Should You Buy Palantir Stock Before May 5th? Wall Street's Surprising Consensus

Table of Contents

Recent Palantir Stock Performance and Analyst Ratings

Palantir stock has experienced significant volatility in recent months, reflecting the inherent risks and rewards associated with this data analytics company. Its stock price has seen periods of both substantial growth and sharp declines, making it a challenging investment for even seasoned traders. Analyzing analyst ratings provides a crucial perspective on current market sentiment towards Palantir stock.

-

Analyst Ratings Diversity: While some analysts maintain a "buy" rating on Palantir stock, citing its long-term growth potential and innovative technology, others hold a more cautious "hold" or even "sell" rating, pointing to concerns about profitability and reliance on government contracts. This divergence highlights the uncertainty surrounding the future trajectory of PLTR.

-

Target Prices Vary Widely: Target prices set by analysts for Palantir stock differ significantly, ranging from a conservative low to an optimistic high. For example, Goldman Sachs might have a target price of $X, while Morgan Stanley might have a target price of $Y, reflecting the wide range of opinions on Palantir's future valuation. This spread underscores the need for careful individual research.

-

Recent Upgrades and Downgrades: Keep a close eye on recent upgrades or downgrades from prominent analyst firms. These actions often reflect new information or a shifting perspective on the company's prospects, directly influencing Palantir stock price movements. A chart illustrating the stock's performance over the past three to six months can help visualize this volatility and identify key trend shifts. (Insert chart here)

Key Factors Influencing Palantir Stock Price

Several key factors significantly influence Palantir's stock price, making it crucial to understand them before making any investment decisions.

-

Financial Performance: Palantir's revenue growth and profitability are pivotal. Consistent revenue growth, coupled with improvements in profitability margins, would generally boost investor confidence and drive up the Palantir stock price. Conversely, disappointing financial results can trigger sell-offs.

-

Government Contracts vs. Commercial Partnerships: Palantir's substantial reliance on government contracts presents both opportunities and risks. While lucrative, these contracts can be subject to delays, budget constraints, and political shifts. Growth in commercial partnerships diversifies revenue streams and reduces reliance on government funding, which is viewed positively by many investors.

-

Competitive Landscape: The data analytics market is highly competitive. Palantir faces established players and emerging competitors, all vying for market share. Its ability to innovate, differentiate its offerings, and secure a significant market position directly impacts investor sentiment towards Palantir stock.

-

Key Factors in Detail:

- Recent Contract Wins/Losses: Major contract wins, particularly large government contracts, can significantly boost Palantir stock. Conversely, losing major contracts can trigger negative market reactions.

- Product Launches and Advancements: The launch of new products or significant technological advancements can enhance Palantir's competitive edge, potentially increasing investor interest and driving up the Palantir stock price.

- Competitor Analysis: Understanding the competitive landscape, including the market share of competitors such as Snowflake, Databricks, and others, is essential to assess Palantir's position and growth potential.

- Market Conditions: The overall market conditions for data analytics software are equally vital. Strong market growth generally benefits all players, while a downturn can negatively impact even the strongest companies.

Understanding the May 5th Deadline (if applicable)

Let's assume that May 5th marks the release of Palantir's next quarterly earnings report. This event is a significant catalyst for potential stock price fluctuations.

-

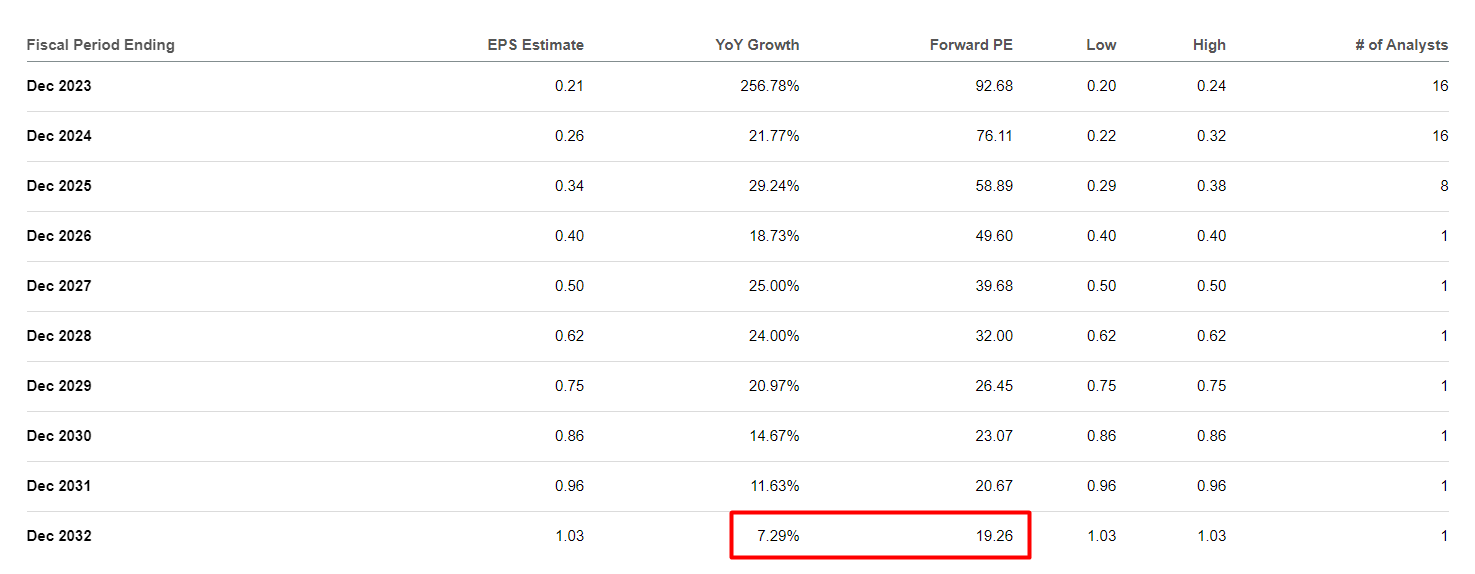

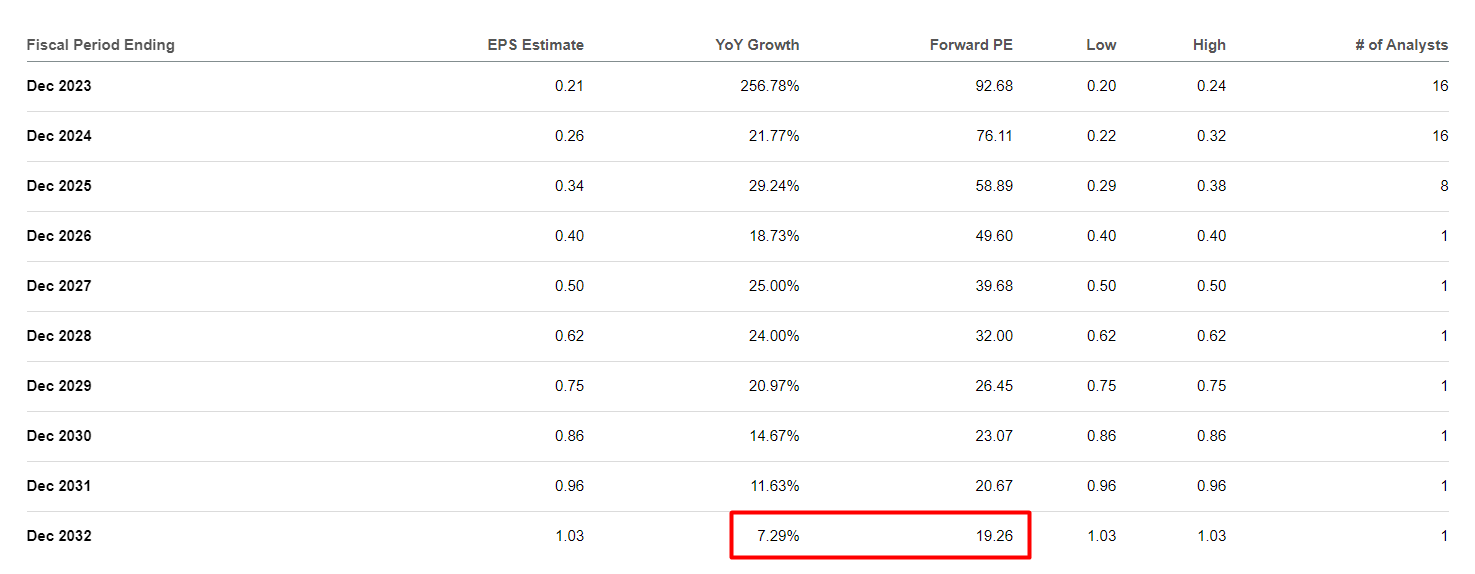

Earnings Report Impact: The earnings report will reveal crucial financial data, including earnings per share (EPS), revenue growth, and future guidance. Positive surprises often lead to price increases, while negative surprises can trigger sell-offs.

-

Key Metrics to Watch: Investors should carefully analyze EPS, revenue growth compared to previous quarters and analyst expectations, and the company's forward-looking guidance for future performance. Any significant changes in these metrics will likely influence Palantir stock's trajectory.

-

Historical Context: Review Palantir's past reactions to similar earnings releases to gauge potential market responses. Understanding historical patterns can offer clues about how the market might react to this specific report.

Risk Assessment of Investing in Palantir Stock

Investing in Palantir stock carries inherent risks.

-

Volatility: Palantir's stock price is known for its volatility, meaning substantial price swings in short periods. This inherent risk is crucial for investors to understand and accept.

-

Government Contract Dependence: A significant portion of Palantir's revenue comes from government contracts. This dependence introduces risks related to budget cuts, contract delays, and potential changes in government priorities.

-

Long-Term Growth Potential: Despite the risks, Palantir operates in a rapidly growing data analytics market with substantial long-term growth potential. Its innovative technology and strategic partnerships could drive significant future value creation.

-

Risk Assessment Details:

- Downsides: Potential downsides include missed earnings expectations, loss of key contracts, increased competition, and slow revenue growth.

- Risk Tolerance: Investing in Palantir stock requires a high-risk tolerance due to its volatility and reliance on government contracts.

- Alternatives: Consider diversifying your portfolio with investments in other sectors or less volatile stocks to mitigate risk.

Conclusion

The decision of whether to buy, sell, or hold Palantir stock before May 5th is a personal one based on your individual risk tolerance and investment strategy. Wall Street analysts offer a diverse range of opinions, highlighting the uncertainty surrounding the stock's future trajectory. Key factors such as financial performance, government contracts, competition, and the upcoming earnings report (if applicable) all significantly influence Palantir stock price. By carefully considering the factors outlined in this article, you can make a more informed decision about your Palantir stock investment. Conduct your own thorough research and consult with a financial advisor before making any investment decisions. Remember to carefully weigh the potential risks and rewards before investing in any Palantir shares or any other PLTR stock.

Featured Posts

-

Harassment Case Polish Woman And Friend Deny Targeting Mc Cann Family Residence

May 09, 2025

Harassment Case Polish Woman And Friend Deny Targeting Mc Cann Family Residence

May 09, 2025 -

Vegas Golden Nayts Pobezhdaet Minnesotu V Overtayme Pley Off

May 09, 2025

Vegas Golden Nayts Pobezhdaet Minnesotu V Overtayme Pley Off

May 09, 2025 -

Draisaitls Injury Update On Edmonton Oilers Leading Scorer

May 09, 2025

Draisaitls Injury Update On Edmonton Oilers Leading Scorer

May 09, 2025 -

Fiery Exchange Fox News Hosts Debate Trump Tariffs

May 09, 2025

Fiery Exchange Fox News Hosts Debate Trump Tariffs

May 09, 2025 -

Family Support For Dakota Johnson At Materialist Film Premiere

May 09, 2025

Family Support For Dakota Johnson At Materialist Film Premiere

May 09, 2025