Secure A Personal Loan Today: Low Interest Rates Available

Table of Contents

Understanding Personal Loan Interest Rates

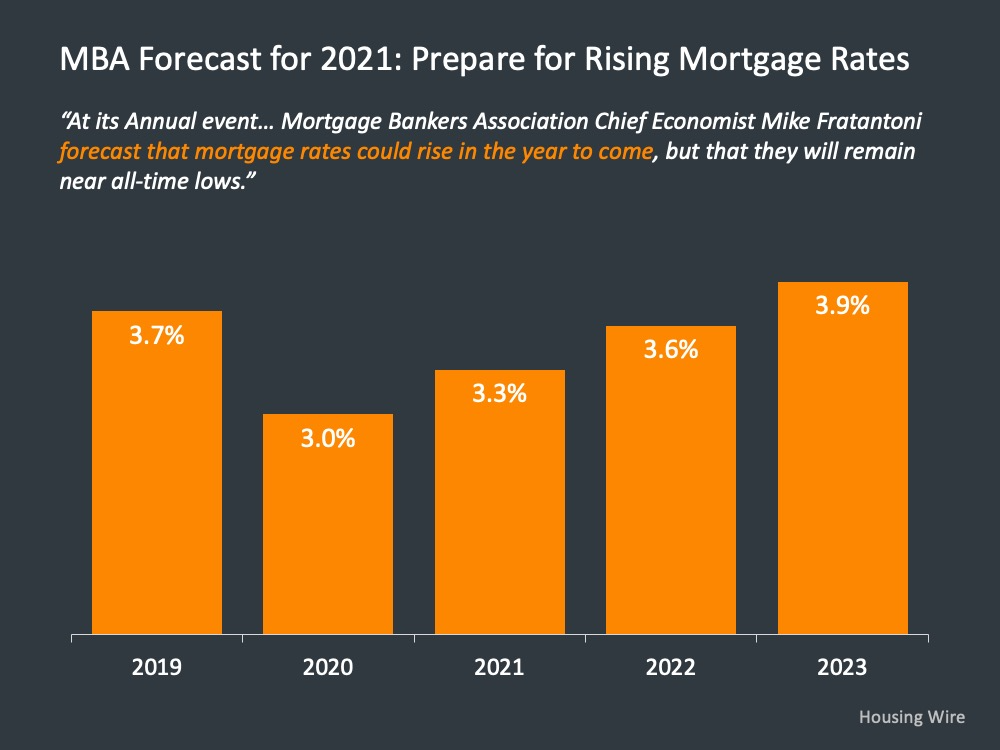

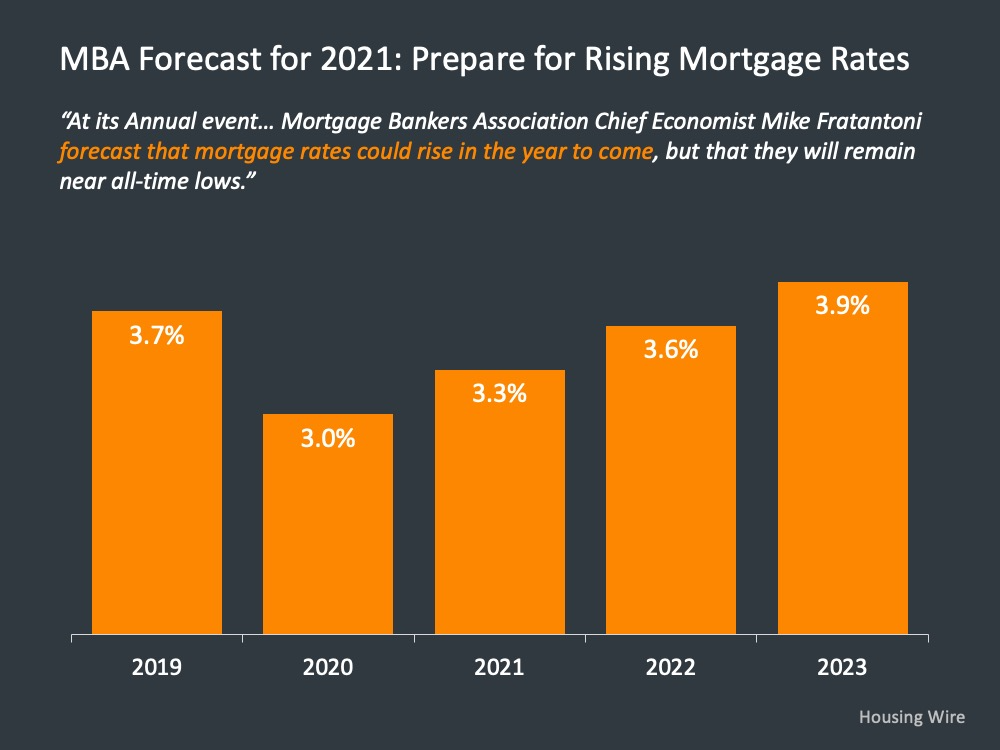

Understanding personal loan interest rates is crucial for securing the best possible deal. The interest rate dictates the total cost of borrowing, significantly impacting your monthly payments and overall loan repayment. Therefore, comparing interest rates from multiple lenders is paramount before you commit to a loan.

Several factors influence the interest rate you'll qualify for:

-

Credit Score: Your credit score is a significant factor. A higher credit score generally translates to lower interest rates, reflecting your creditworthiness. Lenders consider your credit history, payment patterns, and debt levels to assess the risk of lending to you.

-

Loan Amount: Larger loan amounts often carry higher interest rates due to the increased risk for the lender. Smaller loan amounts present less risk, potentially leading to lower interest rates.

-

Loan Term: The loan term (the length of time you have to repay the loan) also affects the interest rate. Longer loan terms generally result in lower monthly payments but higher overall interest paid because you're borrowing the money for a longer period.

Key Considerations:

- Check your credit score before applying: Knowing your credit score empowers you to shop for loans realistically and potentially take steps to improve it.

- Compare offers from multiple banks and credit unions: Don't settle for the first offer you receive. Compare APR (Annual Percentage Rate) from different lenders to find the most competitive rate.

- Understand APR (Annual Percentage Rate) and its components: The APR reflects the total cost of the loan, including interest and any fees. Make sure you understand all the components of the APR before signing any loan agreement.

- Consider loan terms and their impact on total interest paid: Carefully weigh the benefits of lower monthly payments against the higher total interest paid with longer loan terms.

Finding the Best Personal Loan for Your Needs

Once you understand interest rates, focus on finding the right loan for your financial situation. Determining the appropriate loan amount is crucial.

-

Define your financial goals for the loan: Clearly outline why you need the loan. This will help you determine the necessary loan amount and choose the most suitable loan type.

-

Research lenders online and read reviews: Thoroughly research potential lenders, comparing their interest rates, fees, and customer service ratings. Reading online reviews can offer valuable insights into a lender's reputation and customer experience.

-

Compare loan fees and other charges: Don't just look at the interest rate; also consider origination fees, prepayment penalties, and other charges that could add to the total cost of the loan.

-

Check the lender's customer service ratings: A reputable lender will provide excellent customer service, readily available to assist you throughout the loan process.

Types of Personal Loans:

- Secured Loans: Secured loans require collateral (e.g., a car or savings account). They generally offer lower interest rates because the lender has less risk.

- Unsecured Loans: Unsecured loans don't require collateral. They typically have higher interest rates due to the increased risk for the lender.

The Application Process: A Step-by-Step Guide

Applying for a personal loan is generally straightforward. However, organization and accuracy are essential.

-

Gather all necessary documents before starting the application: This usually includes proof of income, identification, and sometimes bank statements. Having everything ready saves time and ensures a smoother application process.

-

Complete the application form accurately and thoroughly: Inaccurate information can delay the approval process or lead to rejection. Double-check all details before submitting the application.

-

Submit all required documentation promptly: A timely submission shows your commitment and keeps the process moving forward.

-

Follow up on the application status with the lender: After submitting your application, follow up with the lender to check the status and address any questions.

The application process varies slightly depending on the lender, but the core steps remain largely the same.

Tips for Securing the Lowest Interest Rates

Several strategies can help you secure a personal loan with the lowest interest rates.

-

Pay off existing debts to improve your credit score: Reducing your debt-to-income ratio is a direct path to a better credit score and lower interest rates.

-

Maintain a consistent payment history: Consistent on-time payments demonstrate creditworthiness, positively impacting your credit score and loan eligibility.

-

Negotiate a lower interest rate with the lender based on your credit profile and other offers: If you receive multiple offers, use them to your advantage by negotiating a lower interest rate with your preferred lender.

-

Consider a secured loan if your credit score is low: If your credit score isn't ideal, a secured loan can provide access to lower interest rates.

Conclusion: Secure Your Personal Loan Today

Securing a personal loan with low interest rates involves careful planning, research, and comparison shopping. By understanding interest rates, choosing the right lender, and completing the application process efficiently, you can find the best financial solution for your needs. Remember to thoroughly compare loan terms and fees from multiple lenders, and don't hesitate to negotiate for the best possible interest rate. Ready to take the next step? Apply for a personal loan today and find a low-interest personal loan that fits your budget. Get a personal loan and achieve your financial goals! [Link to a relevant resource, e.g., loan comparison website]

Featured Posts

-

Analyzing The Legal Ramifications Of The Reynolds Baldoni Dispute

May 28, 2025

Analyzing The Legal Ramifications Of The Reynolds Baldoni Dispute

May 28, 2025 -

Hailee Steinfelds The Sinner Spit Scene Behind The Scenes Filming Details

May 28, 2025

Hailee Steinfelds The Sinner Spit Scene Behind The Scenes Filming Details

May 28, 2025 -

Cuaca Jawa Barat 7 Mei Peringatan Hujan Hingga Sore

May 28, 2025

Cuaca Jawa Barat 7 Mei Peringatan Hujan Hingga Sore

May 28, 2025 -

Will Jacob Wilson Breakout Poll Results And Expert Predictions

May 28, 2025

Will Jacob Wilson Breakout Poll Results And Expert Predictions

May 28, 2025 -

1 Million National Lottery Prize Six Week Warning To Unclaimed Winner

May 28, 2025

1 Million National Lottery Prize Six Week Warning To Unclaimed Winner

May 28, 2025