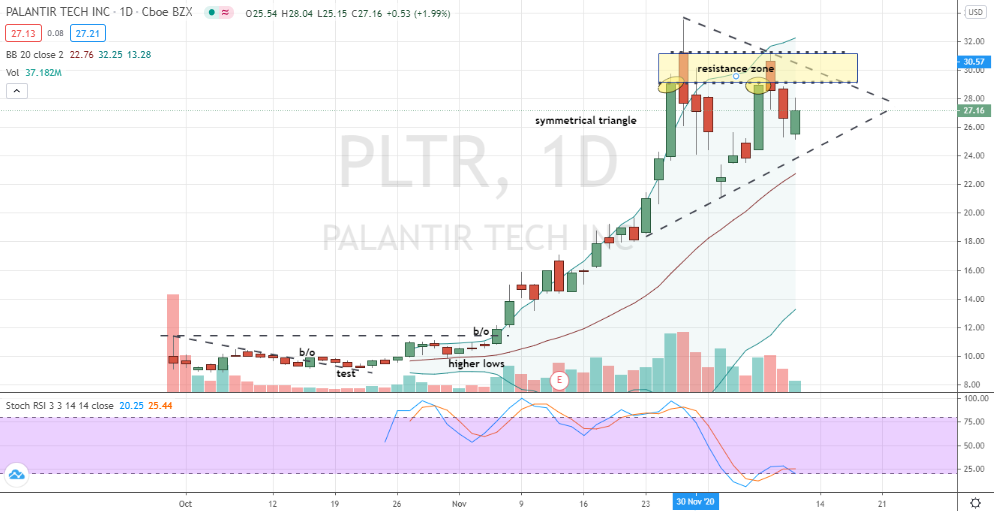

Should Investors Buy Palantir Stock Before May 5th? Wall Street's Analysis

Table of Contents

Wall Street's Current Sentiment Towards Palantir

Wall Street's sentiment towards Palantir stock is, as expected, mixed. Analyst ratings and price targets paint a varied picture, reflecting the inherent volatility of this tech giant. Several factors contribute to this divided opinion, including recent earnings reports, the securing of new contracts, and broader market trends influencing the entire tech sector.

-

Bullish Ratings: Many analysts remain bullish on Palantir, citing the company's strong growth potential in the government and commercial sectors. Their reasoning often points to Palantir's innovative data analytics platform and its increasing adoption by major clients.

-

Bearish Ratings: Conversely, some analysts express concerns about Palantir's profitability and its dependence on large government contracts. They highlight the competitive landscape and the potential for slower-than-expected growth.

-

Average Price Target: The average price target for Palantir stock among analysts provides a benchmark, allowing investors to compare the current market price to the consensus expectation. A significant difference could signal either an undervalued or overvalued opportunity.

-

Price Comparison: Comparing the current Palantir stock price against the average price target is crucial. If the current price is significantly below the target, it might suggest a potential buying opportunity. However, the opposite could indicate overvaluation.

Palantir's Financial Performance and Future Projections

Analyzing Palantir's financial performance is vital for understanding its investment potential. Key metrics such as revenue growth, profitability, and cash flow provide valuable insights into the company's health and prospects.

-

Key Financial Metrics: Examining trends in revenue, earnings per share (EPS), and other key financial indicators helps determine whether Palantir is growing sustainably.

-

Debt-to-Equity Ratio: A review of Palantir's debt-to-equity ratio is essential for assessing its financial stability and risk profile. High debt levels could pose significant challenges in the future.

-

Growth Drivers: Palantir's growth is driven by government contracts, particularly in defense and intelligence, and increasingly by commercial partnerships across various sectors. New product development further contributes to the company’s potential.

-

Upcoming Events: Significant upcoming events, such as new product launches or strategic partnerships, could influence Palantir's stock price significantly. Investors should carefully consider such announcements.

Risks and Potential Downsides of Investing in Palantir Stock

Investing in Palantir stock carries inherent risks that potential investors should carefully evaluate.

-

Competition: The data analytics and software markets are highly competitive. Palantir faces stiff competition from established players and emerging startups, potentially impacting market share and growth.

-

Government Contract Dependence: Palantir's reliance on government contracts makes it susceptible to shifts in government spending and policy, potentially resulting in revenue instability.

-

Geopolitical Risks: Geopolitical factors can influence Palantir's operations, especially concerning international projects and partnerships. These risks should be factored into investment decisions.

Considering Alternative Investments: Comparing Palantir to Competitors

Before committing to Palantir, it's crucial to compare its investment potential with similar companies in the data analytics or software sector. This comparative analysis can help gauge Palantir's relative strengths and weaknesses.

-

Direct Competitors: Identifying key competitors and analyzing their market capitalization, growth rates, and profitability margins provides valuable context for assessing Palantir's position.

-

Competitive Advantages: Evaluating Palantir's competitive advantages, such as its proprietary technology and strong customer relationships, is crucial in determining its long-term success.

Conclusion: Should You Buy Palantir Stock Before May 5th? The Verdict

The decision of whether to buy Palantir stock before May 5th requires a nuanced understanding of Wall Street's sentiment, the company's financial performance, and the associated risks. While Palantir possesses significant growth potential, fueled by innovative technology and a strong customer base, the inherent risks, including competition and dependence on government contracts, must be carefully considered.

Ultimately, the decision rests on your individual risk tolerance and investment goals. We strongly advise conducting thorough due diligence before investing in Palantir shares or any other stock. Remember to consult with a qualified financial advisor to determine the best course of action for your portfolio. Start your research by visiting Palantir's investor relations page and reviewing reputable financial news sources to form your own informed opinion about buying Palantir stock.

Featured Posts

-

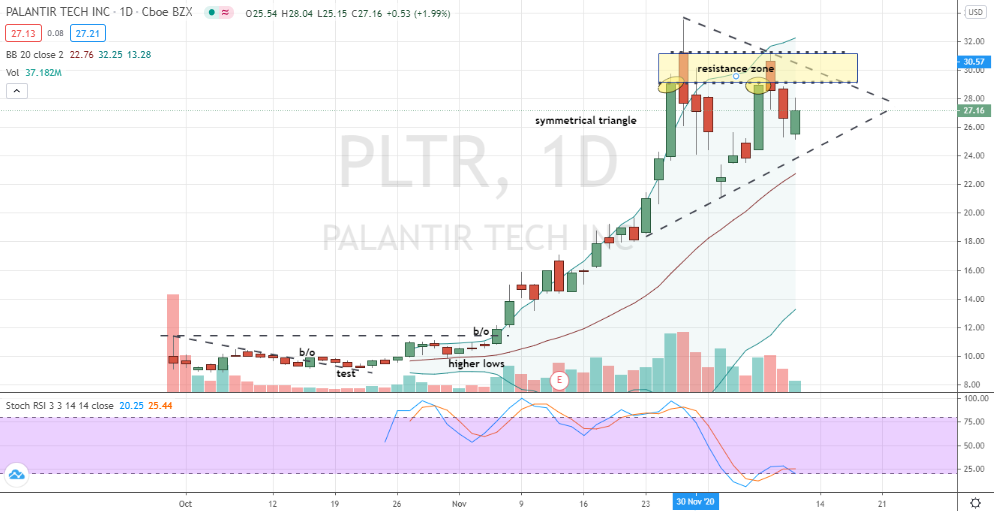

Wildfires And Wagers The Perilous Practice Of Betting On The Los Angeles Fires

May 10, 2025

Wildfires And Wagers The Perilous Practice Of Betting On The Los Angeles Fires

May 10, 2025 -

Strands Nyt Crossword Answers February 15 2024 Game 349

May 10, 2025

Strands Nyt Crossword Answers February 15 2024 Game 349

May 10, 2025 -

Morgans 5 Dumbest Moments In High Potential Season 1

May 10, 2025

Morgans 5 Dumbest Moments In High Potential Season 1

May 10, 2025 -

Elon Musks Brother Kimbal A Profile And Examination Of His Views On Tariffs

May 10, 2025

Elon Musks Brother Kimbal A Profile And Examination Of His Views On Tariffs

May 10, 2025 -

Identifying The Countrys Next Big Business Areas

May 10, 2025

Identifying The Countrys Next Big Business Areas

May 10, 2025