Should Investors Worry About High Stock Market Valuations? BofA Weighs In

Table of Contents

BofA's Perspective on Current Market Valuations

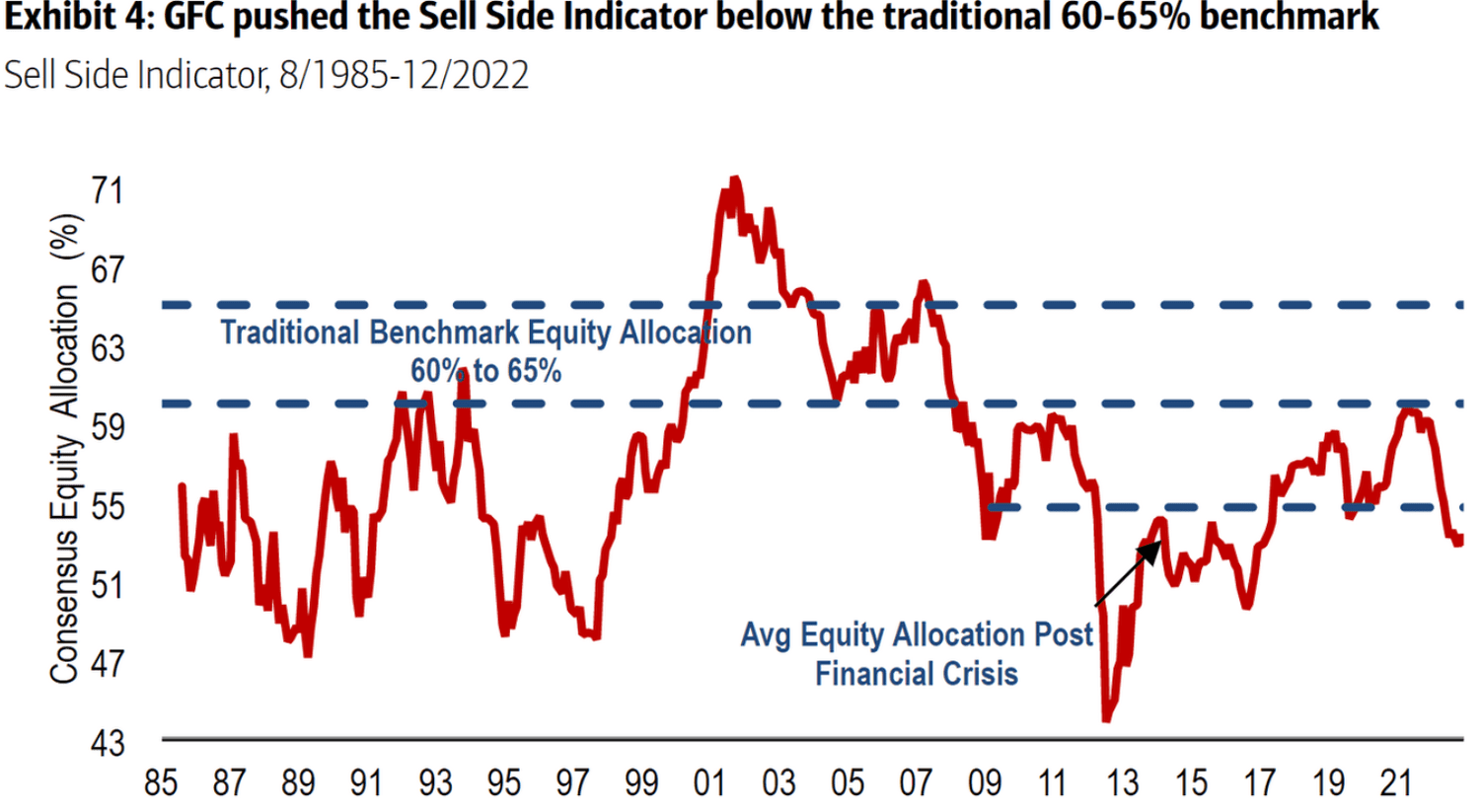

Bank of America, a leading financial institution, regularly publishes reports analyzing market trends and valuations. Their recent assessments reflect a cautious optimism, acknowledging the elevated levels of stock prices while also highlighting potential drivers of future growth. While specific data points change frequently, BofA's analysis often includes metrics like Price-to-Earnings (P/E) ratios and market capitalization relative to GDP to gauge market valuation. These ratios, when compared to historical averages, help determine whether the market is overvalued, undervalued, or trading within a normal range.

-

Key findings from BofA's research on current market sentiment: BofA's research often highlights investor confidence and its influence on current valuations. They analyze factors like investor sentiment surveys and trading activity to understand the underlying market dynamics.

-

BofA's assessment of potential risks associated with high valuations: The bank acknowledges the inherent risks associated with high valuations, including the potential for a market correction or a more significant downturn. They carefully weigh factors like interest rate hikes, inflation, and geopolitical instability in their risk assessment.

-

BofA's predicted market trajectory (if available): BofA's predictions vary based on the economic climate and often present a range of possible outcomes, rather than a single definitive prediction. Their analyses typically consider different scenarios and associated probabilities.

-

Mention any specific sectors BofA flags as overvalued or undervalued: BofA's reports often delve into specific sectors, identifying those that appear overvalued based on their fundamental analysis and those that might represent undervalued opportunities. This sector-specific analysis allows investors to make more informed decisions.

Understanding the Factors Contributing to High Stock Market Valuations

Several macroeconomic factors contribute to the current landscape of high stock market valuations. These factors interact in complex ways, making it challenging to isolate the impact of any single element.

-

Impact of low interest rates on investor behavior and stock prices: Low interest rates incentivize investors to seek higher returns in the stock market, driving demand and pushing prices upward. This phenomenon is particularly evident during periods of quantitative easing by central banks.

-

The role of inflation and its potential impact on future valuations: Inflation erodes the purchasing power of money, influencing investor behavior and impacting future valuations. High inflation can lead to increased interest rates, potentially triggering a market correction. Conversely, controlled inflation can support moderate growth.

-

The influence of technological advancements and growth prospects: Rapid technological advancements and the associated growth prospects in sectors like technology, biotechnology, and renewable energy often attract significant investment, contributing to high valuations in these sectors.

-

Mention the impact of geopolitical events on market sentiment and valuations: Geopolitical instability, trade wars, and unexpected global events can significantly impact investor sentiment and market valuations, creating volatility and uncertainty.

Assessing the Risks of High Valuations: Potential for a Correction

Investing in a highly valued market carries inherent risks. Understanding the concept of a market correction and its implications is crucial for informed decision-making.

-

Explanation of market corrections and their historical precedents: Market corrections are temporary declines in market values, typically ranging from 10% to 20%. They are a normal part of the market cycle and have occurred throughout history. Examining historical precedents provides valuable insights into the potential magnitude and duration of future corrections.

-

Potential triggers for a market correction: Several factors can trigger a market correction, including rising interest rates, unexpected economic downturns, geopolitical events, or shifts in investor sentiment. Identifying potential triggers allows investors to better prepare for and potentially mitigate their impact.

-

Strategies for mitigating risk in a high-valuation market: Diversifying investments across different asset classes, sectors, and geographies can help reduce risk. Hedging strategies, such as using options or futures contracts, can also provide protection against potential market downturns.

-

Discussion of the potential for a “bubble” and its characteristics: The possibility of a market bubble, characterized by excessive speculation and unsustainable price increases, should also be considered. While identifying a bubble in real-time is difficult, understanding the characteristics of past bubbles (e.g., rapid price increases, high levels of debt) can help investors assess the current market's vulnerability.

Strategies for Investors in a High-Valuation Market

Navigating a market with high valuations requires a thoughtful and strategic approach.

-

Importance of a well-diversified investment portfolio: Diversification remains a cornerstone of sound investment strategy, helping to mitigate risk and potentially enhance returns. A well-diversified portfolio spreads investments across different asset classes, reducing exposure to any single investment's performance.

-

Consideration of value investing strategies in a high-growth market: Value investing, focusing on undervalued companies with strong fundamentals, can be a suitable approach even in a high-growth market. This strategy aims to identify companies trading below their intrinsic value.

-

The role of risk tolerance in investment decisions: Investors should carefully assess their own risk tolerance before making investment decisions. This self-assessment should guide their portfolio allocation and investment choices.

-

Importance of long-term investment strategies: A long-term investment horizon allows investors to ride out market fluctuations and potentially benefit from long-term growth. Short-term market movements should not dictate long-term investment strategies.

-

Suggestions for seeking professional financial advice: Seeking guidance from a qualified financial advisor is highly recommended. A financial advisor can help create a personalized investment plan based on individual circumstances, risk tolerance, and financial goals.

Conclusion

High stock market valuations are a significant factor influencing investment decisions. BofA's analysis, while cautiously optimistic, acknowledges the potential risks inherent in the current market conditions. Understanding the factors driving these valuations, assessing potential risks, and employing suitable diversification and risk management strategies are crucial for investors. While the potential for a correction exists, a proactive and well-informed approach is key to navigating this market effectively. Don't let uncertainty about high stock market valuations paralyze you – take control of your financial future by carefully analyzing your options and seeking professional advice. Remember, a diversified portfolio and a long-term perspective are essential components of a robust investment strategy in the face of high stock market valuations.

Featured Posts

-

Confortos Dodgers Future Lessons From Hernandezs Experience

May 18, 2025

Confortos Dodgers Future Lessons From Hernandezs Experience

May 18, 2025 -

Maneskins Jimmy Kimmel Live Appearance Damiano Davids Show Stopping Performance

May 18, 2025

Maneskins Jimmy Kimmel Live Appearance Damiano Davids Show Stopping Performance

May 18, 2025 -

Left Handed Hitters Slump Analyzing The Dodgers Offensive Dip

May 18, 2025

Left Handed Hitters Slump Analyzing The Dodgers Offensive Dip

May 18, 2025 -

Reddit Offline Causes And Duration Of The Current Global Outage

May 18, 2025

Reddit Offline Causes And Duration Of The Current Global Outage

May 18, 2025 -

Michael Confortos Path To Success Breaking Down His Spring Training Challenges

May 18, 2025

Michael Confortos Path To Success Breaking Down His Spring Training Challenges

May 18, 2025

Latest Posts

-

2025 Nfl Draft Analysts Assessment Of The Patriots Future

May 18, 2025

2025 Nfl Draft Analysts Assessment Of The Patriots Future

May 18, 2025 -

Nfl Analyst Predicts Patriots Trajectory Following 2025 Draft

May 18, 2025

Nfl Analyst Predicts Patriots Trajectory Following 2025 Draft

May 18, 2025 -

Patriots Future Nfl Analyst Weighs In After 2025 Draft

May 18, 2025

Patriots Future Nfl Analyst Weighs In After 2025 Draft

May 18, 2025 -

You Toon Caption Contest Winner Announced Booing Bears Takes The Prize

May 18, 2025

You Toon Caption Contest Winner Announced Booing Bears Takes The Prize

May 18, 2025 -

The Swim With Mike Program A Lifeline For The Trojan Community

May 18, 2025

The Swim With Mike Program A Lifeline For The Trojan Community

May 18, 2025