Should Investors Buy Palantir Stock Before May 5th? A Wall Street Perspective

Table of Contents

H2: Palantir's Recent Financial Performance and Future Projections

Palantir's recent quarterly earnings reports offer a mixed bag. While the company continues to demonstrate revenue growth, driven largely by its government contracts and expanding commercial partnerships, profitability remains a key area of focus for investors considering a Palantir investment. Examining key performance indicators (KPIs) is crucial for understanding the company's financial health and future trajectory before making a decision about buying Palantir stock before May 5th.

- Revenue growth rate comparison (YoY, QoQ): Recent reports show a consistent, albeit slowing, rate of year-over-year (YoY) revenue growth. Quarter-over-quarter (QoQ) growth has also shown some fluctuations. Investors should carefully analyze these trends to gauge the sustainability of Palantir's growth.

- Profitability margins and trends: Profitability remains a concern for some analysts. Examining operating margins and net income is crucial for assessing Palantir's long-term financial viability and its ability to deliver returns to shareholders. Improving margins will be a key factor influencing the Palantir share price.

- Key contract wins and their impact on future revenue: Significant contract wins, particularly in the government sector, can substantially impact Palantir's future revenue. These wins should be carefully evaluated for their size, duration, and potential for further expansion.

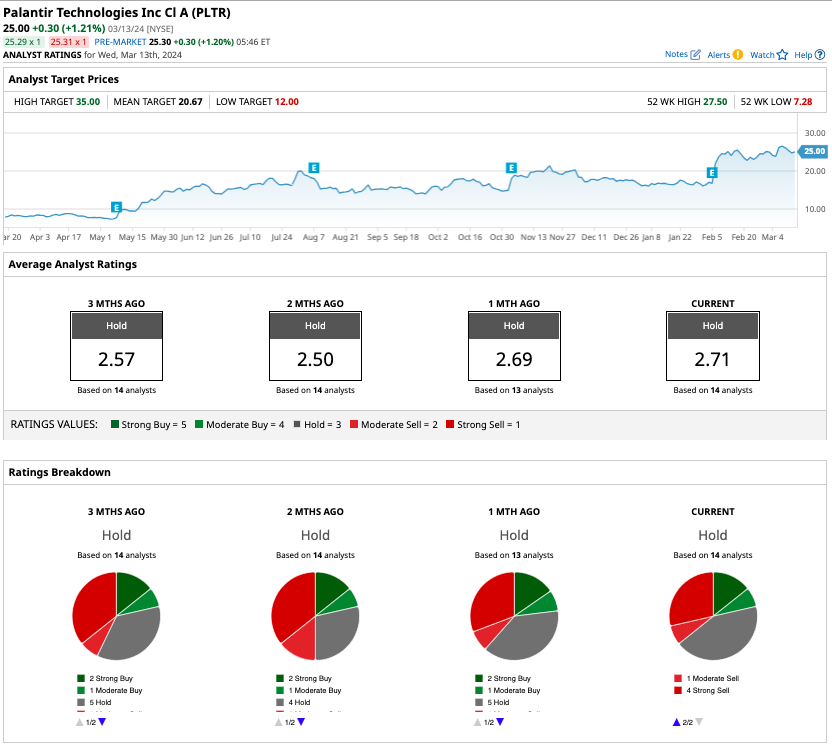

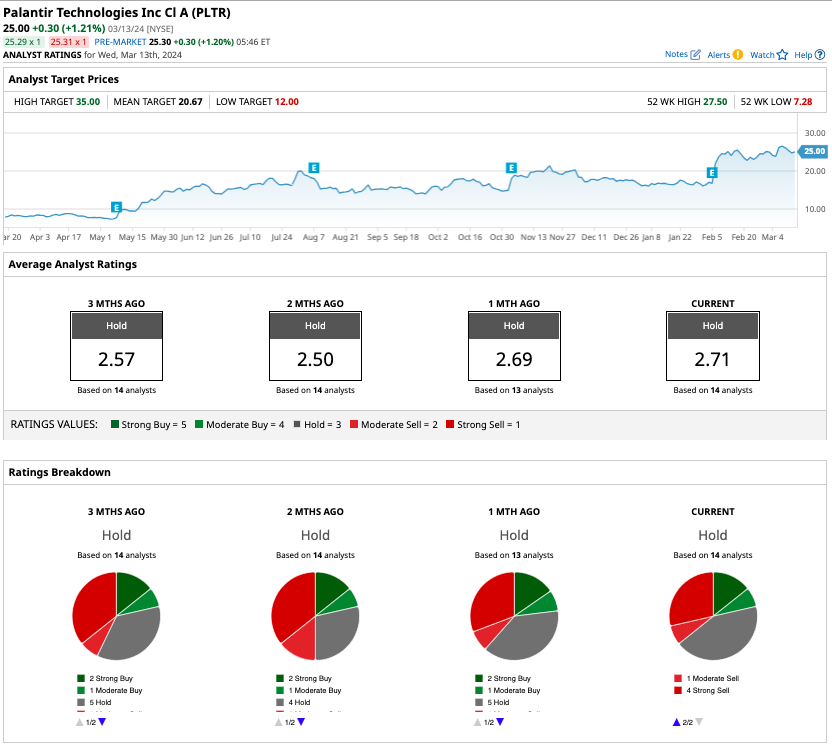

- Analyst target price ranges and consensus rating: Analyst ratings and target prices offer a range of opinions on Palantir's future performance. Understanding the consensus and the range of predictions helps contextualize the potential upside and downside risks associated with a Palantir investment.

H2: Geopolitical Factors and Their Influence on Palantir's Stock Price

Geopolitical events significantly influence Palantir's business. Increased government spending on defense and intelligence, driven by global conflicts like the war in Ukraine, creates opportunities for Palantir's data analytics and software solutions. However, this dependence on government contracts also presents risks.

- Impact of increased government spending on defense technology: The current geopolitical climate has led to increased defense budgets in many countries, potentially boosting demand for Palantir's products. This is a major factor to consider when evaluating Palantir stock before May 5th.

- Analysis of Palantir's presence in key geopolitical regions: Palantir's geographic reach and presence in regions experiencing geopolitical instability can be a source of both opportunity and risk. Assessing its exposure to these regions is vital.

- Risks associated with dependence on government contracts: A significant portion of Palantir's revenue comes from government contracts. Changes in government policy or budget allocations could impact the company's financial performance.

- Potential opportunities arising from global conflicts and security concerns: Global instability can lead to increased demand for Palantir's data analytics and security solutions, creating significant growth opportunities.

H2: Competitive Landscape and Palantir's Market Position

Palantir operates in a competitive market, facing off against tech giants like AWS, Microsoft, and Google Cloud. Its success hinges on its ability to differentiate its technology and maintain strong customer relationships.

- Key competitors (e.g., AWS, Microsoft, Google Cloud): These major cloud providers offer competing data analytics and AI solutions, posing a significant challenge to Palantir.

- Palantir's unique selling propositions (USPs): Palantir's focus on complex data analysis, particularly for government and intelligence agencies, provides a unique niche. Analyzing its USPs and how they sustain its market position is crucial.

- Market share analysis and trends: Monitoring Palantir's market share and the overall market trends will give investors a clearer picture of its competitive position and future growth prospects.

- Assessment of Palantir's long-term growth potential: Palantir's ability to penetrate new markets and maintain its competitive edge will determine its long-term growth potential.

H2: Technical Analysis of Palantir Stock Before May 5th

While not a substitute for fundamental analysis, technical analysis can provide insights into potential price movements. Looking at support and resistance levels, moving averages, and other indicators can help assess the short-term trends in the Palantir share price. However, it's crucial to remember that technical analysis is not foolproof.

- Key support and resistance levels: Identifying key price levels where the stock might find support or face resistance can help predict potential price reversals.

- Moving average analysis (e.g., 50-day, 200-day): Analyzing moving averages can reveal trends and potential momentum shifts in the Palantir stock price.

- Relative Strength Index (RSI) and other technical indicators: Using RSI and other indicators can provide insights into the stock's momentum and potential overbought or oversold conditions.

- Potential price targets (with disclaimers): Technical analysis can suggest potential price targets, but it's vital to remember that these are merely projections and not guarantees.

Conclusion: Should You Invest in Palantir Stock Before May 5th?

Analyzing Palantir's financial performance, geopolitical exposures, competitive positioning, and technical indicators provides a complex picture. While the company demonstrates growth potential, particularly within the government sector and with its expanding commercial reach, risks remain. The dependence on government contracts, the intensifying competition, and the overall volatility of the stock market all require careful consideration. Therefore, whether or not to buy Palantir stock before May 5th depends entirely on your individual risk tolerance, investment horizon, and due diligence. Remember to research Palantir stock before May 5th thoroughly and to consider it as part of a diversified portfolio. Learn more about Palantir investment strategies and make informed decisions based on your own financial goals.

Featured Posts

-

Epstein Files Pam Bondi Promises Release

May 09, 2025

Epstein Files Pam Bondi Promises Release

May 09, 2025 -

Massive Payout For Credit Suisse Whistleblowers Details Of The Settlement

May 09, 2025

Massive Payout For Credit Suisse Whistleblowers Details Of The Settlement

May 09, 2025 -

2024 25 Nhl Season The Top Storylines To Follow

May 09, 2025

2024 25 Nhl Season The Top Storylines To Follow

May 09, 2025 -

February And March Elizabeth Line Strikes Full Details Of Affected Services And Routes

May 09, 2025

February And March Elizabeth Line Strikes Full Details Of Affected Services And Routes

May 09, 2025 -

Woman Accused Of Impersonating Madeleine Mc Cann Charged With Stalking

May 09, 2025

Woman Accused Of Impersonating Madeleine Mc Cann Charged With Stalking

May 09, 2025