Sensex & Nifty 50 Record Gains: Understanding The 1400/23800 Point Surge

Table of Contents

Global Factors Driving the Sensex & Nifty 50 Surge

Several global factors played a crucial role in propelling the Sensex and Nifty 50 to record highs.

Positive Global Economic Indicators

Positive news from global markets significantly boosted investor sentiment. Easing inflation concerns in the US, coupled with positive economic data from Europe and Asia, instilled confidence among investors worldwide.

- Easing Inflation: The decline in US inflation rates, as reported by the [Source - e.g., Federal Reserve], signaled a potential slowdown in interest rate hikes by the Federal Reserve. This reduced fears of an aggressive monetary tightening policy that could stifle global economic growth.

- Positive Economic Data: Strong economic data from major economies indicated a resilient global recovery, further enhancing investor optimism. This includes [cite specific data points and sources, e.g., strong manufacturing PMI in Germany, positive GDP growth in China].

- FII Inflows: The improved global outlook attracted significant Foreign Institutional Investor (FII) inflows into the Indian stock market. FIIs, seeking higher returns, poured capital into Indian equities, contributing significantly to the market surge.

Improved Corporate Earnings

Strong corporate earnings reports from Indian companies across various sectors fueled the market rally. Robust profit growth demonstrated the health of the Indian economy and boosted investor confidence.

- Strong Q[Quarter] Results: Many companies reported better-than-expected Q[Quarter] results, showcasing strong revenue and profit growth. [Cite specific examples and sectors, e.g., the IT sector exceeded expectations due to increased demand for technology services].

- Sector-Specific Performance: Specific sectors like [mention high-performing sectors and reasons why] experienced particularly strong growth, further driving the overall market upward.

- Increased Investor Confidence: These positive earnings announcements significantly improved investor confidence, leading to increased buying activity and higher stock valuations.

Geopolitical Stability (or lack thereof – depending on the context)

The impact of geopolitical events on the Indian stock market can be significant. [Analyze the situation at the time of writing. If there was relative geopolitical stability, highlight that. If there were significant events, analyze their impact - positive or negative - on investor sentiment and market movements. Include specific examples and their effect on the Sensex and Nifty 50]. For instance, [mention specific geopolitical event and its impact].

Domestic Factors Contributing to the Market Rally

In addition to global factors, several domestic elements contributed to the Sensex and Nifty 50's remarkable surge.

Government Policies and Initiatives

The Indian government's proactive policies and initiatives played a crucial role in bolstering investor confidence.

- Infrastructure Development: Increased government spending on infrastructure projects, such as roads, railways, and renewable energy, stimulated economic activity and attracted investment.

- Tax Reforms: Tax reforms and simplification aimed at improving the ease of doing business in India encouraged further investments.

- Economic Reforms: Other economic reforms [mention specific examples] helped create a more favorable investment climate.

Stronger-than-Expected Economic Data

Positive economic indicators from India signaled robust economic growth and further fueled the market rally.

- GDP Growth: Stronger-than-expected GDP growth figures indicated a healthy expansion of the Indian economy.

- Industrial Production: Increased industrial production reflected the growth momentum in various sectors.

- Consumer Spending: Rising consumer spending highlighted strong domestic demand and economic vitality.

Liquidity in the Market

Abundant liquidity in the market also contributed significantly to the surge in stock prices.

- Low Interest Rates: Lower interest rates made borrowing cheaper, encouraging investments in the stock market.

- Increased Investment Flows: Increased investment flows from both domestic and foreign investors added to market liquidity.

- Monetary Policy: The central bank's monetary policy [explain the role of monetary policy] supported the market’s liquidity.

Analyzing the Sustainability of the Sensex & Nifty 50 Gains

While the recent surge is impressive, it's crucial to analyze the sustainability of these gains.

Potential Risks and Challenges

Several factors could impact the market's future performance.

- Global Recession Risk: The risk of a global recession remains a concern, which could negatively impact investor sentiment and trigger market corrections.

- Inflationary Pressures: Persistent inflationary pressures could lead to higher interest rates, dampening economic growth and affecting market performance.

- Geopolitical Uncertainties: Ongoing geopolitical tensions and conflicts could create volatility in the market.

Long-Term Outlook

Despite potential headwinds, the long-term outlook for the Indian stock market remains cautiously optimistic. [Provide a balanced perspective based on expert opinions and market analysis. Cite sources and relevant data]. India's strong economic fundamentals, a young and growing population, and ongoing reforms position the market for continued growth in the long term.

Conclusion: Navigating the Sensex & Nifty 50's Record Gains – What's Next?

The record gains in the Sensex and Nifty 50 indices are a result of a confluence of positive global and domestic factors, including easing inflation, strong corporate earnings, supportive government policies, and abundant market liquidity. Understanding these factors is crucial for making informed investment decisions. Stay informed about Sensex and Nifty 50 trends to make sound investment choices. Conduct further research, consult with financial advisors, and develop a well-diversified investment strategy to navigate the dynamic Indian stock market effectively. Learn more about navigating the dynamic Sensex & Nifty 50 market by [link to relevant resources or further reading].

Featured Posts

-

Palantir And Nato A New Era Of Ai Powered Public Sector Prediction

May 10, 2025

Palantir And Nato A New Era Of Ai Powered Public Sector Prediction

May 10, 2025 -

Dijon Deces D Un Jeune Ouvrier Suite A Une Chute D Un Immeuble

May 10, 2025

Dijon Deces D Un Jeune Ouvrier Suite A Une Chute D Un Immeuble

May 10, 2025 -

Mdkhnw Krt Alqdm Qst Njwm Lebwa Rghm Eadt Altdkhyn Aldart

May 10, 2025

Mdkhnw Krt Alqdm Qst Njwm Lebwa Rghm Eadt Altdkhyn Aldart

May 10, 2025 -

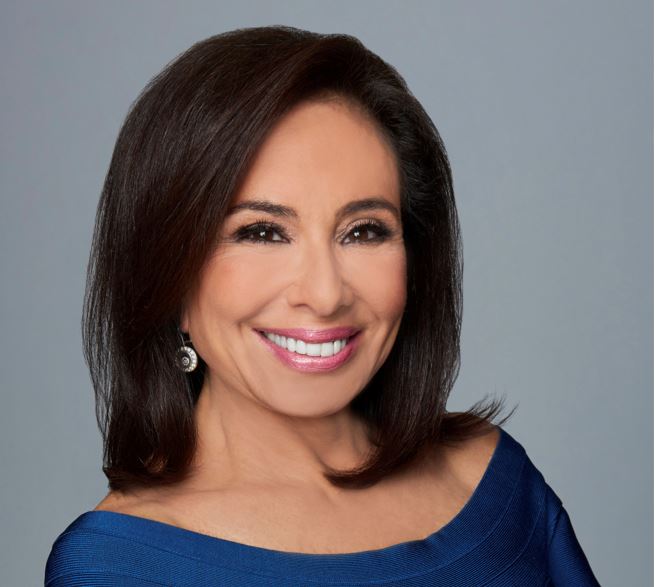

Judge Jeanine Pirro An Exclusive Look At Fox News And Her Life

May 10, 2025

Judge Jeanine Pirro An Exclusive Look At Fox News And Her Life

May 10, 2025 -

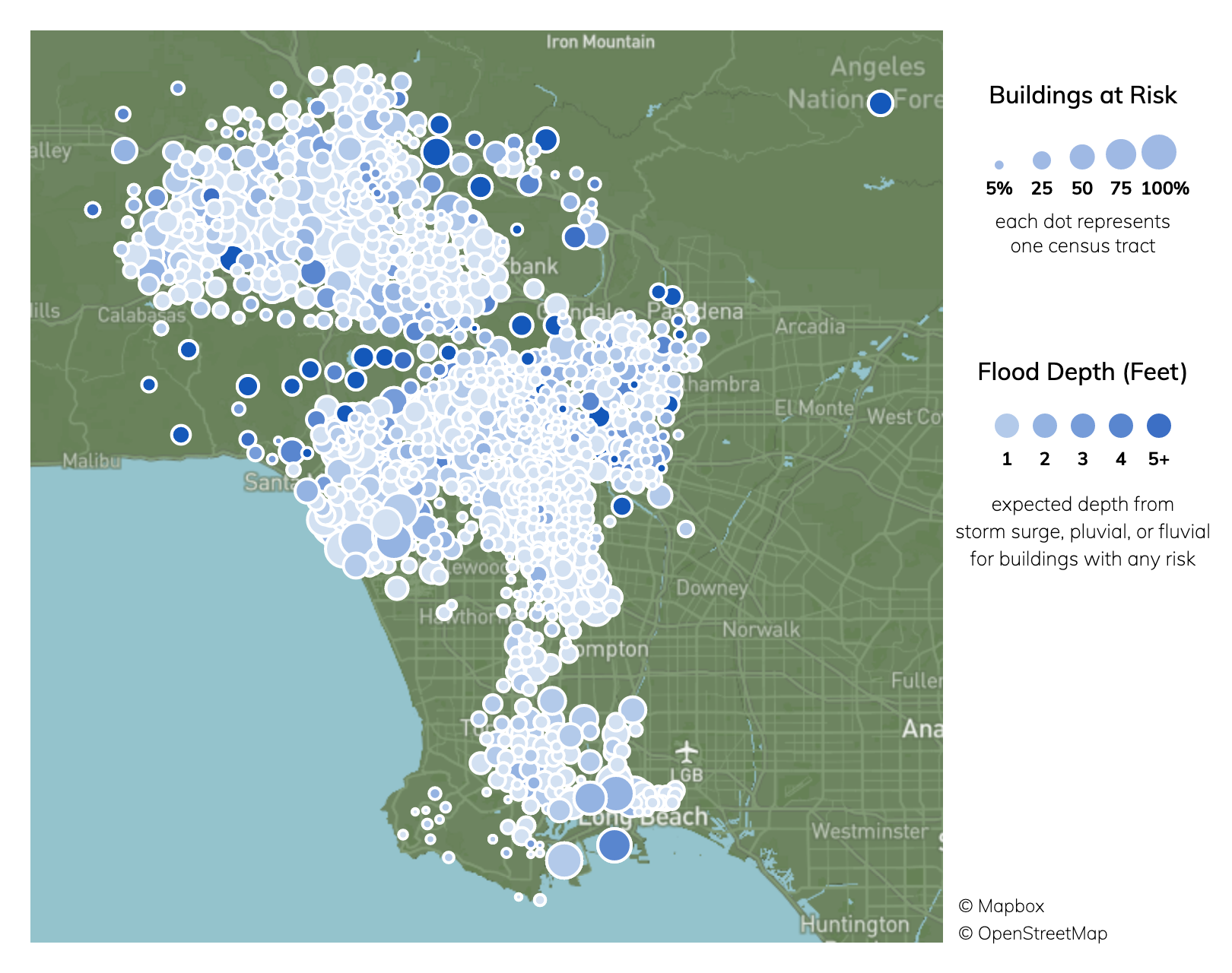

Los Angeles Wildfires And The Growing Market For Disaster Betting

May 10, 2025

Los Angeles Wildfires And The Growing Market For Disaster Betting

May 10, 2025