Saudi Arabia's ABS Market Transformation: A Market Bigger Than Spain

Table of Contents

Government Initiatives Fueling Growth

Saudi Vision 2030, the Kingdom's ambitious national transformation program, is a primary catalyst for the expansion of the Saudi Arabia ABS market. The ambitious diversification plans outlined in Vision 2030 require significant funding, creating a huge demand for alternative financing solutions like ABS. This isn't just about funding; it's about creating a robust and efficient financial ecosystem.

Vision 2030's Impact

Vision 2030's impact on the Saudi Arabia ABS market is multifaceted:

- Increased public-private partnerships (PPPs): Large-scale infrastructure projects, a cornerstone of Vision 2030, rely heavily on PPPs, which necessitate innovative financing mechanisms like ABS. This creates a significant pipeline of potential ABS issuances.

- Government support for Islamic finance: Saudi Arabia's commitment to Islamic finance further enhances the ABS market's potential. The increasing demand for Sharia-compliant ABS structures creates a niche market with significant growth prospects.

- Regulatory reforms streamlining issuance: The Saudi Arabian Monetary Authority (SAMA) is actively working to streamline the ABS issuance process, reducing complexities and attracting both domestic and international investors. This regulatory clarity is crucial for building investor confidence.

Regulatory Frameworks and Reforms

SAMA's proactive regulatory approach is crucial for the sustainable growth of the Saudi Arabia ABS market. Key regulatory reforms include:

- Clearer legal frameworks for securitization: These reforms provide a stable legal foundation for ABS transactions, mitigating risks and attracting investors.

- Increased transparency and disclosure requirements: Enhanced transparency builds trust and encourages participation, attracting a broader range of investors.

- Improved credit rating agencies' involvement: The increased role of credit rating agencies enhances the credibility and transparency of ABS offerings, leading to greater investor confidence.

- Enhanced investor protection measures: Stronger investor protection measures are essential for attracting both domestic and international capital to the Saudi Arabia ABS market.

Growth Sectors Driving ABS Demand

Several key sectors are driving the demand for ABS financing in Saudi Arabia. These sectors represent significant growth opportunities for investors and issuers alike.

Real Estate and Infrastructure

The ambitious infrastructure projects under Vision 2030, such as NEOM and the Red Sea Project, are generating immense demand for ABS financing. The real estate sector, a key component of Vision 2030, also contributes significantly.

- Securitization of mortgages and construction loans: This allows developers and financial institutions to access capital efficiently for new projects.

- Funding for large-scale infrastructure projects: Mega-projects like NEOM require substantial funding, making ABS a crucial financing tool.

- Growing demand for retail and commercial real estate financing: The ongoing development boom fuels a continuous need for real estate financing, creating opportunities for ABS issuances.

Consumer Finance and Islamic Finance

The rapidly expanding consumer finance sector and the significant role of Islamic finance in Saudi Arabia create new avenues for ABS issuance.

- Growth in auto financing and personal loans: The increasing demand for consumer credit generates a substantial pool of assets suitable for securitization.

- Increasing demand for Sharia-compliant ABS products: The strong presence of Islamic finance necessitates the development and issuance of Sharia-compliant ABS, offering a unique market segment.

- Innovative structuring to cater to specific Islamic finance needs: The market is adapting to create innovative ABS structures that comply with Islamic finance principles, attracting a wider investor base.

Challenges and Opportunities for the Future

Despite the significant progress, certain challenges and opportunities remain for the Saudi Arabia ABS market. Addressing these will be crucial for sustained growth.

Developing a Deeper Investor Base

Attracting a more diverse range of investors, both domestic and international, is crucial for the continued expansion of the market.

- Educational initiatives to increase awareness: Educating investors about ABS and their benefits is key to attracting wider participation.

- Strengthening investor relations and promoting transparency: Building trust and enhancing transparency through effective communication is essential.

- Attracting foreign institutional investors: Targeting foreign institutional investors will bring in additional capital and expertise.

Technological Advancements and Fintech

Embracing technology and fintech can enhance the efficiency and transparency of the Saudi Arabia ABS market.

- Blockchain technology for secure and transparent transactions: Blockchain can improve the security and traceability of ABS transactions, attracting more investors.

- AI-powered credit scoring and risk assessment: AI can improve the accuracy and efficiency of credit risk assessment, leading to better pricing and risk management.

- Digital platforms for efficient ABS issuance and trading: Digital platforms can streamline the entire process, from issuance to trading, making it more efficient and cost-effective.

Conclusion

The Saudi Arabia ABS market is undergoing a remarkable transformation, driven by government initiatives, economic growth, and the need for innovative financing solutions. Its potential to surpass even established markets like Spain's is undeniable. While challenges remain, such as developing a deeper investor base and embracing technological advancements, the overall outlook for the Saudi Arabia ABS market is incredibly promising. Investors and businesses should carefully consider the opportunities presented by this rapidly expanding sector and explore the various avenues for participation in this dynamic market. Don't miss out on the potential of the Saudi Arabia ABS market – investigate investment opportunities today!

Featured Posts

-

Tulsa Winter Weather A Statistical Overview

May 02, 2025

Tulsa Winter Weather A Statistical Overview

May 02, 2025 -

Check The April 30 2025 Lotto Results

May 02, 2025

Check The April 30 2025 Lotto Results

May 02, 2025 -

Loyle Carner Announces Dublin 3 Arena Concert Date

May 02, 2025

Loyle Carner Announces Dublin 3 Arena Concert Date

May 02, 2025 -

Improving Mental Healthcare Access In Ghana Tackling The Psychiatrist Deficit

May 02, 2025

Improving Mental Healthcare Access In Ghana Tackling The Psychiatrist Deficit

May 02, 2025 -

Daily Lotto Thursday 17th April 2025 Results

May 02, 2025

Daily Lotto Thursday 17th April 2025 Results

May 02, 2025

Latest Posts

-

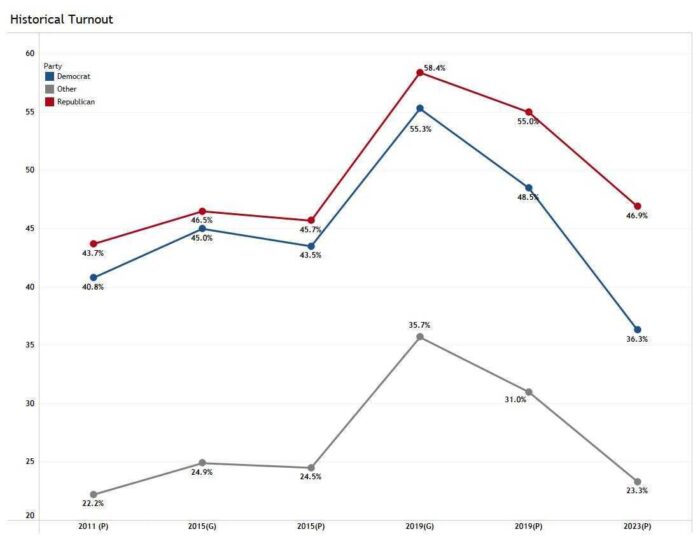

Florida And Wisconsin Turnout A Deep Dive Into The Current Political Landscape

May 02, 2025

Florida And Wisconsin Turnout A Deep Dive Into The Current Political Landscape

May 02, 2025 -

Where To Watch Newsround Bbc Two Hd Tv Guide

May 02, 2025

Where To Watch Newsround Bbc Two Hd Tv Guide

May 02, 2025 -

Newsround Bbc Two Hd Programme Times And Listings

May 02, 2025

Newsround Bbc Two Hd Programme Times And Listings

May 02, 2025 -

Bbc Two Hd Schedule When To Watch Newsround

May 02, 2025

Bbc Two Hd Schedule When To Watch Newsround

May 02, 2025 -

Bbc Income Crisis 1 Billion Drop Sparks Unprecedented Concerns

May 02, 2025

Bbc Income Crisis 1 Billion Drop Sparks Unprecedented Concerns

May 02, 2025