potential impacts.

- Valuation and ROI: The valuation placed on MNTN at its IPO will be a key factor for investors. Understanding the projected return on investment (ROI) is crucial before making any decision.

Risk Assessment for Potential Investors

Investing in any IPO carries inherent risks, and MNTN is no exception.

- Risks of a Newly Public Company: Newly public companies are inherently more volatile than established companies. Stock prices can fluctuate significantly based on market sentiment and news.

- Industry Competition: The fitness industry is highly competitive. MNTN faces competition from established players and new entrants.

- Changing Consumer Trends: Consumer preferences in the fitness industry can change rapidly. MNTN's ability to adapt to these trends will impact its success.

- Market Volatility: Overall market conditions can significantly impact the performance of newly public companies. Economic downturns or periods of market instability can negatively affect MNTN’s stock price.

MNTN's Relationship to Ryan Reynolds' Other Ventures

Ryan Reynolds’ entrepreneurial portfolio extends beyond MNTN, creating potential synergies that could boost the company's growth.

Synergies with Aviation Gin and Maximum Effort

The cross-promotion opportunities between MNTN and Reynolds' other ventures, such as Aviation Gin and Maximum Effort Productions, are significant.

- Cross-Promotional Opportunities: Marketing campaigns could seamlessly integrate MNTN products with Aviation Gin or Maximum Effort projects, leveraging the existing brand recognition and audience.

- Benefits for MNTN's Growth: Reynolds' established network and marketing expertise can accelerate MNTN's growth and brand awareness.

- Impact of Reynolds' Celebrity Status: Reynolds' celebrity status provides an invaluable halo effect, enhancing MNTN's credibility and appeal to consumers.

Conclusion

The potential IPO of Ryan Reynolds' MNTN presents a compelling investment opportunity, fueled by a strong brand, innovative marketing, and a potentially lucrative DTC model. However, potential investors should carefully consider the inherent risks associated with any IPO, particularly in a volatile market. Thorough due diligence, including careful review of financial projections and risk assessments, is crucial before making any investment decision. Stay informed about the latest developments surrounding the MNTN IPO and make informed choices about whether this is the right investment for your portfolio. Don't miss out on the chance to be a part of the MNTN story – learn more about the Ryan Reynolds MNTN IPO and consider its potential.

Featured Posts

-

Sorteo Campeonato Uruguayo Segunda Division 2025 Todo Lo Que Necesitas Saber

May 12, 2025

Sorteo Campeonato Uruguayo Segunda Division 2025 Todo Lo Que Necesitas Saber

May 12, 2025 -

Unlikely 40 Point Performances By Two Boston Celtics Players

May 12, 2025

Unlikely 40 Point Performances By Two Boston Celtics Players

May 12, 2025 -

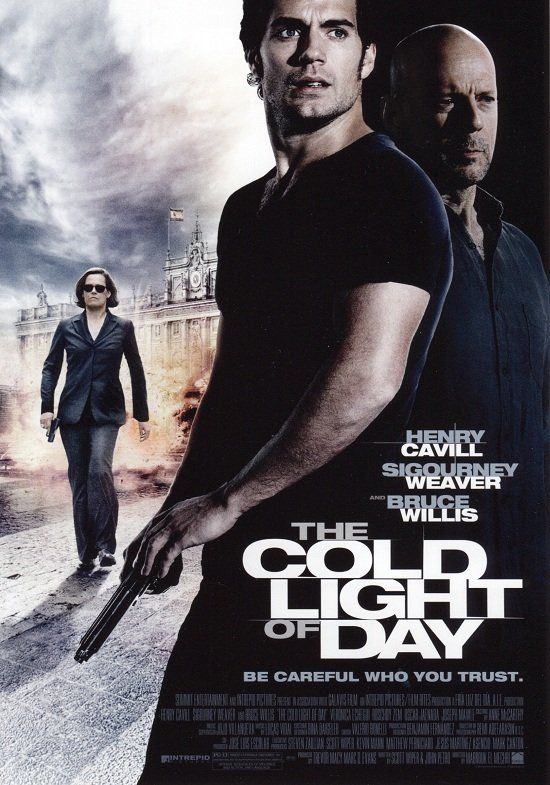

Fake Marvel Cyclops Trailer Starring Henry Cavill Viral Sensation

May 12, 2025

Fake Marvel Cyclops Trailer Starring Henry Cavill Viral Sensation

May 12, 2025 -

Le Magicien Eric Antoine Et Sa Nouvelle Compagne Une Histoire D Amour Apres Le Divorce

May 12, 2025

Le Magicien Eric Antoine Et Sa Nouvelle Compagne Une Histoire D Amour Apres Le Divorce

May 12, 2025 -

Ksiaze Andrzej I Masazystka Szczegoly Szokujacego Spotkania

May 12, 2025

Ksiaze Andrzej I Masazystka Szczegoly Szokujacego Spotkania

May 12, 2025

Latest Posts

-

Mtv Cribs Celebrity Homes And Their Architectural Wonders

May 12, 2025

Mtv Cribs Celebrity Homes And Their Architectural Wonders

May 12, 2025 -

High End Homes Exploring The World Of Mtv Cribs

May 12, 2025

High End Homes Exploring The World Of Mtv Cribs

May 12, 2025 -

Inside The Mansions Of Mtv Cribs A Visual Journey

May 12, 2025

Inside The Mansions Of Mtv Cribs A Visual Journey

May 12, 2025 -

The Opulence Of Mtv Cribs A Look At Celebrity Homes

May 12, 2025

The Opulence Of Mtv Cribs A Look At Celebrity Homes

May 12, 2025 -

Mtv Cribs Celebrity Real Estate Extravaganza

May 12, 2025

Mtv Cribs Celebrity Real Estate Extravaganza

May 12, 2025