Sasol's 2023 Strategy Update: What Investors Need To Know

Table of Contents

Financial Performance and Outlook

Sasol's financial results for the period covered in the 2023 strategy update are pivotal for assessing its current standing and future prospects. Analyzing Sasol's financial results requires careful consideration of several key metrics.

-

Revenue Growth and Profit Margins: The update should detail the company's revenue growth, highlighting the performance of its various business segments. Analyzing profit margins provides insights into operational efficiency and pricing power. Investors should look for evidence of sustainable growth and improved profitability.

-

Earnings and Growth Targets: Sasol's projected earnings and growth targets for the coming year will be crucial for investors evaluating the company's future performance. Realistic and achievable targets indicate a well-planned strategy. Consider comparing these targets to previous years and industry benchmarks.

-

Debt Reduction and Capital Allocation: Sasol's debt levels and its strategy for debt reduction will significantly impact its financial flexibility and ability to invest in future growth opportunities. The details on capital allocation (e.g., investments in new projects, share buybacks, dividends) provide important information about management's priorities.

-

Impact of Global Economic Conditions and Commodity Prices: The update should address the impact of global economic conditions and volatile commodity prices on Sasol's financial performance. Understanding the company's sensitivity to these external factors is crucial for assessing risk. Look for details on hedging strategies and contingency plans.

-

Dividend Policy and Share Buyback Programs: Any changes to Sasol's dividend policy or share buyback programs are significant for investors. These announcements directly impact shareholder returns and should be carefully evaluated in the context of the company's overall financial health. Changes here directly affect the Sasol investment thesis for many.

Operational Highlights and Strategic Priorities

Sasol's operational performance and strategic priorities, as detailed in their 2023 strategy update, provide a comprehensive view of the company's plans for the future. Understanding these aspects is vital for assessing the long-term value of a Sasol investment.

-

Production Targets and Capacity Expansion: The update should outline Sasol's production targets across its various operations (chemical production, etc.) and plans for capacity expansion. Increased production capacity generally signals future growth potential.

-

Sustainability Initiatives and ESG Goals: Sasol's commitment to sustainability and its progress toward its Environmental, Social, and Governance (ESG) goals are increasingly important considerations for investors. Look for specific targets, metrics, and detailed plans. This is crucial for understanding Sasol operations in the context of broader industry trends and regulatory pressures.

-

Energy Transition Strategy: Sasol's strategy for navigating the energy transition and its investments in renewable energy sources are crucial indicators of its long-term viability and adaptability. Investors should scrutinize the detail and realism of these plans.

-

Restructuring and Divestment Plans: Any restructuring or divestment plans announced in the update will significantly affect the company's operational structure and future focus. Understanding the rationale behind these decisions is important for assessing their impact on profitability and future growth. This relates directly to the Sasol investment prospects.

Key Risks and Challenges

Understanding the risks and challenges facing Sasol is essential for any investor considering a position. The 2023 strategy update should provide transparency on these potential headwinds.

-

Market Volatility and Commodity Price Fluctuations: The impact of market volatility and fluctuating commodity prices on Sasol's profitability and operations should be clearly outlined. Investors need to assess the company's ability to mitigate these risks.

-

Geopolitical Risks and Supply Chain Disruptions: Geopolitical instability and potential supply chain disruptions can significantly impact Sasol's operations. The update should address these risks and the company's strategies for managing them.

-

Competition and Market Position: A detailed assessment of the competitive landscape and Sasol's strategies for maintaining its market share is essential. Analyzing the company's competitive advantages is crucial.

-

Regulatory and Legal Risks: Any potential regulatory or legal risks facing Sasol, such as environmental regulations or litigation, should be transparently disclosed. The company's risk management strategies should be examined.

Implications for Investors

The information presented in Sasol's 2023 Strategy Update has significant implications for investors' portfolio management and investment strategies.

-

Assessment of Future Prospects and Investment Potential: Based on the update, investors should assess Sasol's future prospects, considering the financial performance, operational plans, and key risks.

-

Investment Strategies Based on Company Performance: The update should inform investment strategies, allowing investors to adjust their portfolio allocation based on the company's performance and outlook.

-

Valuation and Potential Return on Investment (ROI): Investors should analyze Sasol's valuation and estimate the potential ROI based on the information provided in the update. This requires careful consideration of various factors including risk, growth potential, and market conditions.

Conclusion: Key Takeaways and Call to Action

Sasol's 2023 Strategy Update provides crucial insights into the company's financial performance, operational strategies, and future outlook. Understanding the key takeaways – including financial highlights, operational priorities, and associated risks – is vital for informed investment decisions. The update emphasizes the importance of Sasol's commitment to sustainability and its navigation of the energy transition. The implications for investors include reassessing their portfolio allocation based on Sasol's updated projections and risk profile. Stay informed about Sasol's continued progress by following their investor relations updates to fully understand the implications of Sasol's 2023 Strategy Update for your investment portfolio.

Featured Posts

-

Hmrc Targeting E Bay Vinted And Depop Users With Nudge Letters

May 20, 2025

Hmrc Targeting E Bay Vinted And Depop Users With Nudge Letters

May 20, 2025 -

Mirra Andreeva Vse O Karere I Dostizheniyakh Yunoy Tennisistki

May 20, 2025

Mirra Andreeva Vse O Karere I Dostizheniyakh Yunoy Tennisistki

May 20, 2025 -

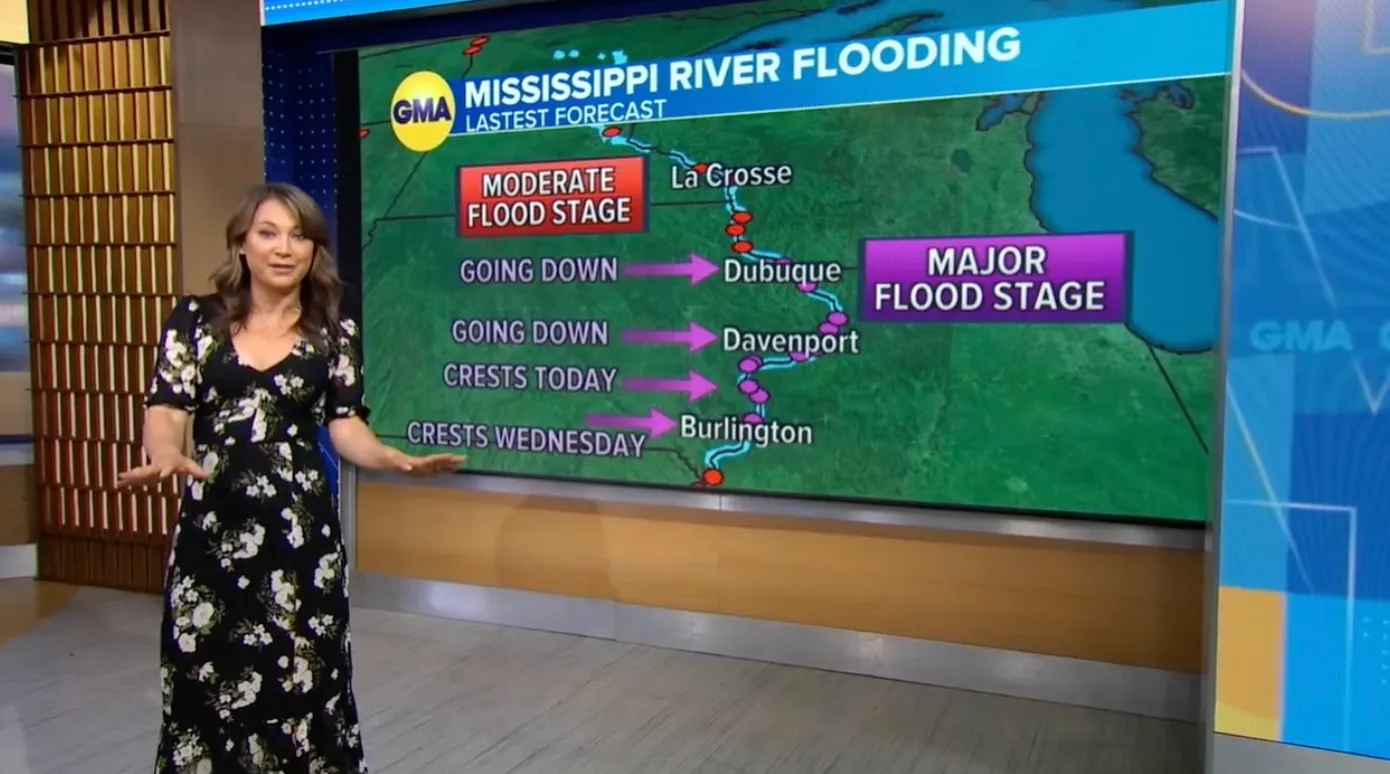

Gmas Ginger Zee Addresses Negative Comments About Her Appearance

May 20, 2025

Gmas Ginger Zee Addresses Negative Comments About Her Appearance

May 20, 2025 -

Agatha Christies Poirot A Comprehensive Guide

May 20, 2025

Agatha Christies Poirot A Comprehensive Guide

May 20, 2025 -

The Love Lives Of Twilight Stars From Robert Pattinson To

May 20, 2025

The Love Lives Of Twilight Stars From Robert Pattinson To

May 20, 2025

Latest Posts

-

D Wave Quantum Inc Qbts Stock Surge Reasons Behind The Recent Rise

May 20, 2025

D Wave Quantum Inc Qbts Stock Surge Reasons Behind The Recent Rise

May 20, 2025 -

Understanding The Recent D Wave Quantum Qbts Stock Surge

May 20, 2025

Understanding The Recent D Wave Quantum Qbts Stock Surge

May 20, 2025 -

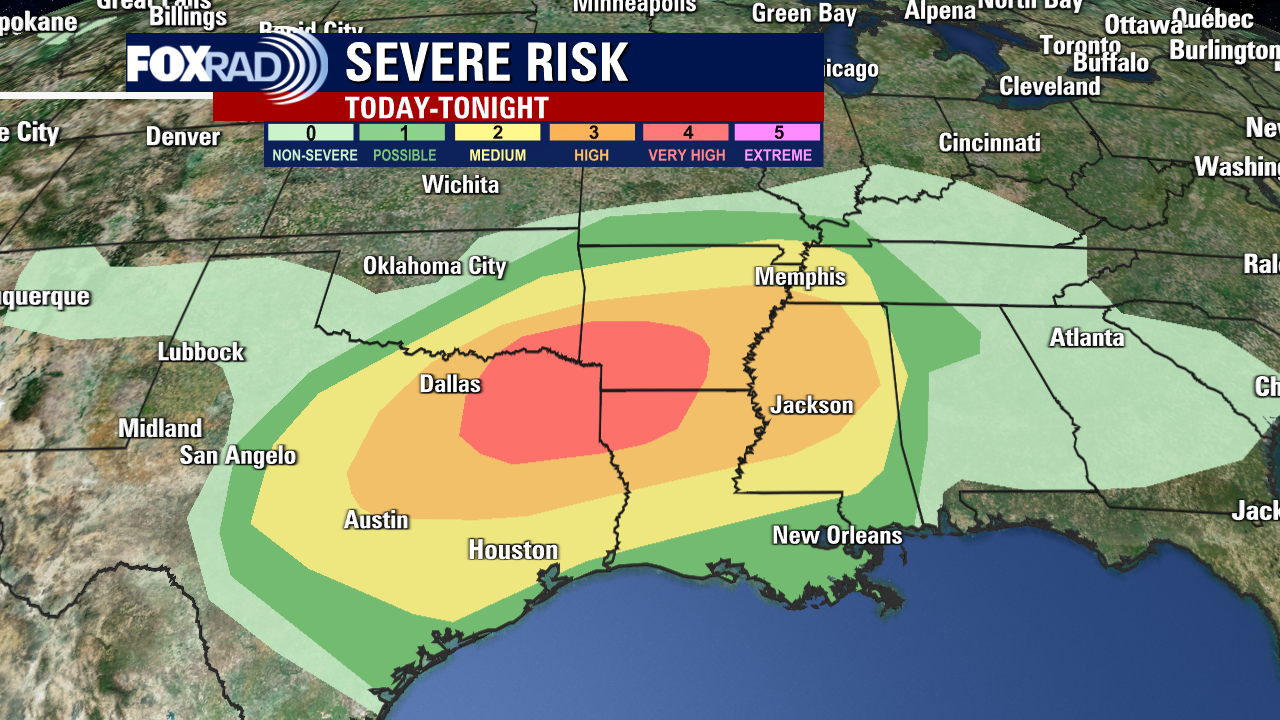

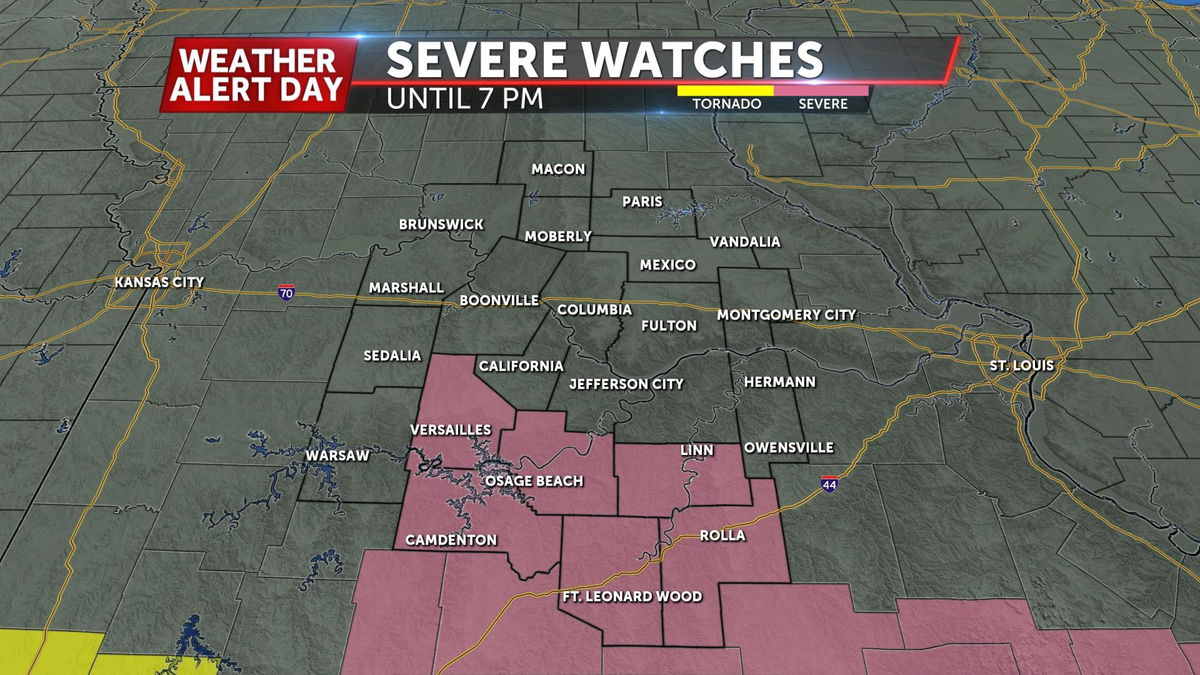

Severe Weather Alert Strong Winds And Potential Storms Approaching

May 20, 2025

Severe Weather Alert Strong Winds And Potential Storms Approaching

May 20, 2025 -

Your First Alert Strong Winds And Severe Storms Expected

May 20, 2025

Your First Alert Strong Winds And Severe Storms Expected

May 20, 2025 -

Analyzing The 2025 Drop In Big Bear Ai Bbai Stock Price

May 20, 2025

Analyzing The 2025 Drop In Big Bear Ai Bbai Stock Price

May 20, 2025