Sensex Jumps 200 Points, Nifty Surges Past 18,600: Stock Market Update

Table of Contents

Sensex's 200-Point Jump: A Detailed Analysis

The Sensex closed with a gain of exactly 200 points today, a significant jump that reflects positive investor sentiment. This Sensex rally wasn't driven by a single sector but rather a confluence of positive performances across various segments.

- IT Sector Dominance: IT stocks were the clear leaders, contributing significantly to the Sensex gains. Companies like Infosys and TCS saw impressive percentage increases, bolstering the overall index.

- Banking and Finance Strength: The banking and financial sector also showed strong performance, with several major players contributing substantially to the overall market uplift. This reflects confidence in the financial stability of the Indian economy.

- Top Performers: Specific examples of exceptionally well-performing stocks include [Insert Specific Stock Examples and Percentage Gains]. These individual successes underscore the broad-based nature of today's positive market movement.

- Trading Volume: The high trading volume observed today further emphasizes the market's dynamism and the significant participation of investors. This suggests a strong underlying confidence in the market's current trajectory. High volume typically indicates robust investor interest and potentially sustained momentum.

Nifty Surges Past 18,600: Implications and Outlook

The Nifty50 index also experienced a substantial surge, closing above the 18,600 mark. This represents a significant psychological barrier broken, adding to the bullish sentiment. The Nifty gains were fueled by several key factors:

- Positive Global Cues: Positive trends in global markets provided a supportive backdrop, influencing investor confidence in the Indian stock market.

- Strong Economic Data: Recent positive economic data releases, particularly in [mention specific data points if available], contributed to the improved market sentiment.

- Improved Investor Sentiment: A general improvement in investor sentiment, potentially driven by factors mentioned above, helped propel the Nifty's upward trajectory.

The implications of the Nifty crossing 18,600 are significant. While it’s difficult to predict with certainty, this could signal a sustained bullish trend. However, it is crucial to remember that market fluctuations are inherent, and temporary corrections are always possible. A short-term outlook suggests continued upward momentum, pending any unforeseen negative global or domestic events. The long-term outlook will depend on macroeconomic factors and global economic stability.

Factors Influencing Market Movement

Several crucial factors contributed to today's market movement:

- Global Market Trends: Positive global market trends, such as [mention specific global market trends], played a significant role in boosting investor confidence.

- Macroeconomic Factors: Macroeconomic indicators such as inflation rates, interest rates, and the value of the Indian Rupee all influence market sentiment. Currently, [mention current status of these factors and their impact].

- News and Events: Any significant news or events (positive or negative) impacting the market should be considered. For instance, [mention any relevant news or events and their influence].

- Expert Opinions: Market analysts are largely positive, with many citing the [mention specific reasons cited by analysts].

Expert Opinions and Future Predictions

Leading market analysts express a cautiously optimistic outlook. [Insert quotes from market analysts, attributing the quotes properly]. The consensus seems to be that the current bullish trend could continue, provided macroeconomic conditions remain stable and global markets perform well. However, they also caution against over-optimism and recommend a diversified investment strategy.

Conclusion: Stay Updated on Sensex and Nifty Movements

Today's market update showcases a significant surge in both the Sensex and Nifty indices, driven by a combination of positive domestic and global factors, strong sectoral performance, and improved investor sentiment. While the short-term outlook appears bullish, investors should maintain a balanced perspective and consider diverse investment strategies. Stay tuned for our next daily stock market update to keep track of Sensex and Nifty movements. Subscribe to our newsletter for regular updates on Sensex and Nifty performance and insightful market analysis!

Featured Posts

-

Dakota Johnson Kraujingos Nuotraukos Kas Is Tikruju Nutiko

May 09, 2025

Dakota Johnson Kraujingos Nuotraukos Kas Is Tikruju Nutiko

May 09, 2025 -

Massive Alaskan Protest Targets Doge And Trump Administration Actions

May 09, 2025

Massive Alaskan Protest Targets Doge And Trump Administration Actions

May 09, 2025 -

Anchor Brewings Legacy Reflecting On 127 Years Of Brewing

May 09, 2025

Anchor Brewings Legacy Reflecting On 127 Years Of Brewing

May 09, 2025 -

Western Manitoba Under Snowfall Warning Heavy Snow Expected

May 09, 2025

Western Manitoba Under Snowfall Warning Heavy Snow Expected

May 09, 2025 -

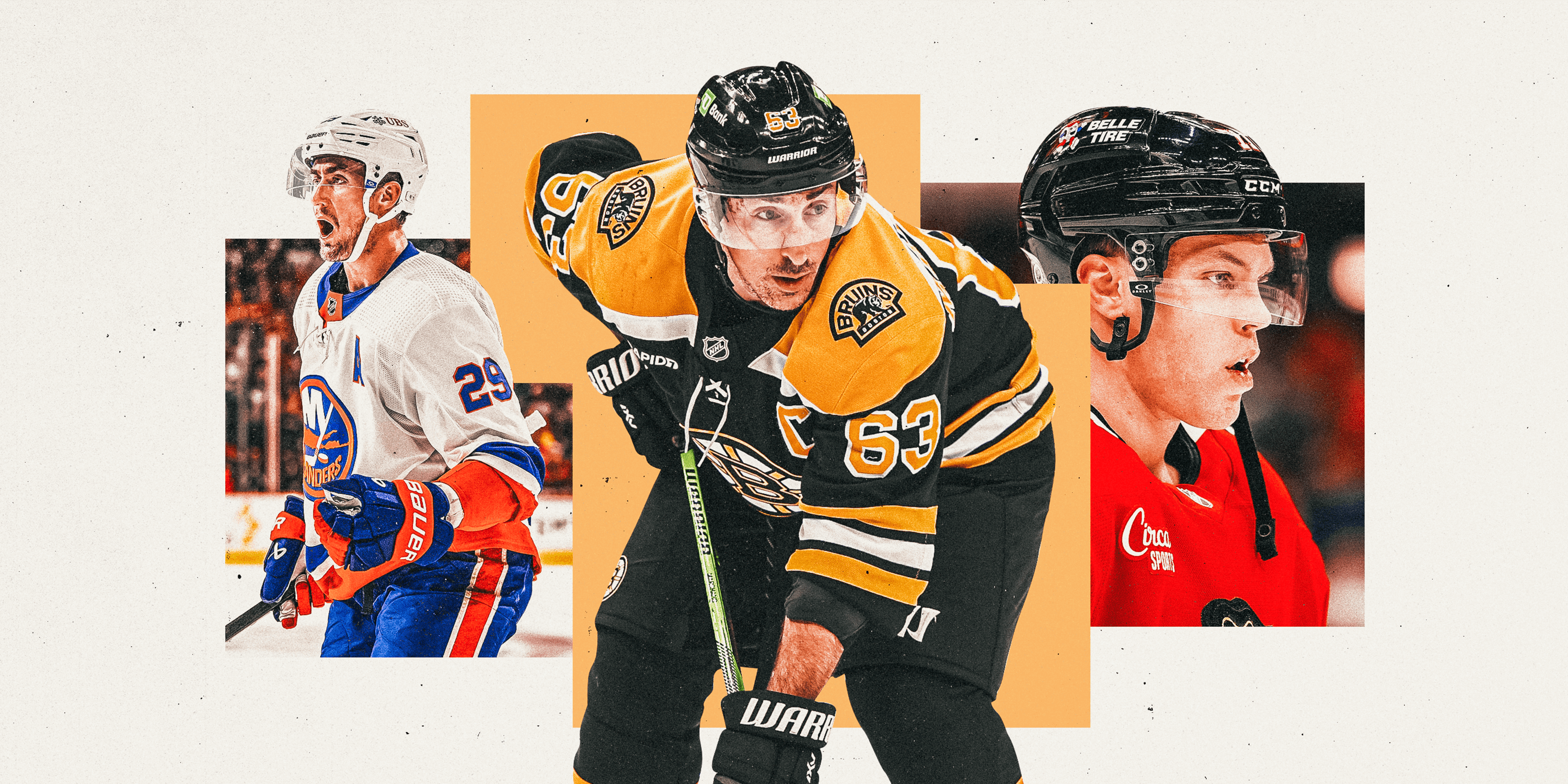

Nhl Playoff Projections Following The 2025 Trade Deadline

May 09, 2025

Nhl Playoff Projections Following The 2025 Trade Deadline

May 09, 2025