Saudi Arabia: Deutsche Bank's Strategy To Attract International Investment

Table of Contents

Understanding Saudi Arabia's Investment Landscape

Vision 2030 is fundamentally reshaping Saudi Arabia's economic landscape, dramatically increasing its attractiveness to foreign direct investment. The initiative aims to reduce the Kingdom's reliance on oil, fostering growth in diverse sectors and creating a more dynamic and diversified economy. This transformation is attracting significant investment across several key areas:

- Renewable Energy: Saudi Arabia is aggressively pursuing renewable energy projects, presenting lucrative opportunities for investors in solar, wind, and other clean energy technologies. This aligns perfectly with global sustainability goals and offers attractive returns.

- Tourism: With ambitious plans to develop world-class tourist destinations, the tourism sector is poised for explosive growth. Investment opportunities span hospitality, infrastructure, and entertainment.

- Technology: Saudi Arabia is investing heavily in technological advancements, creating opportunities in areas such as fintech, artificial intelligence, and e-commerce. The government is actively supporting the development of a thriving tech ecosystem.

The Saudi Arabian government is actively working to streamline the investment process, creating a more welcoming environment for international investors. This includes:

- Tax incentives and benefits for foreign investors: Attractive tax breaks and exemptions are designed to encourage FDI.

- Simplified regulatory frameworks: Bureaucratic hurdles are being reduced to expedite the investment process.

- Infrastructure development projects: Massive infrastructure projects are underway, creating opportunities for investment and further development.

- Focus on Public-Private Partnerships (PPPs): The government is actively pursuing PPPs to leverage private sector expertise and capital.

Deutsche Bank's Role in Facilitating Investment

Deutsche Bank plays a crucial role in connecting international investors with lucrative opportunities in Saudi Arabia. Their services are tailored to meet the specific needs of investors navigating this dynamic market. They leverage their deep expertise in:

- Mergers and Acquisitions (M&A): Deutsche Bank advises on and facilitates M&A transactions in key Saudi Arabian sectors.

- Project Finance: They provide financing solutions for large-scale infrastructure and development projects.

- Wealth Management: They offer sophisticated wealth management services to high-net-worth individuals investing in Saudi Arabia.

Deutsche Bank has also forged strategic partnerships with key Saudi Arabian entities, providing them with unparalleled access to the local market and its intricacies. Their comprehensive suite of services includes:

- Investment banking services: Offering a full range of investment banking solutions.

- Corporate advisory: Providing expert guidance on navigating the Saudi Arabian business environment.

- Access to Saudi Arabian market expertise: Providing in-depth knowledge and local connections.

- Risk management and compliance solutions: Offering comprehensive solutions to mitigate potential risks.

Key Strategies Employed by Deutsche Bank

Deutsche Bank employs a multi-pronged strategy to attract international investors to Saudi Arabia. This involves:

- Targeted marketing campaigns: Reaching out to potential investors through tailored marketing materials and presentations.

- Industry conferences and events: Participating in and hosting key industry events to network and build relationships.

- Investor relations management: Building strong relationships with existing and potential investors.

- Building trust and credibility: Establishing itself as a trusted advisor and partner for investors in the region.

Deutsche Bank's success is evident in several successful investment deals they've facilitated, showcasing their expertise and network within the Kingdom. These case studies demonstrate their ability to navigate complex transactions and deliver exceptional results for their clients.

Addressing Challenges and Risks

Investing in any emerging market presents inherent challenges and risks. In the context of Saudi Arabia, these may include geopolitical factors and potential regulatory changes. However, Deutsche Bank helps mitigate these risks through:

- Geopolitical risk assessment: Providing detailed analysis of potential geopolitical risks and their impact on investments.

- Regulatory compliance support: Ensuring investments adhere to all relevant regulations and laws.

- Due diligence services: Conducting thorough due diligence to minimize investment risks.

- Currency risk management: Offering strategies to manage currency fluctuations and protect investment returns.

Saudi Arabia: A Promising Investment Destination with Deutsche Bank's Support

Deutsche Bank's strategic approach to attracting international investment in Saudi Arabia leverages the Kingdom's transformative Vision 2030 plan, offering significant opportunities across diverse sectors. By providing comprehensive financial services, risk mitigation strategies, and unparalleled access to the Saudi Arabian market, Deutsche Bank positions itself as a trusted partner for international investors. Invest in Saudi Arabia with Deutsche Bank and explore the numerous investment opportunities this dynamic nation has to offer. Partner with Deutsche Bank for your Saudi Arabia investments and unlock the potential of this rapidly evolving market. Contact us today to learn more.

Featured Posts

-

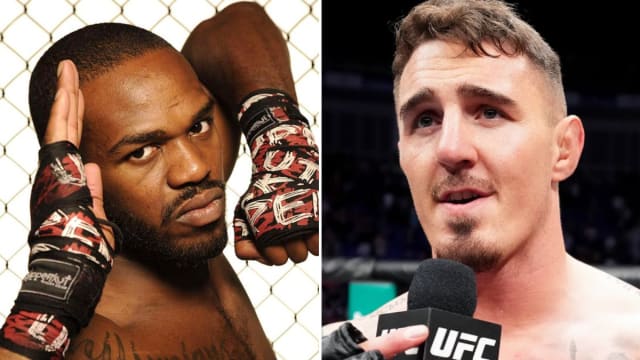

Jon Jones Silences Tom Aspinall With Cutting Remarks

May 30, 2025

Jon Jones Silences Tom Aspinall With Cutting Remarks

May 30, 2025 -

Why Winning Riders Choose Hondas Winning Motorcycles

May 30, 2025

Why Winning Riders Choose Hondas Winning Motorcycles

May 30, 2025 -

Marchs Rainfall Not Enough To Solve Water Crisis

May 30, 2025

Marchs Rainfall Not Enough To Solve Water Crisis

May 30, 2025 -

Jon Jones Requests Six Month Training Camp Before Aspinall Fight

May 30, 2025

Jon Jones Requests Six Month Training Camp Before Aspinall Fight

May 30, 2025 -

Tracking San Diegos Rain Current Totals On Cbs 8 Com

May 30, 2025

Tracking San Diegos Rain Current Totals On Cbs 8 Com

May 30, 2025