Securities Lawsuit Filed Against BigBear.ai Holdings, Inc.

Table of Contents

The Allegations of the Securities Lawsuit Against BigBear.ai

The lawsuit against BigBear.ai alleges multiple instances of misrepresentation and omission of material facts, constituting securities fraud. The plaintiffs, represented by [Insert Law Firm Name(s) here], claim that BigBear.ai made misleading statements to investors regarding [Specific area of alleged misrepresentation, e.g., revenue projections, contract wins, technological capabilities]. These alleged actions violated federal securities laws. The specific allegations include:

-

Allegation 1: Inflated Revenue Projections: The complaint alleges that BigBear.ai knowingly inflated its revenue projections, leading investors to believe the company was performing better than it actually was. Supporting evidence may include internal documents, emails, or expert testimony contradicting public statements.

-

Allegation 2: Misrepresentation of Contract Wins: The lawsuit claims that BigBear.ai misrepresented the nature and value of certain government contracts, exaggerating their significance to inflate its perceived market position. This could involve evidence showing discrepancies between publicized contract details and the reality of the agreements.

-

Allegation 3: Omission of Material Risks: The plaintiffs allege that BigBear.ai failed to disclose significant risks associated with its business operations, such as [Specific risk factors, e.g., reliance on a small number of clients, competitive landscape challenges, technological hurdles]. This could involve evidence showing knowledge of these risks without proper disclosure to investors.

These allegations of BigBear.ai fraud have led to this significant class action lawsuit and potential securities violations.

Potential Impact on BigBear.ai Holdings, Inc. and Investors

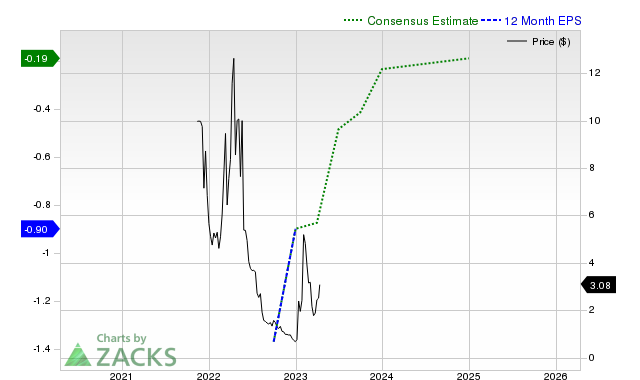

The BigBear.ai lawsuit has the potential to significantly impact the company and its investors. The financial repercussions could be substantial, potentially including: significant fines, legal fees, reputational damage, and a decline in stock price. The impact on BigBear.ai stock and investor confidence is already evident, with [mention specific stock price fluctuations if available]. Several scenarios could unfold:

-

Scenario 1: Favorable Settlement: BigBear.ai might negotiate a settlement with the plaintiffs, avoiding a costly and time-consuming trial. This could still result in significant financial penalties but limit further reputational damage. The impact on stock price would depend on the terms of the settlement.

-

Scenario 2: Unfavorable Verdict: A court ruling against BigBear.ai could lead to substantial financial penalties and further damage to investor confidence, impacting company operations and future prospects negatively.

-

Scenario 3: Dismissal of the Lawsuit: If the court dismisses the lawsuit, BigBear.ai could avoid significant financial penalties, although reputational damage might persist. This could lead to a recovery in investor confidence and stock price.

The market impact of this BigBear.ai stock situation remains to be seen.

Legal Strategy and Next Steps in the BigBear.ai Securities Lawsuit

Both sides in this BigBear.ai securities lawsuit will likely employ robust legal strategies. BigBear.ai's defense will likely focus on refuting the allegations, demonstrating the accuracy of its financial reporting, and challenging the evidence presented by the plaintiffs. The plaintiffs will aim to prove their claims through evidence discovery and expert testimony. The timeline for the legal proceedings will likely follow these phases:

-

Discovery Phase: This phase will involve extensive document review, depositions of key witnesses, and the exchange of information between both parties. It could last for several months, even years.

-

Motion Phase: Both sides may file various motions, including motions to dismiss, motions for summary judgment, and other procedural motions, potentially impacting the case's trajectory.

-

Trial Phase (if applicable): If the case goes to trial, it will involve witness testimony, presentation of evidence, and jury deliberations. The timeline for a trial is highly uncertain, depending on court schedules and other factors.

Key legal precedents related to securities fraud and misrepresentation will undoubtedly influence the judge's decisions and the jury's deliberations in this BigBear.ai litigation.

Conclusion: Understanding the Implications of the BigBear.ai Securities Lawsuit

The securities lawsuit against BigBear.ai Holdings, Inc., with its allegations of misrepresentation, omission of material facts, and potential securities fraud, presents significant risks for the company and its investors. The potential outcomes range from a favorable settlement to a costly and damaging trial. The long-term impact on BigBear.ai's operations, stock price, and reputation remains to be seen. Understanding the implications of this BigBear.ai securities litigation is crucial for investors.

Stay updated on the latest developments in the BigBear.ai securities litigation. Consult a financial advisor for guidance related to your BigBear.ai investments. This information is for informational purposes only and not legal or financial advice.

Featured Posts

-

Planning For The Upcoming Drier Weather Conditions

May 21, 2025

Planning For The Upcoming Drier Weather Conditions

May 21, 2025 -

The Goldbergs A Comprehensive Review Of Every Season

May 21, 2025

The Goldbergs A Comprehensive Review Of Every Season

May 21, 2025 -

Mwafqt Alnwab Ela Mkhalfat Tqryry Dywan Almhasbt 2022 2023

May 21, 2025

Mwafqt Alnwab Ela Mkhalfat Tqryry Dywan Almhasbt 2022 2023

May 21, 2025 -

Space Supercomputing Examining Chinas Latest Development

May 21, 2025

Space Supercomputing Examining Chinas Latest Development

May 21, 2025 -

Looney Tunes And Cartoon Network Stars New 2025 Animated Short

May 21, 2025

Looney Tunes And Cartoon Network Stars New 2025 Animated Short

May 21, 2025