Should You Buy The Dip? Palantir Stock's 30% Decline

Table of Contents

Understanding Palantir's Recent Stock Performance

Palantir's stock price experienced a sharp decline, shedding roughly 30% of its value between [Start Date] and [End Date]. This significant drop wasn't isolated; it mirrored a broader market downturn affecting many tech stocks. However, several Palantir-specific factors contributed to the severity of its fall. Investor sentiment shifted negatively following [mention specific news, e.g., a less-than-stellar earnings report, concerns about future growth, or a significant contract loss]. This negative sentiment was amplified by broader macroeconomic anxieties surrounding [mention relevant macroeconomic factors, e.g., inflation, interest rate hikes].

- Specific Dates and Percentages: The decline started on [Specific Start Date], with the stock price falling from $[Price] to $[Price] by [Specific End Date], representing a [Percentage]% decrease.

- Relevant News and Press Releases: [Link to relevant news article 1] and [Link to relevant news article 2] highlight concerns around [mention specific concerns raised in the news].

- Analyst Downgrades: Several analysts downgraded their price targets for Palantir, citing [mention reasons for downgrades, e.g., concerns about revenue growth, increased competition].

Analyzing Palantir's Fundamentals

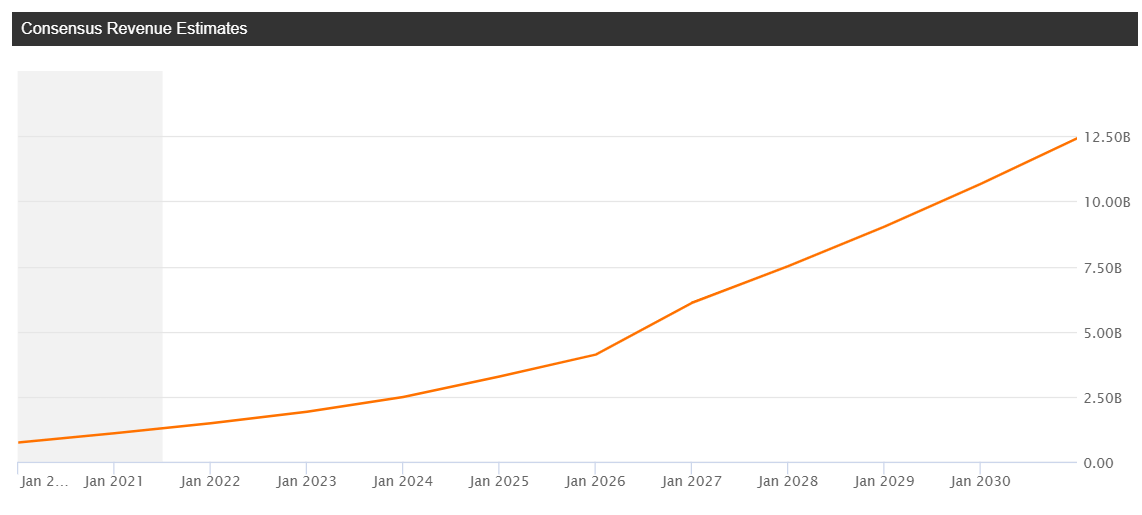

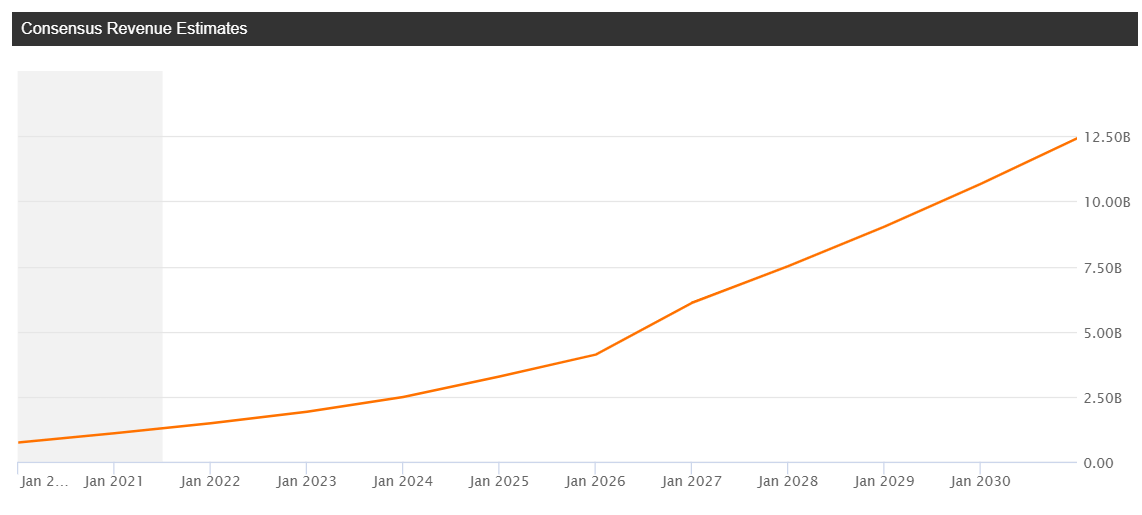

While the recent stock price drop is alarming, it's crucial to analyze Palantir's underlying fundamentals to assess the long-term viability of the company. Palantir continues to demonstrate significant revenue growth, albeit at a slowing pace compared to previous years. Profitability remains a challenge, with the company still operating at a net loss. However, its substantial cash reserves and relatively low debt levels offer a degree of financial stability. Palantir operates in a highly competitive market dominated by established players like Databricks and Snowflake, yet it maintains a strong position in the government and defense sectors.

- Key Financial Figures: Palantir's Q[Quarter] [Year] report showed revenue of $[Revenue Figure], with a net loss of $[Net Loss Figure]. [Link to the financial report].

- Competitive Landscape: Palantir faces stiff competition from cloud-based data analytics companies like Snowflake and Databricks, but its niche expertise in government and defense contracts provides a competitive advantage.

- Strengths and Weaknesses: Palantir's strengths lie in its proprietary technology and strong government partnerships. Weaknesses include its high valuation relative to profits and dependence on a relatively small number of large clients.

Assessing the Risk and Reward of Buying the Dip

Buying the dip in Palantir stock presents both significant risks and potential rewards. The risks include the possibility of further price declines if the company fails to meet expectations or if broader market conditions worsen. However, the potential reward lies in the possibility of significant capital appreciation if the stock price rebounds. The decision hinges on individual risk tolerance and investment horizon.

- Potential Upside and Downside Scenarios: A best-case scenario might see Palantir exceeding revenue expectations and achieving profitability, leading to a significant stock price increase. A worst-case scenario might involve further revenue slowdowns, impacting investor confidence and leading to further price declines.

- Impact of Macroeconomic Factors: Interest rate hikes and potential recessionary pressures could continue to negatively impact Palantir's stock price.

- Investment Strategies: Long-term investors with a high-risk tolerance might view this as an opportunity to buy shares at a discounted price. Short-term investors might prefer to wait for greater clarity on the company's future performance.

Alternative Investment Strategies

For investors hesitant about buying Palantir at its current price, several alternatives exist. Dollar-cost averaging, a strategy involving regular investments regardless of price fluctuations, can mitigate risk. Alternatively, waiting for further price declines could offer a potentially more attractive entry point.

- Dollar-Cost Averaging: This strategy reduces the impact of market volatility by spreading investments over time. [Link to resource on dollar-cost averaging].

- Waiting for Further Price Drops: A more conservative approach involves monitoring the stock price and waiting for a clearer indication of a bottom before investing.

Conclusion

Palantir's recent 30% stock decline is a complex event influenced by both company-specific factors and broader market conditions. While the company shows promise in terms of revenue growth and technological innovation, the risks associated with investing in Palantir at its current price are substantial. The decision of whether to buy the dip in Palantir stock is a complex one requiring careful consideration of the factors discussed above. Before making any investment decisions, conduct thorough research, consult with a financial advisor, and carefully assess your own risk tolerance. Remember, investing in Palantir, or any stock, involves inherent risk. Do your due diligence before buying the dip in Palantir stock.

Featured Posts

-

Activist Suggests Live Womb Transplants For Transgender Mothers

May 10, 2025

Activist Suggests Live Womb Transplants For Transgender Mothers

May 10, 2025 -

Pam Bondi Laughs James Comers Epstein Files Accusations And Bondis Response

May 10, 2025

Pam Bondi Laughs James Comers Epstein Files Accusations And Bondis Response

May 10, 2025 -

Transgender Equality In Thailand The Bangkok Post Reports On Increasing Advocacy

May 10, 2025

Transgender Equality In Thailand The Bangkok Post Reports On Increasing Advocacy

May 10, 2025 -

Trumps Transgender Military Ban A Critical Analysis Of The Rhetoric

May 10, 2025

Trumps Transgender Military Ban A Critical Analysis Of The Rhetoric

May 10, 2025 -

Dakota Johnson And Family At Materialist La Screening

May 10, 2025

Dakota Johnson And Family At Materialist La Screening

May 10, 2025