Shein's London IPO: A Victim Of US Trade Tensions?

Table of Contents

Shein's Business Model and its Vulnerability to Trade Disputes

Shein's success hinges on its unique ultra-fast fashion business model. This model relies heavily on a global supply chain, primarily based in China, enabling it to produce and deliver trendy clothing at incredibly low prices. However, this reliance also creates significant vulnerabilities.

Fast Fashion Supply Chains and Geopolitical Risks

Shein's fast fashion supply chain is intricately woven into the global trade network, making it susceptible to disruptions caused by tariffs, sanctions, and trade disputes. The current strained relationship between the US and China presents significant challenges.

- Tariffs: Increased tariffs on goods imported from China could drastically increase Shein's production costs, impacting its profitability and competitiveness.

- Sanctions: US sanctions targeting specific Chinese companies or industries could disrupt Shein's supply chain and lead to production delays or shortages.

- Trade Wars: Escalating trade wars between major economic powers can create uncertainty and volatility in the global market, making it difficult for companies like Shein to plan and invest long-term. This uncertainty directly affects investor confidence, a crucial factor for a successful IPO. Keywords: Shein supply chain, fast fashion trade wars, global supply chain disruptions.

Intellectual Property Concerns and US-China Trade Relations

Shein has faced numerous allegations of intellectual property infringement, a significant concern for investors. These allegations, coupled with the US's focus on protecting intellectual property rights in its trade policy with China, could further complicate Shein's IPO prospects.

- IP Infringement Lawsuits: Ongoing lawsuits related to copyright and design infringements could damage Shein's reputation and deter potential investors.

- US Trade Policy: The US government's stance on intellectual property rights could lead to further scrutiny of Shein's practices and potentially result in penalties or restrictions.

- Investor Confidence: Negative publicity surrounding intellectual property concerns can significantly impact investor confidence, reducing the likelihood of a successful IPO valuation. Keywords: Shein IP infringement, trade sanctions on China, intellectual property rights.

The Allure of a London IPO and its Strategic Implications

Shein's decision to pursue a London IPO holds significant strategic implications.

London as a Preferred IPO Destination

London offers several advantages as an IPO destination:

- Brexit and Regulatory Environment: Despite Brexit, London remains a significant global financial center with a well-established regulatory framework for IPOs.

- Investor Access: London provides access to a diverse pool of international investors, potentially mitigating reliance on US investors who may be hesitant due to trade tensions.

- Comparision to NYSE: While the New York Stock Exchange (NYSE) remains a prominent option, the current US-China trade climate makes London a comparatively less risky option for Shein. Keywords: London Stock Exchange IPO, Brexit and IPOs, Shein IPO location.

Mitigating US Trade Risks Through a London Listing

A London IPO might offer Shein a degree of protection against US trade restrictions.

- Reduced US Market Dependence: Listing in London reduces Shein's immediate dependence on the US market for capital, lessening the impact of potential US sanctions or tariffs.

- Diversification Strategies: Shein could use the funds raised through the IPO to diversify its supply chain, reducing its reliance on China and mitigating geopolitical risks.

- Lobbying Efforts: A London listing could provide Shein with greater leverage to lobby against unfavorable trade policies. Keywords: Shein risk mitigation, trade war diversification, London IPO strategy.

Investor Sentiment and the Future of Shein's IPO

The success of Shein's IPO hinges significantly on investor sentiment.

Impact of Geopolitical Uncertainty on Investor Confidence

Ongoing US-China trade tensions significantly impact investor perceptions of Shein's risk profile.

- Risk Assessment: Investors will carefully assess the geopolitical risks associated with Shein's business model and its potential exposure to trade disruptions.

- Valuation Impact: High levels of geopolitical uncertainty could negatively impact Shein's IPO valuation, resulting in a lower price and reduced capital raised.

- Investment Decisions: Investors may delay or avoid investing in Shein due to the perceived risk associated with US-China trade relations. Keywords: Shein investor sentiment, geopolitical risk assessment, IPO valuation.

Alternative Scenarios and Potential Outcomes

Several scenarios are possible for Shein's IPO:

- Successful IPO: If trade tensions ease and investor confidence remains high, Shein could achieve a highly successful IPO, raising significant capital.

- Delayed IPO: Increased trade friction might lead Shein to postpone its IPO until geopolitical uncertainty subsides.

- IPO Adjustments: Shein might adjust its IPO plans, such as reducing the amount of capital sought or altering its valuation strategy.

- IPO Cancellation: In a worst-case scenario, heightened trade tensions could force Shein to cancel its IPO altogether. Keywords: Shein IPO outcome, trade war impact on IPO, Shein future prospects.

Conclusion: Shein's London IPO and the Uncertain Landscape of Global Trade

Shein's London IPO presents a fascinating case study of how geopolitical risks and international trade tensions can impact a global company's growth and financial strategies. The company's reliance on a China-centric supply chain, coupled with allegations of intellectual property infringement, creates significant vulnerabilities. While a London listing offers strategic advantages in mitigating some of these US-related risks, the overall success of the IPO remains contingent on investor confidence and the evolving dynamics of US-China trade relations. Will Shein's London IPO succeed despite these challenges? Only time will tell. Share your thoughts on Shein's London IPO and the broader implications of US trade policies on global businesses using #SheinsLondonIPO. Further research into "Shein's London IPO" is encouraged to stay updated on this developing story.

Featured Posts

-

Double Trouble In Hollywood Actors Join Writers Strike Causing Widespread Production Delays

May 05, 2025

Double Trouble In Hollywood Actors Join Writers Strike Causing Widespread Production Delays

May 05, 2025 -

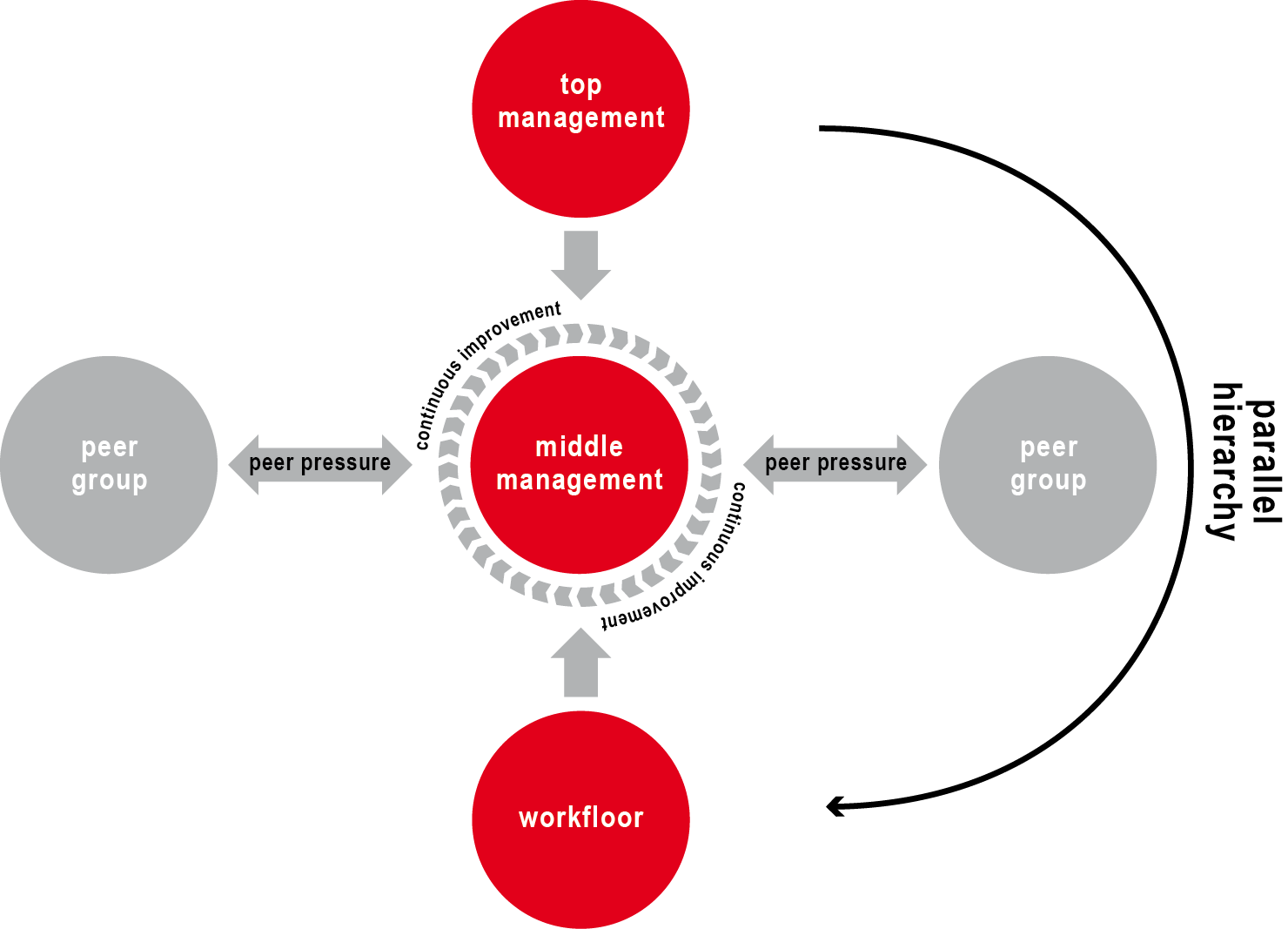

Are Middle Managers Worth It Exploring The Roi Of Middle Management

May 05, 2025

Are Middle Managers Worth It Exploring The Roi Of Middle Management

May 05, 2025 -

Fallica Criticizes Trumps Subservience To Putin

May 05, 2025

Fallica Criticizes Trumps Subservience To Putin

May 05, 2025 -

Is The Mcu Losing Its Way A Look At Recent Films And Series

May 05, 2025

Is The Mcu Losing Its Way A Look At Recent Films And Series

May 05, 2025 -

Navigating The Complexities Automotive Brands Facing Headwinds In The Chinese Market

May 05, 2025

Navigating The Complexities Automotive Brands Facing Headwinds In The Chinese Market

May 05, 2025

Latest Posts

-

Prison For Cult Members A Case Of Child Life Gambling

May 05, 2025

Prison For Cult Members A Case Of Child Life Gambling

May 05, 2025 -

Gambling With Childrens Lives Cult Members Face Prison

May 05, 2025

Gambling With Childrens Lives Cult Members Face Prison

May 05, 2025 -

Cults Gamble With Children Results In Prison Sentences

May 05, 2025

Cults Gamble With Children Results In Prison Sentences

May 05, 2025 -

Seventh Wonder Fleetwood Mac Tribute Concert Wa Tour Dates

May 05, 2025

Seventh Wonder Fleetwood Mac Tribute Concert Wa Tour Dates

May 05, 2025 -

Jail Time For Cult Members Gambling With Childrens Lives

May 05, 2025

Jail Time For Cult Members Gambling With Childrens Lives

May 05, 2025