Sasol (SOL) Investor Concerns Following 2023 Strategy Update

Table of Contents

Debt Burden and Financial Stability Concerns

Sasol's high level of debt remains a primary source of Sasol (SOL) investor concerns. This substantial financial burden casts a long shadow over the company's financial stability and future prospects.

High Debt Levels and their Implications

- Current Debt Levels: Sasol's current debt-to-equity ratio and total debt figures (insert relevant data here) are significantly higher than many industry peers.

- Interest Expense: The substantial interest expense incurred annually (insert data) directly impacts profitability and cash flow, limiting the company's ability to invest in growth opportunities or return capital to shareholders.

- Credit Rating Risk: The high debt load poses a risk to Sasol's credit rating. A downgrade could increase borrowing costs further, exacerbating the financial strain. (Mention current credit rating and outlook from agencies like Moody's, S&P, and Fitch).

Sasol has announced a debt reduction strategy (summarize the plan here), but its feasibility remains a key question for investors. The success of this plan hinges on factors such as commodity prices, operational efficiency improvements, and successful divestment of non-core assets. The effectiveness and timeline of this Sasol debt reduction plan will be crucial in alleviating SOL financial stability concerns.

Impact of Global Energy Transition on Sasol's Long-Term Prospects

The global energy transition presents a formidable challenge to Sasol's long-term viability. As the world shifts towards renewable energy sources, the demand for fossil fuels – Sasol's core business – is expected to decline. This is a significant source of Sasol (SOL) investor concerns.

Challenges Posed by the Energy Transition

- Decreasing Demand for Fossil Fuels: The growth of renewable energy sources like solar, wind, and hydroelectric power is steadily reducing the demand for coal, gas, and other fossil fuels that Sasol produces.

- Sasol's Diversification Efforts: Sasol has attempted to diversify into cleaner energy sources, but the success of these efforts remains questionable. (Discuss specific examples and their impact). The pace of this Sasol diversification is key for mitigating ESG concerns and addressing the threat of stranded assets.

- Risk of Stranded Assets: Significant investments in fossil fuel infrastructure may become "stranded assets" – losing their value prematurely – as the energy transition accelerates. This poses a substantial risk to Sasol's future profitability and shareholder value. The potential for significant losses due to climate change impacts adds to investor anxiety.

Operational Efficiency and Cost Management Issues

Concerns surrounding Sasol operational efficiency and cost management also contribute to Sasol (SOL) investor concerns. Maintaining profitability in a volatile market requires robust cost control and efficient operations.

Operational Challenges and Inefficiencies

- Production Costs: High production costs (insert data and comparison to industry benchmarks) erode profit margins and hamper competitiveness.

- Operational Downtime: Frequent operational disruptions (provide data if available) can significantly impact production volumes and revenue.

- Cost-Cutting Initiatives: Sasol has implemented various cost-cutting initiatives. However, their effectiveness in achieving sustainable improvements in profitability remains to be seen. A detailed analysis of these initiatives and their impact on production costs is crucial for assessing Sasol operational efficiency.

Management's Execution and Strategic Direction

Investor confidence in Sasol's management team and their strategic vision is paramount. The clarity and feasibility of the 2023 strategy update, along with the management's track record in executing previous strategies, are significant factors influencing Sasol (SOL) investor concerns.

Investor Sentiment and Management's Track Record

- Investor Sentiment: Investor sentiment towards Sasol's management appears (describe current sentiment – positive, negative, neutral). (Provide evidence such as analyst ratings, news articles, and investor commentary).

- Clarity and Feasibility of the 2023 Strategy: The clarity and feasibility of Sasol's 2023 strategy update are crucial in regaining investor trust. A thorough analysis of the strategy's key components and their realistic achievability is essential.

- Execution Risk: The risk of failing to execute the strategic plan effectively is a major concern. (Discuss potential roadblocks and the management's capacity to overcome them.) Strong corporate governance is needed to address these Sasol (SOL) investor concerns.

Conclusion: Addressing Sasol (SOL) Investor Concerns – A Path Forward

This analysis highlights several key Sasol (SOL) investor concerns: a substantial debt burden, the challenges posed by the energy transition, operational efficiency issues, and concerns about management's execution of its strategy. These factors, when considered together, paint a complex picture for investors.

Key Takeaways: The successful navigation of these challenges will depend on Sasol's ability to effectively reduce its debt, adapt to the changing energy landscape, improve operational efficiency, and demonstrate strong leadership and strategic execution.

Call to Action: We urge investors to conduct thorough due diligence, carefully assessing the risks and opportunities associated with Sasol (SOL) stock. Consider consulting with a financial advisor before making any investment decisions. Continue monitoring Sasol's financial performance, strategic initiatives, and management's actions to gain a clearer picture of the company's future trajectory. Conduct further Sasol investor analysis, striving to understand Sasol (SOL) concerns and ultimately, properly assessing Sasol's future. By staying informed, you can make more informed investment choices based on your risk tolerance and evaluation of these crucial factors.

Featured Posts

-

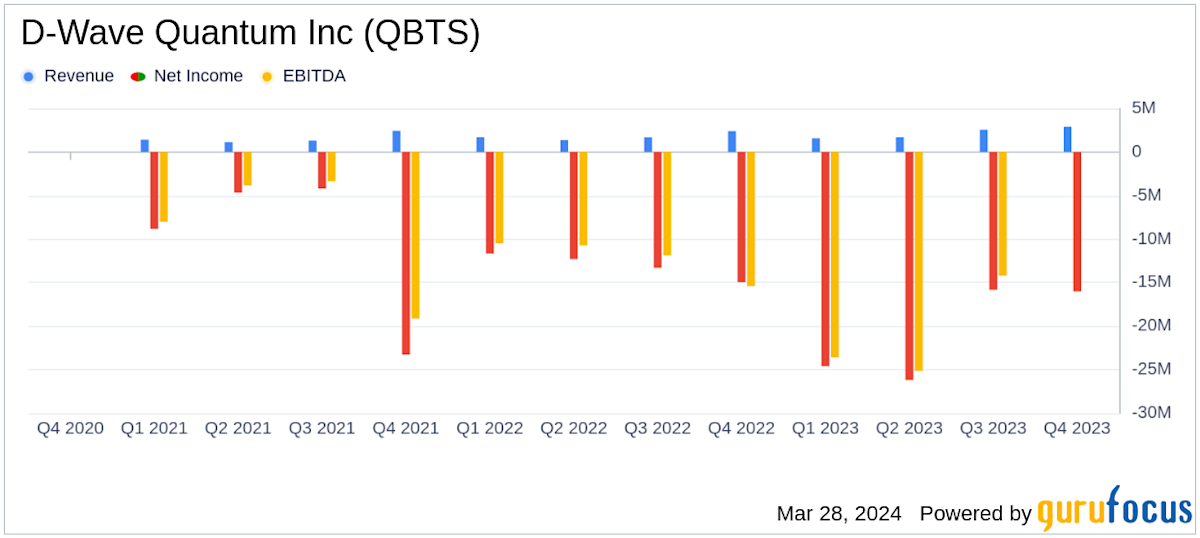

Why Did D Wave Quantum Qbts Stock Fall On Monday

May 21, 2025

Why Did D Wave Quantum Qbts Stock Fall On Monday

May 21, 2025 -

Resilience And Mental Health From Setback To Success

May 21, 2025

Resilience And Mental Health From Setback To Success

May 21, 2025 -

Interview Barry Ward On Playing Cops And Casting

May 21, 2025

Interview Barry Ward On Playing Cops And Casting

May 21, 2025 -

Liverpool Juara Liga Inggris 2024 2025 Pelatih Pelatih Legendaris Di Balik Kesuksesan The Reds

May 21, 2025

Liverpool Juara Liga Inggris 2024 2025 Pelatih Pelatih Legendaris Di Balik Kesuksesan The Reds

May 21, 2025 -

Is Drier Weather Finally In Sight Your Regional Outlook

May 21, 2025

Is Drier Weather Finally In Sight Your Regional Outlook

May 21, 2025