Sensex Today: 800+ Point Surge, Nifty Above 18,500 - LIVE Stock Market Updates

Table of Contents

Sensex's 800+ Point Jump: A Detailed Analysis

The sheer scale of the Sensex's climb is remarkable. Let's break down the contributing factors that propelled this impressive 800+ point jump:

Sector-wise Performance: Identifying the Winning Sectors

Several sectors played a pivotal role in this market surge. The banking, IT, and FMCG sectors were particularly prominent performers.

- Banking: The banking sector witnessed robust gains, with leading players like HDFC Bank and SBI showing significant percentage increases. This positive performance reflects investor confidence in the sector's growth prospects.

- IT: The IT sector also contributed substantially to the overall market surge. Companies like Infosys and TCS experienced strong upward momentum, boosted by positive global tech trends and strong quarterly results.

- FMCG: Fast-moving consumer goods (FMCG) companies also showed commendable performance, reflecting sustained consumer demand and robust earnings. Hindustan Unilever and Nestle India were among the top performers in this sector.

Data Points:

- Banking Sector: Average increase of 3.5%, with HDFC Bank up by 4.2% and SBI up by 3.8%.

- IT Sector: Average increase of 2.8%, with Infosys up by 3.1% and TCS up by 2.5%.

- FMCG Sector: Average increase of 2.2%, with Hindustan Unilever up by 2.5% and Nestle India up by 2%.

Global Market Influences: International Factors at Play

Positive global market trends significantly influenced the Indian stock market's performance.

- Positive US economic data: Stronger-than-expected economic data from the United States boosted investor sentiment globally, leading to increased foreign investment in emerging markets like India.

- Easing global inflation concerns: Signs of easing inflation in several major economies provided further impetus to the positive market mood, reducing investor anxiety about interest rate hikes.

Data Points:

- The Dow Jones Industrial Average closed up 1.2%, while the Nasdaq Composite rose by 1.5%. This positive performance in US markets positively impacted investor sentiment towards the Indian stock market.

Key Economic Indicators: Domestic Drivers of Growth

Recent economic data releases also played a role in bolstering investor confidence.

- Strong GDP growth figures: Positive GDP growth projections for the current fiscal year fueled optimism about India's economic outlook, attracting investment.

- Stable inflation numbers: Stable or slightly declining inflation rates further reassured investors, reducing concerns about monetary tightening.

Data Points:

- India's GDP growth is projected to be around 7% for the current fiscal year.

- Inflation is currently hovering around the Reserve Bank of India's target range.

Nifty Above 18,500: Implications and Future Outlook

The Nifty index crossing the 18,500 mark signifies a significant milestone, warranting a closer look at the technical aspects and future prospects.

Technical Analysis: Charting the Course Ahead

A brief technical analysis reveals that the Nifty has broken through a key resistance level, suggesting further upward potential in the short term.

- Support Levels: The 18,300 level could act as a crucial support level if the market experiences a minor correction.

- Resistance Levels: The 18,700 and 19,000 levels represent potential resistance points in the near future.

(Note: Ideally, this section would include relevant charts and graphs illustrating the technical analysis.)

Expert Opinions: Market Analysts Weigh In

Several market analysts express cautious optimism about the near-term outlook for the Indian stock market.

- "The current market rally is driven by a confluence of global and domestic factors. While further upside potential exists, investors should exercise prudence and manage their risk accordingly," says Mr. X, Chief Analyst at YZ Financial Services.

- "The Nifty crossing 18,500 is a significant psychological barrier. We expect the market to consolidate around these levels before resuming its upward trajectory," notes Ms. Z, Senior Strategist at ABC Investments.

Investor Sentiment and Strategy: Navigating Market Conditions

Investor sentiment is currently positive, but caution is warranted.

- Short-term investors: Consider booking profits on some positions, given the significant gains witnessed today. Short-term trading strategies should incorporate robust risk management measures.

- Long-term investors: This positive market sentiment presents an opportunity to accumulate high-quality stocks in a phased manner. A long-term investment strategy focusing on fundamentally strong companies is recommended.

Conclusion: Staying Updated on Sensex and Nifty Movements

Today's remarkable Sensex surge, exceeding 800 points and pushing the Nifty above 18,500, highlights the dynamic nature of the Indian stock market. This impressive performance stems from a combination of global tailwinds, positive domestic economic indicators, and strong sectoral performances. Understanding these driving forces is crucial for navigating the market effectively. Staying informed about daily "Sensex Today" updates is essential for making sound investment decisions. To stay ahead of the curve, regularly check for live stock market updates and insightful analysis. Subscribe to our newsletters or enable notifications to receive real-time information on the Sensex, Nifty, and other key market indicators. Don't miss out on the crucial "Sensex Today" updates – stay informed and invest wisely!

Featured Posts

-

Celtics Star Jayson Tatum Reflects On The Greatness Of Larry Bird

May 09, 2025

Celtics Star Jayson Tatum Reflects On The Greatness Of Larry Bird

May 09, 2025 -

Bayern Munich Vs Eintracht Frankfurt Match Preview And Prediction

May 09, 2025

Bayern Munich Vs Eintracht Frankfurt Match Preview And Prediction

May 09, 2025 -

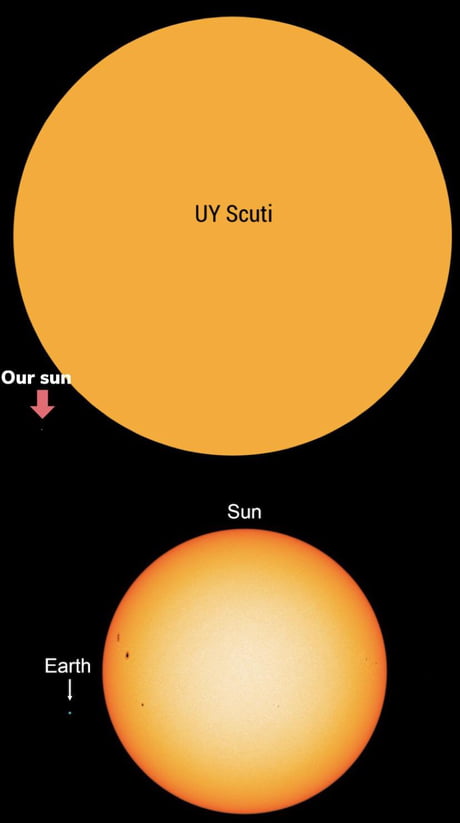

Young Thugs Uy Scuti Album When Can We Expect It

May 09, 2025

Young Thugs Uy Scuti Album When Can We Expect It

May 09, 2025 -

Go Compare Ad Campaign Changes Following Wynne Evans Sex Slur Revelation

May 09, 2025

Go Compare Ad Campaign Changes Following Wynne Evans Sex Slur Revelation

May 09, 2025 -

Family Support For Dakota Johnson At Materialist Film Premiere

May 09, 2025

Family Support For Dakota Johnson At Materialist Film Premiere

May 09, 2025