Should You Add Palantir To Your Portfolio Before May 5th?

Table of Contents

Palantir's Recent Performance and Future Outlook

Palantir's trajectory significantly impacts whether adding it to your portfolio before May 5th makes sense. Analyzing its recent performance and future outlook is crucial for any investment decision.

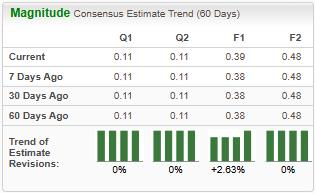

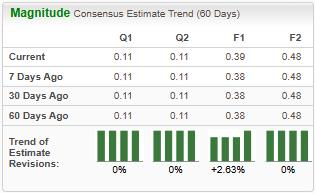

Q1 2024 Earnings Expectations

The upcoming Q1 2024 earnings report is a key catalyst that will likely influence Palantir's stock price. Analysts are eagerly awaiting details on revenue growth, profitability, and key performance indicators (KPIs) like customer acquisition and retention rates.

- Analyst Predictions: While predictions vary, many analysts expect Palantir to demonstrate continued revenue growth, driven by strong demand for its data analytics platform. However, achieving profitability remains a key focus.

- Potential Surprises: Positive surprises could include exceeding revenue expectations, announcing significant new contracts, or reporting improved margins. Conversely, negative surprises might involve slower-than-expected growth or unforeseen challenges.

- Impact on Stock Price: The market's reaction to the earnings report will be highly dependent on whether Palantir meets or exceeds these expectations. Positive results could lead to a surge in the stock price, while disappointing news might trigger a sell-off. Understanding the potential impact on the stock price prediction is key to your investment strategy.

New Contracts and Government Partnerships

Palantir's success is heavily tied to its government contracts and commercial partnerships. Securing new contracts is vital for sustaining long-term growth.

- Recent Wins: Recent contract wins, particularly those involving large government agencies or significant commercial clients, will bolster confidence in Palantir's future. The specifics of these deals – their value, duration, and scope – will be closely scrutinized.

- Significance for Growth and Stability: New contracts, particularly those in the government sector, contribute significantly to Palantir's revenue streams and offer a degree of predictability. Analyzing the industry and specific clients involved helps determine long-term growth potential.

- Data Analytics Market Expansion: Palantir's continued success hinges on its ability to expand its market share in the rapidly growing data analytics market.

Competition and Market Position

Understanding Palantir's competitive landscape is essential. While it occupies a unique niche, several companies offer competing data analytics solutions.

- Key Competitors: Analyzing Palantir's competitive advantages against key players in the data analytics market is crucial. This involves looking at factors like technology, market share, and pricing strategies.

- Strengths and Weaknesses: Palantir's strengths lie in its sophisticated technology and strong government relationships. However, its high valuation and reliance on a few key clients represent potential weaknesses. Understanding these helps assess its ability to maintain its market share and drive long-term growth.

Risk Assessment and Potential Downsides of Investing in Palantir

Before adding Palantir to your investment portfolio, it's crucial to conduct a thorough risk assessment.

Volatility and Stock Price Fluctuations

Palantir's stock price has historically shown significant volatility. Understanding this volatility is key to informed investment decisions.

- Historical Volatility: Examining past stock price fluctuations provides insights into the potential for future volatility. Factors driving volatility include market sentiment, geopolitical events, and company-specific news.

- Factors Influencing Volatility: Market sentiment and news related to government spending, competition, and technological advancements all play a role in determining the volatility of Palantir's stock.

Dependence on Government Contracts

A significant portion of Palantir's revenue comes from government contracts. This dependence introduces specific risks.

- Impact of Budget Cuts: Changes in government priorities or budget cuts could significantly impact Palantir's revenue streams. This risk should be factored into your investment strategy.

- Political Risk: The political landscape also plays a crucial role. Changes in government policy or priorities can have a direct bearing on contract renewals and future business opportunities.

Strategies for Investing in Palantir Before May 5th

To mitigate the inherent risks associated with investing in Palantir, consider these strategies:

Dollar-Cost Averaging (DCA)

DCA is an effective strategy to reduce the impact of stock price volatility.

- How DCA Works: This approach involves investing a fixed amount of money at regular intervals, regardless of the stock price.

- Benefits for Volatile Stocks: DCA helps mitigate the risk of investing a large sum at a market peak. It's an effective way to smooth out the impact of price fluctuations.

Setting Stop-Loss Orders

Stop-loss orders are crucial for protecting against significant losses.

- Protecting Against Losses: A stop-loss order automatically sells your shares when the price drops below a predetermined level, limiting potential losses.

- Setting Stop-Loss Orders Effectively: Setting the stop-loss price at a level that reflects your risk tolerance is crucial.

Diversification and Portfolio Allocation

Diversification is a cornerstone of sound investment strategy.

- Importance of Diversification: Diversifying your portfolio across different asset classes reduces overall risk. Investing in Palantir should be part of a wider investment strategy.

- Palantir's Place in Your Portfolio: Determine how much of your portfolio to allocate to Palantir based on your overall risk tolerance and investment goals.

Conclusion: Should You Add Palantir to Your Portfolio Before May 5th?

Adding Palantir to your portfolio before May 5th presents both significant opportunities and considerable risks. The upcoming earnings report, new contracts, and competitive landscape will all influence the stock's trajectory. While Palantir's innovative technology and government partnerships offer substantial growth potential, its volatility and dependence on government contracts require careful consideration. Remember that dollar-cost averaging, stop-loss orders, and portfolio diversification are crucial for mitigating investment risk. Do your due diligence and decide if adding Palantir to your portfolio before May 5th aligns with your investment strategy and risk tolerance. Building a well-diversified Palantir portfolio requires careful planning and a thorough understanding of the inherent risks and potential rewards.

Featured Posts

-

Masshtabnoe Otklyuchenie Sveta V Sverdlovskoy Oblasti Posle Snegopada

May 09, 2025

Masshtabnoe Otklyuchenie Sveta V Sverdlovskoy Oblasti Posle Snegopada

May 09, 2025 -

High Potential After 11 Years A Legacy Of Psych Spiritual Growth

May 09, 2025

High Potential After 11 Years A Legacy Of Psych Spiritual Growth

May 09, 2025 -

Nhl Highlights Hertls Two Hat Tricks Lead Golden Knights To Victory

May 09, 2025

Nhl Highlights Hertls Two Hat Tricks Lead Golden Knights To Victory

May 09, 2025 -

Examining Bitcoins Recent Rebound A Deeper Dive

May 09, 2025

Examining Bitcoins Recent Rebound A Deeper Dive

May 09, 2025 -

Edmonton Federal Riding Changes What Voters Need To Know

May 09, 2025

Edmonton Federal Riding Changes What Voters Need To Know

May 09, 2025