S&P 500 Index: Significant Gains After US-China Trade Developments

Table of Contents

Easing Trade Tensions Fuel S&P 500 Growth

The recent improvement in US-China trade relations has been a primary driver of the S&P 500's upward trajectory. This positive shift stems from several key factors, significantly impacting investor confidence and market sentiment regarding the S&P 500 index funds and individual equities.

Phase One Trade Deal Impact

The "Phase One" trade deal signed in early 2020 marked a crucial turning point. This agreement resulted in:

- Tariff Reductions: Significant reductions in tariffs on billions of dollars worth of goods exchanged between the US and China. Estimates suggest that these reductions impacted over $100 billion in bilateral trade, significantly reducing costs for businesses and consumers.

- Increased Chinese Purchases: China committed to purchasing a substantial amount of US agricultural products and other goods, boosting American exports and supporting related industries. This commitment provided a concrete demonstration of China's willingness to address US trade concerns.

- Reduced Uncertainty: The agreement itself, despite its limitations, reduced the significant uncertainty that had previously plagued markets. This clarity allowed businesses to make better investment decisions, fostering economic growth, and impacting the S&P 500 positively.

This reduced uncertainty significantly boosted investor confidence, leading to increased investment in the stock market and contributing to the S&P 500's gains.

De-escalation of Trade Rhetoric

Beyond the specific terms of the Phase One deal, a noticeable de-escalation in trade rhetoric from both the US and China played a crucial role.

- Conciliatory Statements: Government officials from both countries issued more conciliatory public statements, signaling a willingness to cooperate and find common ground. This shift in tone helped to calm investor anxieties.

- Reduced Threat of Further Tariffs: The lessening of aggressive trade language reduced the perceived risk of further escalations and the imposition of new tariffs, which had previously caused significant market volatility. This improved outlook created a more favorable environment for investment in the S&P 500 and other related index funds.

Sector-Specific Performance Within the S&P 500

The impact of the improved trade relations wasn't uniform across all sectors within the S&P 500. Some sectors benefited disproportionately from the positive developments.

Technology Sector Gains

The technology sector experienced particularly strong gains, owing to several factors:

- Reduced Tariff Risk: Technology companies were particularly vulnerable to tariffs, and the de-escalation of trade tensions significantly reduced this risk.

- Increased Demand: The positive economic outlook resulting from the trade deal fueled increased demand for technology products and services, further boosting the sector's performance.

- Specific Examples: Companies like Apple and Qualcomm, heavily reliant on international trade, saw significant stock price increases following the positive trade news, reflecting improved investor sentiment and expectations of stronger earnings.

Other Key Sectors

Other key sectors within the S&P 500 also experienced varied performance:

- Consumer Discretionary: This sector saw generally positive growth, reflecting increased consumer confidence and spending fueled by the improved economic outlook.

- Industrials: The industrials sector also benefited from the positive trade news, with companies involved in exporting and importing seeing improved prospects. However, the performance varied depending on the specific sub-sectors and the degree of their reliance on trade with China.

The varied performance highlights the complex interplay between trade relations and specific sector dynamics within the S&P 500.

Long-Term Implications for the S&P 500 and Investors

The positive developments in US-China trade relations have significant long-term implications for the S&P 500 and investors.

Sustained Growth Potential

Many analysts predict sustained growth in the S&P 500 based on these positive trade developments. However, this outlook isn't without caveats:

- Global Economic Conditions: The overall global economic climate will play a vital role in determining the continued success of the S&P 500. Recessions or significant global instability could negatively impact market performance.

- Geopolitical Risks: Geopolitical risks, beyond US-China relations, could impact investor confidence and market stability.

While the outlook is positive, caution and vigilance are still required.

Investment Strategies

The recent market movements call for careful consideration of investment strategies:

- Diversification: Diversifying investments across various sectors and asset classes remains crucial to mitigate risk.

- Index Funds: Investing in S&P 500 index funds offers broad market exposure and can be a suitable approach for long-term investors.

- Individual Stock Picking: For investors with higher risk tolerance and expertise, carefully selecting individual stocks within the S&P 500 might offer greater potential returns.

Remember that market volatility is inherent, and careful investment decisions are always essential.

Conclusion

The recent surge in the S&P 500 index is largely attributable to the positive developments in US-China trade relations. The "Phase One" trade deal, the de-escalation of trade rhetoric, and the resulting increased investor confidence have all contributed to significant market gains. While the long-term implications remain dependent on various economic and geopolitical factors, the current outlook is generally positive. However, it's crucial to maintain a diversified investment strategy and remain informed about ongoing developments. Stay informed about developments in US-China trade relations and their impact on the S&P 500 index. Consider adjusting your investment strategy to capitalize on opportunities presented by this evolving market landscape. Learn more about effective S&P 500 investing strategies today!

Featured Posts

-

Tzortz Mpalntok I Atolmiti Praksi Toy Proponiti Tis Sefilnt Gioynaitent Meta Ti Niki

May 13, 2025

Tzortz Mpalntok I Atolmiti Praksi Toy Proponiti Tis Sefilnt Gioynaitent Meta Ti Niki

May 13, 2025 -

Extensive Search Underway For Missing Senior In Portola Valley Preserve

May 13, 2025

Extensive Search Underway For Missing Senior In Portola Valley Preserve

May 13, 2025 -

Iz Ave Marinike Tepi Da Li E Rech O Govoru Mrzhnje Stav Natsionalnog Saveta Roma

May 13, 2025

Iz Ave Marinike Tepi Da Li E Rech O Govoru Mrzhnje Stav Natsionalnog Saveta Roma

May 13, 2025 -

Ai And Xr Convergence A New Battleground For Tech Platforms

May 13, 2025

Ai And Xr Convergence A New Battleground For Tech Platforms

May 13, 2025 -

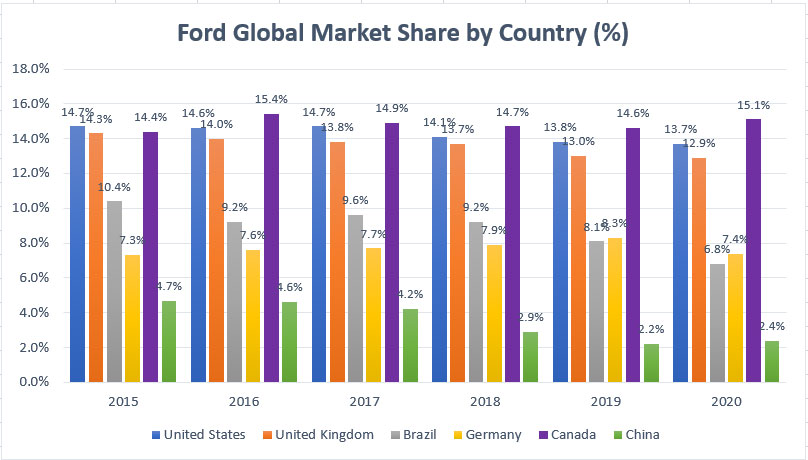

Byds Brazilian Expansion A Threat To Fords Market Share

May 13, 2025

Byds Brazilian Expansion A Threat To Fords Market Share

May 13, 2025