SBI Holdings And XRP: A Significant Development In The Crypto Market

Table of Contents

SBI Holdings' Strategic Investment in XRP and Ripple

SBI Holdings, a prominent player in the Japanese financial sector with a diverse portfolio spanning banking, securities, and asset management, has shown a keen interest in blockchain technology and digital assets. Their history reflects a forward-thinking approach to innovation within the financial industry. While the exact amount of SBI Holdings' investment in Ripple and XRP isn't always publicly disclosed in precise figures, their significant participation is well-documented through various strategic initiatives. This investment extends beyond mere financial backing; it signifies a strategic alliance aimed at mutual benefit and market expansion.

-

Strategic Partnerships and Collaborations: SBI Holdings and Ripple have collaborated on various projects, leveraging their respective strengths to explore the potential of XRP in different sectors. These collaborations often involve exploring the use of XRP for cross-border payments and other blockchain-based applications.

-

Potential Benefits for SBI Holdings: The investment allows SBI Holdings to gain a foothold in the rapidly growing cryptocurrency market, diversify its portfolio, and potentially capitalize on the future growth of XRP. Furthermore, it positions SBI Holdings as a leader in blockchain innovation within the Japanese financial landscape.

-

Impact on XRP's Price and Market Capitalization: SBI Holdings' substantial involvement has undoubtedly influenced XRP's price and market capitalization. While the correlation is complex and influenced by various market factors, the backing of a significant institutional player lends a degree of credibility and stability to XRP.

The Implications for XRP's Adoption and Future

SBI Holdings' backing significantly bolsters XRP's potential for global adoption. The involvement of a reputable Japanese financial institution enhances the credibility of XRP, potentially overcoming some of the skepticism surrounding cryptocurrencies among traditional financial institutions.

-

Increased Liquidity for XRP: SBI Holdings’ investment can facilitate increased liquidity in the XRP market, making it easier for traders and institutions to buy and sell XRP. This increased liquidity is a vital component for fostering market stability and growth.

-

Regulatory Acceptance: SBI Holdings' presence could positively influence the regulatory landscape surrounding XRP, especially in Japan. As a well-established financial institution operating within a regulated environment, SBI Holdings’ involvement lends weight to the argument for clearer, more favorable regulations regarding XRP.

-

Long-Term Implications for XRP's Value and Market Position: The long-term impact of SBI Holdings’ partnership on XRP’s value remains to be seen, but its influence is undeniable. Increased adoption, improved liquidity, and favorable regulatory developments all contribute to a more optimistic outlook for XRP’s future in the cryptocurrency market. This makes it a significant digital asset to watch.

The Broader Impact on the Cryptocurrency Market

SBI Holdings' move has sent a clear signal to the wider cryptocurrency market, boosting investor confidence and signaling the potential for increased institutional participation. This could trigger a domino effect, prompting other large financial institutions to consider similar investments.

-

Increased Institutional Investment: SBI Holdings’ strategic investment may encourage other large financial institutions to explore investment opportunities within the cryptocurrency market. This influx of institutional capital could bring greater stability and legitimacy to the sector.

-

Impact on Overall Market Capitalization: Increased institutional investment and growing confidence could drive the overall market capitalization of cryptocurrencies upwards. This growth, however, is subject to various market dynamics and regulatory changes.

-

Increased Regulation: The growing involvement of established financial players like SBI Holdings could lead to increased scrutiny and, potentially, stricter regulation in the cryptocurrency space. This regulatory environment could enhance the long-term sustainability of the market.

Conclusion

The strategic investment by SBI Holdings in XRP and Ripple represents a significant turning point in the cryptocurrency market. The move demonstrates the growing acceptance of digital assets by traditional financial institutions and carries substantial implications for XRP's future adoption, regulatory acceptance, and overall market standing. The partnership’s ripple effects are already being felt, stimulating investor confidence and potentially paving the way for greater institutional involvement in the crypto sector. Stay informed about the ongoing impact of SBI Holdings and XRP on the evolving landscape of digital assets. Understanding this relationship is crucial for navigating the increasingly complex world of cryptocurrency investments.

Featured Posts

-

Wachtlijsten Tbs Meer Dan Een Jaar Wachten Op Behandeling

May 01, 2025

Wachtlijsten Tbs Meer Dan Een Jaar Wachten Op Behandeling

May 01, 2025 -

Target Starbucks Vs Standalone 9 Key Differences

May 01, 2025

Target Starbucks Vs Standalone 9 Key Differences

May 01, 2025 -

Meta Desafia Chat Gpt Novo App De Ia Promete Revolucionar O Mercado

May 01, 2025

Meta Desafia Chat Gpt Novo App De Ia Promete Revolucionar O Mercado

May 01, 2025 -

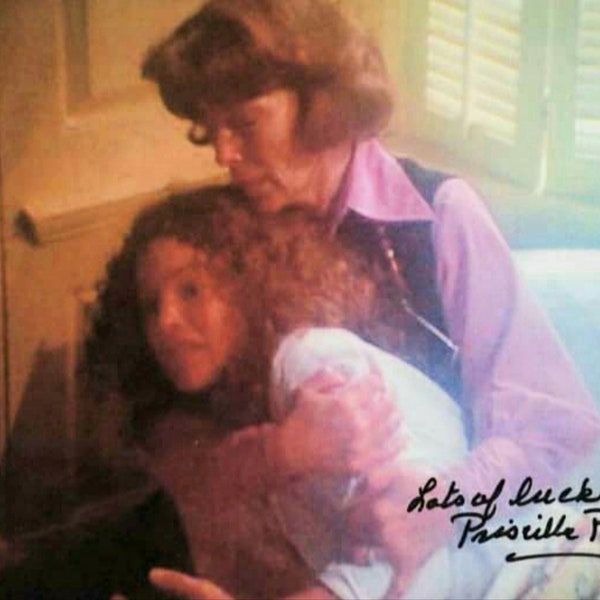

Priscilla Pointer 100 Dies Carrie Actress And Daughter Remembered

May 01, 2025

Priscilla Pointer 100 Dies Carrie Actress And Daughter Remembered

May 01, 2025 -

Massale Stroomuitval In Breda Gevolgen Van De Stroomstoring

May 01, 2025

Massale Stroomuitval In Breda Gevolgen Van De Stroomstoring

May 01, 2025

Latest Posts

-

Local Dallas Star Dies At 100

May 01, 2025

Local Dallas Star Dies At 100

May 01, 2025 -

Veteran Dallas Star Passes Away Aged 100

May 01, 2025

Veteran Dallas Star Passes Away Aged 100

May 01, 2025 -

Dallas Stars Passing At Age 100

May 01, 2025

Dallas Stars Passing At Age 100

May 01, 2025 -

100 Year Old Dallas Star Dead

May 01, 2025

100 Year Old Dallas Star Dead

May 01, 2025 -

Legendary Dallas Figure Dies At 100

May 01, 2025

Legendary Dallas Figure Dies At 100

May 01, 2025