Sasol (SOL) Strategy Update: Investors Demand Answers

Table of Contents

Declining Profitability and Share Price

The fluctuating energy market and operational challenges have significantly impacted Sasol (SOL) stock performance. Sasol profitability has declined, leading to a drop in the share price. Several factors contribute to this downturn:

- Detailed analysis of recent financial reports: Recent quarterly reports reveal a significant decrease in net income compared to previous periods. This decline can be attributed to a combination of lower product prices and increased operating costs.

- Comparison of Sasol's performance to competitors: A comparative analysis against competitors reveals that Sasol's performance lags behind industry benchmarks, highlighting the need for strategic adjustments. Many competitors are demonstrating more agility in adapting to the changing energy landscape.

- Impact of fluctuating oil and gas prices on Sasol's profitability: Sasol's profitability is heavily reliant on global oil and gas prices. The volatility in these markets directly impacts revenue streams and profit margins, creating uncertainty for investors.

- Investor sentiment analysis based on recent market activity: Recent market activity, including trading volume and share price fluctuations, reflects a negative investor sentiment. This highlights the urgent need for a clear and convincing strategy update to regain investor confidence in Sasol’s future.

Concerns Regarding Debt Levels and Capital Expenditure

High Sasol debt levels and significant Sasol capital expenditure plans are causing considerable investor concern. The sustainability of the current financial strategy is being questioned, with investors worried about the potential risks associated with high leverage.

- Breakdown of Sasol's debt structure and its repayment schedule: A detailed analysis of Sasol's debt reveals a substantial amount of long-term debt, raising concerns about its ability to meet future obligations. The repayment schedule needs to be transparent and demonstrate a clear path towards reducing debt.

- Assessment of the company's ability to meet its debt obligations: The company's ability to service its debt obligations amidst fluctuating energy prices and operational challenges requires careful scrutiny. A clear assessment of cash flow projections is crucial to allay investor anxieties.

- Analysis of the planned capital expenditure projects and their potential returns: Investor confidence will be bolstered by a detailed analysis of the potential returns on planned capital expenditure projects. Demonstrating a clear strategy for maximizing return on investment (ROI) is crucial.

- Discussion of alternative financing strategies: Exploring and discussing alternative financing strategies, such as asset sales or strategic partnerships, will demonstrate proactive management of debt and strengthen investor confidence.

The Need for a Clearer Environmental, Social, and Governance (ESG) Strategy

The growing importance of ESG factors in investment decisions cannot be ignored. Investors are increasingly demanding transparency and robust ESG strategies from companies. Sasol’s approach needs to improve to meet these expectations and attract environmentally conscious investors.

- Analysis of Sasol's current ESG performance and reporting: A thorough analysis of Sasol's current ESG performance reveals areas needing improvement, especially concerning carbon emissions and social impact initiatives.

- Comparison to competitors' ESG strategies: Comparing Sasol's ESG strategy to industry competitors reveals a gap in performance and ambition, suggesting a need for more aggressive targets and actions.

- Identification of key ESG risks and opportunities for Sasol: A comprehensive assessment of ESG risks and opportunities will allow Sasol to proactively address vulnerabilities and capitalize on emerging opportunities in the sustainable energy sector.

- Suggestions for improvement in Sasol's ESG strategy: Implementing concrete actions, such as investing in renewable energy and enhancing transparency in reporting, is critical to demonstrating a commitment to sustainability.

Transitioning to a Lower-Carbon Future

Sasol renewable energy investments and progress in reducing its carbon footprint are key aspects of its future Sasol low carbon strategy. This transition is vital not only for environmental responsibility but also for attracting investors concerned about climate change. A clear roadmap for achieving carbon neutrality is essential to demonstrate long-term sustainability and competitiveness.

Lack of Transparency and Communication with Investors

Criticism of Sasol's communication with investors highlights the need for improved transparency and more frequent updates. Strengthening Sasol investor relations and improving Sasol communication are paramount.

- Assessment of Sasol's investor relations activities: An assessment of Sasol's investor relations activities reveals a lack of proactive engagement, impacting investor trust and confidence.

- Suggestions for enhancing communication with investors: Implementing strategies such as regular earnings calls, investor presentations, and enhanced disclosure of key performance indicators (KPIs) are crucial.

- Importance of proactive engagement with the investment community: Proactive engagement with the investment community is necessary to address investor concerns directly and build strong relationships.

Conclusion

This analysis highlights the critical need for a comprehensive Sasol (SOL) strategy update. Addressing investor concerns regarding profitability, debt, ESG performance, and communication is crucial for restoring confidence and ensuring long-term value creation. Sasol's future success hinges on its ability to articulate a clear path forward that reassures investors and demonstrates a firm commitment to sustainable growth.

Call to Action: Investors are demanding answers. Stay informed on the latest developments in Sasol's strategy and monitor the company's response to investor concerns. Continue to follow our updates for further analysis of the Sasol (SOL) strategy and its implications for investors.

Featured Posts

-

D Wave Quantum Qbts Stock Market Performance A Detailed Look At Recent Gains

May 21, 2025

D Wave Quantum Qbts Stock Market Performance A Detailed Look At Recent Gains

May 21, 2025 -

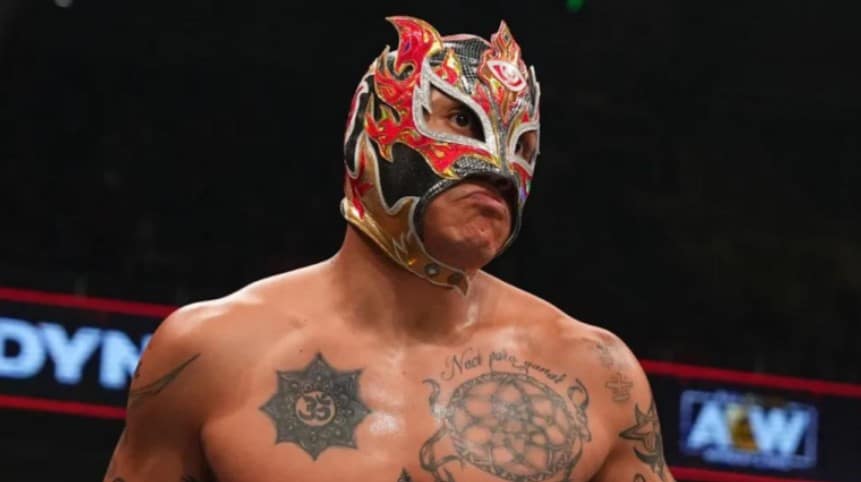

Aew Star Rey Fenix Debuts On Wwe Smack Down Next Week Official Ring Name Announced

May 21, 2025

Aew Star Rey Fenix Debuts On Wwe Smack Down Next Week Official Ring Name Announced

May 21, 2025 -

Friisin Avauskokoonpano Julkistettu Kamara Ja Pukki Vaihdossa

May 21, 2025

Friisin Avauskokoonpano Julkistettu Kamara Ja Pukki Vaihdossa

May 21, 2025 -

19 Indian Paddlers Make History At Wtt Star Contender Chennai

May 21, 2025

19 Indian Paddlers Make History At Wtt Star Contender Chennai

May 21, 2025 -

Bwtshytynw Ydyf Thlatht Laebyn Mmyzyn Lqaymt Mntkhb Amryka

May 21, 2025

Bwtshytynw Ydyf Thlatht Laebyn Mmyzyn Lqaymt Mntkhb Amryka

May 21, 2025