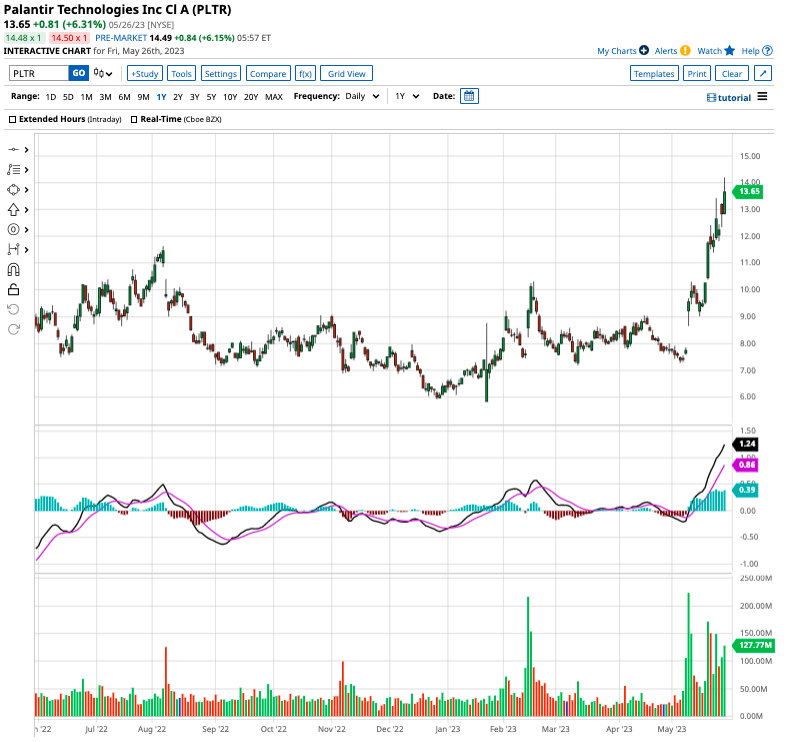

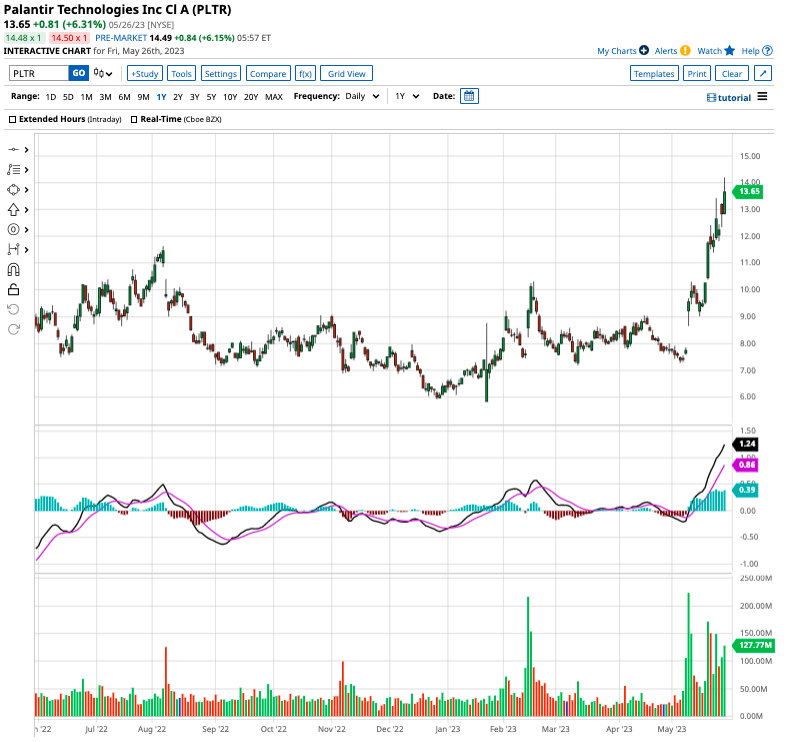

Should I Invest In Palantir Stock Right Now?

Table of Contents

Palantir's Financial Performance and Valuation

Analyzing Palantir's financial health is crucial before considering an investment in Palantir stock. We need to look beyond the headline numbers and dig deeper into the company's key financial metrics.

- Revenue Growth: While Palantir has shown consistent revenue growth, the rate of that growth needs careful examination. Look for trends – is it accelerating, decelerating, or plateauing? A shrinking growth rate could signal potential problems.

- Profitability: Palantir's profitability (or lack thereof) is a key concern for many investors. Examine the company's net income, operating margins, and projected profitability. Are they moving in a positive direction?

- Debt Levels: High debt levels can pose a significant risk. Check Palantir's debt-to-equity ratio to assess its financial leverage. A high ratio indicates a higher risk.

- Valuation: Comparing Palantir's valuation (e.g., Price-to-Earnings ratio or P/E ratio) to its competitors in the big data analytics and government technology sectors provides valuable context. Is Palantir overvalued or undervalued compared to its peers?

Market Trends and Industry Outlook

Understanding the broader market context and the future of the data analytics industry is essential for evaluating Palantir stock.

- Market Conditions: Is the overall market experiencing a bull market or a bear market? A bear market generally increases the risk associated with investing in Palantir stock.

- Industry Growth: The government technology and data analytics sectors are experiencing rapid growth, driven by increasing data volumes and government investment in digital transformation initiatives. This presents opportunities for Palantir, but also increased competition.

- Competitive Landscape: Palantir faces stiff competition from major players like Amazon Web Services (AWS), Google Cloud, and Microsoft Azure. Analyzing Palantir's competitive advantages (e.g., specialized software for government clients, strong security protocols) and disadvantages is crucial.

- Geopolitical Factors: Geopolitical events can significantly impact the demand for Palantir's services, particularly its government contracts. Monitoring these factors is essential for assessing the risk associated with Palantir stock.

Palantir's Growth Potential and Future Prospects

Palantir's future prospects depend heavily on its ability to execute its strategic initiatives and adapt to the evolving technology landscape.

- Strategic Initiatives: Analyzing Palantir's new product launches, partnerships, and expansion plans gives insights into its future growth potential. Are these initiatives likely to generate significant revenue?

- Business Model Viability: The long-term viability of Palantir's business model needs careful consideration. Does it have sustainable revenue streams and the ability to adapt to changing market dynamics?

- Risks and Challenges: Palantir faces potential risks, including increased competition, regulatory hurdles, and the potential for disruptive technologies to impact its business. Understanding these challenges is crucial for assessing the risk of investing in Palantir stock.

Alternative Investment Options

Before investing in Palantir stock, it's wise to explore alternative investment options within the technology sector or with comparable risk profiles.

- Similar Companies: Consider investing in other publicly traded companies in the big data analytics or government technology space. This allows for diversification.

- Risk/Return Comparison: Compare the potential returns and risks associated with Palantir stock to these alternatives. Does Palantir offer a superior risk/reward profile?

- Diversification: Diversification is key to managing risk. Investing solely in Palantir stock might expose your portfolio to unnecessary risk.

Conclusion: Should You Invest in Palantir Stock Right Now?

Investing in Palantir stock involves navigating a complex interplay of financial performance, market trends, and future prospects. While Palantir shows revenue growth and operates in a high-growth sector, it also faces significant competition and questions around profitability. The decision of whether to invest in Palantir stock at this time is highly dependent on your individual risk tolerance and investment goals. A balanced assessment suggests considering Palantir as part of a diversified portfolio, rather than a sole investment.

Before investing in Palantir stock, conduct thorough due diligence and consider consulting a financial advisor. Remember that investing in Palantir stock involves risk, and past performance is not indicative of future results. Consider diversifying your portfolio to mitigate risk and make informed investment decisions.

Featured Posts

-

Liga Chempionov 2024 2025 Prognoz Na Polufinaly I Final Raspisanie Machey I Translyatsii

May 09, 2025

Liga Chempionov 2024 2025 Prognoz Na Polufinaly I Final Raspisanie Machey I Translyatsii

May 09, 2025 -

Draisaitls Hart Trophy Finalist Status Highlights Exceptional Oilers Season

May 09, 2025

Draisaitls Hart Trophy Finalist Status Highlights Exceptional Oilers Season

May 09, 2025 -

Brekelmans India Strategie Maximaliseren Van Samenwerking

May 09, 2025

Brekelmans India Strategie Maximaliseren Van Samenwerking

May 09, 2025 -

23 Year Old Woman Believes She Is Madeleine Mc Cann New Dna Test Results

May 09, 2025

23 Year Old Woman Believes She Is Madeleine Mc Cann New Dna Test Results

May 09, 2025 -

Vegas Golden Nayts Pobezhdaet Minnesotu V Overtayme Pley Off

May 09, 2025

Vegas Golden Nayts Pobezhdaet Minnesotu V Overtayme Pley Off

May 09, 2025