Shein IPO On Hold: US Tariffs Cause London Listing Delay

Table of Contents

The Impact of US Tariffs on Shein's IPO Plans

The imposition of US tariffs has significantly impacted Shein's IPO plans, creating a major hurdle for the company's initial public offering. The increased costs and regulatory scrutiny associated with these tariffs have made the prospect of a successful IPO significantly more challenging.

Increased Costs and Reduced Profitability

US tariffs dramatically increase Shein's import costs, directly impacting its profitability and making it a less attractive investment for potential shareholders. This directly affects the Shein IPO valuation.

- Tariffs increase the price of Shein's goods: Higher import duties translate to higher prices for consumers, potentially impacting sales volume and market share.

- Reduced profit margins make it harder to justify a high valuation: Lower profits mean a lower potential return on investment for shareholders, impacting the attractiveness of the Shein IPO.

- Investors may be hesitant due to the uncertainty surrounding future tariff levels: The unpredictable nature of US trade policy creates uncertainty for investors, leading to hesitation in committing significant capital to the Shein IPO.

Regulatory Scrutiny and Increased Risk

The imposition of tariffs has brought increased regulatory scrutiny to Shein's operations, highlighting potential risks and adding complexity to the IPO process. This scrutiny extends beyond just the financial implications of the Shein IPO.

- Increased scrutiny from investors regarding Shein's supply chain practices: Tariffs often lead to increased scrutiny of a company's supply chain transparency and ethical practices.

- Potential for future tariff increases or trade disputes: The ongoing trade tensions between the US and China increase the risk of further tariff increases or trade disputes, creating uncertainty for investors considering a Shein IPO investment.

- Uncertainty around the long-term sustainability of Shein's business model: The reliance on a low-cost, fast-fashion model makes Shein particularly vulnerable to tariff fluctuations, raising concerns about the long-term sustainability of its business model and the success of the Shein IPO.

Why London Was Chosen (and Why It's Now Delayed)

Initially, the London Stock Exchange appeared to be an attractive venue for Shein's IPO, but the impact of US tariffs has significantly altered this perspective.

Attractiveness of the London Stock Exchange

Several factors initially made the London Stock Exchange a seemingly favorable option for Shein's IPO.

- Access to a large pool of international investors: London is a global financial center with access to a vast network of international investors.

- Less stringent regulatory requirements compared to other major markets (initially perceived): While this perception may have been a factor, the complexities introduced by the US tariffs have complicated matters.

- Potential for a higher valuation than other exchanges: The perception of a less stringent regulatory environment, combined with access to a large investor pool, initially suggested the potential for a higher valuation for the Shein IPO on the London Stock Exchange.

The Impact of the Tariffs on Investor Confidence

The uncertainty introduced by the US tariffs has significantly dampened investor enthusiasm, leading directly to the delay of the Shein IPO.

- Investors are concerned about the long-term financial viability of Shein: The impact of tariffs on profitability raises questions about Shein's long-term sustainability.

- The complexity of navigating the tariff situation adds risk: The legal and logistical complexities of dealing with US tariffs present a significant risk factor for investors considering the Shein IPO.

- A delayed IPO could result in a lower valuation than initially anticipated: The delay itself could negatively affect investor sentiment and lead to a lower valuation for the Shein IPO when it finally proceeds.

Alternative Scenarios and Future Prospects for the Shein IPO

Despite the current setback, several alternative scenarios could shape the future of the Shein IPO.

Potential for a Delayed IPO in London

Shein may still pursue a London listing, but this would require addressing the tariff issues and improving its overall financial outlook.

- Negotiating with the US government to reduce tariffs: Shein may attempt to negotiate with the US government for reduced tariffs or trade concessions.

- Diversifying its supply chain to mitigate tariff risks: Diversifying its manufacturing base would reduce dependence on regions subject to high tariffs.

- Improving transparency regarding its supply chain practices: Greater transparency can help build investor confidence and potentially mitigate some regulatory concerns.

Exploring Other Listing Options

If the London IPO continues to face obstacles, Shein might explore alternative listing locations.

- Lower regulatory hurdles in certain Asian markets: Markets such as Hong Kong or Singapore might offer less stringent regulatory requirements.

- Closer proximity to key manufacturing hubs: Listing in Asia could provide logistical advantages given Shein's manufacturing base.

- Potential access to different investor pools: Different markets offer access to different investor demographics and preferences.

Conclusion

The delay of the Shein IPO, primarily due to the impact of US tariffs, highlights the significant challenges facing even the most successful fast-fashion brands. The uncertainty surrounding tariffs and their impact on Shein's profitability have created a major obstacle. While a London listing remains a possibility, Shein must address these issues to regain investor confidence and secure a successful Shein IPO. Stay tuned for further updates on the evolving situation surrounding the highly anticipated Shein IPO and its future trajectory. Keep checking back for the latest news on the Shein IPO and its potential implications for the fast fashion industry.

Featured Posts

-

Kevin Costner And Demi Moore A New Relationship After Months Of Pursuit Insider Report

May 06, 2025

Kevin Costner And Demi Moore A New Relationship After Months Of Pursuit Insider Report

May 06, 2025 -

Unexpected Snl Guest Sabrina Carpenter And A Fun Size Friend

May 06, 2025

Unexpected Snl Guest Sabrina Carpenter And A Fun Size Friend

May 06, 2025 -

Pratt On Schwarzeneggers White Lotus Nude Scene The Full Story

May 06, 2025

Pratt On Schwarzeneggers White Lotus Nude Scene The Full Story

May 06, 2025 -

Patrick Schwarzenegger Reveals He Auditioned For Superman

May 06, 2025

Patrick Schwarzenegger Reveals He Auditioned For Superman

May 06, 2025 -

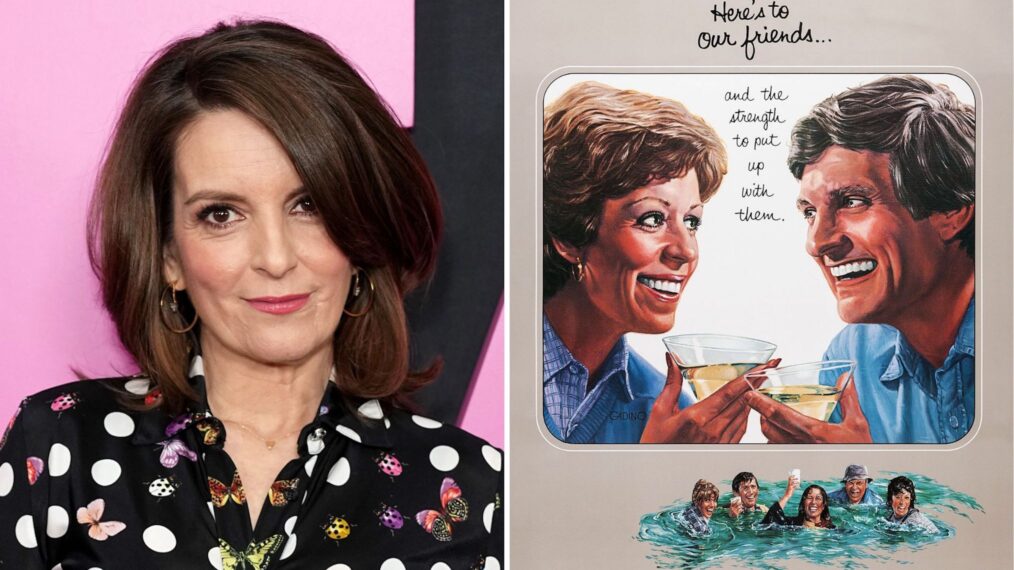

New Trailer For Netflix Series Four Seasons Starring Tina Fey Steve Carell And John Lithgow

May 06, 2025

New Trailer For Netflix Series Four Seasons Starring Tina Fey Steve Carell And John Lithgow

May 06, 2025