Should You Invest In Palantir Before May 5th? A Wall Street Forecast

Table of Contents

Palantir's Q1 2024 Earnings Forecast and its Impact on Stock Price

Palantir's upcoming Q1 2024 earnings report will be a pivotal moment for the company and its shareholders. The results will significantly influence the Palantir stock price, making pre-earnings analysis crucial for investors considering a Palantir investment. Wall Street analysts are closely scrutinizing several key factors:

-

Expected Revenue Growth: Analysts' forecasts vary, but the general expectation is for continued revenue growth, albeit possibly at a slower pace than previous quarters. This growth will heavily depend on the success of securing new government contracts and expanding its presence in the commercial sector.

-

Projected Earnings Per Share (EPS): The projected EPS is another critical metric. A beat on EPS expectations could send the Palantir stock price soaring, while a miss could trigger a significant downturn.

-

Impact on Stock Price: The market's reaction will hinge on whether Palantir meets or exceeds expectations. A positive surprise could result in a substantial price increase, while a negative surprise might lead to a sell-off. This underscores the importance of managing your risk when considering a Palantir investment.

-

Analyst Ratings and Price Targets: Keep an eye on analyst ratings and price targets. These offer insights into the collective sentiment and predictions for Palantir's future performance and directly influence whether investors consider a Palantir investment worthwhile.

Analyzing Palantir's Long-Term Growth Potential

Beyond the immediate earnings report, Palantir's long-term prospects are crucial for any serious Palantir investment strategy. The company's focus on AI-powered data analytics positions it favorably within the rapidly evolving tech landscape. Several factors contribute to its potential for sustained growth:

-

Key Growth Drivers: Government contracts remain a cornerstone of Palantir's revenue, but expansion into commercial sectors like healthcare and finance offers significant upside. Its Foundry platform is also a key driver, offering a scalable solution for various data analytics needs.

-

Market Share Analysis: Palantir is actively competing in a crowded market. However, its strong brand recognition, advanced technology, and government relationships give it a considerable competitive edge.

-

Technological Innovation: Continuous innovation in AI and data analytics is key to Palantir's long-term success. Its ability to adapt and integrate new technologies will be critical to maintaining its market position.

Understanding the Risks Associated with Investing in Palantir

While Palantir offers significant potential, investing in Palantir before May 5th, or any time, involves inherent risks:

-

Market Volatility: The tech sector, and particularly growth stocks like Palantir, are susceptible to market fluctuations. A downturn in the broader market could significantly impact the Palantir stock price.

-

Financial Health and Debt: Analyzing Palantir's financial statements – including its debt levels and cash flow – is crucial for assessing its financial stability.

-

Competitive Landscape: The data analytics market is highly competitive, with established players and new entrants constantly vying for market share. Palantir faces ongoing challenges from competitors with substantial resources.

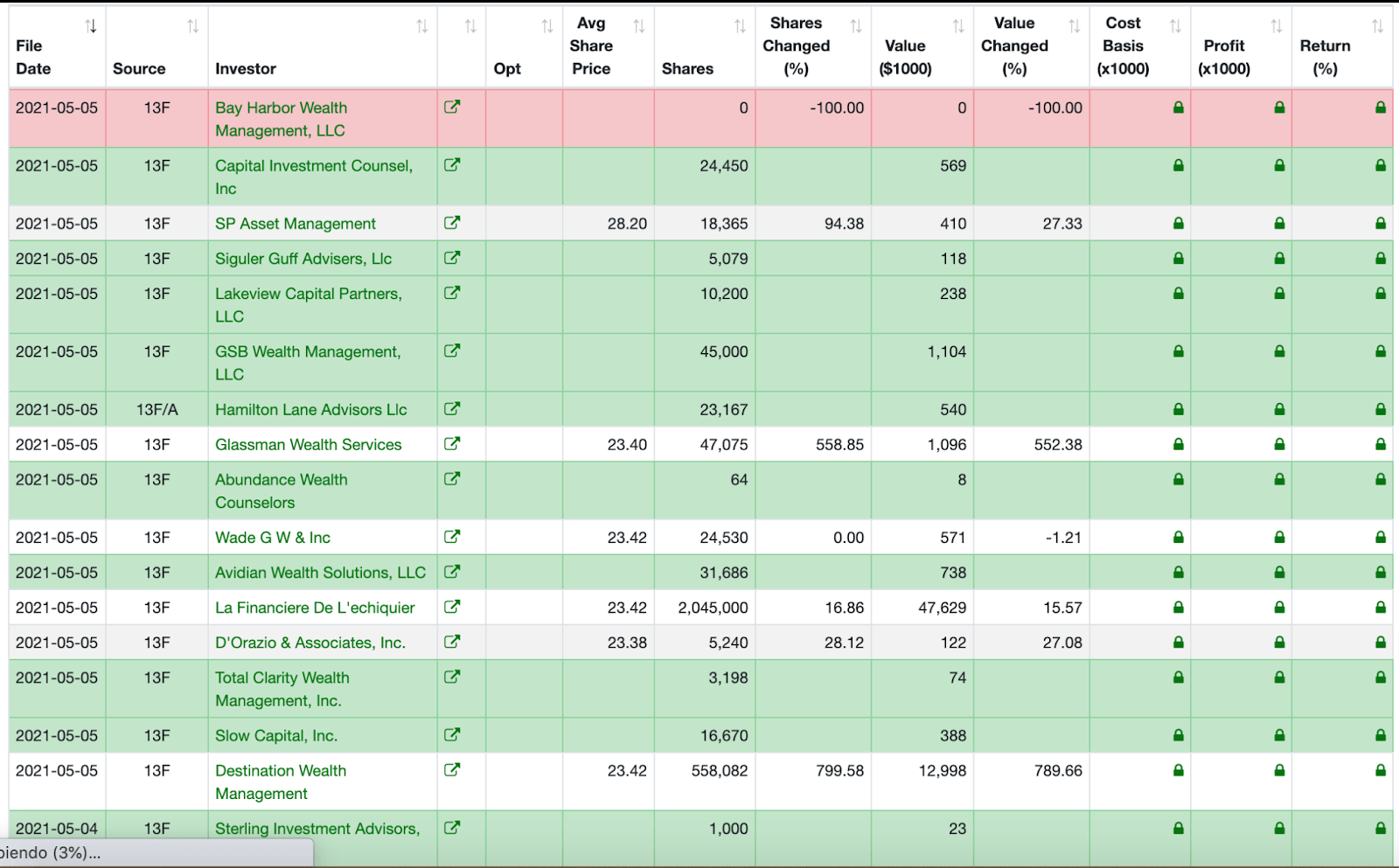

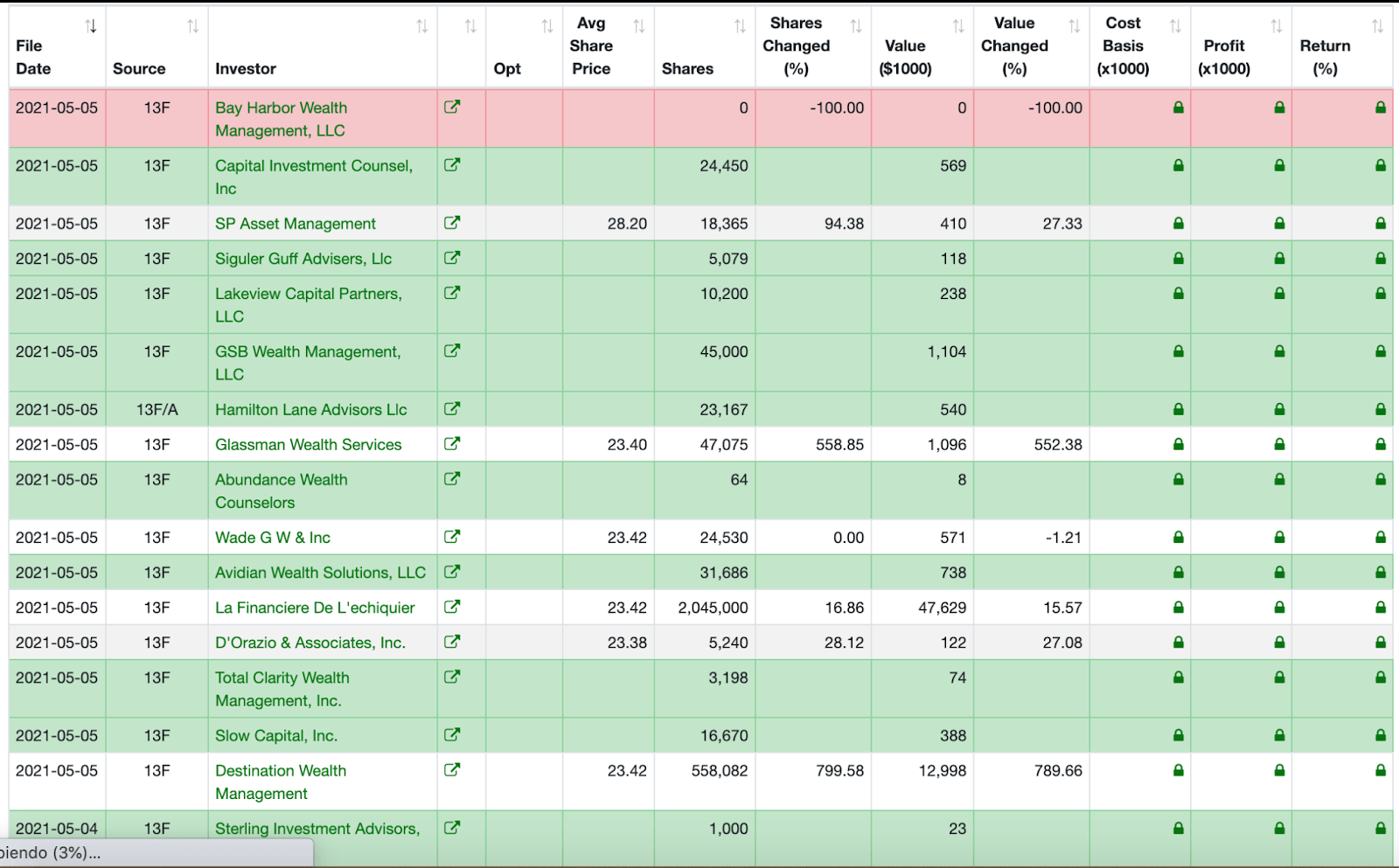

Expert Opinions and Wall Street Sentiment Towards Palantir

Wall Street sentiment towards Palantir is mixed, with a range of opinions from bullish to bearish. While some analysts remain optimistic about its long-term potential, others express concerns about its valuation and profitability. Understanding the diverse perspectives is crucial before making a Palantir investment.

-

Analyst Reports: Carefully reviewing analyst reports provides valuable insights into their rationale and price target predictions. These reports often offer detailed financial modeling and competitive analysis.

-

Expert Predictions: Following reputable financial news sources and expert commentary helps you gauge the overall sentiment and identify potential risks and opportunities.

-

Consensus View: While there's no single consensus, identifying the prevailing sentiment helps assess the level of risk associated with a Palantir investment.

Should You Invest in Palantir Before May 5th? A Final Verdict

The decision of whether to invest in Palantir before May 5th requires careful consideration of the potential rewards and risks. While the company's long-term prospects look promising, the short-term volatility associated with earnings reports and market fluctuations needs to be acknowledged. A wait-and-see approach following the earnings release might be prudent for some investors, allowing for a clearer picture of Palantir's financial performance and market sentiment. However, a cautiously optimistic stance might be suitable for long-term investors with a higher risk tolerance. Conduct thorough research and consider your own risk tolerance before making any investment decisions. Should you invest in Palantir? The answer depends on your individual circumstances and investment goals. Remember to consult a financial advisor for personalized advice. Learn more about Palantir investment strategies by [linking to relevant resources].

Featured Posts

-

Dijon Psg Le Resume Du Match D Arkema Premiere Ligue

May 09, 2025

Dijon Psg Le Resume Du Match D Arkema Premiere Ligue

May 09, 2025 -

Elizabeth Arden Skincare On A Budget Walmart Guide

May 09, 2025

Elizabeth Arden Skincare On A Budget Walmart Guide

May 09, 2025 -

Mild Vinter Forer Til Tidlig Stenging Av Skisentre

May 09, 2025

Mild Vinter Forer Til Tidlig Stenging Av Skisentre

May 09, 2025 -

El Salvadors Gang Violence Kilmar Abrego Garcias Flight And Us Political Impact

May 09, 2025

El Salvadors Gang Violence Kilmar Abrego Garcias Flight And Us Political Impact

May 09, 2025 -

Jeanine Pirros Controversial Appointment The Impact Of Past Allegations

May 09, 2025

Jeanine Pirros Controversial Appointment The Impact Of Past Allegations

May 09, 2025