Significant Losses Continue: Amsterdam Stock Exchange Down 11%

Table of Contents

Causes of the Amsterdam Stock Exchange Decline

Several interconnected factors have contributed to the recent AEX decline. Understanding these root causes is crucial for navigating the current market volatility.

Global Economic Uncertainty

The current global economic climate is characterized by significant uncertainty, significantly impacting investor confidence and triggering sell-offs in various markets, including the AEX.

- Rising Inflation: Persistently high inflation rates across the globe, exceeding central bank targets in many countries, erode purchasing power and increase the cost of borrowing, dampening economic growth. For example, Eurozone inflation recently hit [insert current Eurozone inflation data]%, impacting consumer spending and corporate profits.

- Interest Rate Hikes: Central banks worldwide are aggressively raising interest rates to combat inflation. This increases borrowing costs for businesses, reducing investment and potentially leading to economic slowdown. The European Central Bank's recent rate hike of [insert ECB rate hike data] is a prime example.

- Geopolitical Instability: The ongoing war in Ukraine continues to disrupt global supply chains, fueling energy price volatility and increasing uncertainty in the global economy. This instability directly impacts investor sentiment and risk appetite.

- Energy Crisis: The energy crisis, exacerbated by the war in Ukraine and reduced Russian gas supplies, has created significant economic uncertainty and inflationary pressure across Europe, including the Netherlands. This impacts various sectors, from manufacturing to transportation.

- Supply Chain Disruptions: Lingering supply chain bottlenecks continue to constrain production and increase input costs, further contributing to inflationary pressures and impacting business profitability.

These interconnected global factors have collectively undermined investor confidence, leading to a significant sell-off in the AEX.

Sector-Specific Weakness

The AEX decline isn't uniform across all sectors. Certain sectors have been disproportionately impacted, reflecting specific vulnerabilities.

- Energy Sector: The energy sector, highly sensitive to geopolitical events and price fluctuations, has experienced significant volatility. Companies heavily reliant on Russian gas imports have faced substantial challenges. [Mention specific company examples and their stock performance].

- Technology Sector: The technology sector, often susceptible to interest rate hikes and shifts in investor sentiment, has also seen considerable downward pressure. [Mention specific company examples and their stock performance].

- Banking Sector: Concerns about potential loan defaults and the impact of rising interest rates have impacted the performance of banking stocks listed on the AEX. [Mention specific company examples and their stock performance].

Investor Sentiment and Market Psychology

Fear and uncertainty play a significant role in driving market downturns. The recent AEX decline is no exception.

- Panic Selling: Negative news and market volatility can trigger panic selling, as investors rush to liquidate their holdings to minimize potential losses. This exacerbates the downward trend.

- Herd Behavior: Investors often follow the actions of others, leading to herd behavior and amplified market reactions. A sell-off by a large number of investors can create a self-fulfilling prophecy.

- Lack of Investor Confidence: A combination of global economic uncertainty and sector-specific weaknesses has eroded investor confidence in the AEX, contributing to the sharp decline.

Consequences of the 11% Drop in the AEX

The 11% drop in the AEX has far-reaching consequences, impacting businesses, investors, and the Dutch economy as a whole.

Impact on Dutch Businesses

The decline in the AEX has significant implications for Dutch businesses listed on the exchange.

- Reduced Valuations: The market downturn has resulted in lower valuations for many Dutch companies, impacting their market capitalization and access to capital.

- Difficulty Raising Capital: Companies may find it harder to raise capital through equity financing in the current market environment.

- Potential Job Losses: Some companies might be forced to cut costs, potentially leading to job losses to maintain profitability.

- Decreased Investment: Reduced investor confidence can lead to decreased investment in Dutch businesses, hindering growth and expansion.

Implications for Pension Funds and Individual Investors

The AEX decline has directly impacted the retirement savings and investment portfolios of many individuals and pension funds.

- Loss of Retirement Savings: Pension funds and individuals with investments in the AEX have experienced significant losses, potentially affecting their retirement plans.

- Decreased Investment Returns: The downturn has reduced investment returns, impacting long-term financial goals.

- Impact on Wealth: The market decline has led to a decrease in overall wealth for many investors, creating financial uncertainty. Diversification and careful risk management are crucial in mitigating losses.

Broader Economic Impact on the Netherlands

The AEX decline has broader implications for the Dutch economy.

- Decreased Consumer Spending: Market uncertainty and potential job losses can lead to decreased consumer spending, slowing down economic growth.

- Potential Recession: The prolonged downturn could increase the risk of a recession in the Netherlands.

- Government Intervention: The Dutch government may need to implement fiscal or monetary policies to stabilize the economy and boost investor confidence.

Potential Future Scenarios and Recovery Strategies

Predicting the future of the AEX is challenging, but analyzing various scenarios and potential recovery strategies is crucial.

Short-Term Outlook

The short-term outlook for the AEX remains uncertain. A swift rebound is possible if global economic conditions improve and investor sentiment recovers. However, a more prolonged downturn is also a distinct possibility, depending on the evolution of global events.

Long-Term Implications

The long-term implications of the current downturn depend on several factors, including the success of government interventions, the pace of global economic recovery, and the resilience of Dutch businesses. A prolonged period of low growth or recession could have lasting impacts on the Dutch economy.

Government Intervention & Policy Responses

The Dutch government may implement various measures to stabilize the market and stimulate economic activity, such as tax cuts, increased government spending, or measures to support specific industries. The effectiveness of these interventions will be critical in shaping the long-term recovery.

Investor Strategies for Navigating Volatility

During periods of market uncertainty, investors should adopt prudent strategies to mitigate risk and protect their portfolios:

- Diversification: Diversifying investments across different asset classes and geographies can reduce the impact of market volatility.

- Risk Management: Understanding and managing risk is essential. Investors should carefully assess their risk tolerance and adjust their portfolio accordingly.

- Long-Term Perspective: Maintaining a long-term investment strategy is crucial during short-term market fluctuations. Avoid impulsive decisions driven by short-term market movements.

Conclusion

The 11% drop in the Amsterdam Stock Exchange (AEX) represents a significant setback for investors and raises concerns about the Dutch economy's outlook. Global economic uncertainty, sector-specific weaknesses, and market psychology have all contributed to this sharp decline. The consequences are far-reaching, impacting businesses, individuals, and the broader economy. While the short-term outlook remains uncertain, careful risk management, diversification, and a long-term perspective are key for investors navigating this volatile period. Stay informed about the evolving situation on the Amsterdam Stock Exchange and monitor your investments closely. Understanding the risks associated with stock market volatility and developing a robust investment strategy are critical to navigate future fluctuations in the AEX. Continue to follow our coverage for further updates on the Amsterdam Stock Exchange and the ongoing market downturn.

Featured Posts

-

Sergey Yurskiy Vecher Pamyati V Teatre Mossoveta

May 24, 2025

Sergey Yurskiy Vecher Pamyati V Teatre Mossoveta

May 24, 2025 -

Pobeditel Evrovideniya 2014 Konchita Vurst 13 Let Kaming Aut I Mechty O Bonde

May 24, 2025

Pobeditel Evrovideniya 2014 Konchita Vurst 13 Let Kaming Aut I Mechty O Bonde

May 24, 2025 -

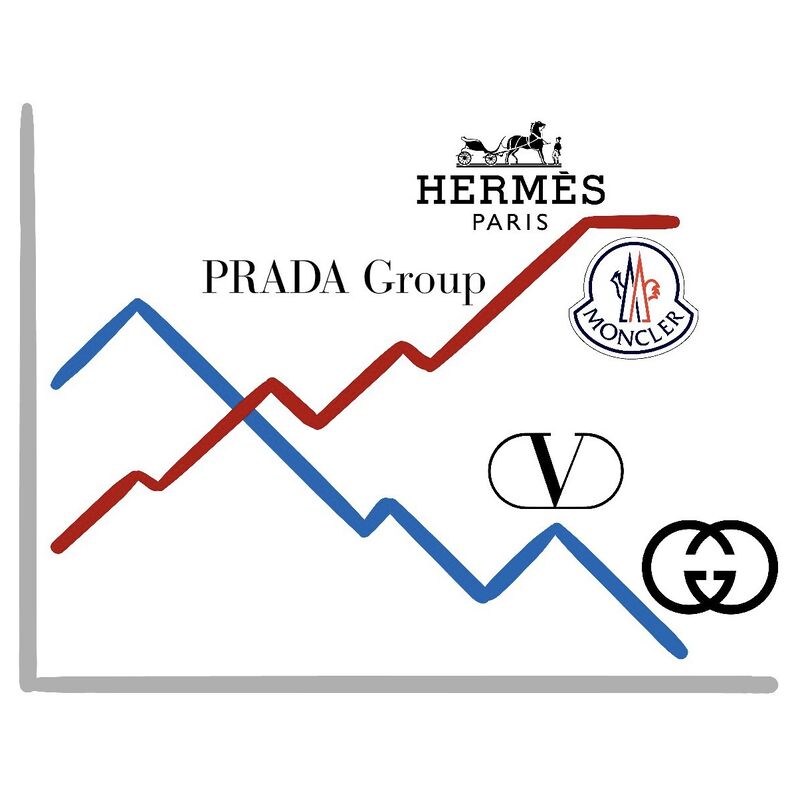

Paris In The Red Luxury Market Downturn Hits Hard March 7 2025

May 24, 2025

Paris In The Red Luxury Market Downturn Hits Hard March 7 2025

May 24, 2025 -

Football Match Disrupted By Sexist Chants Against Female Referee Probe Ordered

May 24, 2025

Football Match Disrupted By Sexist Chants Against Female Referee Probe Ordered

May 24, 2025 -

Kyle Walker And The Mysterious Milan Night Out

May 24, 2025

Kyle Walker And The Mysterious Milan Night Out

May 24, 2025

Latest Posts

-

Betting On Disaster The Troubling Trend Of Wildfire Wagers In Los Angeles

May 24, 2025

Betting On Disaster The Troubling Trend Of Wildfire Wagers In Los Angeles

May 24, 2025 -

5 Essential Dos And Don Ts Securing A Private Credit Role

May 24, 2025

5 Essential Dos And Don Ts Securing A Private Credit Role

May 24, 2025 -

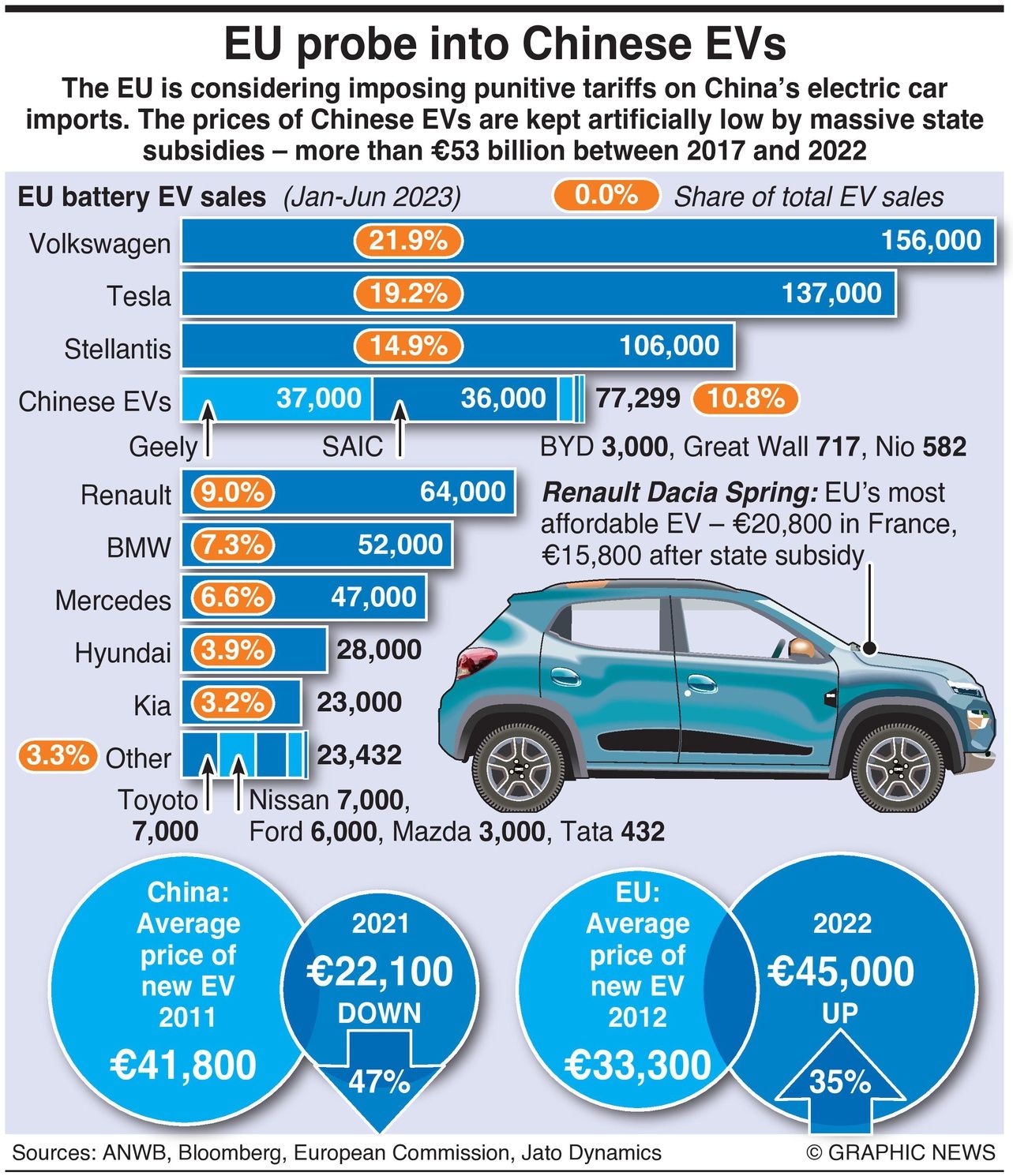

G 7s Consideration Of Reduced Tariffs On Chinese Imports A Closer Look

May 24, 2025

G 7s Consideration Of Reduced Tariffs On Chinese Imports A Closer Look

May 24, 2025 -

Hollywood Production Halts Joint Writers And Actors Strike Impacts Industry

May 24, 2025

Hollywood Production Halts Joint Writers And Actors Strike Impacts Industry

May 24, 2025 -

Delayed But Delivered Accenture Confirms 50 000 Employee Promotions

May 24, 2025

Delayed But Delivered Accenture Confirms 50 000 Employee Promotions

May 24, 2025