Shifting Strategies: European Stock Market Forecasts Downgraded Due To Trade War Risks

Table of Contents

Weakening Economic Indicators Fueling Downgrades

Several key economic indicators are pointing towards a slowdown in European economic growth, directly contributing to the downward revision of stock market forecasts. These factors reflect the real-world impact of the trade war on businesses and consumers. Keywords related to this section include GDP growth, inflation, consumer confidence, unemployment, and purchasing managers index (PMI).

-

Slowing GDP Growth: Major European economies are experiencing a deceleration in GDP growth. This reduced economic output directly translates to lower corporate profits and decreased investor confidence. The projected GDP growth for several EU nations has been revised downward, reflecting the negative impact of trade uncertainties.

-

Declining Consumer Confidence: The ongoing trade war is fueling uncertainty among consumers, leading to a decline in confidence. Fear of job losses, rising prices, and reduced purchasing power are causing consumers to postpone major purchases, impacting overall economic activity. Surveys measuring consumer sentiment are showing consistently lower scores, confirming this trend.

-

Rising Inflation: Increased tariffs and supply chain disruptions are contributing to rising inflation across Europe. This erodes consumer purchasing power, further dampening economic growth and negatively influencing stock market performance. Higher inflation reduces the real value of investments and makes future earnings less predictable.

-

Potential Increase in Unemployment: As businesses struggle with reduced demand and increased costs, some are forced to scale back operations, leading to potential job losses. The threat of unemployment contributes to a more pessimistic outlook on the economy and the stock market.

-

Falling PMI Readings: Purchasing Managers' Index (PMI) readings, which gauge business activity in the manufacturing and services sectors, are showing declining trends. This indicates a contraction in economic activity and adds further weight to the downgraded stock market forecasts. Falling PMIs across key European sectors confirm weakening economic momentum.

Impact of Tariffs and Retaliatory Measures on European Businesses

The trade war's direct impact on European businesses is a major driver of the negative outlook. Increased costs, reduced sales, and supply chain disruptions are forcing companies to adjust their strategies, leading to lower projected earnings and impacting stock valuations. Keywords for this section include tariffs, trade barriers, supply chain disruption, export decline, and import costs.

-

Increased Tariffs on European Exports: The imposition of tariffs on European exports to key trading partners significantly reduces their competitiveness in global markets, leading to lower export volumes and reduced revenue. This directly impacts the profitability of exporting businesses.

-

Retaliatory Tariffs: The EU's retaliatory tariffs on imports from other countries further exacerbate the problem, increasing costs for European businesses and potentially harming their competitiveness. These measures can disrupt established supply chains and force businesses to seek more expensive alternatives.

-

Supply Chain Disruption: Trade barriers and uncertainties are creating significant disruptions to global supply chains. Delays in delivering goods, increased transportation costs, and shortages of raw materials are impacting production timelines and increasing operating costs for European companies.

-

Decline in Export Volumes: European businesses are experiencing a decline in export volumes due to reduced global demand and increased trade barriers. This directly affects their revenues and profitability, influencing stock market valuations.

-

Rising Import Costs: Increased tariffs and supply chain disruptions translate to rising import costs for European businesses. These higher costs reduce profit margins and can lead to price increases for consumers, impacting overall economic activity.

Investor Sentiment and Market Volatility

The uncertainty surrounding the trade war is fostering risk aversion among investors. This leads to reduced investment, increased market volatility, and a downward pressure on stock prices, further justifying the downgraded forecasts. Keywords here include investor confidence, market volatility, risk aversion, stock prices, and investment strategies.

-

Decreased Investor Confidence: The ongoing trade war and its negative impact on the European economy have significantly reduced investor confidence in the European stock market. Investors are becoming more cautious and less willing to take risks.

-

Increased Market Volatility: Uncertainty about the future direction of the trade war is causing increased market volatility. Stock prices are fluctuating more dramatically, making it more challenging for investors to predict market movements and manage risk.

-

Sharp Declines in Stock Prices: Certain sectors heavily impacted by the trade war, such as manufacturing and export-oriented industries, are experiencing sharp declines in stock prices. These declines reflect the market's assessment of the risks and potential for future losses.

-

Shift to Safer Assets: Many investors are shifting their investments from riskier assets like stocks to safer assets such as government bonds, reflecting the increased risk aversion due to trade war uncertainty.

-

Increased Demand for Hedging Strategies: The increased market volatility is leading to a higher demand for hedging strategies to mitigate potential losses. Investors are seeking ways to protect their portfolios from the negative effects of the trade war.

Adapting Investment Strategies in a Challenging Market

Given the current uncertainty, investors need to proactively adjust their strategies to navigate this challenging market. A diversified and well-managed portfolio is crucial to weathering the storm. Keywords for this section include diversification, risk management, defensive stocks, long-term investment, and active management.

-

Diversification: Diversifying investment portfolios across different asset classes (stocks, bonds, real estate, etc.) and geographies is crucial to reducing risk. Don't put all your eggs in one basket.

-

Risk Management: Implementing robust risk management strategies, including setting stop-loss orders and diversifying holdings, is essential to mitigate potential losses. Thorough risk assessment is paramount.

-

Defensive Stocks: Consider investing in defensive stocks, which are less susceptible to economic downturns. These companies typically provide essential goods and services, making them relatively resilient during periods of economic uncertainty.

-

Long-Term Investment: Adopt a long-term investment perspective, rather than focusing on short-term market fluctuations. Remember that markets will eventually recover, even after periods of significant decline.

-

Active Management: Utilize active management strategies, regularly reviewing your portfolio and adjusting your holdings based on evolving market conditions. This will help you capitalize on opportunities and minimize losses.

Conclusion

The downgrading of European stock market forecasts is a direct consequence of the escalating global trade war. Weakening economic indicators, the direct impact of tariffs on European businesses, and heightened investor uncertainty all contribute to this pessimistic outlook. To successfully navigate this complex environment, investors must adapt their strategies, focusing on diversification, risk management, and a long-term perspective. Understanding the implications of the ongoing trade war and proactively adjusting your approach to European stock market investment is crucial for minimizing risk and maximizing potential returns in this uncertain climate. Don't wait – review your stock market forecast and adjust your investment strategy today.

Featured Posts

-

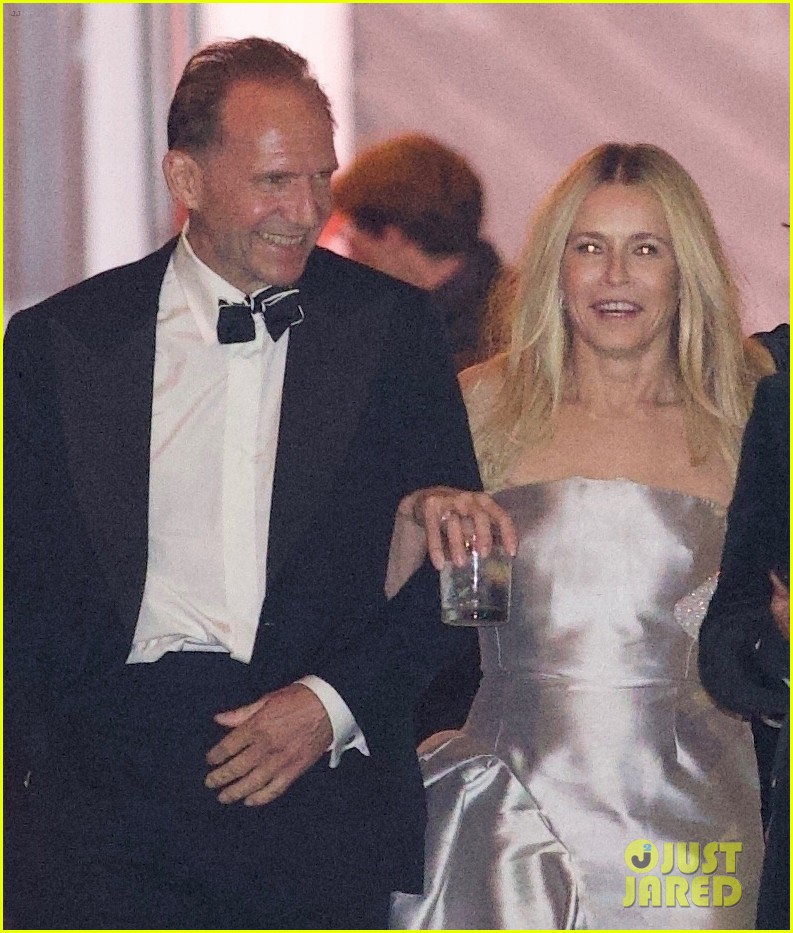

The Truth About Chelsea Handler And Ralph Fiennes Relationship

Apr 26, 2025

The Truth About Chelsea Handler And Ralph Fiennes Relationship

Apr 26, 2025 -

Het Geheim Van De Lentetaal Ontcijferd

Apr 26, 2025

Het Geheim Van De Lentetaal Ontcijferd

Apr 26, 2025 -

Benson Boone Biografia Musica E Sucesso No Lollapalooza Brasil

Apr 26, 2025

Benson Boone Biografia Musica E Sucesso No Lollapalooza Brasil

Apr 26, 2025 -

Experience A Dutch Street Party At Millcreek Commons King Day

Apr 26, 2025

Experience A Dutch Street Party At Millcreek Commons King Day

Apr 26, 2025 -

140

Apr 26, 2025

140

Apr 26, 2025

Latest Posts

-

Trumps Higher Education Policies A Nationwide Analysis

Apr 28, 2025

Trumps Higher Education Policies A Nationwide Analysis

Apr 28, 2025 -

The Trump Era And Its Legacy On College Campuses Across America

Apr 28, 2025

The Trump Era And Its Legacy On College Campuses Across America

Apr 28, 2025 -

Far Reaching Effects Of Trumps Campus Policies

Apr 28, 2025

Far Reaching Effects Of Trumps Campus Policies

Apr 28, 2025 -

Trump Administrations Impact On Higher Education Nationwide

Apr 28, 2025

Trump Administrations Impact On Higher Education Nationwide

Apr 28, 2025 -

Trumps Campus Crackdown Beyond The Ivy League

Apr 28, 2025

Trumps Campus Crackdown Beyond The Ivy League

Apr 28, 2025