Should You Buy Palantir Stock Before May 5? A Pre-Earnings Analysis

Table of Contents

Palantir's Recent Performance and Growth Prospects

Analyzing Palantir's recent performance is crucial to predicting its future trajectory. We need to examine its financial health, growth rate, and the overall market conditions impacting its success.

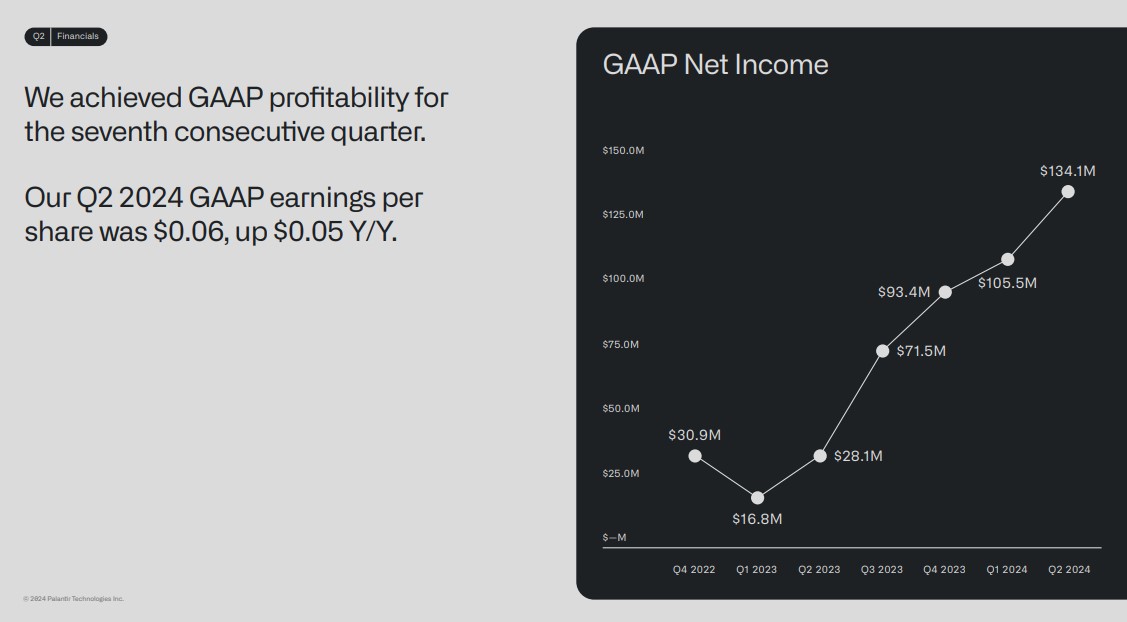

- Q4 2022 revenue and earnings per share (EPS): Reviewing the Q4 2022 results provides a snapshot of the company's immediate performance. Examining the reported revenue and EPS against expectations will highlight whether the company met or exceeded analyst forecasts. This is a key indicator for assessing current investor sentiment.

- Year-over-year revenue growth comparison: Consistent year-over-year revenue growth is a sign of a healthy and expanding business. Analyzing this growth rate will reveal Palantir's ability to increase sales and penetrate new markets. A slowing growth rate may warrant further investigation into potential headwinds.

- Key contract wins and their impact on future revenue: Large contract wins, particularly government contracts, can significantly impact Palantir's future revenue streams. Analyzing these contracts, their value, and their duration provides insight into the company's future financial stability and growth potential.

- Analysis of the company's guidance for Q1 2023 and full-year 2023: Management's guidance offers an indication of their expectations for future performance. Comparing this guidance to previous performance and analyst expectations is crucial in assessing whether Palantir is on track to meet its targets.

Palantir's long-term growth prospects are tied to its focus on artificial intelligence (AI), big data analytics, and government contracts. The increasing demand for advanced data analytics and AI solutions across various sectors presents significant opportunities for growth. However, competition in the data analytics market is fierce, and the company faces challenges in scaling operations and maintaining profitability. Geopolitical factors and potential regulatory changes also pose risks.

Analyzing the Market Sentiment Towards Palantir

Understanding the market sentiment surrounding Palantir stock is crucial before making an investment decision. This involves examining various factors that influence investor perception and confidence.

- Recent price fluctuations and trading volume: Analyzing recent price movements and trading volume helps gauge investor confidence. High trading volume alongside significant price swings suggests increased volatility and heightened market interest.

- Analyst ratings and price targets for Palantir stock: Analyst ratings and price targets reflect professional opinions on the stock's future performance. While not a definitive indicator, the consensus among analysts can provide a valuable perspective.

- Impact of recent news and events on Palantir's stock price: Significant news events, such as new partnerships, contract wins, or regulatory changes, can heavily influence Palantir's stock price. Monitoring news and its impact on the share price provides insight into market reaction.

- Discussion of the overall market conditions and their influence on PLTR: The overall market climate, particularly within the technology sector, significantly impacts PLTR. A bullish or bearish market trend can heavily influence the performance of Palantir stock, regardless of its individual performance.

Social media sentiment and news articles also contribute to the overall market sentiment. A positive sentiment generally suggests increased investor confidence, while negative sentiment can lead to sell-offs.

Key Factors to Consider Before Buying Palantir Stock

Several key factors require careful consideration before investing in Palantir stock, particularly before the May 5th earnings release.

- Expected earnings per share (EPS) and revenue figures: The actual reported EPS and revenue figures will be pivotal in determining the market's reaction. A beat or miss of analyst expectations will cause significant price movements.

- Guidance for the upcoming quarter and the full year: Management's guidance provides a glimpse into their future expectations. A positive outlook can boost investor confidence, while a negative outlook can lead to sell-offs.

- Any significant announcements or partnerships: Any new partnerships, product launches, or strategic initiatives announced during the earnings call can significantly impact the stock price.

- Potential impact of geopolitical events or regulatory changes: External factors such as geopolitical instability or regulatory changes in the tech sector can significantly impact Palantir's performance and stock price.

Investing in Palantir stock involves inherent risks. The company's stock is known for its volatility, and its performance can fluctuate significantly. Diversification within your investment portfolio is crucial to mitigate this risk.

Valuation and Comparative Analysis

Evaluating Palantir's valuation relative to its competitors is essential.

- Price-to-sales (P/S) ratio compared to peers: Comparing Palantir's P/S ratio to those of its competitors in the data analytics and AI sectors allows investors to assess whether its valuation is justified given its revenue generation.

- Market capitalization and growth potential: A high market capitalization indicates a substantial market valuation. Comparing this to its growth potential allows investors to assess whether the valuation accurately reflects its future prospects.

- Assessment of the company's overall financial health: A thorough assessment of Palantir's financial health, including its debt levels, cash flow, and profitability, is essential to gauge its long-term viability.

Ultimately, determining whether Palantir's current stock price is justified requires a comprehensive analysis of its fundamentals, future growth prospects, and its valuation relative to competitors.

Conclusion

Should you buy Palantir stock before May 5th? The decision is complex and depends on your individual risk tolerance and investment goals. This pre-earnings analysis highlights the potential rewards and risks associated with investing in Palantir before its earnings release. The company's future growth hinges on its ability to maintain revenue growth, secure lucrative contracts, and navigate the competitive landscape of the data analytics and AI industries. Remember to conduct your own thorough due diligence, consider the upcoming earnings report, and consult a financial advisor before investing in Palantir or any other stock. Carefully analyze the factors impacting Palantir stock before making any investment decisions. Remember that investing in the stock market always carries risk.

Featured Posts

-

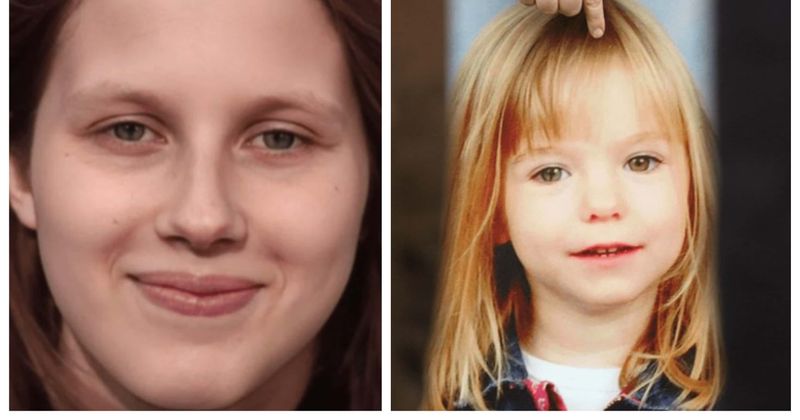

Woman Claims To Be Madeleine Mc Cann Now Faces Stalking Charges

May 09, 2025

Woman Claims To Be Madeleine Mc Cann Now Faces Stalking Charges

May 09, 2025 -

Handhaving Van De Relatie Brekelmans India Kansen En Bedreigingen

May 09, 2025

Handhaving Van De Relatie Brekelmans India Kansen En Bedreigingen

May 09, 2025 -

Leon Draisaitl Injury Oilers Leading Goal Scorer Leaves Game

May 09, 2025

Leon Draisaitl Injury Oilers Leading Goal Scorer Leaves Game

May 09, 2025 -

Analyzing Morgans Strategic Weaknesses 5 Examples From High Potential Season 1

May 09, 2025

Analyzing Morgans Strategic Weaknesses 5 Examples From High Potential Season 1

May 09, 2025 -

Madeleine Mc Cann Case Update On Julia Wandelts Arrest In The United Kingdom

May 09, 2025

Madeleine Mc Cann Case Update On Julia Wandelts Arrest In The United Kingdom

May 09, 2025