Secure Your Child Benefit Payments: Recognizing Genuine HMRC Communication

Table of Contents

Identifying Genuine HMRC Communication Channels

HMRC uses several official communication channels to contact recipients regarding their Child Benefit. Understanding these legitimate methods is crucial for identifying fraudulent attempts. Knowing how HMRC communicates will help you secure your child benefit payments.

-

Email: Genuine HMRC emails will always originate from a

@gov.ukaddress. Crucially, they will never ask for sensitive personal information such as your full bank account details, online banking password, or full National Insurance number. Legitimate emails often include a unique reference number specific to your case. Always check for this. -

Letter: Official HMRC correspondence regarding your Child Benefit arrives via post. Look for official letterhead and the clear HMRC logo. This is usually the most secure form of communication.

-

Phone: HMRC may occasionally contact you by phone, but they will never request your banking details or full National Insurance number over the phone. If you receive a call claiming to be from HMRC requesting such information, do not provide it. Instead, end the call and contact HMRC using the number on their official website to verify the call's legitimacy.

-

Text Message: HMRC rarely uses text messages for anything other than simple notifications and will never request personal data via SMS. Be extremely wary of any text messages demanding personal information.

Key things to remember when checking for genuine HMRC communication:

- Never click on links in suspicious emails or texts. Always type the HMRC website address directly into your browser.

- Independently verify the sender's identity using the official HMRC website contact details.

- Be highly suspicious of emails or texts that create a sense of urgency or threaten immediate action.

- Report any suspicious communication to HMRC immediately through their official channels.

Recognizing the Red Flags of Child Benefit Scams

Scammers employ increasingly sophisticated tactics to trick unsuspecting recipients. Being aware of these common red flags can significantly reduce your risk of becoming a victim of Child Benefit fraud.

-

Urgent Requests for Information: A hallmark of a scam is the pressure to act immediately. Genuine HMRC communication will not demand instant responses or threaten immediate consequences.

-

Requests for Personal Financial Information: This is the biggest red flag. HMRC will never ask for your banking details, passwords, or your complete National Insurance number via email, text message, or phone call.

-

Suspicious Links or Attachments: Avoid clicking on any links or opening attachments from unknown or unverified sources. These can install malware on your devices or redirect you to phishing websites.

-

Poor Grammar and Spelling: Official HMRC communication is always professionally written and free from grammatical errors or spelling mistakes.

-

Threats or Intimidation: Genuine HMRC communication will be polite and professional. Threatening language is a major red flag.

What to do if you suspect a scam:

- Forward suspicious emails and text messages to HMRC's phishing reporting address.

- Never share your personal information unless you have independently verified the source through official HMRC channels.

- Report suspected fraud to Action Fraud, the UK's national fraud and cybercrime reporting centre.

Protecting Yourself from Child Benefit Fraud

Proactive steps can significantly enhance your protection against Child Benefit fraud. These simple measures can greatly reduce your vulnerability.

-

Strong Passwords: Use strong, unique passwords for all your online accounts, including your HMRC online account. Consider using a password manager to help generate and securely store complex passwords.

-

Regular Software Updates: Keep your computer, smartphone, and other devices updated with the latest security patches to protect against known vulnerabilities.

-

Beware of Phishing: Remain vigilant and extremely cautious of any unsolicited emails or text messages requesting personal information or asking you to click on links.

-

Monitor Your Account: Regularly check your Child Benefit account online for any unusual activity, such as unexpected changes or withdrawals.

Further proactive steps to take:

- Enable two-factor authentication (2FA) wherever possible to add an extra layer of security to your online accounts.

- Be exceptionally cautious about clicking links in unsolicited emails. Always type the website address directly into your browser.

- Install and regularly update reputable anti-virus and anti-malware software on all your devices.

Conclusion

Securing your Child Benefit payments is paramount. By understanding how to identify genuine HMRC communication, recognizing the red flags of scams, and taking proactive security measures, you can significantly reduce the risk of fraud. Always verify any communication independently using the official HMRC website and report suspicious activity immediately. Stay informed and stay safe to protect your family's financial well-being and secure your Child Benefit payments.

Featured Posts

-

Inclement Weather Impacts First F1 Practice In Monaco

May 20, 2025

Inclement Weather Impacts First F1 Practice In Monaco

May 20, 2025 -

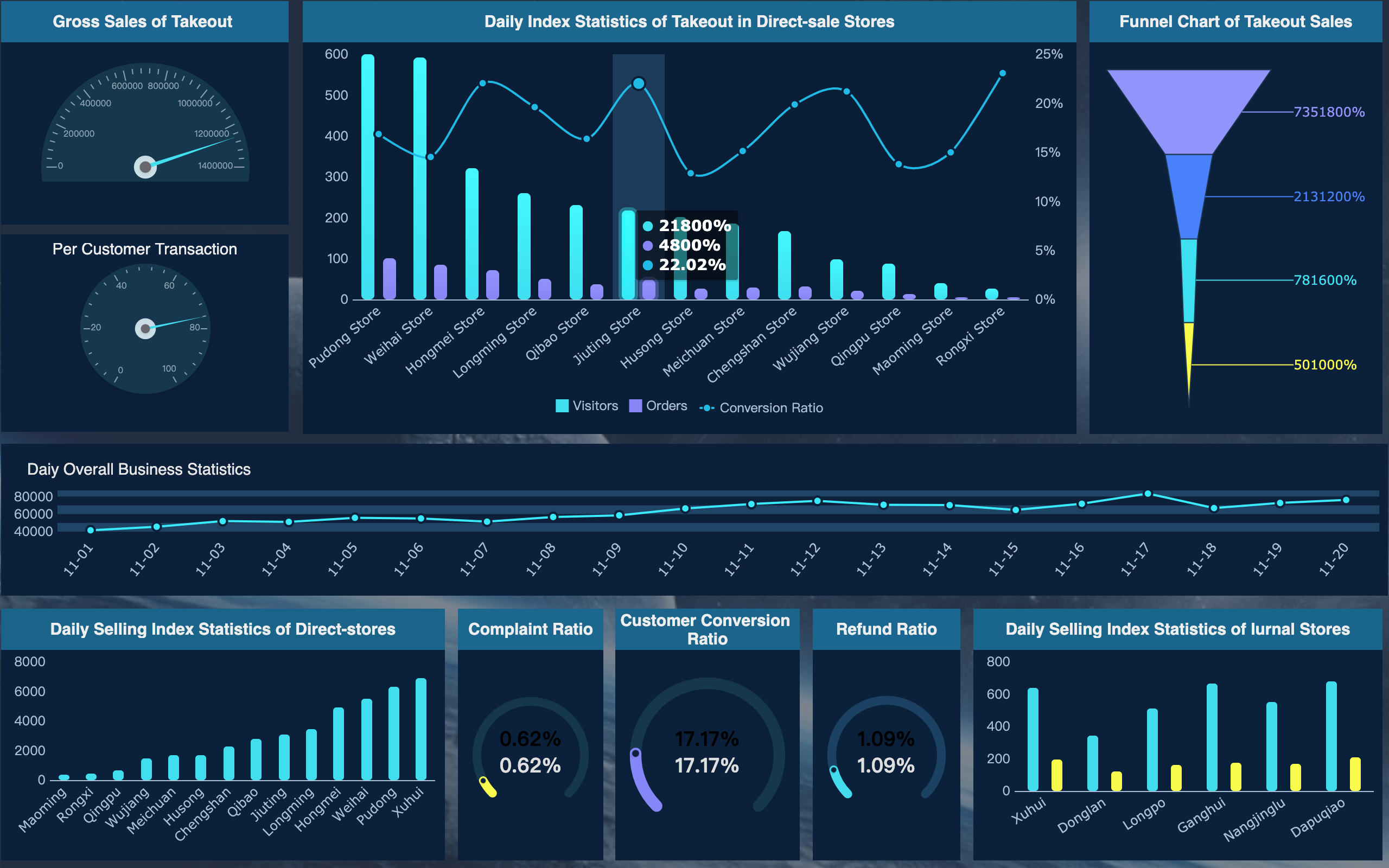

Analyzing The Countrys New Business Hot Spots Data And Insights

May 20, 2025

Analyzing The Countrys New Business Hot Spots Data And Insights

May 20, 2025 -

Agatha Christie Returns The Bbcs Groundbreaking Adaptation

May 20, 2025

Agatha Christie Returns The Bbcs Groundbreaking Adaptation

May 20, 2025 -

Biarritz Debat Sur Le Budget Les Logements Saisonniers Et Sainte Eugenie

May 20, 2025

Biarritz Debat Sur Le Budget Les Logements Saisonniers Et Sainte Eugenie

May 20, 2025 -

Jalkapallo Friisin Valinnat Kamara Ja Pukki Penkillae

May 20, 2025

Jalkapallo Friisin Valinnat Kamara Ja Pukki Penkillae

May 20, 2025

Latest Posts

-

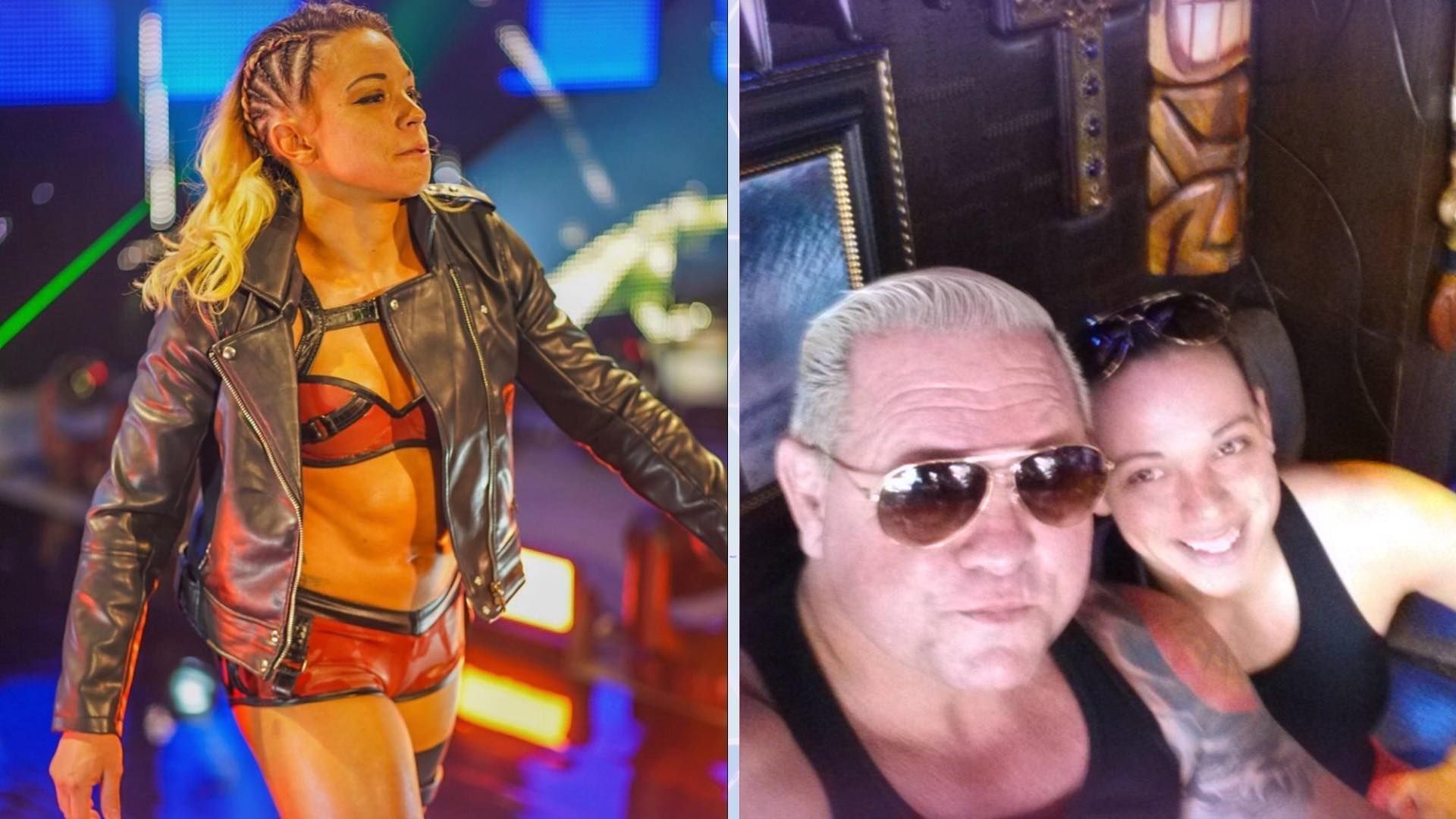

Zoey Stark Injured During Wwe Raw Match Details And Updates

May 20, 2025

Zoey Stark Injured During Wwe Raw Match Details And Updates

May 20, 2025 -

Huuhkajien Alkukokoonpano Naein Se Muuttui

May 20, 2025

Huuhkajien Alkukokoonpano Naein Se Muuttui

May 20, 2025 -

Roxanne Perez And Rhea Ripley Qualify For The 2025 Money In The Bank Ladder Match

May 20, 2025

Roxanne Perez And Rhea Ripley Qualify For The 2025 Money In The Bank Ladder Match

May 20, 2025 -

Huuhkajat Avauskokoonpanoon Kolme Muutosta Kaellman Penkille

May 20, 2025

Huuhkajat Avauskokoonpanoon Kolme Muutosta Kaellman Penkille

May 20, 2025 -

2025 Money In The Bank Perez And Ripley Earn Their Place In The Ladder Match

May 20, 2025

2025 Money In The Bank Perez And Ripley Earn Their Place In The Ladder Match

May 20, 2025