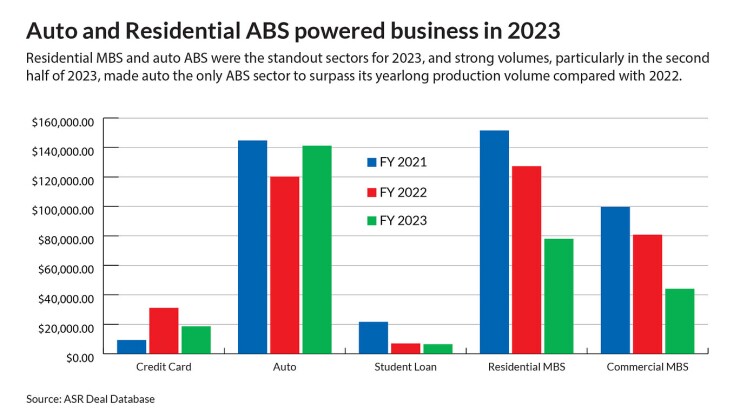

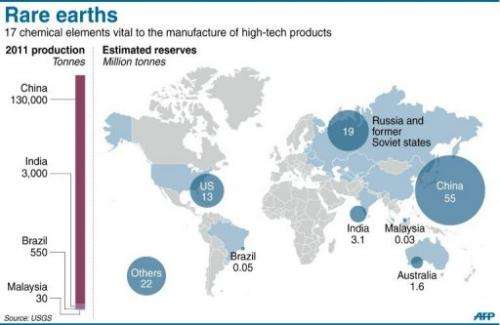

Saudi ABS Market Transformation: Impact Of A Key Regulatory Shift

Table of Contents

The Regulatory Shift: A Deep Dive

The Saudi ABS market's recent transformation stems from a series of significant regulatory changes aimed at enhancing market transparency, protecting investors, and fostering sustainable growth. Understanding these changes is critical for navigating the new landscape.

Details of the New Regulations:

The specific details of the new regulations are complex, but key amendments include:

- Enhanced Due Diligence Requirements: Issuers now face stricter due diligence requirements for underlying assets, leading to more rigorous underwriting standards.

- Strengthened Disclosure Requirements: Increased transparency is mandated through more comprehensive and detailed disclosure requirements for ABS offerings. This includes clearer explanations of risks and associated potential losses.

- Revised Securitization Structures: The regulations have introduced changes to permissible securitization structures, impacting the types of assets that can be securitized.

- Streamlined Approval Processes: While stricter in some areas, the regulatory changes have also aimed to streamline certain aspects of the approval process, potentially reducing processing times.

- Increased Regulatory Oversight: The Saudi Central Bank (SAMA) and other relevant regulatory bodies now exert more robust oversight of the ABS market, ensuring greater compliance and stability.

Impact on Securitization Processes:

The regulatory shift has undeniably affected the process of creating and issuing ABS in Saudi Arabia. While some aspects have become more complex, others have seen improvements.

- Increased Due Diligence: The added due diligence procedures have increased transaction costs and timelines.

- More Rigorous Documentation: More extensive documentation is required, leading to increased legal and administrative expenses.

- Enhanced Transparency: The improvements in transparency aim to attract greater investor confidence and improve market efficiency.

- Potential for Faster Approvals: Streamlined approval processes in some areas could potentially lead to faster issuance times, albeit offset by the increased due diligence.

Impact on Market Participants

The regulatory changes have had a profound impact on both issuers and investors in the Saudi ABS market.

Implications for Issuers:

The new regulations present both challenges and opportunities for companies seeking to issue ABS in Saudi Arabia.

- Higher Compliance Costs: Increased due diligence and documentation requirements lead to higher compliance costs for issuers.

- Potential for Reduced Issuance: Some issuers might find the stricter requirements more challenging to meet, potentially leading to a reduction in the overall number of ABS issuances.

- Focus on Quality Assets: The emphasis on quality underlying assets may incentivize issuers to focus on stronger, more creditworthy assets.

- Increased Credibility: Meeting the higher regulatory standards enhances the credibility and attractiveness of Saudi ABS in the international market.

Implications for Investors:

The regulatory changes have also significantly affected the risk profile and attractiveness of Saudi ABS for investors.

- Enhanced Investor Protection: The improved transparency and stricter regulations provide greater protection for investors.

- Increased Confidence: This enhanced investor protection should improve investor confidence in the Saudi ABS market.

- Potential for Higher Returns: The focus on quality underlying assets could potentially lead to higher returns for investors, though risk assessment remains crucial.

- Shift in Investment Strategies: Investors may need to adjust their investment strategies to adapt to the changes in risk profiles and the evolving landscape of available ABS offerings.

Opportunities and Challenges in the Transformed Market

The transformation of the Saudi ABS market presents both exciting new opportunities and significant challenges.

Emerging Opportunities:

The new regulatory environment creates several opportunities for growth and innovation.

- Growth in Specific Sectors: The regulations may open up new avenues for securitizing assets from specific sectors experiencing rapid growth within the Saudi economy.

- New Securitization Structures: The changes may encourage the development and adoption of innovative securitization structures.

- Attracting Foreign Investment: The increased transparency and robust regulatory framework could attract greater foreign investment into the Saudi ABS market.

Challenges and Potential Risks:

Navigating the new landscape also presents significant challenges and potential risks.

- Increased Compliance Costs: Meeting the higher compliance standards necessitates increased expenditure on legal, administrative, and technical resources.

- Complexity of New Regulations: The complexity of the new regulations could pose challenges for smaller issuers and investors.

- Potential Impact on Market Liquidity: The stricter requirements could potentially impact market liquidity in the short term, although long-term benefits are anticipated.

Conclusion

The regulatory shift in the Saudi ABS market has created a transformative environment. While increased compliance costs and the complexity of new regulations present challenges, the enhanced transparency, investor protection, and potential for innovation create significant opportunities. The changes have impacted both issuers and investors, requiring adaptations in strategy and operations. Understanding the nuances of these changes is crucial for navigating the evolving landscape of the Saudi ABS market successfully. Further research into the specific details of the amended regulations is highly encouraged to fully leverage the potential of the dynamic Saudi ABS Market. Stay informed and make the most of this evolving market.

Featured Posts

-

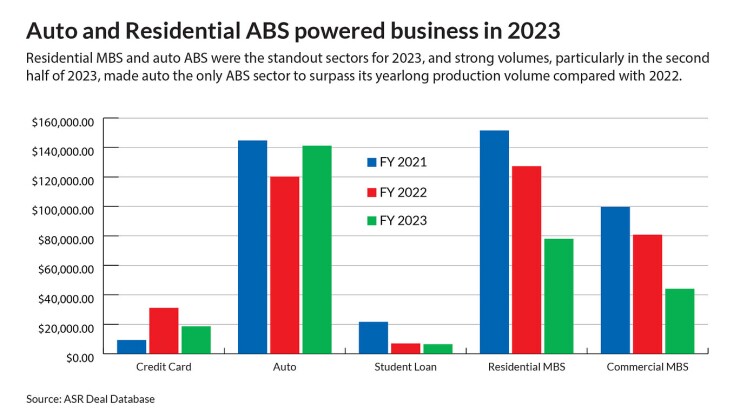

School Suspension A Counterproductive Approach To Discipline

May 03, 2025

School Suspension A Counterproductive Approach To Discipline

May 03, 2025 -

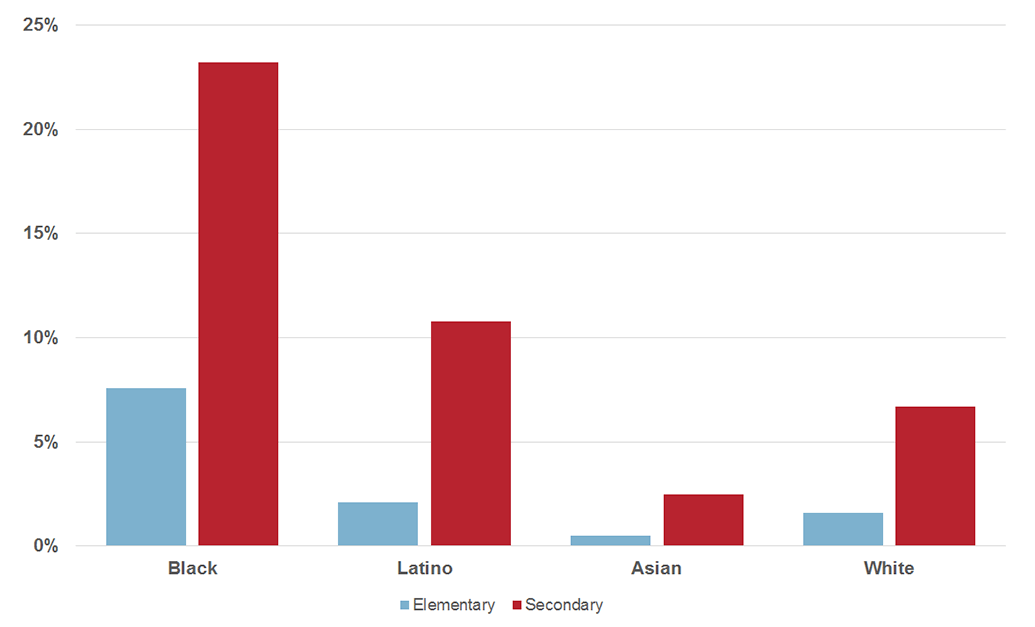

Ukraine U S Collaboration A Strategic Partnership For Rare Earth Minerals

May 03, 2025

Ukraine U S Collaboration A Strategic Partnership For Rare Earth Minerals

May 03, 2025 -

Daisy May Coopers Honest Admission Shoplifting And Job Termination

May 03, 2025

Daisy May Coopers Honest Admission Shoplifting And Job Termination

May 03, 2025 -

Doctor Who Future Uncertain Showrunner Hints At Potential Hiatus

May 03, 2025

Doctor Who Future Uncertain Showrunner Hints At Potential Hiatus

May 03, 2025 -

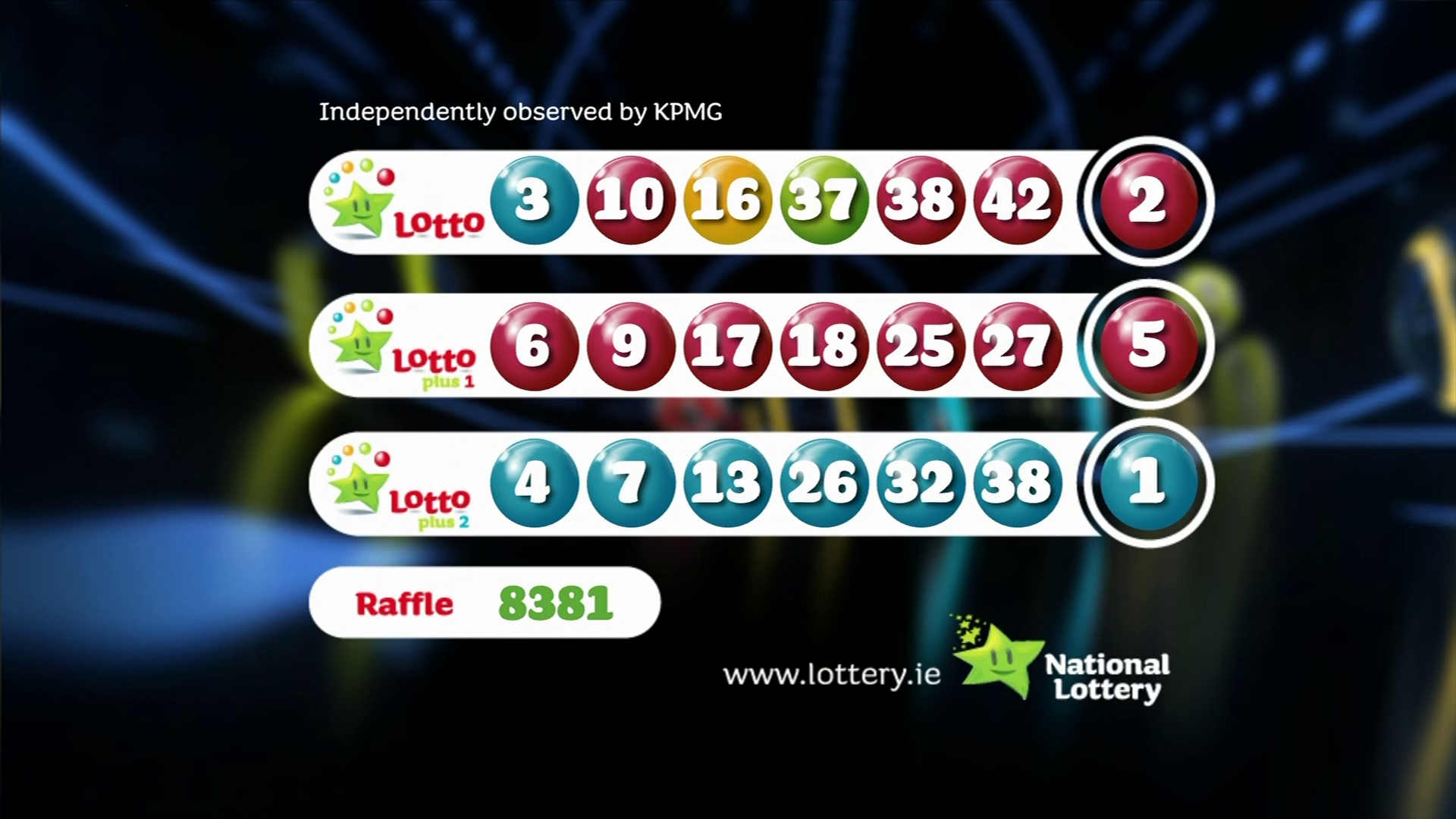

Lotto Plus 1 And Lotto Plus 2 Check The Latest Draw Results

May 03, 2025

Lotto Plus 1 And Lotto Plus 2 Check The Latest Draw Results

May 03, 2025

Latest Posts

-

La Terapia Alla Russofobia Secondo Medvedev L Ombra Dei Missili Nucleari

May 03, 2025

La Terapia Alla Russofobia Secondo Medvedev L Ombra Dei Missili Nucleari

May 03, 2025 -

Suspended Uk Mp Rupert Lowe Breaks Silence On Farage Confrontation

May 03, 2025

Suspended Uk Mp Rupert Lowe Breaks Silence On Farage Confrontation

May 03, 2025 -

Public Spat Deepens Farage Vs Lowe

May 03, 2025

Public Spat Deepens Farage Vs Lowe

May 03, 2025 -

Medvedev Missili Nucleari E La Crisi Della Russofobia In Europa

May 03, 2025

Medvedev Missili Nucleari E La Crisi Della Russofobia In Europa

May 03, 2025 -

Rupert Lowe Great Yarmouth Takes Priority Post Reform Row

May 03, 2025

Rupert Lowe Great Yarmouth Takes Priority Post Reform Row

May 03, 2025