Should I Buy Palantir Stock Now? Risks And Rewards Evaluated

Table of Contents

Palantir Technologies (PLTR) has captivated investors with its innovative data analytics platform, offering powerful solutions to both government agencies and commercial enterprises. But the question remains: is now the right time to buy Palantir stock? This in-depth analysis weighs the potential rewards against the inherent risks, providing you with the information you need to make an informed investment decision. We will explore Palantir's current market position, future growth prospects, and the key factors influencing its stock price, helping you determine if investing in Palantir stock aligns with your financial goals.

Palantir's Business Model and Current Market Position

Palantir operates primarily through two distinct yet interconnected segments: government and commercial. Understanding the dynamics of both is crucial for assessing the viability of a Palantir stock investment.

Government Contracts and Their Impact

Palantir has a long-standing history of providing data analytics solutions to government agencies, including the CIA and other intelligence organizations. This segment provides a significant portion of Palantir's revenue and offers a degree of stability due to the ongoing need for advanced data analysis within the public sector. However, reliance on government contracts also presents inherent risks. Budget cycles, political changes, and shifts in government priorities can impact funding and contract renewals.

- Examples of significant government contracts: While specific details are often confidential, Palantir's government contracts consistently represent a substantial portion of their overall revenue.

- Percentage of revenue from government sources: This fluctuates but historically has been a significant percentage, highlighting the importance of this sector to Palantir's financial performance.

- Potential for future contract wins: Palantir actively pursues new government contracts, both domestically and internationally, suggesting continued growth potential in this area. However, competition for these contracts is fierce.

Commercial Market Penetration and Growth

Palantir is actively expanding its presence in the commercial sector, targeting industries like healthcare, finance, and manufacturing. This diversification strategy aims to reduce reliance on government contracts and unlock new revenue streams. The commercial market offers significant growth potential but also presents challenges, including intense competition from established players and the need to adapt to the evolving needs of diverse industries.

- Key commercial clients: Palantir boasts a growing list of commercial clients, demonstrating increasing adoption of its platform across various sectors.

- Market share estimates: Although exact market share figures are difficult to obtain, Palantir is increasingly recognized as a key player in the enterprise data analytics space.

- Success stories and case studies: Palantir showcases numerous case studies highlighting the successful implementation of its solutions and the resulting improvements in efficiency and decision-making for its commercial clients.

Foundry Platform and its Role in Future Growth

Palantir's Foundry platform is a crucial element of its strategy for future growth. Foundry acts as a unified data operating system, enabling organizations to integrate and analyze vast amounts of data from diverse sources. This platform's ability to streamline data workflows and generate actionable insights positions Palantir for expansion into new markets and increased revenue generation.

- Key features of Foundry: Foundry offers a range of features aimed at simplifying data integration, analysis, and visualization, enabling clients to make better-informed decisions.

- Adoption rate among clients: The growing adoption of Foundry by both government and commercial clients indicates a positive market response and demonstrates the platform's value proposition.

- Potential for expansion into new markets: The scalability and flexibility of Foundry allows Palantir to target new industries and expand its reach beyond its current customer base.

Assessing the Risks of Investing in Palantir Stock

While Palantir presents exciting opportunities, potential investors must carefully consider the inherent risks associated with its stock.

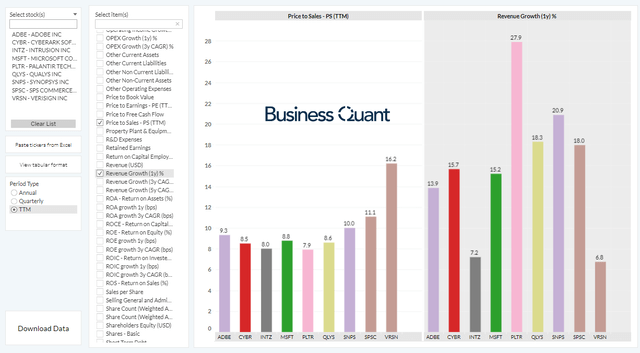

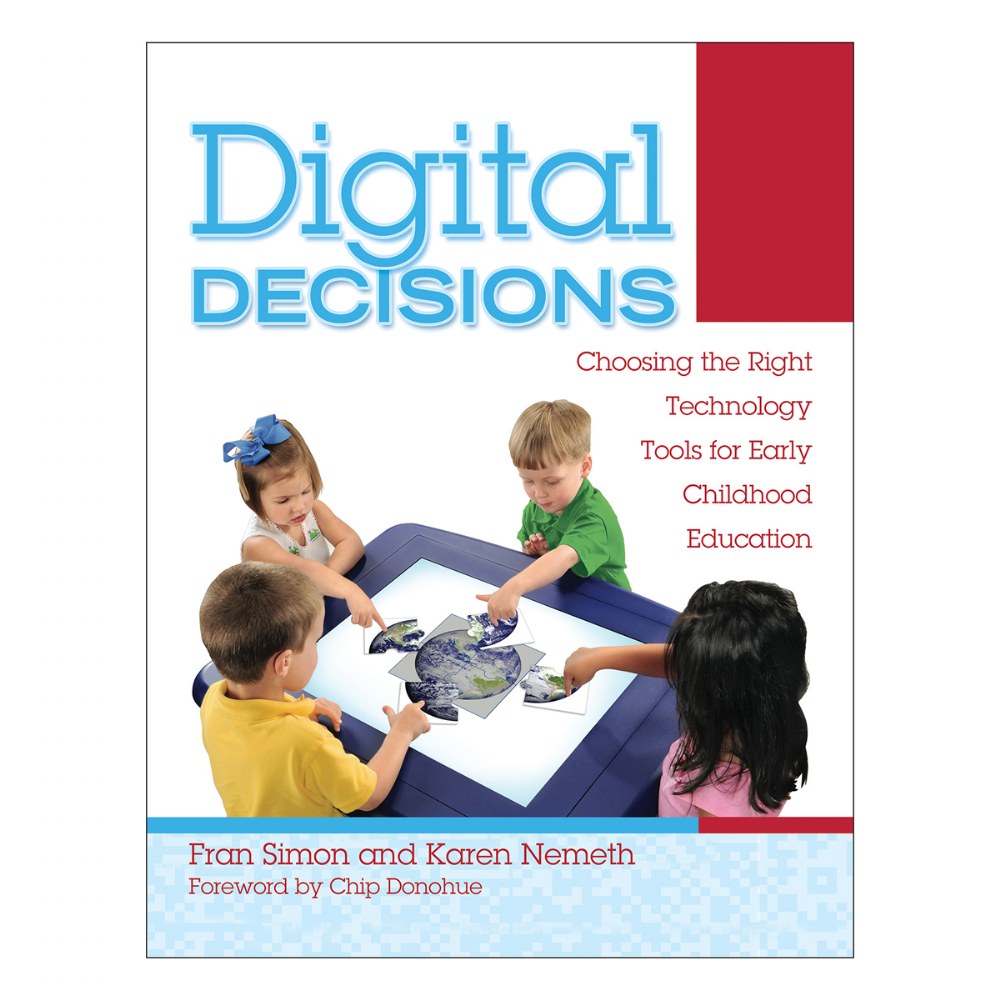

Valuation and Stock Price Volatility

Palantir's valuation compared to its competitors is a key consideration. The stock price has historically demonstrated significant volatility, influenced by factors such as quarterly earnings reports, contract wins and losses, and broader market trends.

- Price-to-earnings ratio: Analyzing Palantir's P/E ratio in relation to its competitors provides insights into its relative valuation.

- Historical stock price performance: Examining past stock price performance helps assess the level of volatility and potential risks.

- Significant price movements and their causes: Understanding the factors driving past price fluctuations can inform future expectations.

Dependence on a Few Key Clients

Palantir's revenue is concentrated among a relatively small number of large clients. The loss of a significant contract could have a substantial negative impact on its financial performance.

- Percentage of revenue from top clients: Understanding the concentration of revenue from top clients is critical for assessing the risk of over-reliance.

- Risk mitigation strategies employed by Palantir: Palantir is actively working to diversify its client base to mitigate this risk.

Competition in the Data Analytics Market

The data analytics market is highly competitive, with established players and new entrants constantly vying for market share. Palantir faces competition from companies with substantial resources and market presence.

- List of major competitors: Identifying key competitors and understanding their strengths and weaknesses is essential.

- Comparison of Palantir's offerings with those of competitors: Assessing Palantir's competitive advantages and disadvantages is crucial for evaluating its long-term prospects.

Evaluating the Potential Rewards of Investing in Palantir Stock

Despite the risks, Palantir offers several potential rewards for investors with a long-term perspective.

Long-Term Growth Potential

The data analytics market is projected to experience significant growth in the coming years, presenting a substantial opportunity for Palantir to expand its market share.

- Market size projections: Analyzing market size projections helps to assess the potential for future growth in the data analytics sector.

- Palantir's innovation pipeline: Palantir's commitment to innovation and product development is crucial for maintaining its competitive edge.

- Projected revenue growth estimates: Analyzing revenue growth estimates provides insights into the company's financial outlook.

First-Mover Advantage and Brand Recognition

Palantir's early entry into the data analytics market has provided it with a first-mover advantage and established brand recognition.

- Examples of successful brand building initiatives: Palantir's brand building initiatives have helped establish its reputation as a leader in the data analytics field.

- Client testimonials showcasing Palantir’s capabilities: Positive client testimonials highlight the effectiveness of Palantir's solutions and build confidence in the company's capabilities.

Potential for Strategic Acquisitions

Palantir may choose to acquire smaller companies to enhance its product offerings and expand into new markets. Such acquisitions can accelerate growth and enhance its competitive position.

- Past acquisitions: Reviewing Palantir's past acquisitions provides insights into its acquisition strategy.

- Potential acquisition targets: Analyzing potential acquisition targets helps assess the company's future growth strategy.

- Strategic rationale for acquisitions: Understanding the strategic rationale behind acquisitions provides insights into the potential benefits of these actions.

Conclusion

Investing in Palantir stock presents both significant opportunities and considerable risks. The innovative technology and strong government contracts offer potential for substantial long-term growth. However, the volatility of the stock price and dependence on key clients necessitate careful consideration. Ultimately, the decision of whether to buy Palantir stock now depends on your risk tolerance and investment horizon. Thoroughly research the company, understand the market dynamics, and consider consulting a financial advisor before investing. Remember, this is for informational purposes only and not financial advice. Do your own due diligence before buying Palantir stock.

Featured Posts

-

Nome Bound Meet The 7 Rookie Mushers Competing In The Iditarod

May 09, 2025

Nome Bound Meet The 7 Rookie Mushers Competing In The Iditarod

May 09, 2025 -

Nhl 2025 Post Trade Deadline Playoff Contenders And Predictions

May 09, 2025

Nhl 2025 Post Trade Deadline Playoff Contenders And Predictions

May 09, 2025 -

10 Adn Pas Selangor Usaha Bantuan Bencana Tragedi Putra Heights

May 09, 2025

10 Adn Pas Selangor Usaha Bantuan Bencana Tragedi Putra Heights

May 09, 2025 -

The Fragility Of Early Childhood Reconsidering Daycare Decisions

May 09, 2025

The Fragility Of Early Childhood Reconsidering Daycare Decisions

May 09, 2025 -

Madeleine Mc Cann Investigation Receives 108 000 Boost

May 09, 2025

Madeleine Mc Cann Investigation Receives 108 000 Boost

May 09, 2025