Secure Your Future: Identifying The Real Safe Bet For You

Table of Contents

Understanding Your Risk Tolerance

Before diving into specific investment options, it's crucial to understand your risk tolerance. This involves a thorough assessment of your current financial situation, your investment timeline, and your comfort level with potential losses.

Assessing Your Financial Situation

Understanding your current financial health is the cornerstone of any successful investment strategy. This involves:

- Analyzing existing investments: Review your current portfolio, including stocks, bonds, mutual funds, and real estate. Identify your asset allocation and any potential areas for improvement.

- Calculating net worth: Determine your total assets (what you own) minus your total liabilities (what you owe). This provides a clear picture of your overall financial standing.

- Evaluating debt levels: High levels of debt can significantly impact your investment choices and limit your risk tolerance. Assess your debt-to-income ratio and create a plan to manage or reduce your debt.

- Projecting future income: Estimate your future income based on your career trajectory and other potential income streams. This projection helps determine how much you can comfortably invest. Accurate financial security depends on realistic projections.

These steps allow you to create a comprehensive financial profile, essential for determining your appropriate risk assessment and investment strategy.

Defining Your Time Horizon

Your investment timeline significantly influences your risk tolerance. Short-term goals require a more conservative approach, while long-term goals allow for greater risk-taking.

- Short-term goals (less than 3 years): These include an emergency fund, a down payment on a house, or paying off high-interest debt. Focus on preserving capital and maintaining liquidity.

- Mid-term goals (3-10 years): These might encompass funding your child's education or a significant purchase like a car. A moderate-risk approach with a balance between growth and capital preservation is suitable here.

- Long-term goals (10+ years): This usually refers to retirement planning. A longer time horizon allows for greater exposure to growth-oriented assets with potentially higher returns, though this comes with increased risk. Long-term investment strategies often require more patience and a longer-term perspective on the market.

Considering your time horizon helps you tailor your investment strategy for optimal growth while managing your risk effectively.

Identifying Your Comfort Level with Risk

Different investors have different risk profiles:

- Conservative: These investors prioritize capital preservation and low risk, often preferring savings accounts, CDs, and government bonds.

- Moderate: These investors seek a balance between risk and return, often diversifying their portfolios across stocks, bonds, and other asset classes.

- Aggressive: These investors are comfortable with higher risk in pursuit of higher returns, often investing heavily in stocks and other growth-oriented assets.

Understanding your risk profile is critical for selecting appropriate investments and building a balanced portfolio. Effective risk management is crucial for long-term financial success.

Exploring Diverse Investment Options

Once you understand your risk tolerance, you can explore different investment options.

Low-Risk Investments

Low-risk investments prioritize capital preservation over significant growth.

- Savings Accounts: Offer easy access to your money, but returns are typically low.

- Certificates of Deposit (CDs): Provide a fixed interest rate for a specified term, offering higher returns than savings accounts but with lower liquidity.

- Government Bonds: Considered very safe investments backed by the government, offering relatively stable returns. These are often considered safe investments.

Low-risk options are ideal for emergency funds and short-term goals.

Moderate-Risk Investments

Moderate-risk investments offer a balance between risk and return.

- Mutual Funds: Professionally managed portfolios that diversify your investments across various stocks and bonds, reducing individual stock risk.

- Exchange-Traded Funds (ETFs): Similar to mutual funds but traded on stock exchanges, offering greater flexibility and lower expense ratios.

- Real Estate Investment Trusts (REITs): Invest in income-producing real estate, providing diversification and potential for higher returns, but also greater volatility than bonds.

These offer a good balance for those seeking a blend of stability and growth. A balanced portfolio is essential for managing moderate risk investments.

High-Risk Investments

High-risk investments offer the potential for substantial returns but also the possibility of significant losses.

- Individual Stocks: Investing in individual companies carries higher risk but also potentially higher rewards. Thorough research is essential.

- Options Trading: A complex strategy involving buying or selling the right to buy or sell an asset at a specific price, requiring advanced knowledge and significant risk tolerance.

- Cryptocurrency: A highly volatile digital asset class with significant potential for both gains and losses.

High-growth potential investments require careful consideration of your risk tolerance and a thorough understanding of the market.

Seeking Professional Guidance

While this article provides a foundation, seeking professional guidance is often beneficial.

Financial Advisors

Financial advisors can help you develop a personalized investment strategy aligned with your goals and risk tolerance.

- Benefits: Personalized plans, expert advice, and ongoing portfolio management.

- Considerations: Choosing a qualified advisor, understanding fees, and assessing their compatibility with your financial goals.

- Cost: Financial advice comes at a cost, which varies depending on the advisor and services offered.

Working with a qualified professional can significantly improve your chances of achieving your financial objectives.

Financial Education Resources

Continuously learning about personal finance and investing is crucial.

- Websites: Many reputable websites offer valuable information and resources.

- Books: Numerous books cover personal finance, investment strategies, and wealth management.

- Courses: Online courses and seminars provide structured learning experiences.

Conclusion

Securing your future requires a multifaceted approach encompassing understanding your risk tolerance, exploring various investment options, and seeking professional guidance when needed. Remember to create a financial plan that aligns with your specific goals and risk appetite. Start planning your financial future today! Take the first step toward securing your future by assessing your risk tolerance and exploring the investment options that best align with your goals. Remember, securing your financial future is a journey, not a destination, and continuous learning and planning are key to achieving long-term financial security.

Featured Posts

-

Sinoptiki O Snegopadakh V Mae Faktory Nepredskazuemosti

May 09, 2025

Sinoptiki O Snegopadakh V Mae Faktory Nepredskazuemosti

May 09, 2025 -

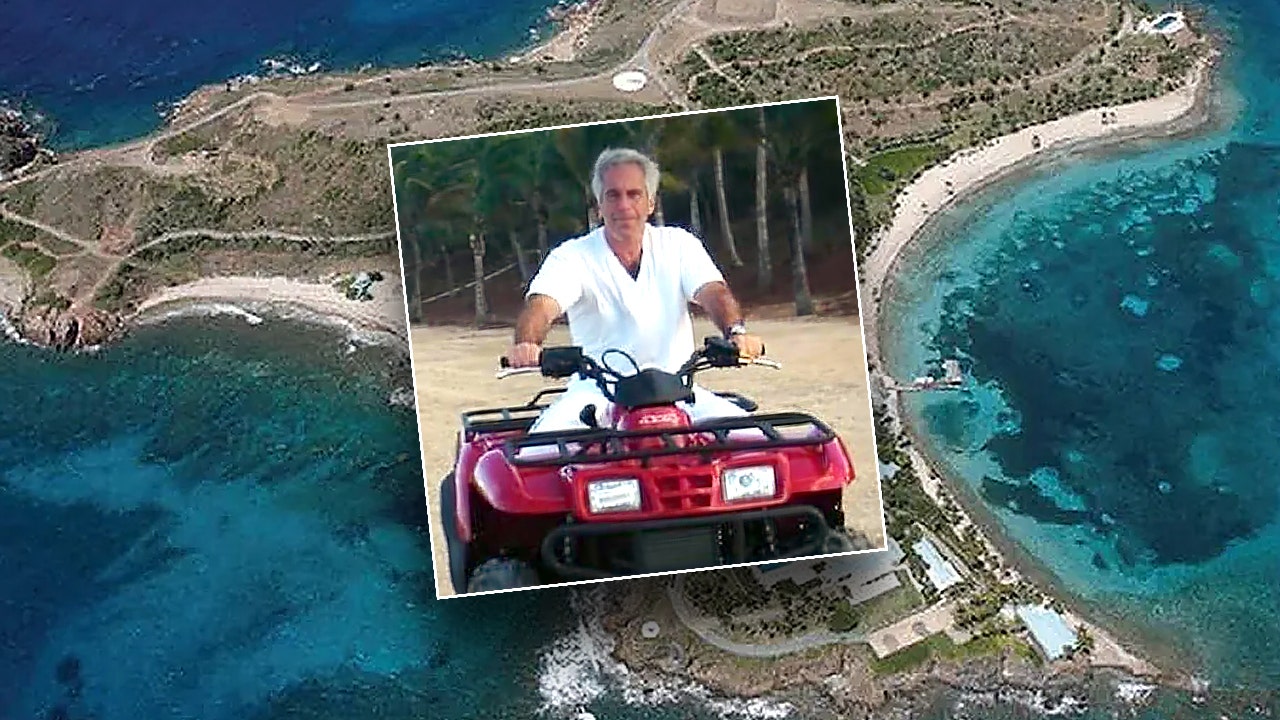

Pam Bondi Accused Of Hiding Epstein Records Senate Democrats Claims

May 09, 2025

Pam Bondi Accused Of Hiding Epstein Records Senate Democrats Claims

May 09, 2025 -

Nhl Oilers Vs Sharks Prediction And Betting Preview For Tonight

May 09, 2025

Nhl Oilers Vs Sharks Prediction And Betting Preview For Tonight

May 09, 2025 -

Is Young Thugs Back Outside Album Really Coming Soon A Look At The Clues

May 09, 2025

Is Young Thugs Back Outside Album Really Coming Soon A Look At The Clues

May 09, 2025 -

Bondi Announces Record Breaking Fentanyl Seizure In Us History

May 09, 2025

Bondi Announces Record Breaking Fentanyl Seizure In Us History

May 09, 2025