"Sell America" Sentiment Returns As 30-Year Treasury Yield Hits 5%

Table of Contents

Rising Interest Rates and Their Impact on "Sell America" Sentiment

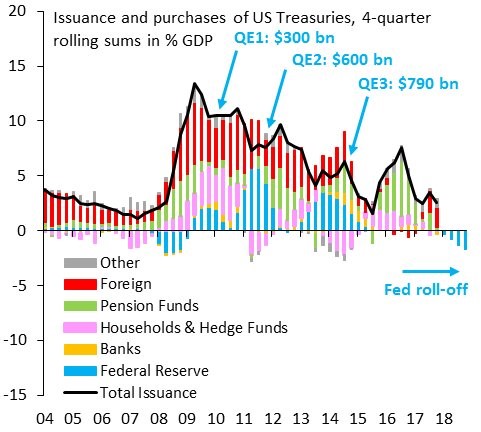

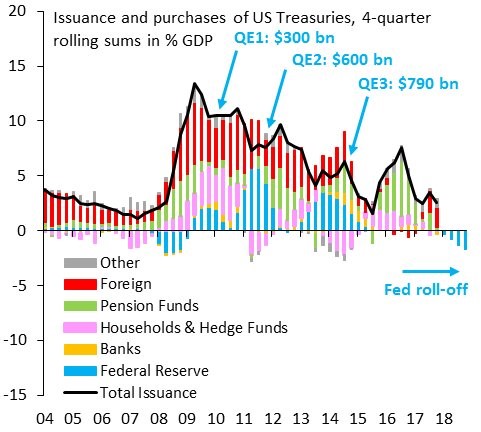

The direct correlation between rising interest rates, particularly the 30-year Treasury yield hitting 5%, and investor behavior is undeniable. While higher yields might seem attractive, making US bonds more appealing to foreign investors and potentially leading to capital inflows, the reality is more nuanced.

- Higher yields attract foreign investment: The increased returns on US bonds can incentivize foreign investors to park their money in the US, strengthening the dollar.

- Increased borrowing costs: Conversely, these higher rates simultaneously increase borrowing costs for US businesses and consumers, potentially slowing economic growth and dampening investor confidence. This can lead to a decrease in investment within the US market itself.

- Impact on the US dollar: A strong US dollar, fueled by higher yields, can make US assets more expensive for international investors, potentially offsetting the benefits of higher returns.

The potential for a "flight to safety" – investors seeking refuge in US assets despite higher yields – exists, particularly during times of global uncertainty. However, this dynamic might only partially counteract the "Sell America" narrative, as economic concerns and geopolitical instability could outweigh the allure of higher yields.

Geopolitical Risks and their Role in Fueling "Sell America" Sentiment

Current geopolitical instability significantly contributes to investor uncertainty and fuels the "Sell America" sentiment. The global landscape is fraught with challenges that impact market confidence and drive capital outflows.

- The war in Ukraine: The ongoing conflict creates significant economic uncertainty, impacting global supply chains and energy markets, thus influencing investment decisions.

- US-China relations: Strained relations between the US and China introduce geopolitical risks and concerns about potential trade disruptions, causing investors to seek diversification.

- Risk aversion: The heightened uncertainty encourages risk aversion, prompting investors to shift away from perceived higher-risk assets, including some US equities and bonds.

Compared to other global markets, the US is perceived by some as carrying relatively higher geopolitical risk at this moment, even if that risk is considered low in the long-term. This perception is enough to shift capital towards other perceived 'safe havens' or higher-growth opportunities abroad. This perception directly contributes to the "Sell America" narrative, amplifying concerns and encouraging diversification strategies.

Alternative Investment Opportunities and the Appeal of Diversification

The emergence of compelling investment opportunities outside the US further contributes to the "Sell America" trend. Investors are actively seeking higher returns and diversification to mitigate risks.

- Emerging markets: Countries with higher growth potential, such as those in Southeast Asia and parts of Africa, present attractive alternatives to mature US markets.

- Alternative asset classes: Commodities, particularly energy and precious metals, and emerging market equities offer potentially higher returns, drawing investor attention away from the US market.

- Currency fluctuations: Favorable currency exchange rates can significantly enhance the returns from non-US assets, further incentivizing diversification away from the dollar.

Diversification strategies are a core element of the "Sell America" trend. Investors are reducing their reliance on US-centric portfolios to protect themselves against potential economic downturns or geopolitical shocks. This strategic shift is a key driver of the current market dynamics.

Inflation Concerns and Their Influence on "Sell America" Sentiment"

Persistent inflation plays a critical role in shaping investor decisions and intensifying the "Sell America" sentiment.

- Impact on long-term bond yields: High and persistent inflation erodes the real return on long-term bonds, impacting investment strategies and potentially pushing investors towards shorter-term or inflation-protected securities.

- Central bank policies: Central bank policies aimed at curbing inflation, such as aggressive interest rate hikes, while necessary to control prices, can inadvertently fuel the "Sell America" sentiment by slowing economic growth.

Inflation expectations remain a significant factor driving investor behavior. The perceived effectiveness of central bank policies in managing inflation directly influences long-term investment decisions and contributes to the "Sell America" trend.

Navigating the "Sell America" Sentiment

The resurgence of the "Sell America" sentiment is driven by a complex interplay of factors: rising interest rates, geopolitical uncertainties, attractive alternative investments, and persistent inflation concerns, all impacting the attractiveness of US assets relative to other global options. The 5% 30-year Treasury yield serves as a significant indicator of this shift.

While the current market conditions present potential risks, they also offer opportunities. Investors must maintain a balanced perspective and adapt their strategies accordingly.

To effectively navigate this evolving landscape, it’s crucial to stay informed about market trends and develop a robust investment strategy that accounts for the fluctuations in US Treasury yields and the evolving "Sell America" sentiment. Conduct thorough research on diversification strategies and explore alternative investment options to mitigate risk and potentially capitalize on emerging opportunities. Don't let the "Sell America" narrative dictate your investment decisions without careful consideration of your own risk tolerance and long-term financial goals.

Featured Posts

-

Abn Amro En Transferz Samenwerking Voor Een Innovatief Digitaal Platform

May 21, 2025

Abn Amro En Transferz Samenwerking Voor Een Innovatief Digitaal Platform

May 21, 2025 -

Vybz Kartel Tour A Dream Realized For Nuffy

May 21, 2025

Vybz Kartel Tour A Dream Realized For Nuffy

May 21, 2025 -

Work From Home

May 21, 2025

Work From Home

May 21, 2025 -

Record Breaking Ratings For Snls 50th Season Finale

May 21, 2025

Record Breaking Ratings For Snls 50th Season Finale

May 21, 2025 -

Le Matin Auto Conduit L Alfa Romeo Junior 1 2 Turbo Speciale Essai Complet

May 21, 2025

Le Matin Auto Conduit L Alfa Romeo Junior 1 2 Turbo Speciale Essai Complet

May 21, 2025