Should You Buy XRP Now? Analyzing The Recent 400% Price Increase

Table of Contents

Keywords: XRP, XRP price, buy XRP, XRP investment, Ripple, cryptocurrency investment, XRP price prediction, should I buy XRP, 400% XRP price increase

The cryptocurrency market is notoriously volatile, and recent weeks have witnessed a dramatic example: XRP, Ripple's native cryptocurrency, experienced a staggering 400% price surge. This significant price jump has left many investors wondering: should I buy XRP now? This article delves into the factors behind this impressive rally, analyzing the potential benefits and risks to help you make an informed decision about whether to invest in XRP.

The 400% XRP Price Surge: Understanding the Phenomenon

XRP's recent price increase has been nothing short of spectacular. Between [Start Date] and [End Date], the price of XRP rose from approximately $[Starting Price] to $[Peak Price], representing a remarkable 400% increase. Several factors contributed to this dramatic rise.

- Specific Dates and Percentage Changes: [Insert specific dates and percentage changes for different periods within the surge. Example: "Between July 1st and July 15th, XRP saw a 150% increase, followed by another 250% surge by July 31st."]

- Relevant News Articles and Announcements: [Link to and briefly describe relevant news articles and announcements that might have influenced the price, such as court filings related to the Ripple lawsuit or major partnerships announced by Ripple.] Examples include: [Insert links and brief descriptions]

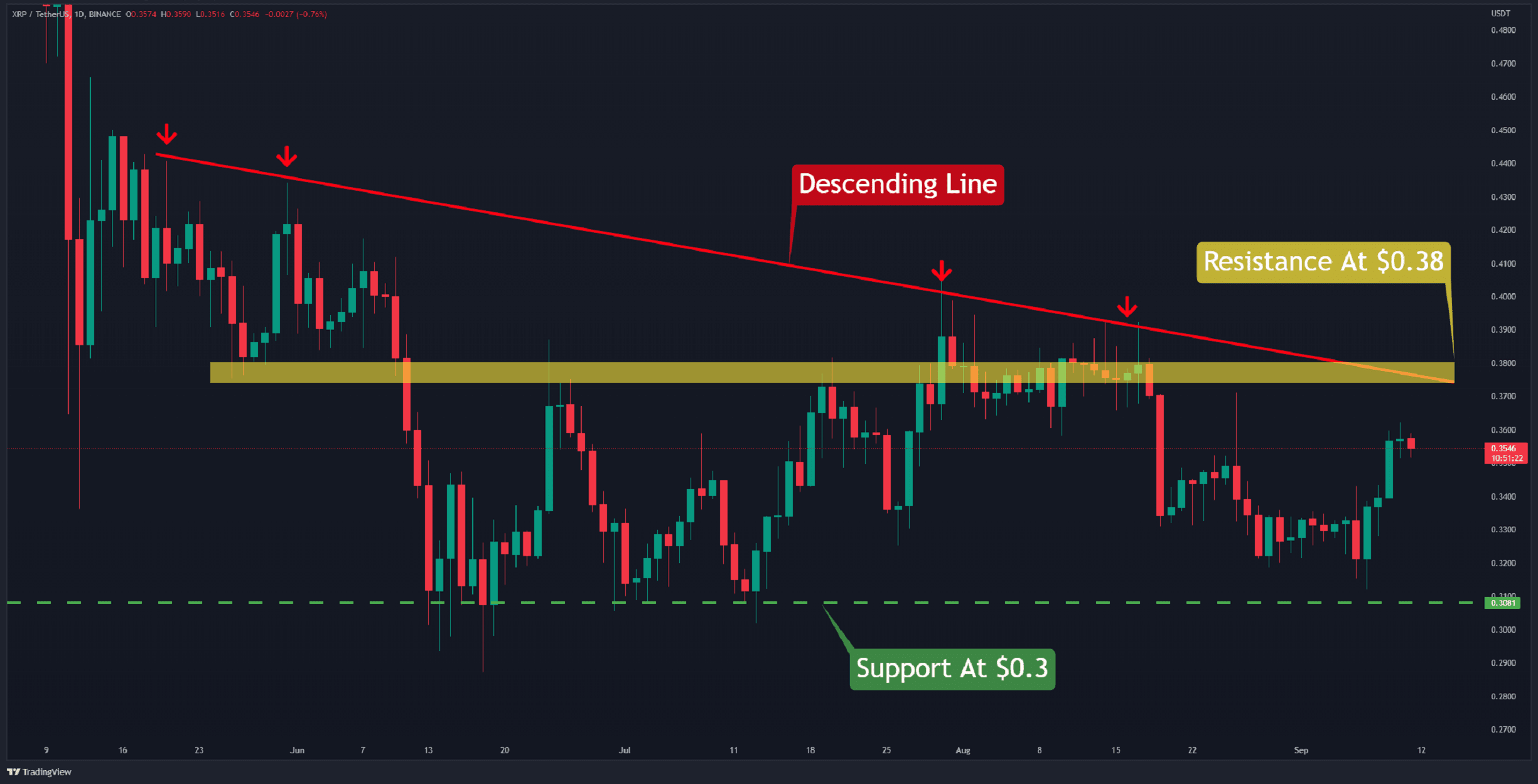

- Charts Illustrating the Price Movement: [Insert a chart visualizing the XRP price movement during the period in question. Clearly label axes and highlight key milestones.]

Factors Influencing XRP's Price Volatility

Several interwoven factors contribute to XRP's notoriously volatile price. Understanding these factors is crucial for assessing the current investment climate.

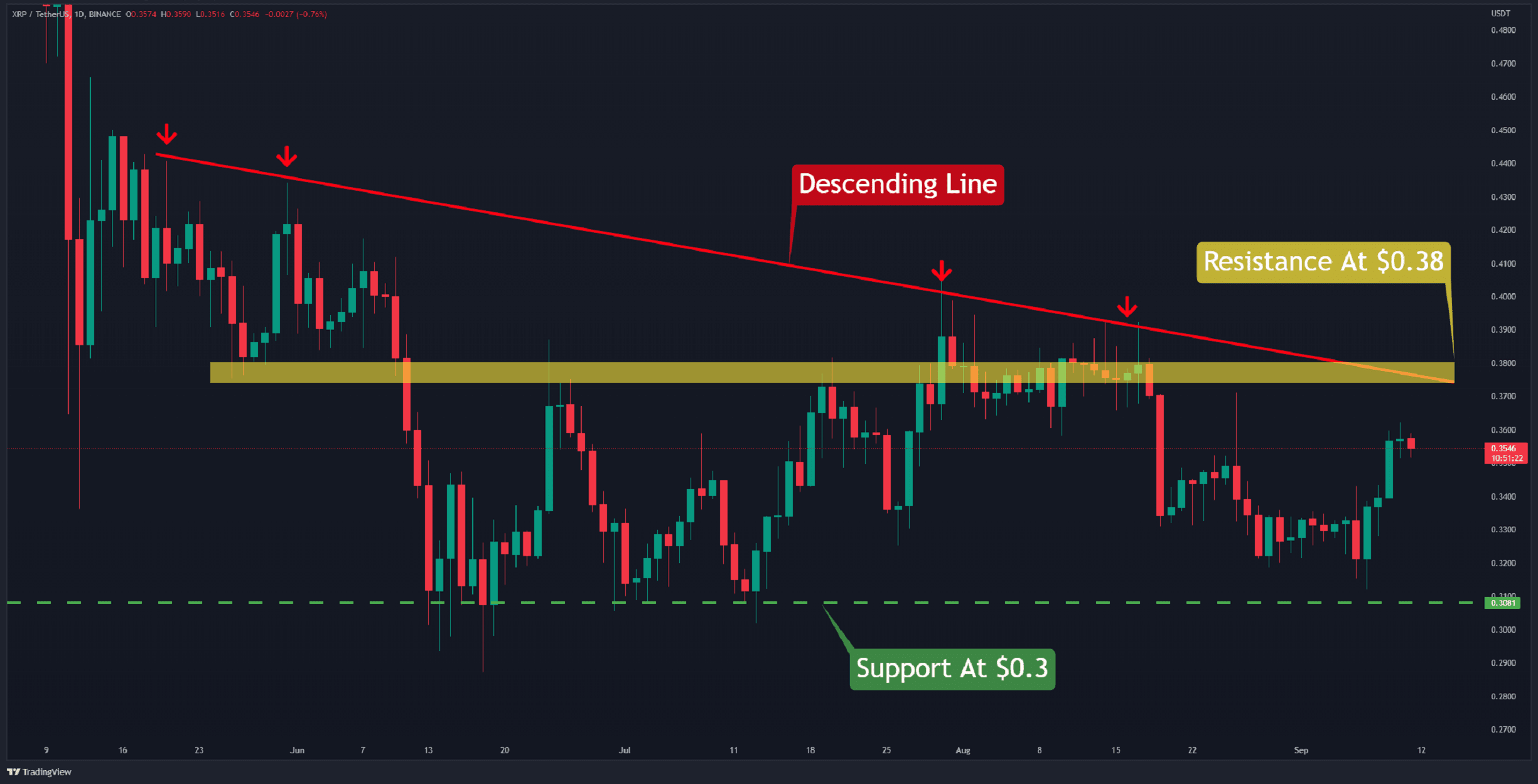

The Ripple Lawsuit and its Impact

The ongoing legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) significantly influences XRP's price. Positive developments in the case, such as favorable court rulings or settlements, generally lead to price increases, reflecting increased investor confidence. Conversely, negative news can trigger sharp drops.

- Court Proceedings and Potential Outcomes: [Summarize key court proceedings and their potential implications for XRP. Discuss the arguments presented by both sides and potential outcomes like a settlement or a court decision.]

- Impact on Investor Confidence: [Explain how different court decisions or news related to the lawsuit impact investor sentiment and, consequently, the XRP price.]

- Expert Opinions and Legal Analysis: [Mention opinions from legal experts and analysts regarding the likelihood of different outcomes in the lawsuit and their potential effects on XRP.]

Market Sentiment and Speculation

Market sentiment and speculation play a crucial role in driving XRP's price. The overall cryptocurrency market's performance, Bitcoin's price in particular, influences investor appetite for altcoins like XRP.

- Bitcoin's Price and Overall Crypto Market Capitalization: [Explain the correlation between Bitcoin's price and XRP's price. Discuss how changes in the overall crypto market capitalization impact XRP.]

- Social Media Sentiment and News Coverage: [Analyze social media trends and news coverage related to XRP. Mention the role of FOMO (fear of missing out) in driving price increases.]

- Speculative Trading: [Discuss the impact of speculative trading and the potential for price bubbles based on speculation rather than fundamental value.]

Technological Developments and Adoption

Technological advancements and increased adoption of XRP also impact its price. RippleNet, Ripple's payment network, continues to expand its partnerships, increasing the utility and demand for XRP.

- RippleNet's Progress and Partnerships: [Highlight RippleNet's recent progress and new partnerships. Show how this expansion increases XRP's real-world usage and potential for future growth.]

- New Use Cases for XRP: [Mention any emerging use cases for XRP beyond cross-border payments. Discuss potential applications in areas like supply chain management or decentralized finance (DeFi).]

- Potential as a Bridge Currency: [Discuss XRP's potential role as a bridge currency facilitating faster and cheaper cross-border transactions between different cryptocurrencies.]

Assessing the Risks and Rewards of Investing in XRP Now

Deciding whether to buy XRP now requires carefully weighing the potential upsides against the inherent risks.

Potential Upsides

Investing in XRP at this stage offers several potential benefits.

- Potential Long-Term Growth: [Discuss the possibility of long-term growth based on RippleNet's expansion and the increasing adoption of XRP.]

- Further Price Appreciation: [While predicting future price movements is impossible, discuss the possibility of further price appreciation based on positive developments in the lawsuit or increased market adoption.]

- High Returns on Investment: [Acknowledge the potential for high returns on investment, but emphasize that this comes with significant risk.]

Potential Downsides

Investing in XRP carries substantial risks.

- Volatility of Cryptocurrencies: [Emphasize the inherent volatility of the cryptocurrency market and the possibility of significant price drops.]

- Regulatory Uncertainty: [Highlight the ongoing regulatory uncertainty surrounding cryptocurrencies and its potential impact on XRP's price.]

- Risk of Losing Investment Capital: [Clearly state the risk of losing all or part of your investment capital.]

Diversification and Risk Management

Diversification and risk management are crucial when investing in cryptocurrencies like XRP.

- Dollar-Cost Averaging: [Explain how dollar-cost averaging can mitigate risk by spreading investments over time.]

- Only Invest What You Can Afford to Lose: [Strongly emphasize this crucial point to protect investors from financial hardship.]

Conclusion

XRP's recent 400% price surge is a complex event driven by a confluence of factors, including positive developments in the Ripple lawsuit, positive market sentiment, and increasing adoption. While the potential for high returns exists, significant risks remain, primarily due to the inherent volatility of cryptocurrencies and ongoing regulatory uncertainty. Ultimately, the decision of whether or not to buy XRP is a personal one, dependent on your risk tolerance and investment strategy. Conduct thorough research and carefully consider the information presented before making any decisions about buying XRP. Remember to always invest responsibly and only what you can afford to lose.

Featured Posts

-

Ripple Vs Sec What Xrp Investors Need To Know Today

May 01, 2025

Ripple Vs Sec What Xrp Investors Need To Know Today

May 01, 2025 -

Holdens Shocking Revelation Davina Mc Calls Cancer Battle

May 01, 2025

Holdens Shocking Revelation Davina Mc Calls Cancer Battle

May 01, 2025 -

Centenarian Dallas Star Passes Away

May 01, 2025

Centenarian Dallas Star Passes Away

May 01, 2025 -

Bbcs Dragons Den Airs Old Episode Featuring Defunct Company

May 01, 2025

Bbcs Dragons Den Airs Old Episode Featuring Defunct Company

May 01, 2025 -

Toppins 21 Points Power Colorados Matchup Against Texas Tech

May 01, 2025

Toppins 21 Points Power Colorados Matchup Against Texas Tech

May 01, 2025

Latest Posts

-

Canadian Federal Election Poilievres Seat In Question

May 01, 2025

Canadian Federal Election Poilievres Seat In Question

May 01, 2025 -

Analysis Pierre Poilievres Electoral Setback In Canada

May 01, 2025

Analysis Pierre Poilievres Electoral Setback In Canada

May 01, 2025 -

China Lifes Successful Investment Strategy Higher Profits

May 01, 2025

China Lifes Successful Investment Strategy Higher Profits

May 01, 2025 -

Canada Election Results Poilievres Unexpected Loss

May 01, 2025

Canada Election Results Poilievres Unexpected Loss

May 01, 2025 -

How Strong Investments Helped China Life Increase Profits

May 01, 2025

How Strong Investments Helped China Life Increase Profits

May 01, 2025