Sasol (SOL): A Deep Dive Into The Newly Unveiled Strategy

Table of Contents

Redefining Sasol's Core Business Focus

Sasol's new strategy marks a significant shift in its core business focus, aiming for sustainable growth and enhanced profitability. This involves a strategic repositioning within its existing operations and a renewed emphasis on specific market segments.

Shifting Priorities Towards Chemicals

The new Sasol (SOL) strategy prioritizes higher-margin chemical products. This involves:

- Focus on higher-margin chemical products: Sasol is moving away from lower-margin commodity chemicals, concentrating instead on specialty chemicals and those with higher growth potential. This includes expanding its presence in sectors like performance chemicals and polymers.

- Strategic divestment of underperforming assets: To streamline operations and focus resources on core strengths, Sasol plans to divest non-core assets and businesses that don't align with its new strategic direction. This allows for capital reallocation towards more profitable ventures.

- Investment in research and development for innovative chemical solutions: Significant investment in R&D will fuel innovation and development of new, high-value chemical products. This commitment to technological advancement is crucial for maintaining a competitive edge in the global chemical market.

- Exploration of new markets for specialty chemicals: Sasol aims to expand its market reach into new geographic regions and emerging markets with a high demand for specialty chemicals. This diversification strategy reduces reliance on any single market and enhances overall resilience.

Keyword Optimization: Sasol Chemicals, SOL Chemical Strategy, Sasol Portfolio Restructuring

Enhanced Operational Efficiency

A cornerstone of the new Sasol (SOL) Strategy is a commitment to improving operational efficiency across all aspects of the business. This involves:

- Implementation of cost-cutting measures: Sasol is actively pursuing cost reduction initiatives to improve profitability and financial stability. This includes optimizing supply chains, reducing operational expenses, and streamlining administrative processes.

- Streamlining operations for improved productivity: Improving operational processes through automation, digitalization, and lean manufacturing principles will boost productivity and output.

- Technological advancements to optimize processes: The adoption of advanced technologies, such as artificial intelligence and machine learning, will optimize production processes, improve yields, and reduce waste.

- Focus on safety and environmental sustainability: Integrating safety and environmental considerations into every aspect of operations is a key element of the improved efficiency strategy. This commitment aligns with broader ESG initiatives and reduces risks associated with operational incidents.

Keyword Optimization: Sasol Operational Efficiency, SOL Cost Reduction, Sasol Sustainability Initiatives

Financial Implications of the New Sasol (SOL) Strategy

The strategic shift will have a significant impact on Sasol's financial performance and shareholder value.

Impact on Shareholder Value

Sasol projects that its revised strategy will lead to improved shareholder returns. This projection is based on:

- Projected return on investment (ROI) and growth forecasts: The company's financial projections indicate a substantial increase in ROI and revenue growth, driven by the higher-margin chemical focus and cost-cutting measures.

- Analysis of potential risks and challenges: Sasol acknowledges potential challenges, including market volatility and economic uncertainty, but believes the strategic changes mitigate these risks.

- Discussion of capital allocation plans: Sasol's revised capital allocation plan prioritizes investments in high-return projects and debt reduction.

- Comparison with previous strategies and performance: The new strategy builds upon past learning, and detailed analysis shows a clear improvement in projected performance compared to previous strategies.

Keyword Optimization: Sasol Stock Price, SOL Shareholder Returns, Sasol Investment Outlook

Debt Reduction and Financial Stability

A critical aspect of the new strategy is strengthening Sasol's financial position through debt reduction and improved financial stability. This involves:

- Strategies for reducing debt levels: Sasol is implementing several strategies to reduce debt, including asset sales, improved cash flow management, and cost optimization.

- Improving cash flow generation: The focus on higher-margin products and operational efficiency should boost cash flow, providing more resources for debt repayment and future investments.

- Enhanced financial transparency and reporting: Sasol commits to greater transparency in its financial reporting to enhance investor confidence and trust.

- Assessment of credit ratings and financial outlook: The company expects improved credit ratings reflecting the improved financial health resulting from the implemented strategy.

Keyword Optimization: Sasol Debt, SOL Financial Health, Sasol Credit Rating

Environmental, Social, and Governance (ESG) Considerations in Sasol's (SOL) New Strategy

Sasol's new strategy integrates robust ESG considerations, reflecting a broader commitment to sustainability and responsible business practices.

Commitment to Sustainability

Sasol's commitment to sustainability is a central theme within the new strategic framework:

- Targets for reducing carbon emissions: Sasol has set ambitious targets for reducing its carbon footprint, investing in renewable energy and carbon capture technologies.

- Investment in renewable energy sources: The company plans to increase its investment in renewable energy sources, such as solar and wind power, to reduce reliance on fossil fuels.

- Implementation of responsible sourcing practices: Sasol will continue implementing responsible sourcing initiatives, ensuring ethical and sustainable procurement of raw materials.

- Emphasis on community engagement and social responsibility: The company remains committed to community development and social responsibility initiatives, fostering positive relationships with local communities.

Keyword Optimization: Sasol ESG, SOL Sustainability Report, Sasol Carbon Footprint, Sasol Renewable Energy

Conclusion

Sasol's (SOL) newly unveiled strategy represents a significant shift, focusing on higher-margin chemicals, improved operational efficiency, and strengthened ESG commitments. While challenges remain, the strategic changes suggest potential for enhanced shareholder value and long-term sustainability. Investors should carefully analyze these elements before making investment decisions. For a comprehensive understanding of the Sasol (SOL) strategy and its implications, review official Sasol publications and independent financial analyses. Understanding the complete Sasol (SOL) Strategy is crucial for informed investment decisions.

Featured Posts

-

Agatha Christie Returns The Bbcs Groundbreaking Adaptation

May 20, 2025

Agatha Christie Returns The Bbcs Groundbreaking Adaptation

May 20, 2025 -

Hegseth Confirms Further Us Missile Deployment To The Philippines

May 20, 2025

Hegseth Confirms Further Us Missile Deployment To The Philippines

May 20, 2025 -

The Evolution Of Hercule Poirot In Agatha Christies Novels

May 20, 2025

The Evolution Of Hercule Poirot In Agatha Christies Novels

May 20, 2025 -

Ivoire Tech Forum 2025 Promouvoir L Innovation Et La Technologie En Cote D Ivoire

May 20, 2025

Ivoire Tech Forum 2025 Promouvoir L Innovation Et La Technologie En Cote D Ivoire

May 20, 2025 -

Kto Takaya Novaya Sharapova Znakomstvo S Voskhodyaschey Zvezdoy

May 20, 2025

Kto Takaya Novaya Sharapova Znakomstvo S Voskhodyaschey Zvezdoy

May 20, 2025

Latest Posts

-

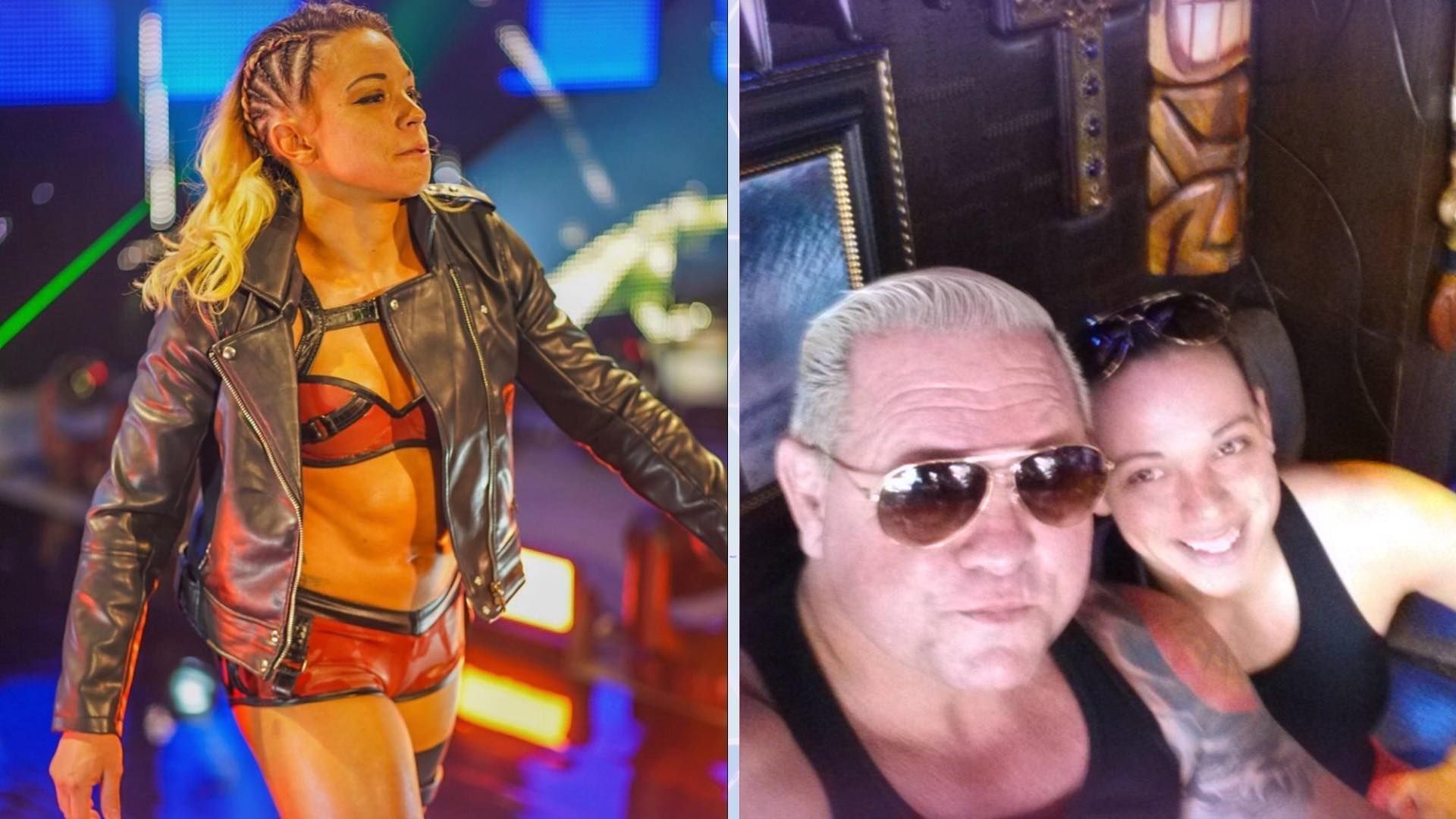

Wwe Raw Zoey Stark Suffers Injury Match Cut Short

May 20, 2025

Wwe Raw Zoey Stark Suffers Injury Match Cut Short

May 20, 2025 -

Zoey Stark Injured During Wwe Raw Match Details And Updates

May 20, 2025

Zoey Stark Injured During Wwe Raw Match Details And Updates

May 20, 2025 -

Huuhkajien Alkukokoonpano Naein Se Muuttui

May 20, 2025

Huuhkajien Alkukokoonpano Naein Se Muuttui

May 20, 2025 -

Roxanne Perez And Rhea Ripley Qualify For The 2025 Money In The Bank Ladder Match

May 20, 2025

Roxanne Perez And Rhea Ripley Qualify For The 2025 Money In The Bank Ladder Match

May 20, 2025 -

Huuhkajat Avauskokoonpanoon Kolme Muutosta Kaellman Penkille

May 20, 2025

Huuhkajat Avauskokoonpanoon Kolme Muutosta Kaellman Penkille

May 20, 2025