Should You Buy Palantir Stock After Its 30% Decline?

Table of Contents

Palantir's Current Financial Performance and Future Prospects

Revenue Growth and Profitability

Palantir's recent financial reports paint a mixed picture. While the company has demonstrated consistent revenue growth year-over-year (YoY), its path to profitability remains a key focus for investors.

- Revenue Growth (YoY): [Insert latest YoY revenue growth percentage from financial reports]. While this represents growth, it's crucial to compare this figure to previous years and industry benchmarks.

- Net Income: [Insert latest net income figure from financial reports]. Profitability is still a work in progress for Palantir, with net income fluctuating from quarter to quarter.

- Operating Margin: [Insert latest operating margin from financial reports]. This metric provides insights into the efficiency of Palantir's operations and its ability to translate revenue into profit.

Analyzing these key metrics against previous quarters and years reveals trends that are essential for predicting future performance and the potential for increased profitability, impacting the value of a Palantir stock investment.

Government vs. Commercial Contracts

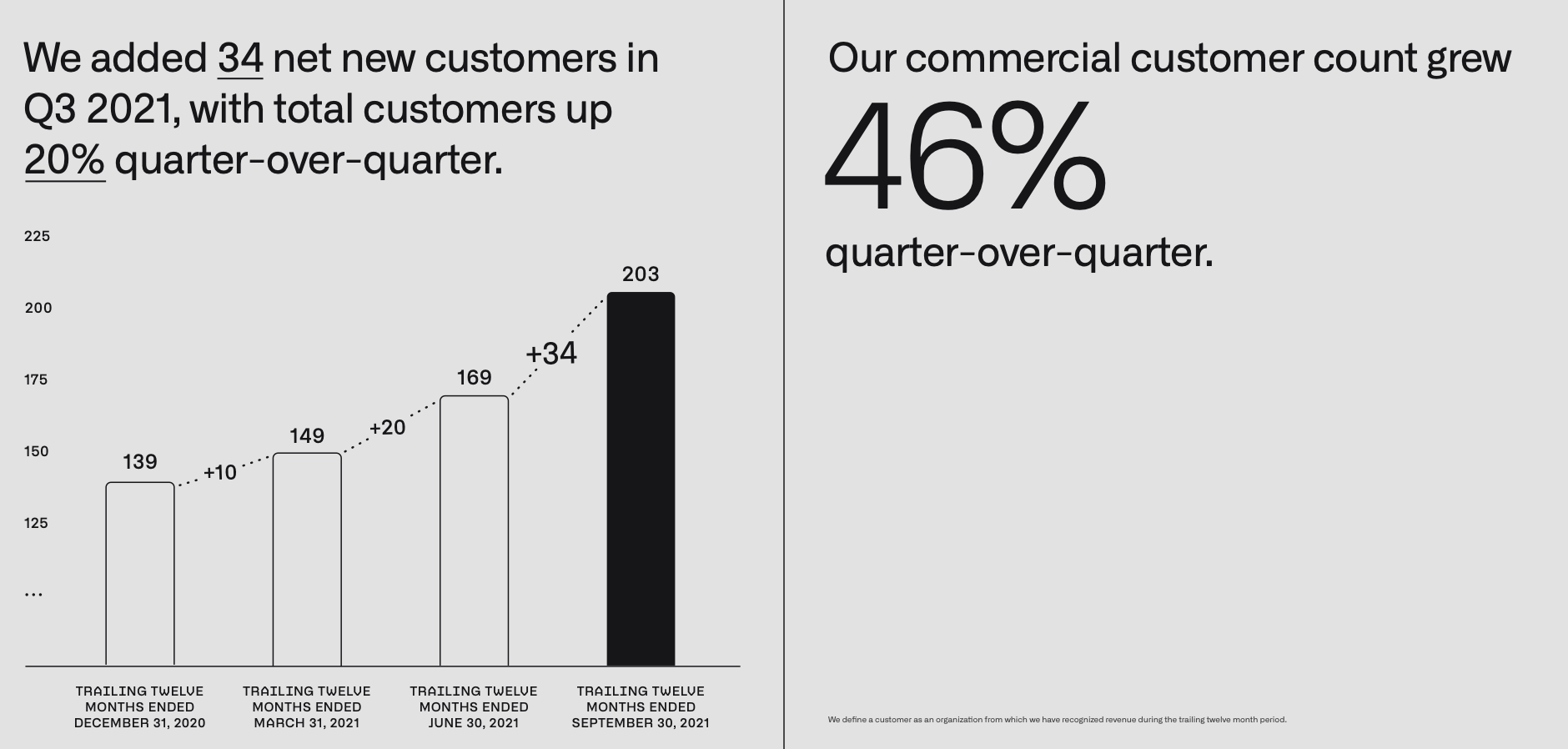

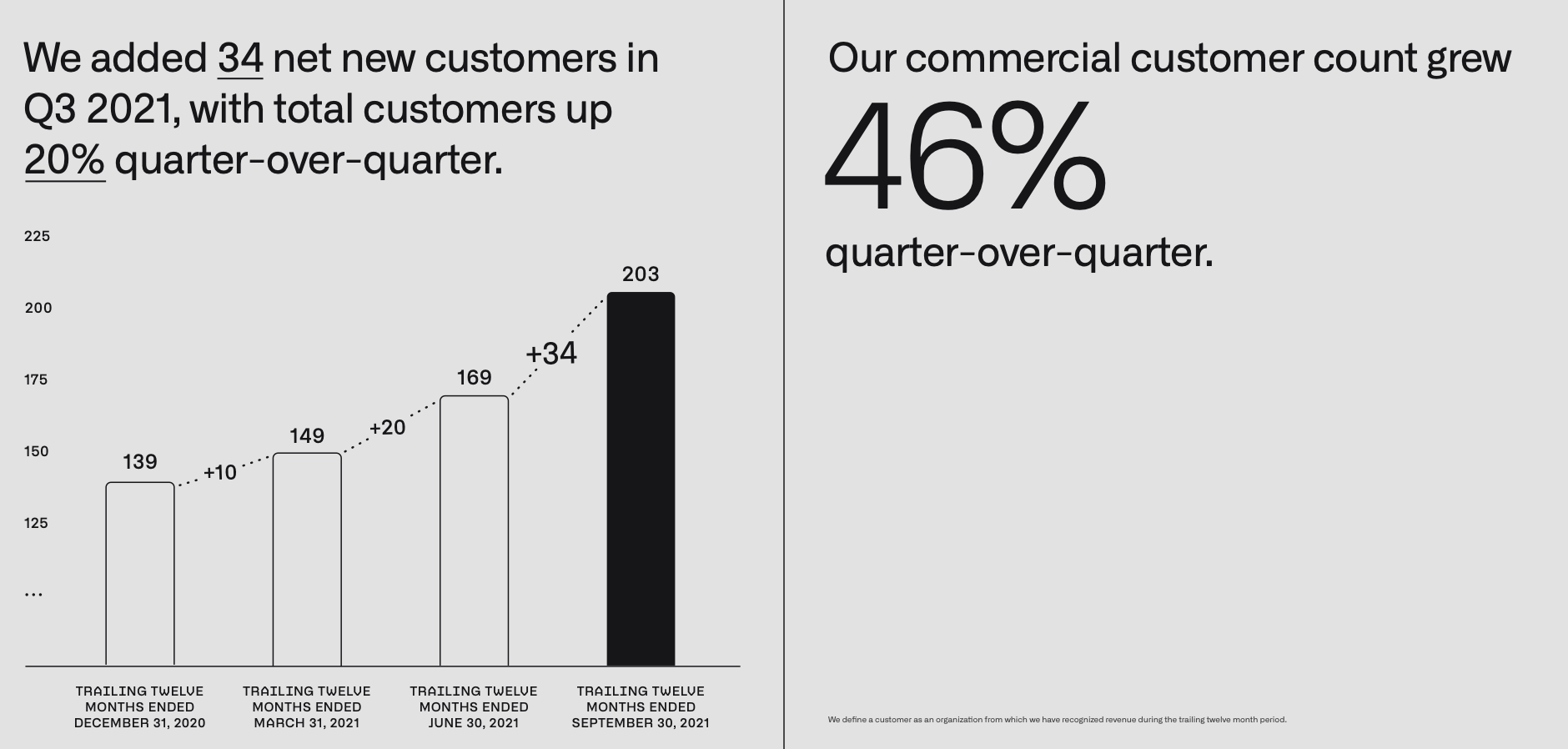

Palantir's revenue streams are split between government and commercial contracts. The balance between these two sectors significantly impacts the company's revenue stability and growth potential.

- Government Contracts: These contracts often provide stable, long-term revenue streams but can be subject to budgetary constraints and regulatory changes. Growth in this sector depends on government spending and geopolitical factors.

- Commercial Contracts: This sector offers higher growth potential but may be subject to greater competition and market fluctuations. Success here hinges on Palantir's ability to secure and retain large commercial clients.

The mix of these contracts influences the overall risk profile of a Palantir stock investment. A heavily government-reliant model might be less volatile, while a more commercially focused approach could lead to higher growth but also greater risk.

Competition and Market Position

Palantir operates in a competitive big data analytics market, facing established players and emerging startups.

- Key Competitors: Companies like AWS, Microsoft Azure, and Google Cloud Platform offer competing analytics solutions.

- Palantir's Competitive Advantages: Palantir's proprietary technology, strong relationships with government agencies (especially in defense and intelligence), and its focus on highly secure and complex data analytics provide crucial advantages.

- Long-Term Market Position: The long-term sustainability of Palantir's market position depends on its ability to innovate, adapt to changing market demands, and maintain its competitive edge.

Understanding the competitive dynamics and Palantir's unique selling points is crucial for assessing the long-term viability of a Palantir stock investment.

Factors Contributing to the 30% Stock Price Decline

Macroeconomic Factors

Broader macroeconomic trends have significantly impacted Palantir's stock price.

- Market Sentiment Towards Tech Stocks: The overall negative sentiment towards technology stocks, driven by inflation concerns and rising interest rates, has dragged down many tech companies, including Palantir.

- Recessionary Fears: Concerns about a potential recession have led investors to favor more defensive stocks, further impacting the price of growth-oriented companies like Palantir.

The macroeconomic environment is a significant factor impacting the valuation of Palantir stock. Understanding these external forces is vital for evaluating potential investment risks.

Company-Specific News and Events

Specific company-related news and events have also contributed to the stock price decline.

- Recent Earnings Reports: [Discuss any significant announcements or surprises in recent earnings reports, including any guidance that impacted investor expectations].

- Regulatory Changes: Any changes in regulations affecting Palantir's operations, especially within the government sector, could negatively influence its stock price.

Keeping abreast of Palantir’s news and developments is essential for informed investment decision-making.

Investor Sentiment and Market Volatility

Investor sentiment and market volatility played a significant role in the price drop.

- Short Sellers: The presence of short-sellers betting against Palantir's stock can amplify price declines.

- Market Speculation: Market speculation and general uncertainty around the company's future prospects contribute to price volatility.

Understanding investor psychology and market dynamics is crucial when evaluating a Palantir stock investment.

Is Palantir Stock Currently Undervalued? A Valuation Analysis

Different Valuation Methods

Several valuation methods can help determine if Palantir's stock is undervalued.

- Discounted Cash Flow (DCF) Analysis: This method projects future cash flows and discounts them to their present value. [Insert results of a DCF analysis, if available, or explain the methodology and its implications for Palantir's valuation].

- Comparable Company Analysis: This involves comparing Palantir's valuation multiples (such as Price-to-Sales ratio) to those of similar companies. [Insert results of a comparable company analysis, if available, or explain how such an analysis could be applied to Palantir].

These valuation methods provide different perspectives on Palantir's intrinsic value, helping to determine whether the current market price accurately reflects its potential.

Risk Assessment

Investing in Palantir stock carries inherent risks.

- Competition: Intense competition from established tech giants and emerging players poses a significant risk.

- Regulatory Changes: Changes in government regulations could negatively impact Palantir's revenue streams.

- Financial Performance: The company's path to profitability is still uncertain, making it a higher-risk investment.

- Macroeconomic Factors: Economic downturns could significantly impact Palantir's target markets.

Investors need to carefully assess these risks and their own risk tolerance before deciding whether to invest in Palantir.

Conclusion

Should you buy Palantir stock after its 30% decline? The answer is nuanced. While Palantir demonstrates revenue growth and has unique technological advantages, its path to consistent profitability remains unclear. The recent stock price decline reflects both macroeconomic headwinds and company-specific factors. Our analysis, using various valuation methods, suggests that Palantir might be undervalued for long-term investors willing to tolerate significant risk, however, this isn't a definitive "buy" recommendation. A thorough review of the above analysis, coupled with your own due diligence and risk assessment, is crucial. While this analysis provides insights, remember to conduct your own thorough research before making any investment decisions regarding buying Palantir stock, considering your individual risk tolerance and financial goals. Investing in Palantir stock requires careful consideration of the potential rewards and risks associated with this growth-stage company.

Featured Posts

-

Bed Antqalh Llahly Almsry Madha Qdm Markw Fyraty Me Alerby Alqtry

May 10, 2025

Bed Antqalh Llahly Almsry Madha Qdm Markw Fyraty Me Alerby Alqtry

May 10, 2025 -

Tragedie A Dijon Deces D Un Ouvrier Apres Une Chute De Quatre Etages

May 10, 2025

Tragedie A Dijon Deces D Un Ouvrier Apres Une Chute De Quatre Etages

May 10, 2025 -

Transgender Women And Pregnancy A Community Activists Proposal

May 10, 2025

Transgender Women And Pregnancy A Community Activists Proposal

May 10, 2025 -

Aocs Fierce Fact Check Of Jeanine Pirro On Fox News

May 10, 2025

Aocs Fierce Fact Check Of Jeanine Pirro On Fox News

May 10, 2025 -

Overtaym Drama Vegas Golden Nayts Pobezhdaet Minnesotu V Pley Off

May 10, 2025

Overtaym Drama Vegas Golden Nayts Pobezhdaet Minnesotu V Pley Off

May 10, 2025