Should You Buy XRP (Ripple) Right Now While It's Under $3?

Table of Contents

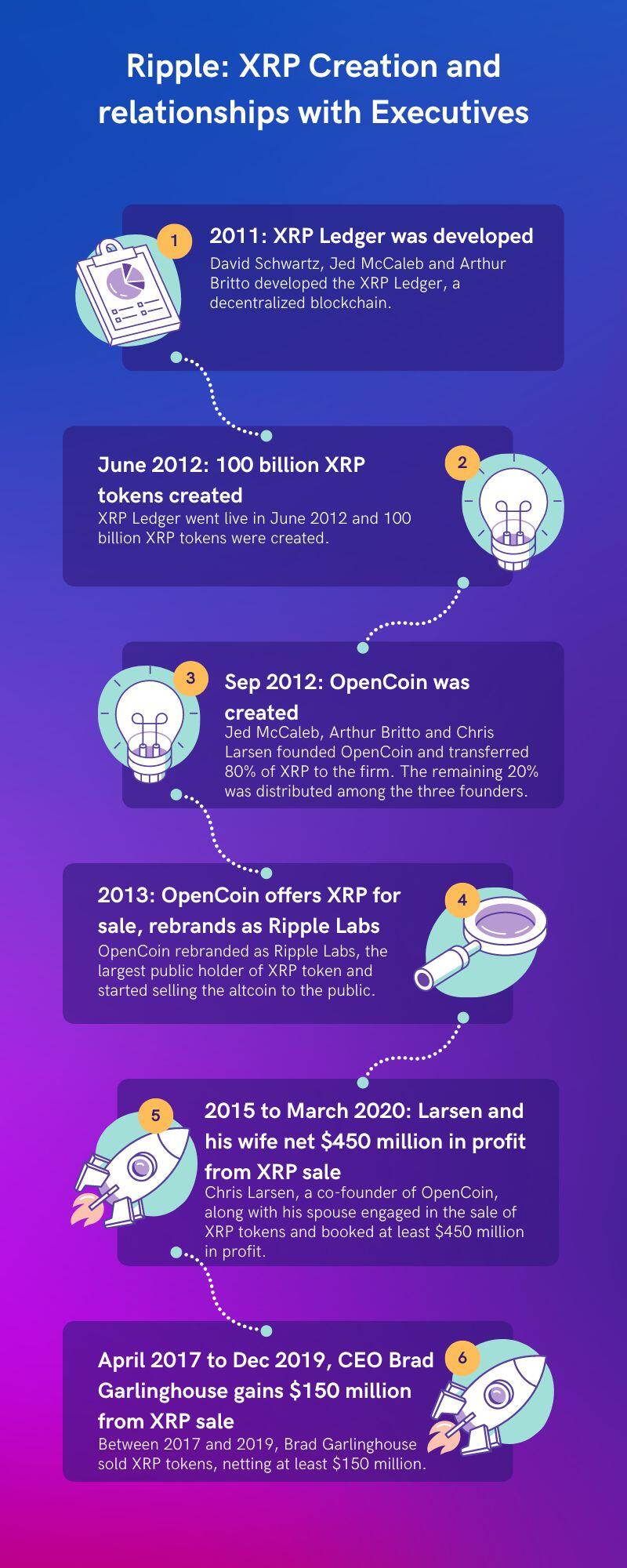

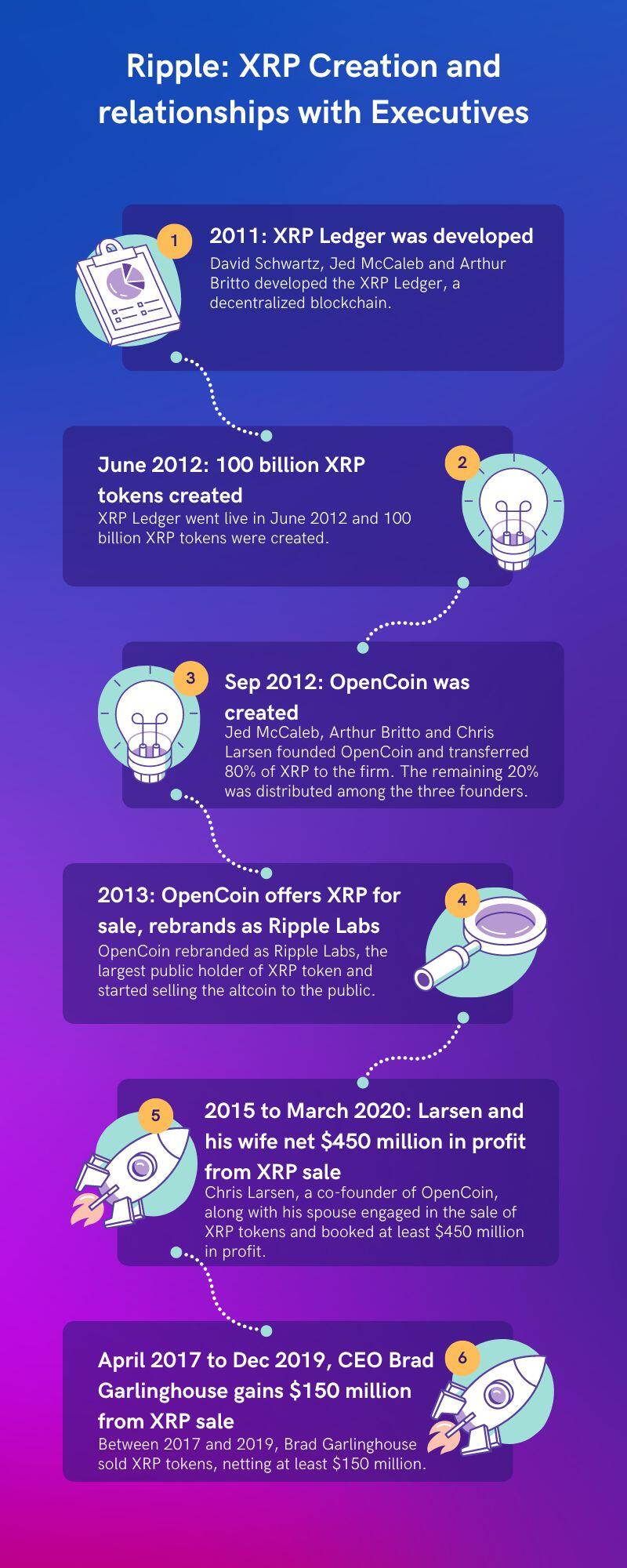

Ripple's Current Legal Battle and Its Impact on XRP Price

The SEC Lawsuit

The ongoing SEC lawsuit against Ripple Labs is the elephant in the room when considering XRP. The Securities and Exchange Commission alleges that Ripple sold unregistered securities in the form of XRP. The potential outcomes significantly impact XRP's price.

- Ripple Wins: A favorable ruling could send XRP's price soaring, potentially unlocking substantial gains for investors. This scenario suggests a positive regulatory environment and increased market confidence.

- SEC Wins: A victory for the SEC could severely depress XRP's price, potentially leading to significant losses. This outcome would likely involve heavy regulatory scrutiny and a negative impact on investor sentiment.

- Settlement: A negotiated settlement could result in a range of outcomes, depending on the terms agreed upon. This scenario offers less certainty but could still significantly affect the short-term and long-term XRP price trajectory.

Analyzing expert opinions and market sentiment surrounding the Ripple SEC lawsuit is crucial. Many legal experts offer varying predictions, highlighting the uncertainty surrounding this case. The ongoing legal battle represents significant regulatory uncertainty, a key factor influencing XRP's price volatility. You can find updates on the lawsuit through links to relevant news articles and legal documents (links would be inserted here in a real-world article). SEO Keywords: Ripple SEC lawsuit, XRP lawsuit update, regulatory uncertainty, SEC vs Ripple.

Analyzing XRP's Technical and Fundamental Aspects

Technical Analysis

Examining XRP's technical indicators offers valuable insight into potential price movements. Current chart patterns, support and resistance levels, and trading volume are key factors to analyze. Indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) can provide signals about potential price trends.

- Support and Resistance Levels: Identifying key support and resistance levels on the XRP chart helps predict potential price reversals or breakouts.

- Trading Volume: High trading volume often accompanies significant price movements, indicating strong buying or selling pressure.

- Technical Indicators: Analyzing indicators like RSI and MACD can help determine overbought or oversold conditions, suggesting potential price corrections or continuations.

(In a real-world article, charts and graphs illustrating these technical indicators would be included here). Remember that technical analysis is not a foolproof method and should be combined with other forms of analysis. SEO Keywords: XRP technical analysis, XRP chart patterns, XRP trading volume, cryptocurrency technical indicators.

Fundamental Analysis

Ripple's technology, partnerships, and potential for growth form the foundation of its fundamental analysis.

- RippleNet Adoption: The broader adoption of RippleNet, Ripple's payment solution, positively impacts XRP's utility and potential long-term value. The increasing number of financial institutions using RippleNet suggests growing demand for XRP.

- XRP Use Cases: XRP's use in cross-border payments and other financial transactions contributes to its inherent value. Its speed and efficiency compared to traditional payment systems are key selling points.

- Ripple Partnerships: Strategic partnerships with banks and financial institutions strengthen Ripple's position within the financial industry. These partnerships bolster XRP’s potential for mainstream adoption.

These fundamental factors suggest a potentially bullish outlook for XRP, but the legal uncertainty remains a significant counterweight. SEO Keywords: RippleNet adoption, XRP use cases, Ripple partnerships, XRP fundamentals, blockchain technology.

Risk Assessment and Investment Strategies

Understanding the Risks

Investing in cryptocurrencies, especially XRP, involves substantial risks.

- Price Volatility: XRP's price is highly volatile, subject to rapid and unpredictable fluctuations.

- Regulatory Risks: The ongoing SEC lawsuit and potential future regulatory actions pose significant risks.

- Market Manipulation: The cryptocurrency market is susceptible to manipulation, potentially impacting XRP's price.

To mitigate these risks, consider these strategies:

- Diversification: Spread your investments across different asset classes to reduce overall risk.

- Dollar-Cost Averaging: Invest a fixed amount of money regularly, regardless of price fluctuations.

- Stop-Loss Orders: Set stop-loss orders to limit potential losses if the price falls below a certain threshold. SEO Keywords: XRP risk assessment, cryptocurrency risks, investment strategies, risk mitigation, dollar-cost averaging.

Investment Strategies for XRP

Several approaches to investing in XRP exist, depending on your risk tolerance and investment goals.

- Long-Term Holding: This strategy involves holding XRP for an extended period, aiming to benefit from long-term growth potential. It's best suited for investors with higher risk tolerance and a longer time horizon.

- Short-Term Trading: This strategy involves frequent buying and selling of XRP, aiming to capitalize on short-term price fluctuations. This approach is much riskier and requires more active market monitoring.

Choosing the right strategy is crucial and depends on your individual circumstances. SEO Keywords: XRP investment strategy, long-term XRP investment, short-term XRP trading.

Conclusion

Should you buy XRP (Ripple) right now while it's under $3? The decision is complex. While XRP offers potential growth based on its technology and use cases, the significant risk stemming from the ongoing SEC lawsuit cannot be ignored. A favorable outcome could lead to substantial gains, but an unfavorable ruling could result in significant losses. We've analyzed XRP's technical and fundamental aspects, identified key risks, and explored various investment strategies.

Ultimately, the decision of whether to buy XRP (Ripple) right now while it's under $3 is yours. Make sure to conduct your own in-depth research before investing, considering your risk tolerance and investment goals. Remember, this is not financial advice. SEO Keywords: XRP investment decision, XRP research, buy XRP, invest in XRP.

Featured Posts

-

Another Dallas Star Passes Remembering The 80s Soap Icon

May 01, 2025

Another Dallas Star Passes Remembering The 80s Soap Icon

May 01, 2025 -

Dragons Den What Investors Look For In A Deal

May 01, 2025

Dragons Den What Investors Look For In A Deal

May 01, 2025 -

Shrimp Ramen Stir Fry Flavorful And Fun

May 01, 2025

Shrimp Ramen Stir Fry Flavorful And Fun

May 01, 2025 -

The Truth About Michael Sheens Million Pound Charity Initiative

May 01, 2025

The Truth About Michael Sheens Million Pound Charity Initiative

May 01, 2025 -

How To Prepare A Winning Dragons Den Pitch

May 01, 2025

How To Prepare A Winning Dragons Den Pitch

May 01, 2025

Latest Posts

-

Local Dallas Star Dies At 100

May 01, 2025

Local Dallas Star Dies At 100

May 01, 2025 -

Veteran Dallas Star Passes Away Aged 100

May 01, 2025

Veteran Dallas Star Passes Away Aged 100

May 01, 2025 -

Dallas Stars Passing At Age 100

May 01, 2025

Dallas Stars Passing At Age 100

May 01, 2025 -

100 Year Old Dallas Star Dead

May 01, 2025

100 Year Old Dallas Star Dead

May 01, 2025 -

Legendary Dallas Figure Dies At 100

May 01, 2025

Legendary Dallas Figure Dies At 100

May 01, 2025