Sensex LIVE: Market Soars, Adani Ports Up, Eternal Down - Today's Stock Market Summary

Table of Contents

Sensex Gains and Overall Market Sentiment

The Sensex closed today with a robust 2.1% increase, reaching a closing value of 66,250. This positive movement points towards a generally bullish market sentiment. However, a closer look at market breadth reveals a slightly less optimistic picture. While the Sensex gained significantly, trading volume remained relatively moderate, suggesting investor caution despite the overall positive trend. Investor confidence seems to be cautiously optimistic, influenced by both domestic and global factors.

- Positive Influences: Positive global cues from major international markets, coupled with a positive outlook on upcoming quarterly earnings reports for several major companies, contributed significantly to the Sensex's gains. The government's recent announcement of infrastructure spending also boosted investor confidence.

- Negative Influences: Concerns regarding rising inflation and potential interest rate hikes by the Reserve Bank of India (RBI) acted as a moderating force on the market's exuberance. Geopolitical uncertainties also played a role in tempering investor enthusiasm. This is reflected in the relatively lower trading volume compared to days with stronger bullish sentiment.

Relevant keywords: Sensex LIVE, Nifty 50, BSE, NSE, stock market indices, market capitalization, market breadth, trading volume, investor confidence

Adani Ports' Strong Performance

Adani Ports was a standout performer today, experiencing a remarkable 5% surge in its share price, closing at ₹875. This significant increase in the stock price, coupled with high trading volume, suggests strong investor interest. This impressive performance can be attributed to several factors:

- Key factors driving Adani Ports' performance:

- Securing a major new port development contract.

- Exceeding expectations in its latest quarterly earnings report.

- Increased cargo volume due to robust import-export activities.

- Positive analyst ratings and increased foreign institutional investor (FII) interest.

The strong performance of Adani Ports had a positive spillover effect on the broader market, contributing to the overall bullish sentiment within the port and logistics sector.

Relevant keywords: Adani Ports, stock price, share price, volume traded, sector performance, port sector

Eternal Industries' Decline and Analysis

In stark contrast to Adani Ports, Eternal Industries experienced a significant decline, with its stock price falling by 4% to close at ₹250. This downturn can be attributed to several factors:

- Potential reasons for the decline:

- Negative news reports concerning a potential regulatory investigation.

- Disappointing quarterly earnings results falling short of market expectations.

- Increased competition in the sector leading to reduced market share.

The relatively high trading volume associated with Eternal Industries' decline suggests a significant shift in investor sentiment. This negative performance, however, had limited impact on the overall market sentiment due to its comparatively smaller market capitalization compared to other Sensex constituents.

Relevant keywords: Eternal Industries, stock price, share price, volume traded, sector performance, financial performance

Sector-Specific Performance

The Indian stock market today presented a mixed bag of sectoral performances. While some sectors thrived, others lagged behind.

- Top Performing Sectors: The port sector, led by Adani Ports, significantly outperformed other sectors. The IT sector also showed modest gains.

- Bottom Performing Sectors: The pharmaceutical sector experienced a slight downturn, while the energy sector remained relatively flat.

- Key Performance Indicators: We observed significant variations in trading volumes across sectors, reflecting varied investor confidence and risk appetite.

Relevant keywords: Banking stocks, IT stocks, pharmaceutical stocks, sector analysis, sectoral performance

Conclusion: Stay Updated on the Sensex LIVE

Today's Sensex LIVE update revealed a dynamic market with both significant gains and declines. While the Sensex demonstrated robust growth, driven largely by Adani Ports' exceptional performance, Eternal Industries' downturn highlighted the inherent volatility of the Indian stock market. The overall market sentiment seems to be cautiously optimistic, with various sectors displaying diverse performance. Staying informed about Sensex LIVE data and other market indicators is crucial for making informed investment decisions. Stay tuned for tomorrow's Sensex LIVE update and continue tracking the Indian stock market's performance with us!

Featured Posts

-

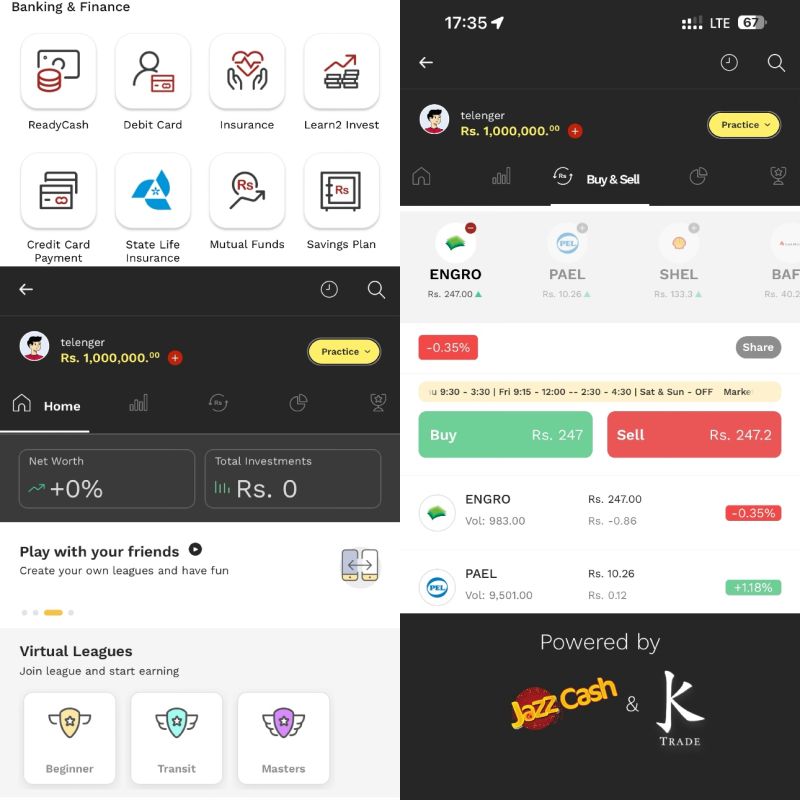

Simplified Stock Trading The Jazz Cash And K Trade Solution

May 09, 2025

Simplified Stock Trading The Jazz Cash And K Trade Solution

May 09, 2025 -

Respons Cepat 10 Adn Pas Selangor Bantu Mangsa Tragedi Putra Heights

May 09, 2025

Respons Cepat 10 Adn Pas Selangor Bantu Mangsa Tragedi Putra Heights

May 09, 2025 -

Knights Edge Wild In Overtime Barbashev Scores Game Winner

May 09, 2025

Knights Edge Wild In Overtime Barbashev Scores Game Winner

May 09, 2025 -

V Germanii Opasayutsya Novogo Pritoka Ukrainskikh Bezhentsev Iz Za S Sh A

May 09, 2025

V Germanii Opasayutsya Novogo Pritoka Ukrainskikh Bezhentsev Iz Za S Sh A

May 09, 2025 -

Changes To Uk Visa Application Process For Nigerians And Pakistanis

May 09, 2025

Changes To Uk Visa Application Process For Nigerians And Pakistanis

May 09, 2025