Should Investors Worry About Elevated Stock Market Valuations? BofA's Analysis

Table of Contents

Keywords: Elevated stock market valuations, stock market valuation, BofA analysis, investment risk, market volatility, stock market outlook, investor concerns, stock market predictions, high stock valuations

Are current stock market valuations justified, or should investors be concerned? Bank of America (BofA) recently released an analysis examining these elevated stock market valuations, providing valuable insights for investors navigating the current market landscape. This article delves into BofA's findings and explores what they mean for your portfolio.

BofA's Key Findings on Elevated Stock Market Valuations

BofA's analysis, while not publicly released in a single, easily accessible report, frequently comments on market valuations through various publications and client notes. Their conclusions often center around the use of several key valuation metrics to gauge the current market environment. These metrics are crucial for understanding the degree of "elevated" valuations.

-

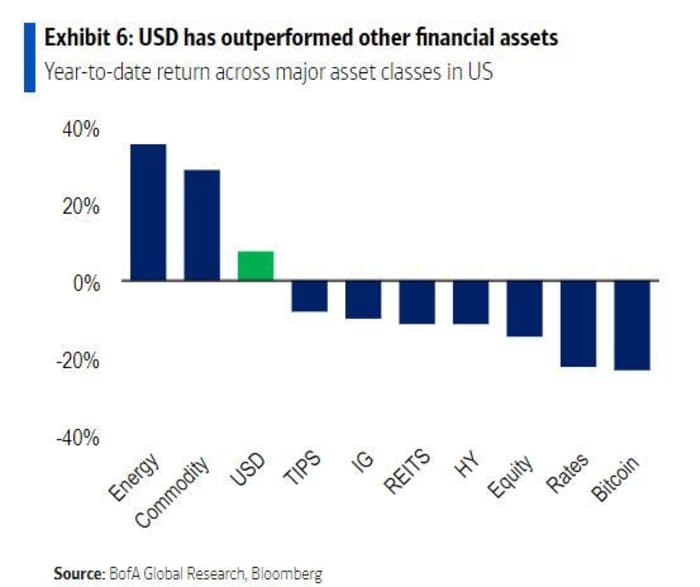

Summary of BofA's valuation metrics and their interpretation: BofA typically uses metrics such as the price-to-earnings ratio (P/E), the cyclically adjusted price-to-earnings ratio (Shiller PE), and other forward-looking valuation models. High values in these metrics generally indicate that the market is trading at a premium relative to historical averages or projected earnings. The interpretation often depends on the specific economic context, growth prospects, and interest rate environment.

-

Identification of specific sectors or asset classes exhibiting particularly high valuations: BofA's analyses often highlight specific sectors, such as technology or certain growth stocks, as having particularly high valuations. These sectors tend to be more sensitive to changes in interest rates and investor sentiment. They may be prone to sharper corrections if valuations are deemed unsustainable.

-

Mention any potential triggers for a market correction identified by BofA: BofA analysts frequently point to potential triggers for a market correction, such as rising interest rates, inflation exceeding expectations, or geopolitical instability. These factors can lead to a reassessment of future earnings expectations and result in lower stock prices.

Understanding the Risks of High Stock Market Valuations

Investing in a market with elevated stock market valuations presents several inherent risks:

-

Increased vulnerability to market corrections or crashes: High valuations inherently imply a higher probability of a market correction or even a crash. When valuations are stretched, even a small negative surprise can trigger a significant sell-off.

-

Lower potential for future returns compared to markets with lower valuations: Historically, markets with high valuations tend to deliver lower future returns than markets with lower valuations. This is because much of the future growth potential is already priced in.

-

The impact of rising interest rates on valuations: Rising interest rates increase the discount rate used to value future cash flows. This typically results in lower valuations for stocks, making high-valuation stocks particularly vulnerable.

-

Explain the concept of mean reversion and its relevance to high valuations: Mean reversion is the tendency for market valuations to revert to their historical averages over the long term. While not guaranteed, this concept suggests that extremely high valuations are unlikely to persist indefinitely.

Factors Supporting Elevated Stock Market Valuations

Despite the risks, several factors can support elevated stock market valuations:

-

Strong corporate earnings growth: Robust corporate earnings growth can justify higher valuations if the growth is sustainable and exceeds expectations. This is a crucial factor in BofA's analysis.

-

Low interest rates (if applicable and relevant to BofA's analysis): Low interest rates reduce the cost of borrowing for corporations and stimulate investment, potentially supporting higher stock prices. However, this relationship can change as interest rates rise.

-

Technological advancements and innovation driving future growth: Innovation and technological advancements can drive future growth and justify higher valuations if these innovations lead to significant increases in earnings and profits.

-

Positive economic outlook (if supported by BofA's analysis): A positive economic outlook can boost investor confidence and lead to higher stock prices. However, this outlook must be realistic and sustainable.

BofA's Recommendations for Investors

Based on their analysis of elevated stock market valuations, BofA's recommendations for investors usually emphasize a cautious and diversified approach.

-

Diversification strategies to mitigate risk: Diversification across different asset classes and sectors is crucial to reduce portfolio volatility.

-

Recommendations on asset allocation (e.g., shifting to less volatile assets): Depending on the market outlook, BofA might suggest shifting to less volatile assets like bonds or high-quality dividend stocks.

-

Advice on sector selection based on valuation: BofA's analyses usually provide guidance on sector selection, suggesting a focus on undervalued sectors or companies with strong fundamentals and sustainable growth prospects.

-

Importance of a long-term investment horizon: Maintaining a long-term investment horizon can help investors weather short-term market fluctuations and benefit from long-term growth.

Comparing BofA's Analysis with Other Market Perspectives

BofA's views on elevated stock market valuations are not isolated. Other financial institutions, such as Goldman Sachs, Morgan Stanley, and JP Morgan, also regularly publish analyses offering their perspectives. While there's often general agreement on the elevated nature of valuations, the specific interpretations and recommendations can differ depending on the institution's analytical methods and outlook. For a comprehensive picture, it's advisable to consult reports from multiple sources.

Conclusion

BofA's analysis highlights the current elevated stock market valuations and the inherent risks associated with such high valuations. While factors like strong corporate earnings and low-interest rates (depending on the time period) can provide support, the potential for market corrections or lower future returns remains significant. Investors should focus on diversification, careful asset allocation, and a long-term investment horizon to manage the risks associated with these elevated stock market valuations. Remember that understanding the implications of elevated stock market valuations is crucial for making sound investment decisions. Consult with a financial advisor to develop a personalized strategy aligned with your risk tolerance and financial goals.

Featured Posts

-

Get Your 2025 New York Yankees Gear Hats Jerseys And More Online And In Store

May 11, 2025

Get Your 2025 New York Yankees Gear Hats Jerseys And More Online And In Store

May 11, 2025 -

News Roundup Superman Daredevil Vs Bullseye And 1923 Updates

May 11, 2025

News Roundup Superman Daredevil Vs Bullseye And 1923 Updates

May 11, 2025 -

Crazy Rich Asians A New Tv Series In Development At Hbo Max

May 11, 2025

Crazy Rich Asians A New Tv Series In Development At Hbo Max

May 11, 2025 -

First Of Its Kind Ottawa And Indigenous Capital Group Partner For Next Decade

May 11, 2025

First Of Its Kind Ottawa And Indigenous Capital Group Partner For Next Decade

May 11, 2025 -

Updated Injury Report Yankees Vs Rays May 2 4

May 11, 2025

Updated Injury Report Yankees Vs Rays May 2 4

May 11, 2025

Latest Posts

-

Five Drivers On The Bubble Who Will Miss The 2025 Indy 500

May 11, 2025

Five Drivers On The Bubble Who Will Miss The 2025 Indy 500

May 11, 2025 -

Indy 500 2025 Predicting The Five Drivers Most Likely To Miss The Race

May 11, 2025

Indy 500 2025 Predicting The Five Drivers Most Likely To Miss The Race

May 11, 2025 -

Top 5 Indy 500 Drivers Facing Elimination In 2025

May 11, 2025

Top 5 Indy 500 Drivers Facing Elimination In 2025

May 11, 2025 -

Indy Car Warm Up Palou Leads Dixon At Thermal Club

May 11, 2025

Indy Car Warm Up Palou Leads Dixon At Thermal Club

May 11, 2025 -

Indy Car 2025 Predicting Rahal Letterman Lanigan Racings Performance

May 11, 2025

Indy Car 2025 Predicting Rahal Letterman Lanigan Racings Performance

May 11, 2025