Should You Buy Apple Stock After Wedbush's Price Target Cut?

Table of Contents

Understanding Wedbush's Price Target Cut

Reasons Behind the Downgrade

Wedbush's decision to lower its Apple stock price target wasn't arbitrary. Several factors contributed to this downgrade, primarily centered around concerns about the near-term outlook.

- Weakening iPhone Demand: Reports suggest a slowdown in iPhone sales, particularly in key markets like China and Europe. This is partly attributed to macroeconomic headwinds and increased consumer caution.

- Increased Competition from Android: The Android operating system continues to gain market share, putting pressure on Apple's dominance in the smartphone sector. Innovative features from competitors are also impacting Apple's sales.

- Potential Impact of Global Economic Slowdown: Global economic uncertainty and potential recessionary pressures are likely to impact consumer spending on discretionary items like iPhones and other Apple products. This macro-economic factor is a major concern for many analysts.

[Link to relevant news article about iPhone sales slowdown] [Link to relevant financial report discussing macroeconomic factors]

Impact on Investor Sentiment

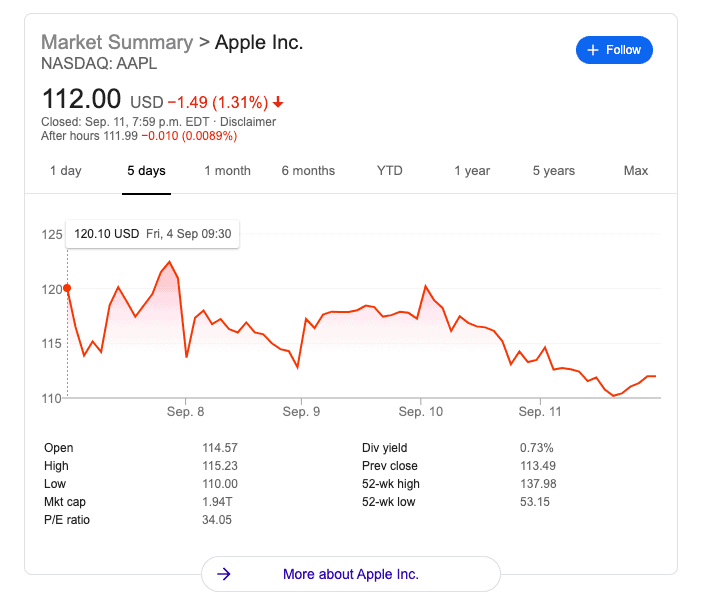

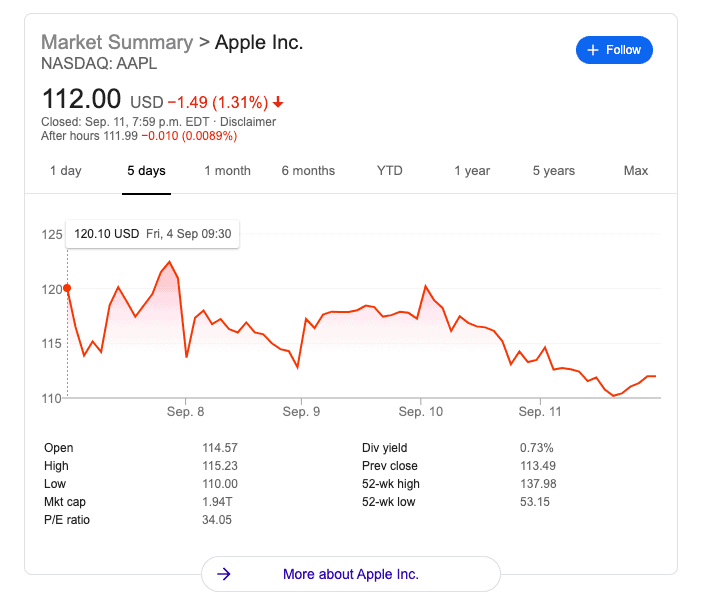

The immediate market reaction to Wedbush's announcement was a noticeable dip in Apple's stock price. The stock price dropped by [Insert Percentage]% in the days following the announcement, and trading volume increased significantly, indicating heightened investor activity. However, the reaction wasn't universally negative. Some analysts maintained a positive outlook, pointing to Apple's strong brand loyalty and diverse revenue streams. For instance, [Analyst Name] at [Analyst Firm] still holds a [Price Target] price target for Apple stock, citing [Reason].

Apple's Current Financial Performance and Future Outlook

Analyzing Apple's Financials

Despite the concerns raised by Wedbush, Apple's recent financial reports still showcase a financially healthy and robust company. While revenue growth may have slowed slightly compared to previous quarters, the company continues to generate substantial profits and maintain strong cash flow.

- Revenue: Apple's most recent quarterly revenue was [Insert Amount], a [Percentage]% change compared to the same period last year.

- Profit Margins: Apple maintains healthy profit margins, indicating efficient operations and strong pricing power. [Insert Data on Profit Margins]

- Services Revenue Growth: Apple's services segment (including App Store, Apple Music, iCloud, etc.) continues to be a significant growth driver, demonstrating the company's ability to diversify its revenue streams beyond hardware sales. [Insert Data on Services Revenue Growth]

Growth Potential and Innovation

Apple's future growth prospects remain strong, driven by innovation and expansion into new markets. The upcoming launch of [New Product, e.g., Apple Glasses or new iPhone models] is expected to boost sales and further solidify Apple's position in the technology sector. Furthermore, Apple's expansion into areas like augmented reality (AR) and virtual reality (VR) represents significant long-term growth potential. The company's strong brand loyalty and ecosystem also represent a significant competitive advantage.

Assessing the Risk and Reward of Investing in Apple Stock

Risk Factors

Investing in Apple stock, like any stock, carries inherent risks.

- Competition: Intense competition from other tech giants, especially in the smartphone market, presents a significant challenge.

- Economic Downturns: A global economic recession could significantly impact consumer spending, affecting Apple's sales.

- Supply Chain Disruptions: Global supply chain vulnerabilities can impact Apple's ability to produce and deliver its products.

- Regulatory Changes: Changes in government regulations, particularly concerning data privacy and antitrust issues, could negatively affect Apple's business.

Reward Potential

Despite the risks, the potential rewards of investing in Apple stock are significant.

- Long-Term Growth: Apple has a proven track record of long-term growth and innovation.

- Dividend Payouts: While not guaranteed, Apple’s history of dividend payments provides an additional source of income for investors.

- Capital Appreciation: The potential for significant capital appreciation over the long term remains substantial, given Apple's strong brand, innovative products, and large market capitalization.

Conclusion

Wedbush's price target cut for Apple stock highlights some near-term concerns, primarily related to slowing iPhone sales and macroeconomic uncertainty. However, Apple's strong financial performance, diverse revenue streams, and continuous innovation suggest a positive long-term outlook. The decision of whether to buy Apple stock after this price target cut depends on your individual investment strategy and risk tolerance. Conduct thorough research, consider the factors discussed in this article, and consult with a financial advisor before making any investment decisions regarding Apple stock or any other stock. Remember to always perform your own due diligence before buying Apple stock.

Featured Posts

-

Cybersecurity Breach At Marks And Spencer Results In 300 Million Loss

May 25, 2025

Cybersecurity Breach At Marks And Spencer Results In 300 Million Loss

May 25, 2025 -

Prime Videos Picture This Every Song Featured In The Romantic Comedy

May 25, 2025

Prime Videos Picture This Every Song Featured In The Romantic Comedy

May 25, 2025 -

Record Highs Near Frankfurt Equities Opening And Dax Performance

May 25, 2025

Record Highs Near Frankfurt Equities Opening And Dax Performance

May 25, 2025 -

Black Lives Matter Plaza Its Impact And Legacy

May 25, 2025

Black Lives Matter Plaza Its Impact And Legacy

May 25, 2025 -

Musk Zuckerberg Bezos La Lotta Per Il Titolo Di Uomo Piu Ricco Del Mondo Nel 2025 Forbes

May 25, 2025

Musk Zuckerberg Bezos La Lotta Per Il Titolo Di Uomo Piu Ricco Del Mondo Nel 2025 Forbes

May 25, 2025

Latest Posts

-

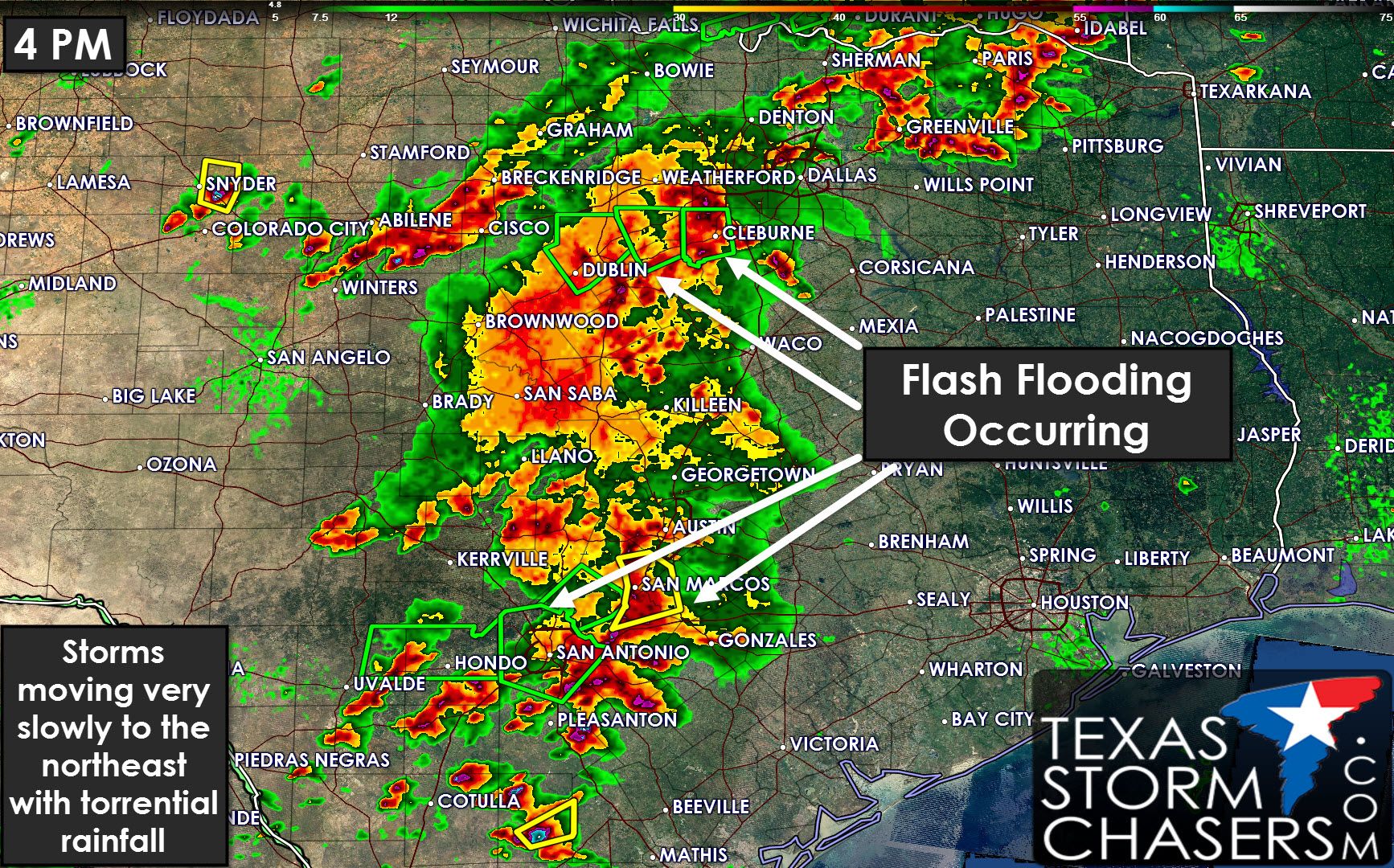

Flood Warnings And Alerts A Comprehensive Guide To Protecting Yourself

May 25, 2025

Flood Warnings And Alerts A Comprehensive Guide To Protecting Yourself

May 25, 2025 -

Flash Floods Understanding The Dangers And How To Stay Safe

May 25, 2025

Flash Floods Understanding The Dangers And How To Stay Safe

May 25, 2025 -

What Is A Flash Flood Understanding Flood Warnings And Alerts

May 25, 2025

What Is A Flash Flood Understanding Flood Warnings And Alerts

May 25, 2025 -

Urgent Flash Flood Warning Issued For Parts Of North Central Texas

May 25, 2025

Urgent Flash Flood Warning Issued For Parts Of North Central Texas

May 25, 2025 -

Flash Flood Threat Bradford And Wyoming Counties On High Alert Until Tuesday

May 25, 2025

Flash Flood Threat Bradford And Wyoming Counties On High Alert Until Tuesday

May 25, 2025