Shein's London IPO Delay: The Impact Of US Tariffs

Table of Contents

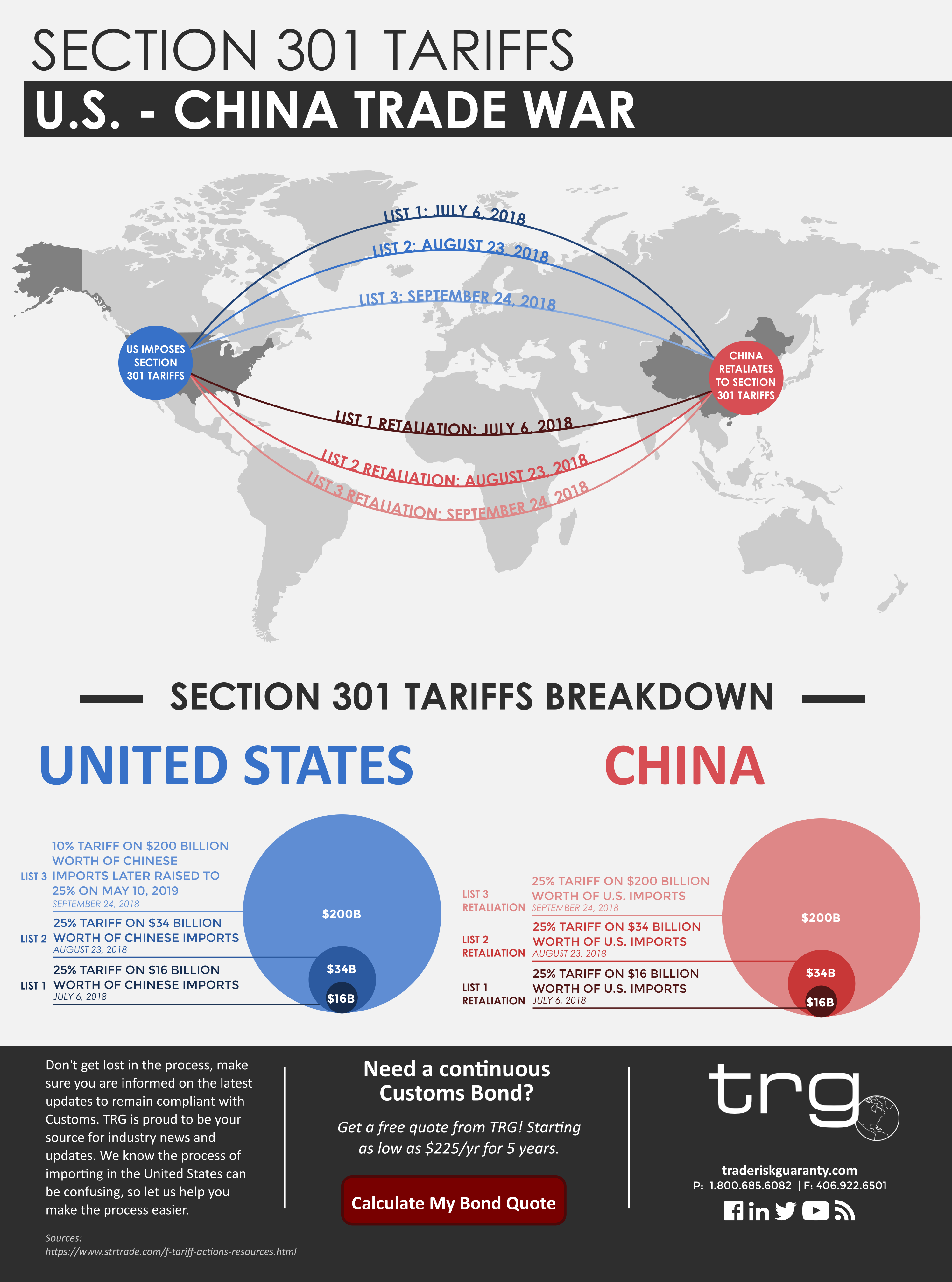

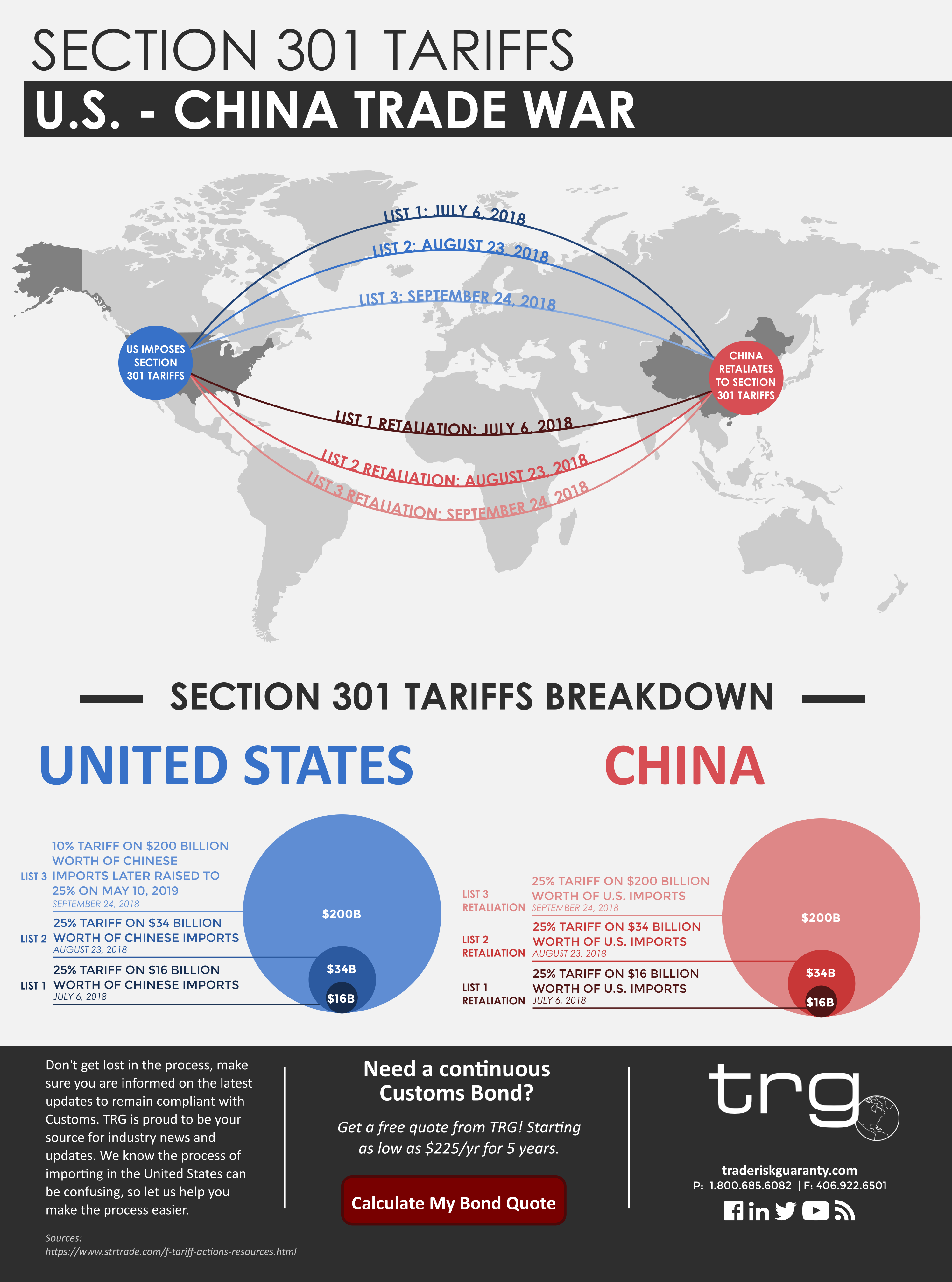

The Mounting Pressure of US Tariffs on Shein's Business Model

US tariffs represent a substantial challenge to Shein's business model. The company's low-cost, high-volume strategy relies heavily on efficient production and distribution. However, increased import duties on clothing and accessories directly increase Shein's production and distribution costs. This significantly impacts profit margins, potentially eroding the very foundation of its success.

- Increased import costs: Tariffs add a considerable percentage to the cost of each item, impacting profitability.

- Reduced competitiveness: Higher prices make Shein less competitive against other fast-fashion brands that may not be as heavily affected by these tariffs.

- Price increases and customer impact: To maintain profitability, Shein might be forced to increase prices, potentially alienating price-sensitive customers.

- Shifting sourcing strategies: The company is likely exploring alternative manufacturing locations outside of China to mitigate the impact of US tariffs. This involves significant logistical and infrastructural challenges.

Shein's Strategic Response to the Tariff Challenges

Shein is actively working to mitigate the negative impacts of US tariffs. This involves a multi-pronged approach focused on supply chain optimization, diversification, and potentially, strategic price adjustments.

- Negotiating with suppliers: Shein is likely negotiating with its suppliers to share some of the burden of the increased tariff costs.

- Investing in automation: Automation can streamline production processes, reducing costs and improving efficiency.

- Exploring alternative sourcing locations: Diversifying manufacturing outside of China, perhaps into Southeast Asia or other regions, is crucial to reduce reliance on tariff-affected routes.

- Potential price increases: While undesirable, carefully planned price increases could help offset higher costs, although this requires delicate management to avoid customer churn.

The Impact of the Delay on Shein's Valuation and Investor Confidence

The delay of Shein's London IPO has significant implications for its valuation and investor confidence. Uncertainty surrounding future profitability, directly linked to the ongoing tariff challenges, can negatively influence investor perception.

- Uncertainty around future profitability: Investors are naturally cautious about investing in a company facing significant headwinds.

- Potential for a lower IPO valuation: The delay and the associated uncertainty could result in a lower valuation than initially anticipated.

- Demonstrating resilience: Shein needs to demonstrate its capacity to navigate these challenges and maintain sustainable long-term growth to regain investor trust.

- Increased scrutiny: The delay will likely result in increased scrutiny from financial analysts and regulators.

Alternative Market Entry Strategies for Shein Postponing the London IPO

While the London IPO is delayed, Shein isn't necessarily stagnant. The company might explore various strategic alternatives to fuel growth and solidify its market position.

- Market share expansion: Focusing on increasing market share in existing regions, even without an IPO, is a viable strategy.

- Strategic acquisitions: Acquiring smaller brands could broaden Shein's product offerings and market reach.

- Brand reputation improvement: Addressing ethical concerns and enhancing its brand image will attract more investors and consumers.

- Seeking private equity funding: Securing private funding could provide the capital needed to weather the tariff challenges and pursue expansion plans.

Shein's London IPO Delay and the Future of Fast Fashion

The delay of Shein's London IPO underscores the significant impact of US tariffs on the global fast-fashion industry. Shein's strategic responses – from supply chain diversification to automation investments – will be crucial for its future success. The company’s ability to navigate these challenges will not only affect its own trajectory but also set a precedent for other fast-fashion players facing similar pressures. Staying informed about Shein's future plans, the evolving landscape of US Tariffs on Shein, and the broader implications for the fast-fashion industry is vital. Keep an eye on further developments regarding the Shein IPO and how the company adapts to the changing global economic environment.

Featured Posts

-

Lizzo In Real Life Tour Ticket Prices A Comprehensive Guide

May 04, 2025

Lizzo In Real Life Tour Ticket Prices A Comprehensive Guide

May 04, 2025 -

How Lizzo Achieved Her Weight Loss Goals A Closer Look

May 04, 2025

How Lizzo Achieved Her Weight Loss Goals A Closer Look

May 04, 2025 -

Angelina Bianca Censoris Sister Stuns In A Cutout Bodysuit And Tights

May 04, 2025

Angelina Bianca Censoris Sister Stuns In A Cutout Bodysuit And Tights

May 04, 2025 -

Basel Bound Abor And Tynnas Journey From Germany

May 04, 2025

Basel Bound Abor And Tynnas Journey From Germany

May 04, 2025 -

Ufc 313 Predictions Fights And What To Watch For

May 04, 2025

Ufc 313 Predictions Fights And What To Watch For

May 04, 2025