Should I Buy Palantir Stock Before May 5th? A Detailed Investor's Guide

Table of Contents

Palantir's Recent Performance and Financial Health

Analyzing Palantir's current financial standing is crucial before deciding whether to buy its stock before May 5th. Understanding the company’s trajectory and future prospects informs any investment strategy.

Analyzing Q1 2024 Earnings Expectations: The upcoming earnings report will undoubtedly be a market-moving event. Analysts' predictions vary, with some forecasting strong revenue growth driven by increased government and commercial contracts, while others anticipate a more moderate performance.

- Key financial metrics to watch: Revenue growth, earnings per share (EPS), operating margin, and free cash flow. Comparing these figures to previous quarters will reveal growth trends and potential areas of concern.

- Potential market reaction scenarios: A significant beat on expectations could send the stock price soaring, while a miss could trigger a sharp decline. Understanding these potential scenarios is vital for managing risk. A "beat and raise" scenario (beating expectations and raising future guidance) is particularly bullish.

Evaluation of Palantir's Long-Term Growth Prospects: Beyond the short-term fluctuations, Palantir’s long-term prospects heavily influence its investment appeal.

- Key growth drivers: Government contracts remain a significant revenue source, but the expansion into the commercial sector presents substantial growth opportunities. New product launches and strategic partnerships will play a pivotal role in future growth.

- Competitive advantages: Palantir’s advanced data analytics platform offers a competitive edge, particularly in highly regulated industries like government and finance. However, competition from established tech giants like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud presents a significant challenge.

- Potential risks to long-term growth: These include intense competition, the potential for regulatory changes impacting government contracts, and the successful execution of its commercial strategy.

Understanding the Risks Associated with Palantir Stock

Investing in Palantir stock carries inherent risks that must be carefully considered before making a purchase before May 5th. A balanced understanding of both potential upside and downside is essential.

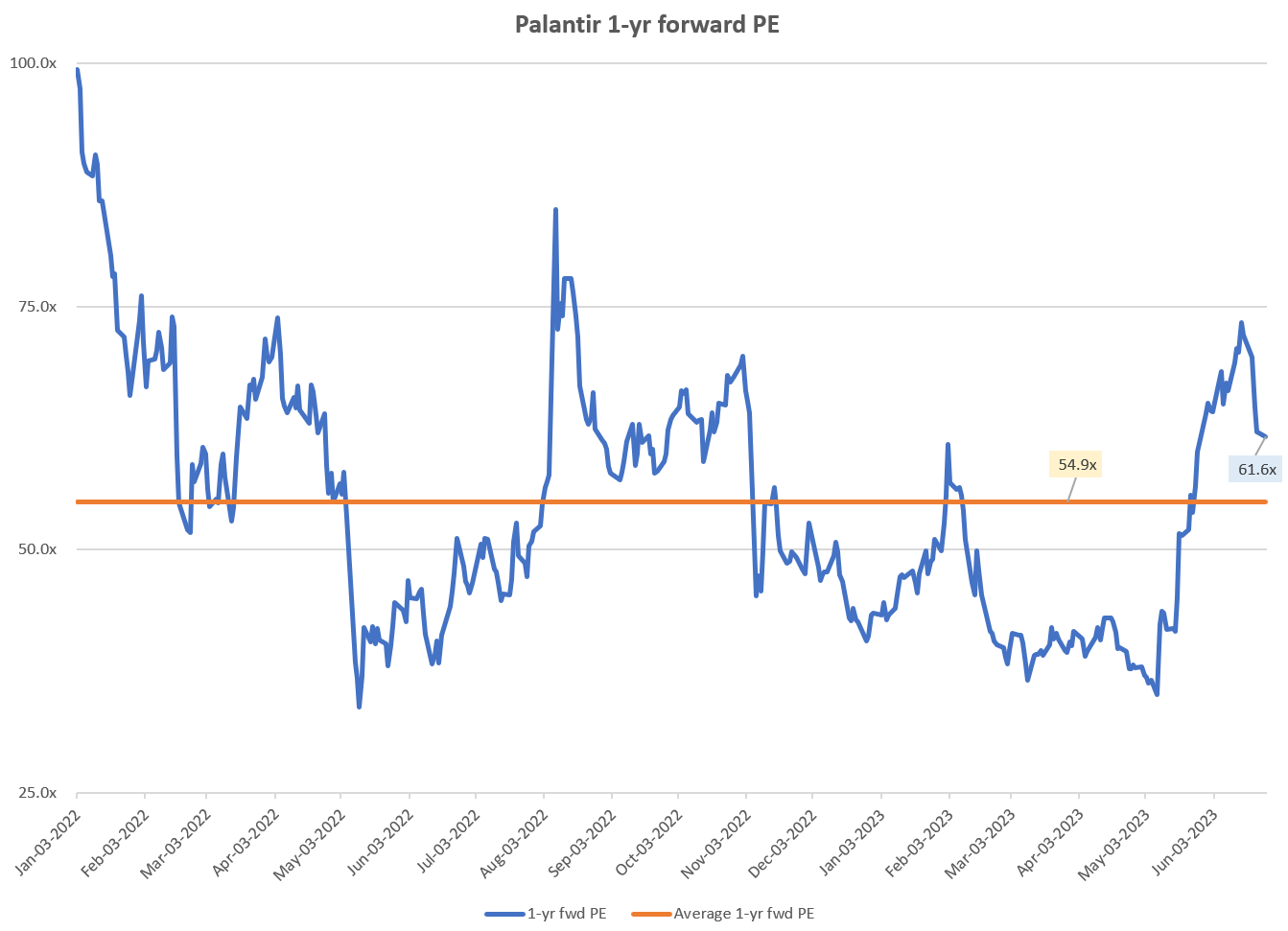

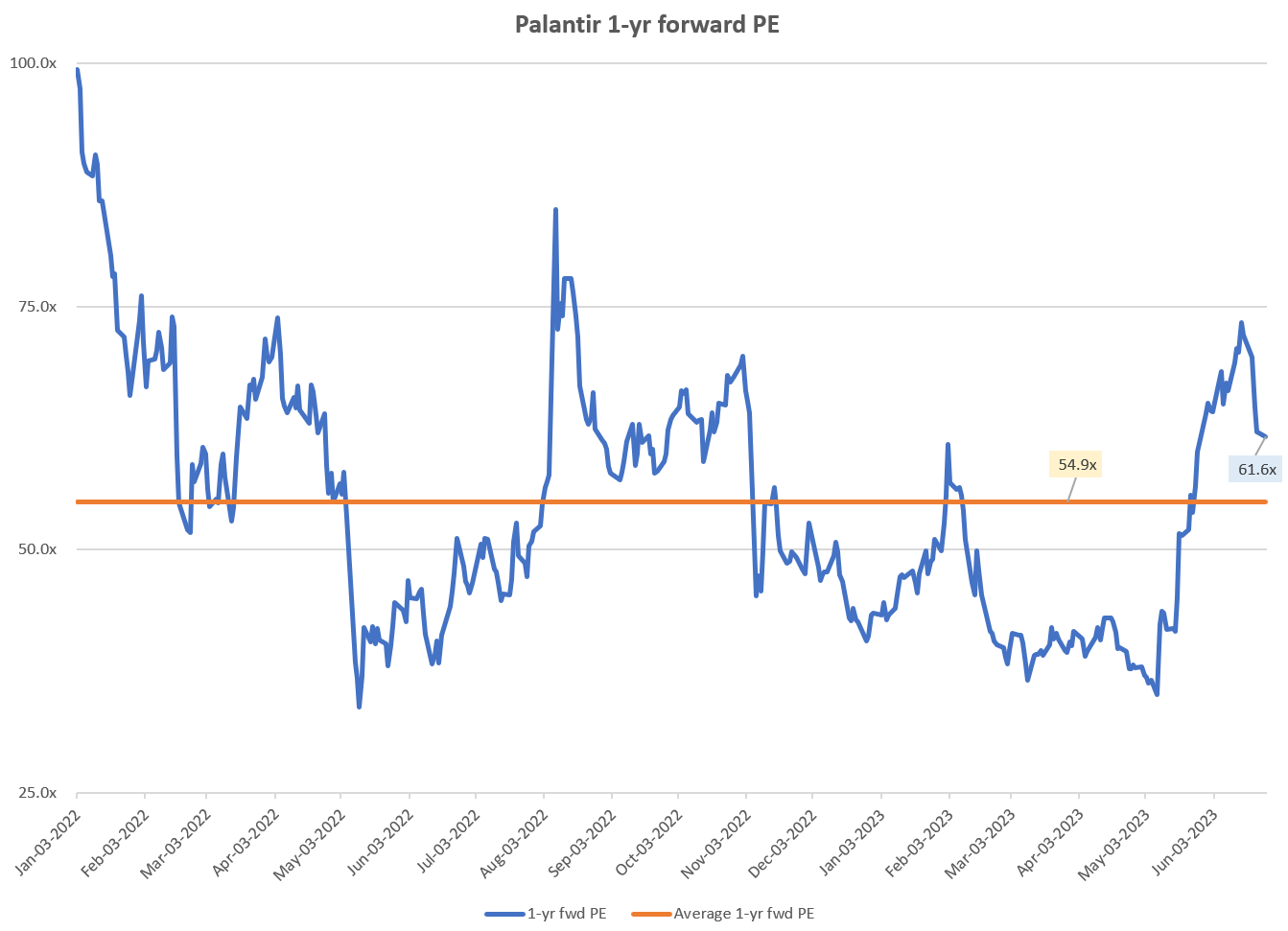

Volatility and Market Sentiment: Palantir's stock price has historically exhibited significant volatility. Market sentiment, news events, and even geopolitical factors can significantly influence its price.

- Factors influencing price volatility: Earnings reports, news related to government contracts, changes in the competitive landscape, and broader market trends all impact the stock.

- Historical price charts: Examining historical price charts can illustrate past volatility and help investors assess potential future price swings. Utilizing technical analysis tools can help in gauging potential support and resistance levels.

- Strategies for managing risk: Diversification, careful position sizing, and stop-loss orders are crucial for mitigating risk in volatile stocks like Palantir.

Key Risks and Potential Downsides: Beyond market volatility, several specific risks could negatively impact Palantir's stock price.

- Competition from AWS, Azure, and Google Cloud: These tech giants possess substantial resources and established market positions, creating intense competition.

- Regulatory hurdles: Government regulations could impact Palantir's ability to secure and execute contracts.

- Dependence on large government contracts: A significant portion of Palantir’s revenue stems from government contracts. Changes in government priorities or budgetary constraints could negatively affect the company’s performance.

Factors to Consider Before Investing in Palantir Stock Before May 5th

Making an informed decision about whether to buy Palantir stock before May 5th requires a careful consideration of several factors.

Impact of the Upcoming Earnings Report: The May 5th earnings report will likely have a significant impact on the stock price.

- Possible scenarios: The company may beat, meet, or miss analysts’ expectations. Each scenario could lead to dramatically different market reactions. A significant earnings beat, coupled with positive future guidance, could create substantial upward momentum.

- Likely market response: Understanding the potential market response to each scenario is crucial for managing risk and setting realistic expectations.

Your Personal Investment Goals and Risk Tolerance: Before investing, aligning your investment decisions with your personal financial situation is paramount.

- Questions to ask yourself: What are your investment goals (short-term or long-term)? What is your risk tolerance (high, medium, or low)? How does Palantir fit into your overall investment portfolio?

- Guidance on diversification: Diversifying your investment portfolio is a crucial risk-management strategy. Don't put all your eggs in one basket.

Technical Analysis and Chart Patterns (Optional): For experienced investors, reviewing technical indicators like moving averages, RSI, and support/resistance levels might offer additional insights into potential price movements before May 5th. However, this should only be considered alongside fundamental analysis.

Conclusion

The decision of whether to buy Palantir stock before May 5th is a personal one. This analysis highlights the potential upsides – strong growth prospects driven by government and commercial contracts – and the significant downsides – market volatility, competition, and regulatory risks. The May 5th earnings report will be a pivotal event, potentially triggering significant price movements. Remember to conduct your own thorough research and consider consulting a financial advisor before investing in Palantir or any other stock. Carefully weigh the potential rewards against the inherent risks before making your investment decision regarding Palantir stock before May 5th.

Featured Posts

-

La Cite De La Gastronomie Et La Ville De Dijon Un Desaccord Sur La Situation D Epicure

May 10, 2025

La Cite De La Gastronomie Et La Ville De Dijon Un Desaccord Sur La Situation D Epicure

May 10, 2025 -

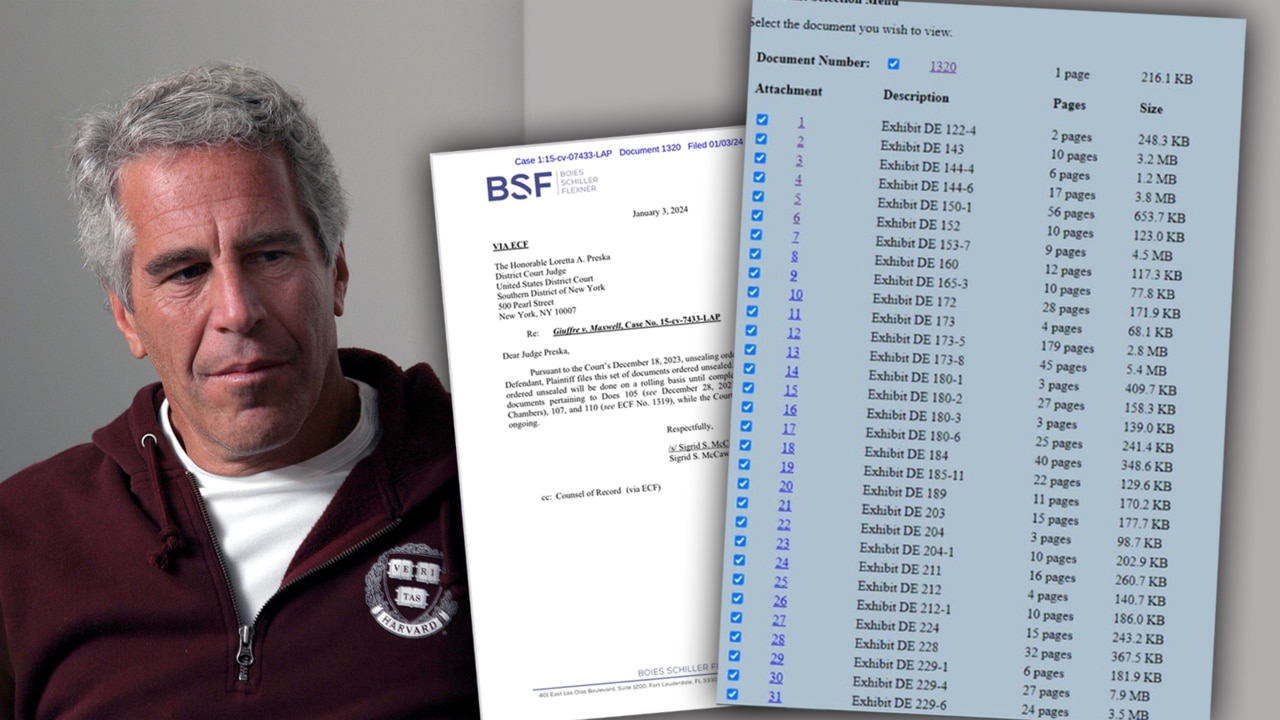

Pam Bondis Announcement Documents On Epstein Diddy Jfk And Mlk To Be Released

May 10, 2025

Pam Bondis Announcement Documents On Epstein Diddy Jfk And Mlk To Be Released

May 10, 2025 -

Selling Sunset Star Accuses La Landlords Of Price Gouging After Fires

May 10, 2025

Selling Sunset Star Accuses La Landlords Of Price Gouging After Fires

May 10, 2025 -

Real Id Compliance Your Guide To Smooth Summer Travel

May 10, 2025

Real Id Compliance Your Guide To Smooth Summer Travel

May 10, 2025 -

Under 5 Hours The Best Stephen King Tv Series For A Short Binge

May 10, 2025

Under 5 Hours The Best Stephen King Tv Series For A Short Binge

May 10, 2025