Schroders Q1 Asset Drop: Client Stock Exodus

Table of Contents

The Magnitude of the Schroders Q1 Asset Drop

The Schroders Q1 asset drop was substantial. While the exact figures may vary slightly depending on the reporting source, preliminary reports suggest a decline in AUM of approximately X% (or insert specific monetary value), representing a significant loss compared to the previous quarter and year-over-year performance. This represents a sharper decline than many competitors experienced during the same period. To contextualize the severity, consider that the industry average AUM drop was only Y%, highlighting the disproportionate impact on Schroders.

- Specific Figures: Reports indicate a loss of approximately [Insert Specific Monetary Value] in AUM during Q1 2024.

- Competitor Comparison: Competitors such as [Name Competitor 1] and [Name Competitor 2] experienced AUM declines of only [Percentage]% and [Percentage]%, respectively, during the same period.

- Schroders' Official Statement: Schroders' official press release acknowledged the decline, attributing it to [briefly mention official reasons given, if any].

Reasons Behind the Client Stock Exodus

Several interconnected factors contributed to the significant client stock exodus from Schroders during Q1 2024. The combination of macroeconomic instability and investor apprehension played a crucial role.

-

Global Economic Uncertainty and Inflation: Persistently high inflation rates and concerns about a potential recession fueled investor anxiety, leading many to seek safer havens for their investments. The volatility in global markets further exacerbated this trend.

-

Geopolitical Events: Ongoing geopolitical tensions, such as [mention specific events relevant to market volatility], created significant uncertainty and negatively impacted investor confidence. This uncertainty likely prompted risk-averse investors to withdraw from riskier assets managed by Schroders.

-

Rising Interest Rates: The increase in interest rates by central banks worldwide made fixed-income investments more attractive, prompting some investors to shift their portfolios away from equities and toward higher-yielding, lower-risk options.

-

Specific Examples: The unexpected [mention specific market event] had a significant impact on investor sentiment, prompting many to re-evaluate their investment strategies.

-

Investor Behavior Analysis: The shift in investor behavior reflects a growing preference for less volatile investments in times of economic uncertainty.

-

Internal Factors (Speculative): While not explicitly stated, potential internal factors such as [mention potential internal challenges carefully and speculatively, e.g., underperformance of certain funds, changes in management] might have also contributed to investor withdrawals.

Impact on Schroders' Performance and Future Outlook

The Schroders Q1 asset drop has had a noticeable impact on the company's financial performance. The decline in AUM directly affected profitability and likely led to a decrease in the company's share price. Schroders will likely experience a [mention the predicted impact, e.g., reduced revenue, lower profit margins] in their Q1 financial report.

- Q1 Financial Report Analysis: A detailed analysis of Schroders' Q1 financial report will provide a clearer picture of the overall impact.

- Revised Forecasts: Schroders may issue revised forecasts for the remainder of 2024, reflecting the challenges presented by the Q1 performance.

- Strategic Adjustments: Expect Schroders to implement strategic adjustments, such as [mention possible strategies, e.g., focusing on specific market segments, developing new investment products, cost-cutting measures] to address the challenges and regain investor confidence.

Investor Sentiment and Market Reactions

The news of the Schroders Q1 asset drop triggered immediate reactions in the market. Schroders' share price experienced a significant [mention the type of fluctuation, e.g., decline, dip] following the announcement.

- Share Price Fluctuations: Tracking Schroders' share price in the days and weeks following the Q1 announcement provides valuable insights into investor sentiment.

- Expert Opinions: Financial analysts have offered varying perspectives, with some expressing concern about the long-term implications, while others remain optimistic about Schroders' ability to recover. [Mention specific quotes from analysts, if available.]

- Investor Concerns: The primary concerns among investors revolve around the sustainability of the asset outflows and Schroders' ability to attract new clients and reverse the negative trend.

Conclusion

The Schroders Q1 asset drop, characterized by a significant client stock exodus, reflects a confluence of factors ranging from global economic uncertainty to specific market events. The impact on Schroders' financial performance is undeniable, requiring a strategic response to regain investor confidence. While the long-term implications remain uncertain, the situation demands close monitoring.

Stay updated on the latest developments regarding the Schroders Q1 Asset Drop by following financial news sources, reviewing Schroders' official announcements, and conducting further research on the factors influencing this significant market event. Understanding the complexities surrounding this Schroders Q1 asset drop is crucial for navigating the evolving investment landscape.

Featured Posts

-

Michael Sheens 1 Million Giveaway A Documentary Under Scrutiny

May 02, 2025

Michael Sheens 1 Million Giveaway A Documentary Under Scrutiny

May 02, 2025 -

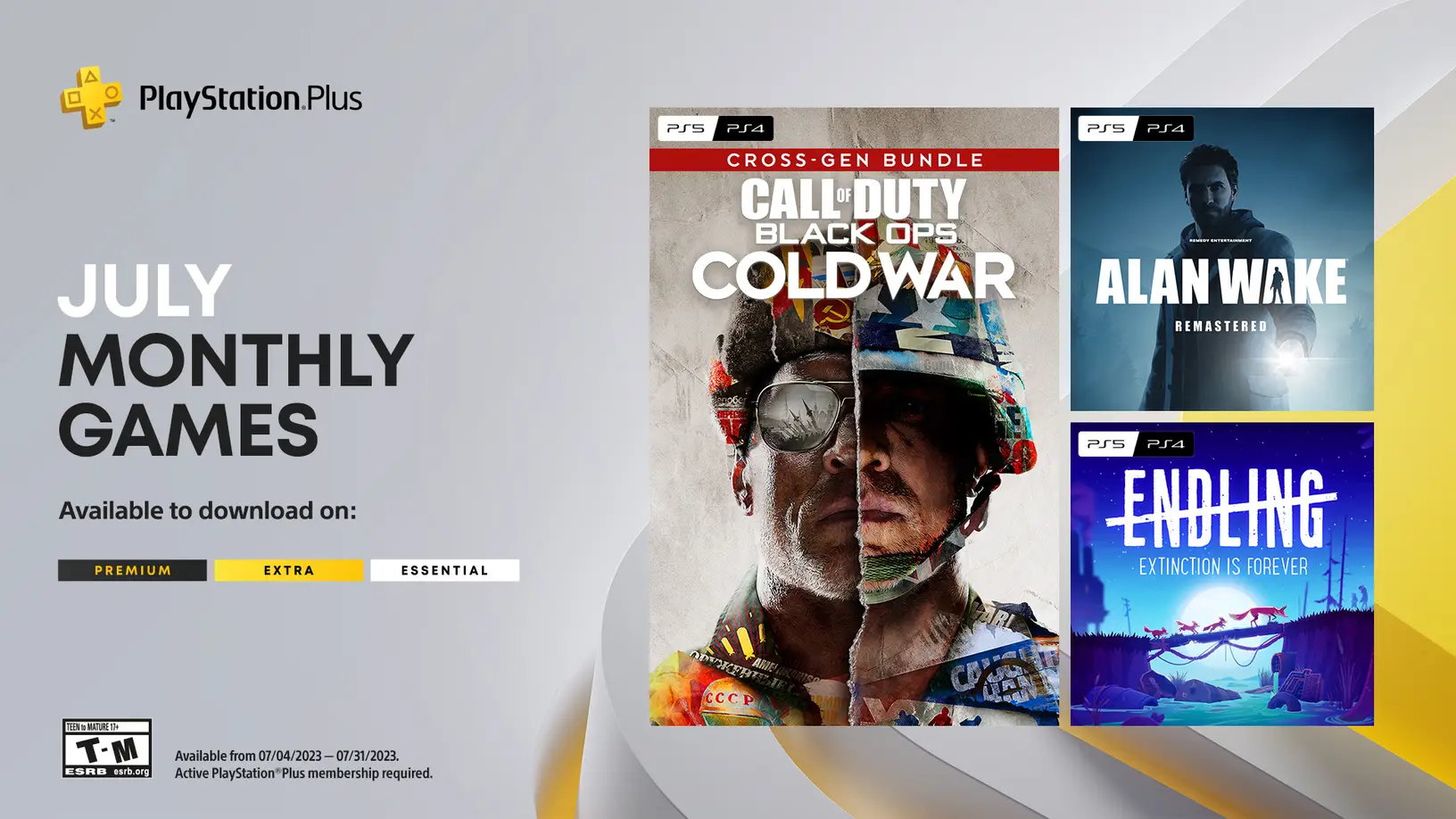

This Months Ps Plus An Underrated 2024 Game You Shouldnt Miss

May 02, 2025

This Months Ps Plus An Underrated 2024 Game You Shouldnt Miss

May 02, 2025 -

5 Effective Ways To Foster Mental Health Acceptance In Your Community

May 02, 2025

5 Effective Ways To Foster Mental Health Acceptance In Your Community

May 02, 2025 -

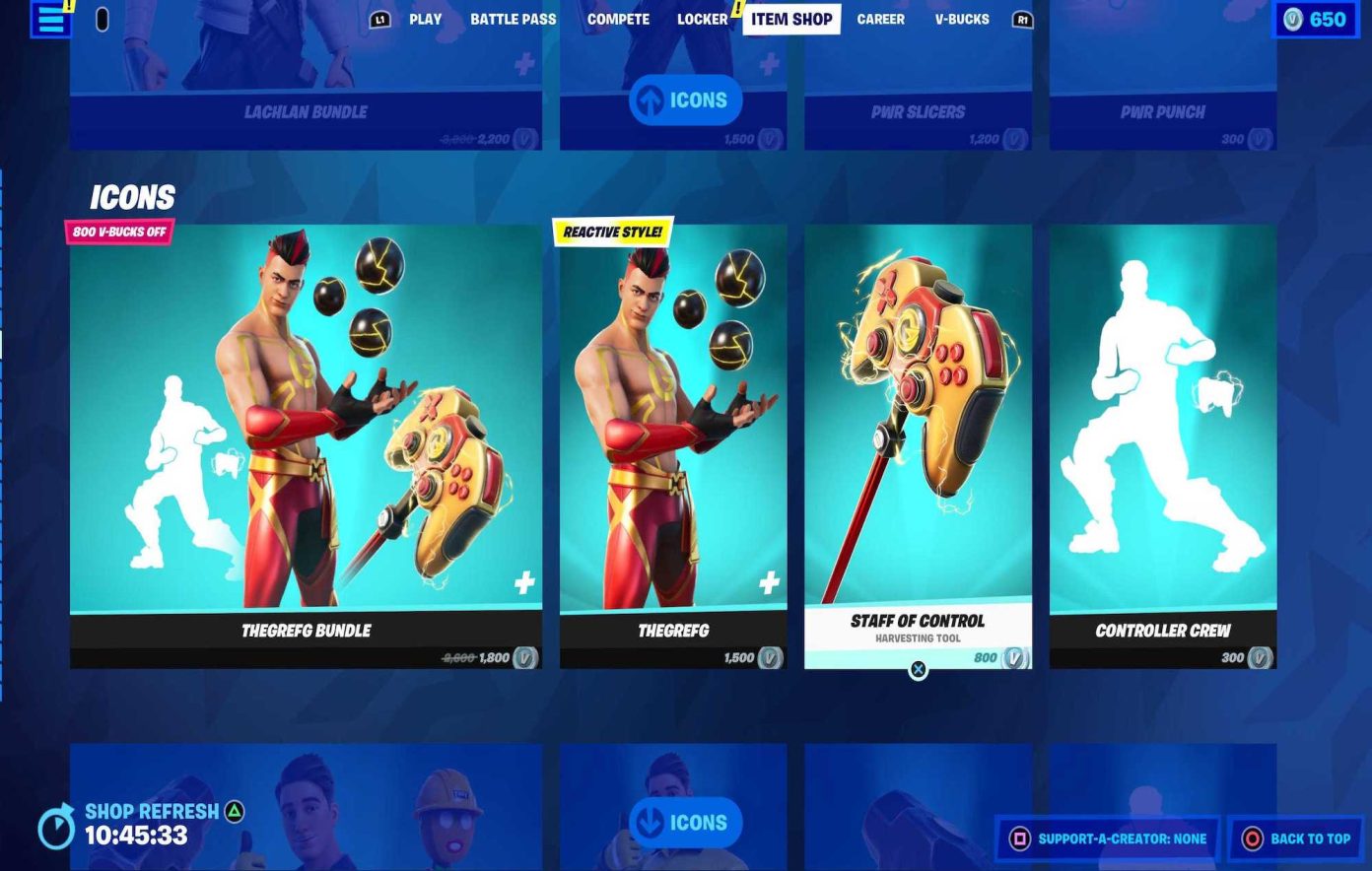

Highly Anticipated Fortnite Skins Back In The Item Shop

May 02, 2025

Highly Anticipated Fortnite Skins Back In The Item Shop

May 02, 2025 -

Eskortnitsy Moskvy Pochemu Oni Vybirayut Kladovki

May 02, 2025

Eskortnitsy Moskvy Pochemu Oni Vybirayut Kladovki

May 02, 2025

Latest Posts

-

2024 Glastonbury Infuriating Stage Time Conflicts Cause Backlash

May 02, 2025

2024 Glastonbury Infuriating Stage Time Conflicts Cause Backlash

May 02, 2025 -

Glastonburys Scheduling Fiasco Overlapping Acts Spark Fan Anger

May 02, 2025

Glastonburys Scheduling Fiasco Overlapping Acts Spark Fan Anger

May 02, 2025 -

Loyle Carner Announces 3 Arena Dublin Gig

May 02, 2025

Loyle Carner Announces 3 Arena Dublin Gig

May 02, 2025 -

Loyle Carner Dublin 3 Arena Concert Announced

May 02, 2025

Loyle Carner Dublin 3 Arena Concert Announced

May 02, 2025 -

Glastonbury Stage Times 2024 A Scheduling Nightmare

May 02, 2025

Glastonbury Stage Times 2024 A Scheduling Nightmare

May 02, 2025