Should Investors Worry About Current Stock Market Valuations? BofA's Take

Table of Contents

BofA's Current Market Assessment

BofA's stance on current stock market valuations is nuanced, leaning towards cautious optimism. While not outright bearish, their recent reports express concerns about certain valuation metrics reaching historically high levels. This cautious approach is evident in statements from their chief investment strategist, who highlights the need for selective investment and careful risk management in the current environment (Source: insert link to BofA report here).

Key Valuation Metrics Used by BofA

BofA employs a range of valuation metrics to gauge the market's health. Understanding these metrics is crucial to comprehending their assessment:

-

Price-to-Earnings Ratio (P/E): This compares a company's stock price to its earnings per share. A high P/E ratio suggests investors are paying a premium for each dollar of earnings, potentially indicating overvaluation. Currently, BofA notes that the overall market P/E ratio is elevated compared to its historical average.

-

Shiller P/E (Cyclically Adjusted P/E): This metric smooths out earnings fluctuations over a longer period (10 years), providing a more stable picture of valuation. BofA's analysis reveals the Shiller P/E is also above its long-term average, signaling potential overvaluation.

-

Price-to-Sales Ratio (P/S): This metric compares a company's market capitalization to its revenue. It's useful for valuing companies with inconsistent or negative earnings. BofA's analysis indicates that the P/S ratio for certain sectors is high, highlighting potential overvaluation in specific market segments.

-

Implications: These elevated metrics, according to BofA, suggest a potential for lower future returns compared to historical averages. This doesn't necessarily predict a market crash, but it does warrant caution and a more selective investment approach.

Factors Influencing BofA's Valuation Concerns (or Lack Thereof)

BofA's valuation assessment isn't solely based on these metrics. Several other factors contribute to their overall outlook:

Economic Growth Projections

BofA's economic growth projections play a significant role in their market analysis. They are currently forecasting moderate GDP growth, but with significant uncertainty surrounding inflation and interest rate hikes.

- Key Indicators: BofA closely monitors indicators like inflation rates (CPI, PPI), consumer confidence, unemployment figures, and manufacturing activity. Changes in these indicators can significantly influence their valuation forecasts.

- Impact on Valuations: Higher-than-expected inflation could lead to further interest rate hikes, impacting corporate profitability and potentially causing stock valuations to fall. Conversely, robust economic growth could support higher valuations.

Geopolitical Risks and Uncertainty

Geopolitical events significantly impact market sentiment and investor confidence. BofA incorporates these risks into its analysis.

- Specific Risks: The ongoing war in Ukraine, trade tensions between major economies, and political instability in various regions are all factors that BofA considers.

- Impact on Stock Prices: These geopolitical events create uncertainty, potentially leading to increased market volatility and impacting investor appetite for riskier assets.

Interest Rate Environment

Interest rates play a critical role in determining stock valuations. Rising interest rates increase borrowing costs for companies, potentially impacting their profitability and reducing their attractiveness to investors.

- Impact on Sectors: Rising rates tend to disproportionately affect growth stocks, while defensive sectors (like utilities and consumer staples) may hold up better.

- BofA's Perspective: BofA's view on interest rates is crucial to understanding their overall valuation assessment. Their projections on future rate hikes influence their recommendations for investors.

BofA's Investment Strategy Recommendations

Based on their valuation analysis and the factors discussed above, BofA suggests a cautious and selective investment approach.

- Strategic Recommendations: They recommend a focus on quality companies with strong balance sheets and sustainable earnings growth. This may involve shifting towards value stocks and defensive sectors.

- Asset Allocation: BofA may advise reducing exposure to high-growth, high-valuation companies and increasing allocation to assets perceived as less risky, such as high-quality bonds.

- Sector Rotation: They might suggest rotating out of overvalued sectors and into undervalued ones, based on their valuation analysis and economic outlook.

Conclusion

BofA's assessment of current stock market valuations reveals a cautious optimism, acknowledging elevated valuation metrics while considering various economic and geopolitical factors. Their analysis emphasizes the need for selective investment and a thorough understanding of the risks involved. Understanding current stock market valuations is crucial for informed investment decisions. Don't hesitate to seek professional advice to tailor your investment strategy based on your risk tolerance and financial goals. For more detailed information, refer to BofA's official reports and resources (insert link to relevant BofA resources here).

Featured Posts

-

Lottozahlen 6aus49 Vom 12 April 2025 Ueberpruefen Sie Ihre Tipps

May 02, 2025

Lottozahlen 6aus49 Vom 12 April 2025 Ueberpruefen Sie Ihre Tipps

May 02, 2025 -

Alec Baldwins Rust A Critical Review Of The Film And The Incident

May 02, 2025

Alec Baldwins Rust A Critical Review Of The Film And The Incident

May 02, 2025 -

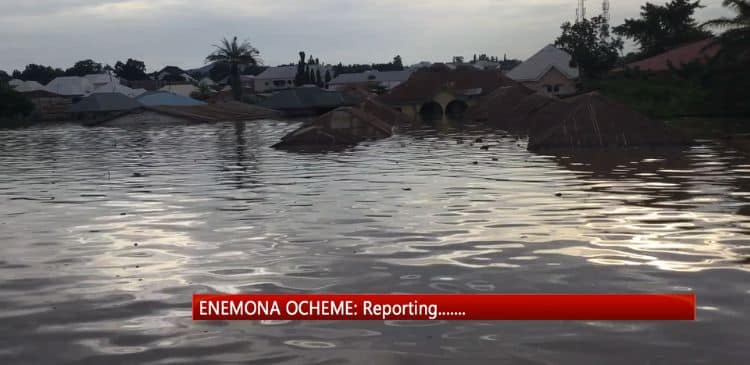

Hundreds Stranded In Kogi Following Train Failure

May 02, 2025

Hundreds Stranded In Kogi Following Train Failure

May 02, 2025 -

Officieel Bram Endedijk Is De Nieuwe Presentator Van Nrc Vandaag

May 02, 2025

Officieel Bram Endedijk Is De Nieuwe Presentator Van Nrc Vandaag

May 02, 2025 -

Arc Raiders What To Expect In The Upcoming Public Test

May 02, 2025

Arc Raiders What To Expect In The Upcoming Public Test

May 02, 2025

Latest Posts

-

Nigel Farages Reform Uk Five Threats To Its Future Success

May 03, 2025

Nigel Farages Reform Uk Five Threats To Its Future Success

May 03, 2025 -

Reform Uks Struggle For Survival Five Reasons For Concern

May 03, 2025

Reform Uks Struggle For Survival Five Reasons For Concern

May 03, 2025 -

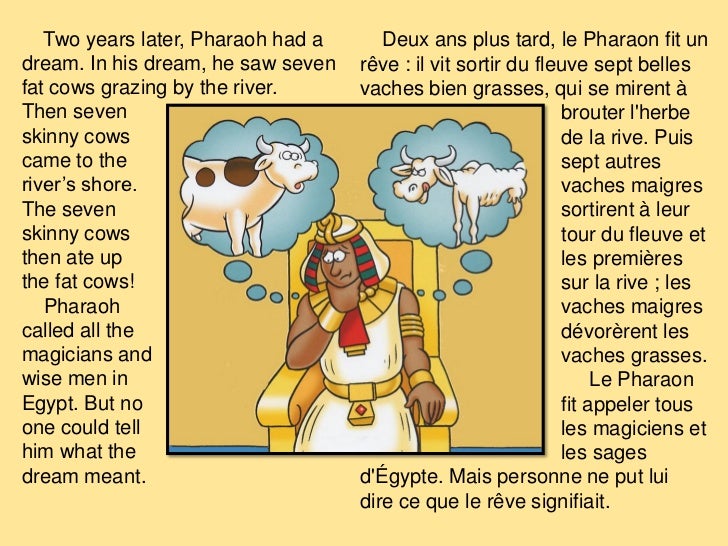

Exploration De La Serie Joseph Tf 1 Et Son Intrigue La Creme De La Crim

May 03, 2025

Exploration De La Serie Joseph Tf 1 Et Son Intrigue La Creme De La Crim

May 03, 2025 -

La Creme De La Crim L Impact De Joseph Sur Tf 1

May 03, 2025

La Creme De La Crim L Impact De Joseph Sur Tf 1

May 03, 2025 -

Is Reform Uk Doomed Five Warning Signs For Nigel Farages Party

May 03, 2025

Is Reform Uk Doomed Five Warning Signs For Nigel Farages Party

May 03, 2025