Saudi Arabia's Regulatory Changes Fuel ABS Market Expansion

Table of Contents

Liberalisation of the Saudi Arabian Financial Sector

The liberalization of the Saudi Arabian financial sector has been instrumental in unlocking the potential of the ABS market. Key regulatory changes have simplified processes and incentivized participation, leading to significant market expansion. These changes include:

- Relaxation of capital requirements for financial institutions: Reduced capital requirements have allowed banks and other financial institutions to increase their involvement in ABS issuance and trading, injecting much-needed liquidity into the market. This fosters a more competitive environment and encourages innovation in product offerings.

- Simplified issuance procedures for ABS: Streamlined processes for issuing ABS have reduced bureaucratic hurdles and sped up the time to market, making it easier for companies to access funding through securitization.

- Increased transparency and disclosure requirements: Improved transparency and standardized disclosure requirements have enhanced investor confidence by providing clearer information about the underlying assets and risks associated with ABS investments. This is crucial for attracting both domestic and international investors.

- Improved investor protection mechanisms: Strengthened investor protection measures, including robust regulatory oversight, have mitigated risks and instilled greater confidence in the market. This is a key factor in attracting foreign investment.

- Specific examples of regulatory reforms: The introduction of new laws and decrees, such as [Insert specific examples of relevant Saudi Arabian laws or decrees here, providing links if available], have directly facilitated the growth of the ABS market.

These reforms have created a more favorable environment for market participants, encouraging greater participation and driving market growth.

Growing Demand for Sharia-Compliant ABS

Saudi Arabia's robust Islamic finance sector plays a pivotal role in the expanding ABS market. The increasing demand for Sharia-compliant financial products aligns perfectly with the Kingdom's commitment to Islamic principles. Regulatory changes have specifically supported this growth by:

- Increased demand for Islamic financing products: The inherent growth of the Islamic finance sector directly translates into an increased need for Sharia-compliant ABS to diversify investment options and meet financing requirements.

- Development of robust regulatory frameworks for Sharia-compliant securities: The development of clear and comprehensive regulatory frameworks for Sharia-compliant ABS has ensured compliance and provided a stable legal foundation for this growing segment of the market.

- Examples of successful Sharia-compliant ABS issuances: Successful issuances of Sharia-compliant ABS demonstrate the viability and attractiveness of this segment, encouraging further participation from both issuers and investors. [Insert examples of successful issuances here].

- Mention key players in the Islamic finance sector: The active involvement of leading players in the Islamic finance sector, such as [Insert names of key banks and financial institutions here], further underscores the potential for growth in this market segment.

The future growth potential of Sharia-compliant ABS in Saudi Arabia is significant, driven by both domestic and international demand.

Increased Investor Confidence and Participation

Regulatory reforms have significantly boosted investor confidence in the Saudi Arabia ABS market, leading to increased participation from both domestic and international investors. This is evident in:

- Improved transparency and disclosure leading to better risk assessment: Greater transparency allows investors to better assess risk, leading to more informed investment decisions.

- Stronger investor protection measures: Robust investor protection enhances confidence and encourages participation, particularly from international investors.

- Increased participation from both domestic and international investors: The influx of both domestic and international capital signifies the growing attractiveness of the Saudi Arabia ABS market.

- Growth of institutional investment in the ABS market: Increased participation by institutional investors, such as pension funds and insurance companies, signifies the market's maturation and stability.

- Data showcasing increased market capitalization or trading volumes: [Insert data here showcasing growth in market capitalization or trading volumes to demonstrate the market's expansion].

Increased investor participation has dramatically improved market liquidity and fueled further expansion.

The Role of Technology in ABS Market Growth

Technology is playing a transformative role in the Saudi Arabia ABS market, streamlining processes and enhancing efficiency.

- Use of blockchain technology for enhanced transparency and security: Blockchain technology offers greater transparency and security in the issuance and trading of ABS, improving trust and efficiency.

- Digital platforms facilitating efficient trading and settlement: Digital platforms are facilitating quicker and more efficient trading and settlement of ABS, reducing costs and improving liquidity.

- Improved data analytics for better risk management: Advanced data analytics tools are enabling better risk assessment and management, leading to more informed investment decisions.

The continued adoption of technology will be critical to the ongoing expansion of the Saudi Arabia ABS market.

Challenges and Opportunities in the Saudi Arabian ABS Market

While the Saudi Arabia ABS market shows immense promise, certain challenges remain:

- Challenges in standardizing documentation and processes: Standardization of documentation and processes is crucial for attracting greater international participation and improving efficiency.

- Need for further development of the secondary market: Developing a more liquid secondary market is essential for increasing investor participation and reducing the risk of illiquidity.

- Potential risks associated with specific asset classes: Careful risk assessment and management are crucial to mitigate potential risks associated with specific underlying asset classes.

Despite these challenges, the future opportunities for growth in the Saudi Arabia ABS market are considerable. Continued regulatory reform, technological innovation, and a deepening of investor confidence will all contribute to its ongoing expansion.

Conclusion

Regulatory changes in Saudi Arabia have profoundly impacted the growth of its ABS market. The increased investor confidence, growing demand for Sharia-compliant securities, and leveraging technological advancements have created a dynamic and expanding market. These changes have reshaped the Kingdom's financial landscape, fostering greater economic diversification and attracting significant international investment. Learn more about the exciting opportunities in the rapidly expanding Saudi Arabia ABS market. Explore the potential of investing in or issuing Asset-Backed Securities in Saudi Arabia. Invest in Saudi Arabia's dynamic ABS market today!

Featured Posts

-

Government Funded Mental Health Courses A Complete Guide To Ignou Tiss Nimhans Programs

May 02, 2025

Government Funded Mental Health Courses A Complete Guide To Ignou Tiss Nimhans Programs

May 02, 2025 -

Rare Earth Minerals Ukraine And The U S Announce Key Economic Deal

May 02, 2025

Rare Earth Minerals Ukraine And The U S Announce Key Economic Deal

May 02, 2025 -

Daily Lotto Results Tuesday 15 April 2025

May 02, 2025

Daily Lotto Results Tuesday 15 April 2025

May 02, 2025 -

Scotland In The Six Nations 2025 A Realistic Assessment Of Their Capabilities

May 02, 2025

Scotland In The Six Nations 2025 A Realistic Assessment Of Their Capabilities

May 02, 2025 -

Riot Platforms Inc Early Warning Report And Irrevocable Proxy Waiver Press Release

May 02, 2025

Riot Platforms Inc Early Warning Report And Irrevocable Proxy Waiver Press Release

May 02, 2025

Latest Posts

-

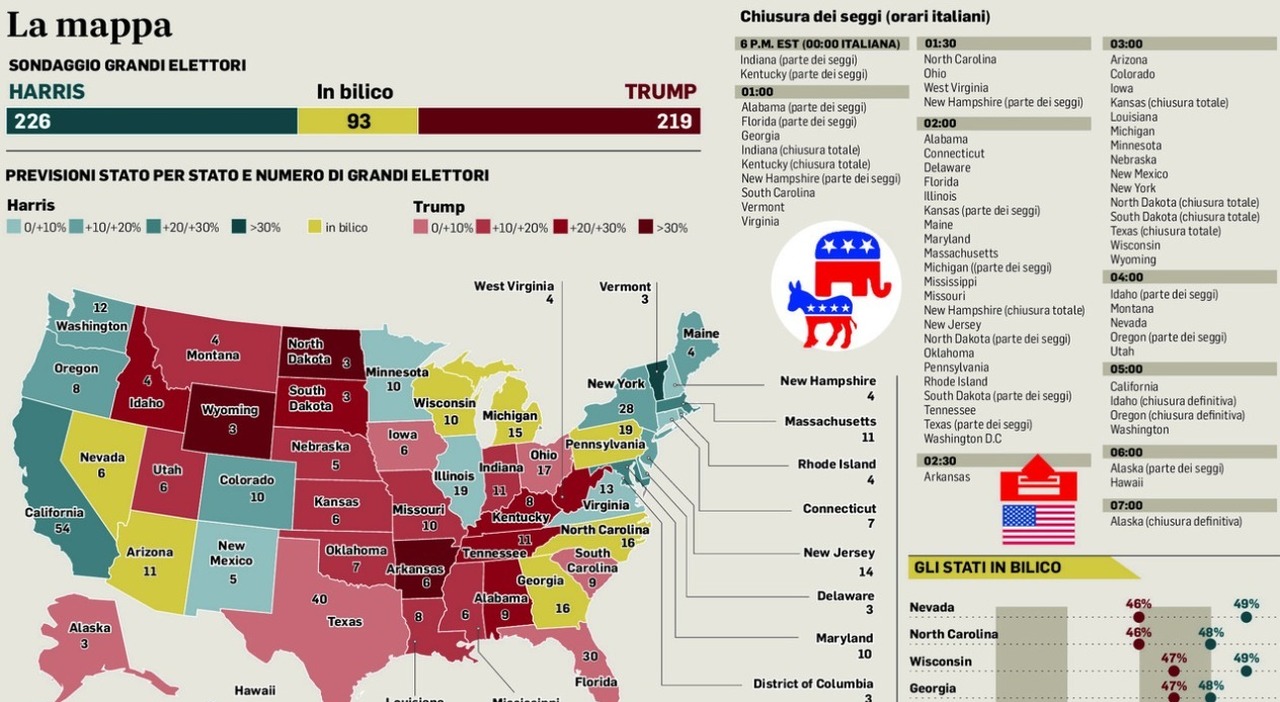

Analyzing The 2024 Election Key Insights From Florida And Wisconsin Voter Turnout

May 02, 2025

Analyzing The 2024 Election Key Insights From Florida And Wisconsin Voter Turnout

May 02, 2025 -

Newsround Viewing Guide Bbc Two Hd Channel

May 02, 2025

Newsround Viewing Guide Bbc Two Hd Channel

May 02, 2025 -

Interpreting The 2024 Election Turnout In Florida And Wisconsin Key Political Insights

May 02, 2025

Interpreting The 2024 Election Turnout In Florida And Wisconsin Key Political Insights

May 02, 2025 -

What Florida And Wisconsins Voter Turnout Reveals About The Shifting Political Climate

May 02, 2025

What Florida And Wisconsins Voter Turnout Reveals About The Shifting Political Climate

May 02, 2025 -

Check The Bbc Two Hd Schedule For Newsround

May 02, 2025

Check The Bbc Two Hd Schedule For Newsround

May 02, 2025