Saudi Arabia's PIF: PwC Faces One-Year Advisory Services Suspension

Table of Contents

The Nature of the PwC Suspension

Details of the Suspension

The suspension of PwC's advisory services by the PIF encompasses a one-year period, effectively halting all advisory work for the fund. While the precise reasons behind the suspension haven't been fully disclosed publicly, it is understood that the decision stems from concerns surrounding regulatory compliance and potentially, conflicts of interest. The scope of the suspension is significant, impacting various advisory services:

- Specific advisory services impacted: Financial advisory, due diligence, strategic planning, and potentially other areas depending on the specifics of the contract.

- Official Statements: Both the PIF and PwC have released carefully worded statements acknowledging the suspension, but details regarding the underlying reasons remain limited, likely due to ongoing investigations.

- Penalties: While the suspension itself is a significant penalty, the possibility of further financial repercussions or legal action remains open.

Regulatory Context

This decision highlights the strengthening regulatory environment within Saudi Arabia and the increasing focus on corporate governance and transparency. The Capital Market Authority (CMA), the primary regulatory body governing the Saudi capital markets, is likely playing a key role in overseeing this situation. Other relevant regulatory bodies might also be involved, depending on the specific nature of the services provided by PwC and the investments made by PIF.

- Relevant Regulatory Bodies: The CMA's role is crucial, given its mandate to ensure fair and transparent markets. Other relevant bodies may include those governing specific sectors where PIF invests.

- Existing Regulations: Saudi Arabia's regulatory framework is evolving, with increasing emphasis on auditor independence, conflict of interest regulations, and robust financial reporting standards. This suspension underscores the importance of these regulations and the potential for stringent enforcement.

- Future Regulatory Changes: This event may lead to further refinement of existing regulations and the implementation of stricter guidelines aimed at enhancing transparency and accountability in the Saudi Arabian financial sector.

Impact on the PIF's Investment Activities

Short-Term Implications

The suspension of PwC's services creates immediate challenges for the PIF. The short-term impacts include potential delays in ongoing projects and investment decisions. The PIF will need to secure alternative advisory services quickly to maintain its ambitious investment timelines.

- Projects Affected: Specific projects that might be affected remain undisclosed, but delays in major deals or investment processes are almost certain in the short term.

- Impact on Deal-Making: The loss of PwC’s expertise could impact the PIF’s ability to efficiently evaluate and execute new investment opportunities, potentially leading to missed deadlines and reduced investment activity.

- Finding Alternative Services: The PIF will need to carefully select a replacement advisory firm, a process that will take time and resources.

Long-Term Implications

The long-term consequences for the PIF are multifaceted. The suspension could affect investor confidence, both domestically and internationally. The PIF's ability to attract foreign investment and maintain its reputation as a sophisticated global investor will depend on how effectively it manages this situation.

- Foreign Investor Confidence: The incident might raise concerns amongst international investors about the regulatory environment and potentially impact future investment decisions.

- Impact on Diversification Plans: Potential delays in project completion could affect the PIF's broader diversification plans and its ability to achieve Vision 2030 goals.

- Long-Term Auditor Selection: The search for a new auditor will require careful consideration and due diligence to ensure the selection of a firm with impeccable credentials and a strong understanding of Saudi Arabian regulations.

Consequences for PwC

Reputational Damage

The suspension deals a significant blow to PwC's reputation, particularly within the Saudi Arabian market and globally. Losing a high-profile client like the PIF raises questions about the firm’s risk management and compliance practices.

- Loss of Future Business: The suspension could deter other potential clients in Saudi Arabia and globally from engaging PwC's services.

- Impact on Client Relationships: The incident could erode trust among existing clients, potentially leading to a loss of business in other regions.

- Public Relations Strategies: PwC will likely need to implement robust public relations strategies to address the situation, regain trust, and mitigate the damage to its reputation.

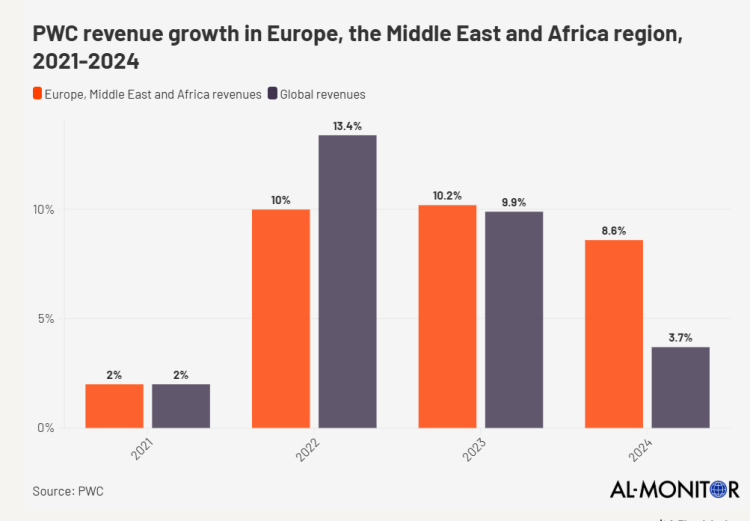

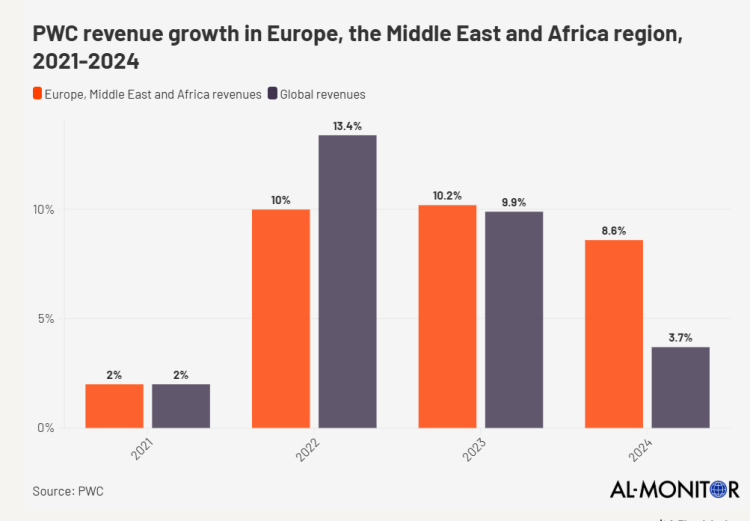

Financial Implications

The suspension carries significant financial implications for PwC, including lost revenue and potential legal costs.

- Lost Revenue: The PIF contract represented a substantial portion of PwC's revenue. The loss of this income will negatively affect the firm's financial performance.

- Potential Legal Costs: PwC may face legal challenges or investigations relating to the circumstances that led to the suspension, incurring significant legal fees.

- Impact on Overall Performance: The combined impact of lost revenue and legal costs could significantly affect PwC's overall financial performance in the short and medium term.

Conclusion

The suspension of PwC's advisory services by Saudi Arabia's PIF is a significant event with far-reaching implications for both parties. The short-term effects include project delays and the need to find alternative advisory services for the PIF, and reputational damage and financial losses for PwC. The long-term consequences remain uncertain, but the incident highlights the crucial importance of robust regulatory frameworks and stringent compliance standards in the global financial landscape. The impact on Saudi Arabia investment and investor confidence warrants close monitoring.

To stay informed about the evolving developments related to Saudi Arabia's Public Investment Fund and the implications of this suspension for PwC, subscribe to reputable financial news sources and follow updates from the Capital Market Authority and other relevant regulatory bodies. Continue monitoring the situation for further insights into the long-term consequences of this significant development.

Featured Posts

-

The 8 Most Subtle Signs Of Adhd In Grownups

Apr 29, 2025

The 8 Most Subtle Signs Of Adhd In Grownups

Apr 29, 2025 -

Modificari Fiscale 2025 Ce Trebuie Sa Stiti De La Conferinta Pw C Romania

Apr 29, 2025

Modificari Fiscale 2025 Ce Trebuie Sa Stiti De La Conferinta Pw C Romania

Apr 29, 2025 -

Geary County Mugshots April 24 28 Bookings

Apr 29, 2025

Geary County Mugshots April 24 28 Bookings

Apr 29, 2025 -

Astedwa Lfn Abwzby 19 Nwfmbr

Apr 29, 2025

Astedwa Lfn Abwzby 19 Nwfmbr

Apr 29, 2025 -

Nyt Spelling Bee March 13 2025 Complete Solutions And Pangram

Apr 29, 2025

Nyt Spelling Bee March 13 2025 Complete Solutions And Pangram

Apr 29, 2025

Latest Posts

-

Our Yorkshire Farm Has Anything Changed Between Amanda And Clive Owen

Apr 30, 2025

Our Yorkshire Farm Has Anything Changed Between Amanda And Clive Owen

Apr 30, 2025 -

Our Yorkshire Farm Reuben Owen Gives Update On The Family

Apr 30, 2025

Our Yorkshire Farm Reuben Owen Gives Update On The Family

Apr 30, 2025 -

Amanda And Clive Owen A Look At Their Ongoing Relationship On Our Yorkshire Farm

Apr 30, 2025

Amanda And Clive Owen A Look At Their Ongoing Relationship On Our Yorkshire Farm

Apr 30, 2025 -

Our Yorkshire Farm Siblings Reuben Owen Shares Family News

Apr 30, 2025

Our Yorkshire Farm Siblings Reuben Owen Shares Family News

Apr 30, 2025 -

Amanda Owen Addresses The Strains Of Farming And Family

Apr 30, 2025

Amanda Owen Addresses The Strains Of Farming And Family

Apr 30, 2025